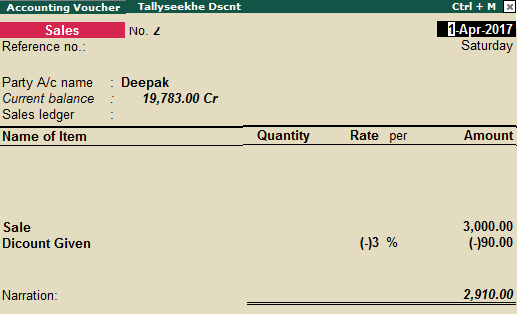

Sales Discount Journal Entry In Tally While recording a sales transaction you can easily enter the discount rate or amount for each stock item To consider discounts for GST sales you have to create a discount ledger and then select it in the invoice

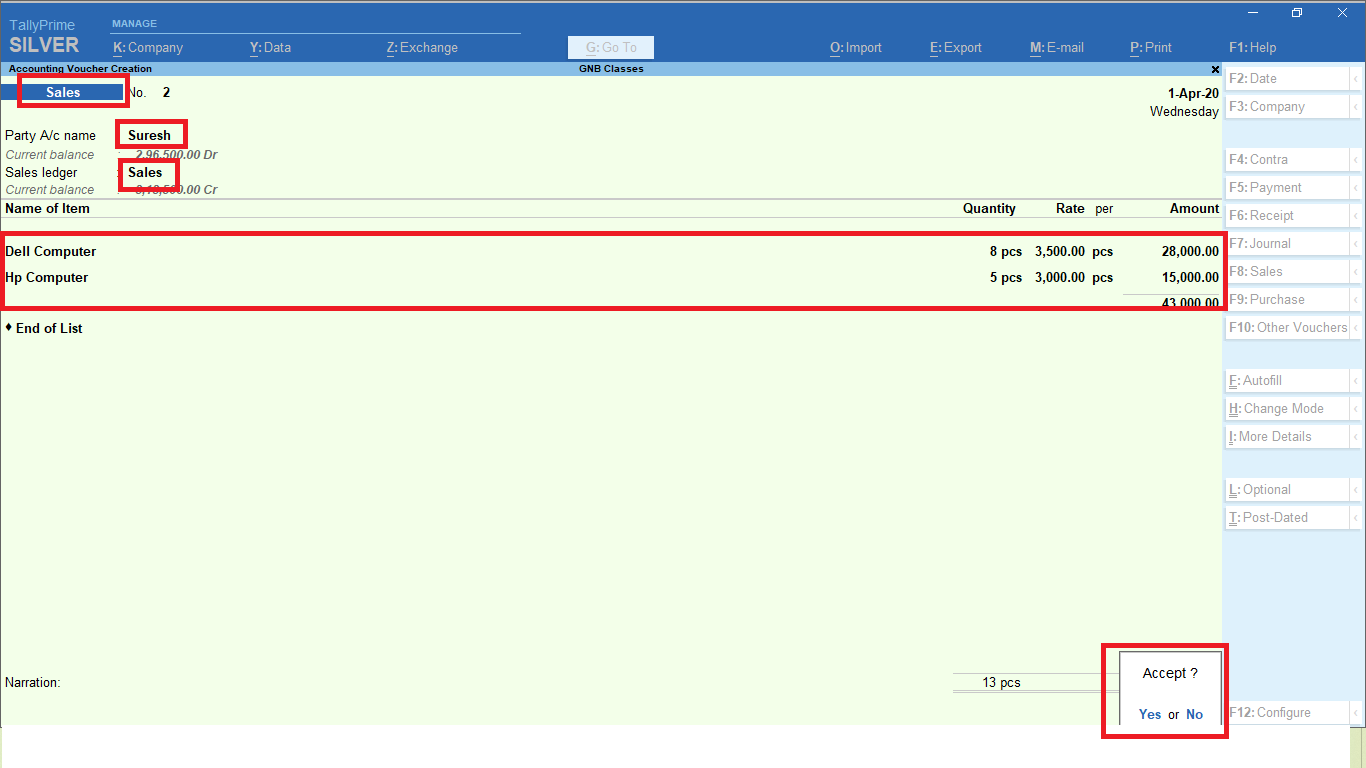

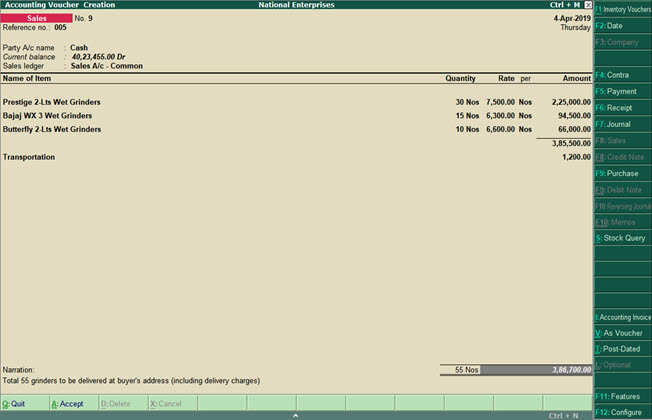

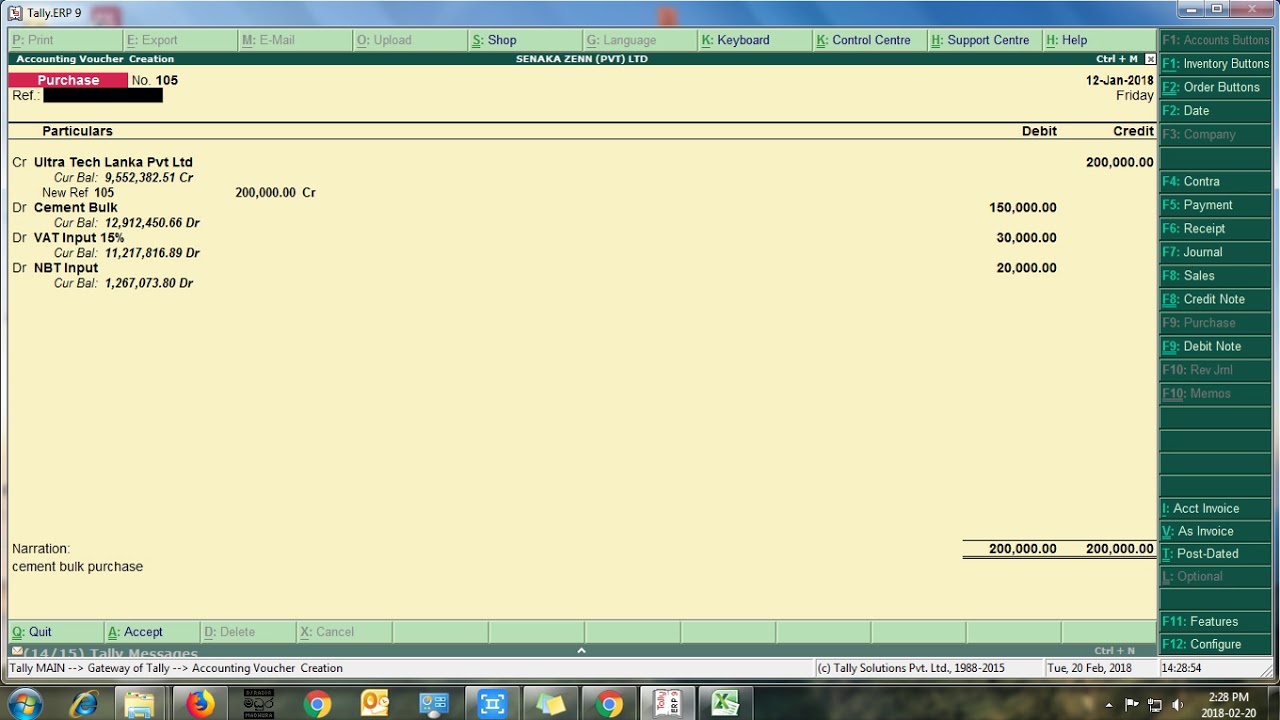

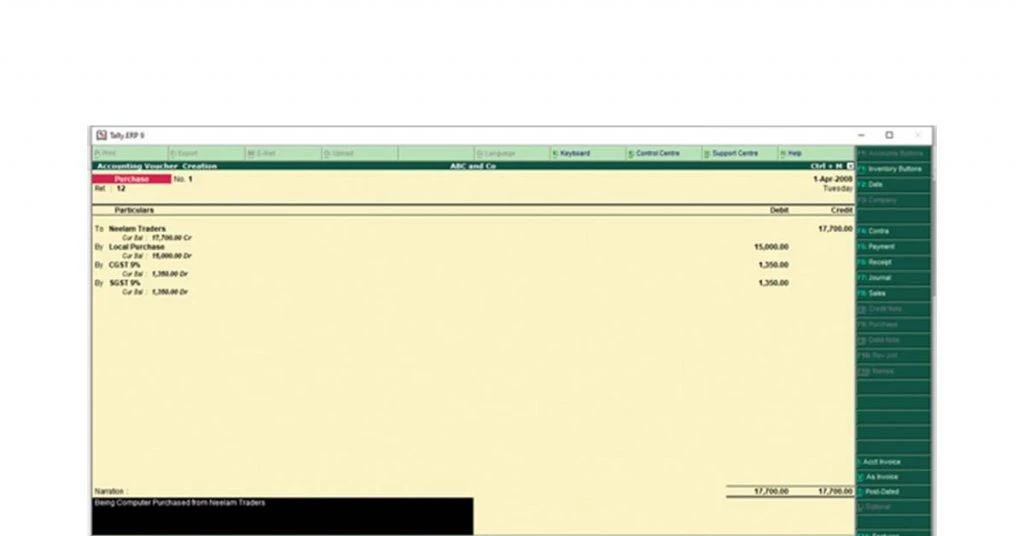

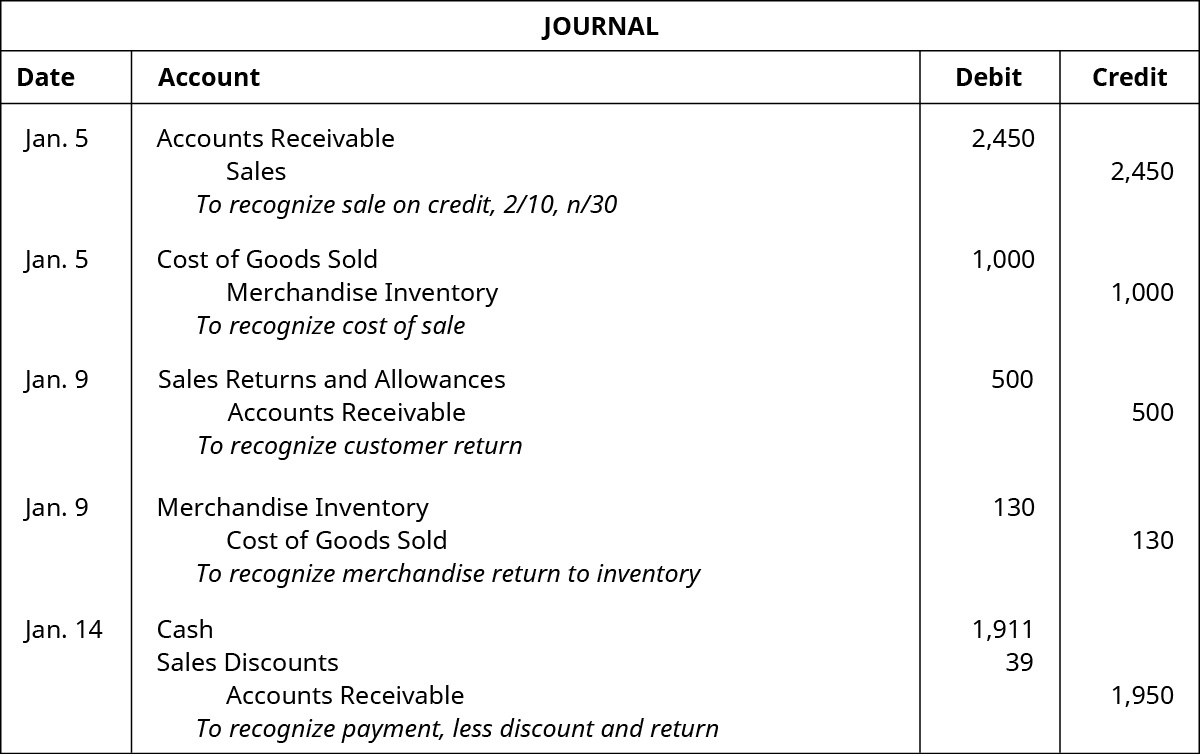

Sale discount journal entry The company can make sale discount journal entry by debiting cash account and sales discounts account and crediting accounts receivable Sales discounts is a contra account to sales revenues in which its normal balance is on the debit side In TallyPrime 4 you can record discounts on each item either by mentioning the discount percentage against each item or mentioning the discount value for each item and then showing the total discount amount against the discount ledger as below Display discount percentage against each item without using ledger account

Sales Discount Journal Entry In Tally

Sales Discount Journal Entry In Tally

https://2.bp.blogspot.com/-GI9_zPecBO8/WzB-jojG8WI/AAAAAAAAAzY/FjJpCShsnZMFLZ6aLFzoI0GpbnAPs3ZrgCLcBGAs/s1600/tallyseekh5.png

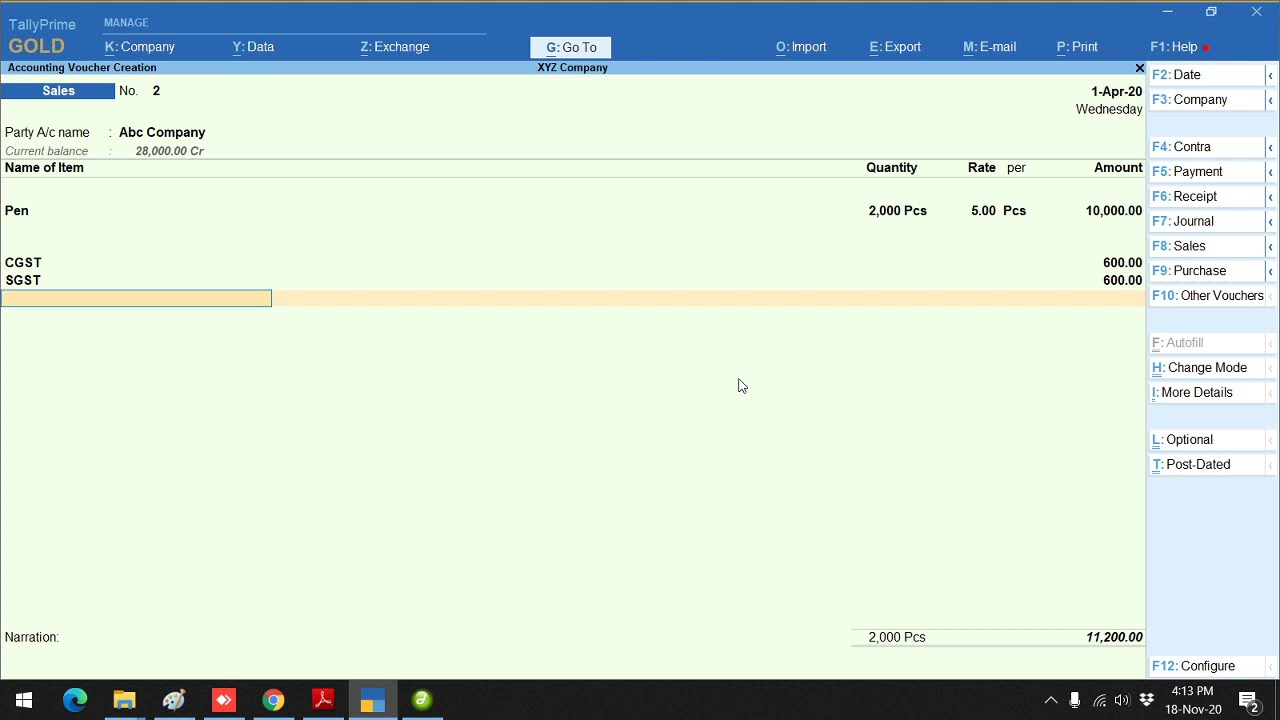

TALLY PRIME Sales Cycle Sales Order Delivery Note Sales Bill

https://i.ytimg.com/vi/5KozyIz2DYU/maxresdefault.jpg

GST Sales With Discount At The Item Level

https://help.tallysolutions.com/docs/te9rel61/Tax_India/gst/images/discount_2.gif

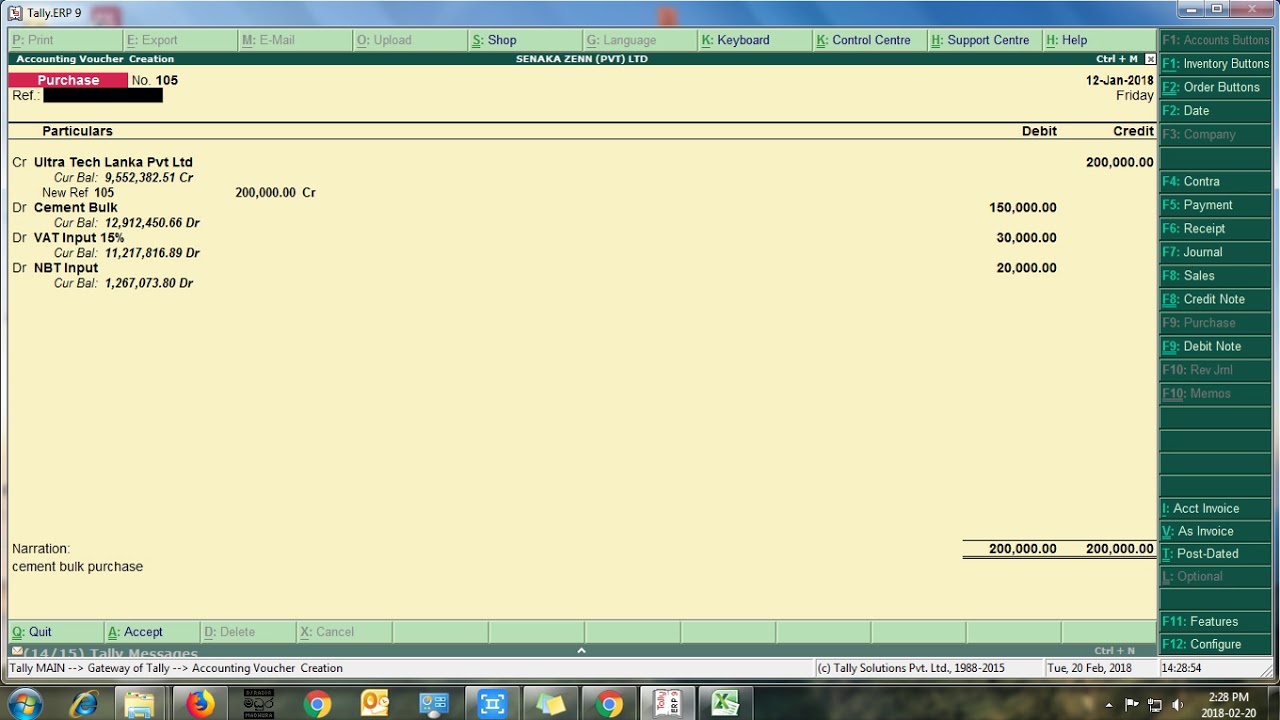

The discount will be calculated based on the total amount of the sales invoice You can choose to apply a fixed discount amount or a percentage discount Discounts can be recorded at the item level or the invoice level To record a sale with such trade discounts in Tally ERP 9 you can show the discount percentage against the quantity of the item You can also enter the discount percentage or amount for each selected item and show the total discount using a ledger account

Purchase and Sales Entry using Discount Column in Tally Visit us For Taxation Loan Insurance Serviceshttps mrass Steps to Record Sales with Trade Discounts in TallyPrime 1 Create a Purchase Invoice 2 Enter Supplier Details 3 Add Items 4 Apply Trade Discount 5 Save the Invoice 6 Create a Sales Invoice 7 Enter Customer Details 8 Add Items 9 Include Trade Discount Optional 3 Example to Record Sales with Trade Discounts in TallyPrime 1

Download Sales Discount Journal Entry In Tally

More picture related to Sales Discount Journal Entry In Tally

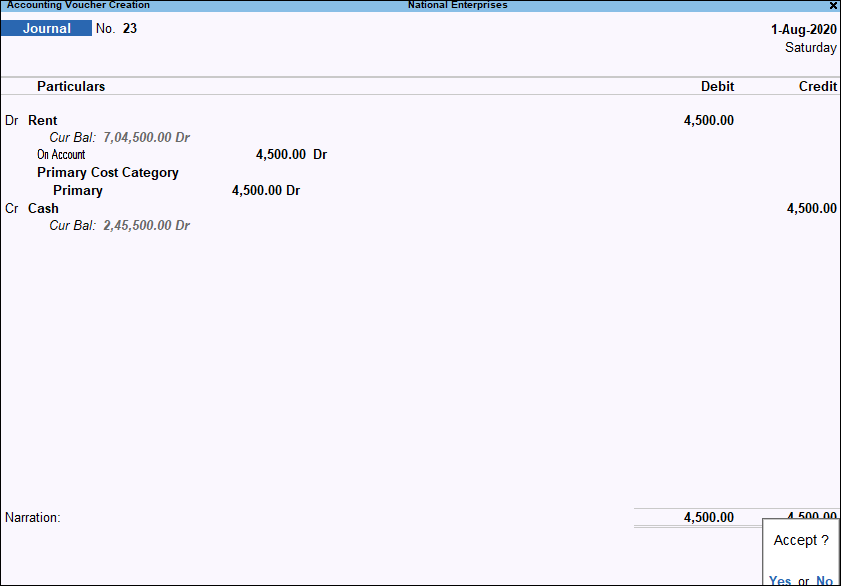

How To Pass Journal Entry In Tally Prime 2023 Screenshots

https://caknowledge.com/wp-content/uploads/2021/09/journal-entry-accounting-expenss-tally.png

Debit Note Credit Note Voucher In Tally Prime Purchase Sales Return

https://1.bp.blogspot.com/-ktKZQQ6l6SE/YFHKZWub41I/AAAAAAAAWnI/ckPALrEagHIEkoinoXQF5gJNmxIV521rACNcBGAsYHQ/s1366/sales%2Bentry%2Bfor%2Bcredit%2Bnote%2Bvoucher%2Bin%2Btally%2Bprime%2Bhindi%2Bnotes.png

Sales Of Goods And Services I Tally ERP 9

https://help.tallysolutions.com/docs/te9rel66/sales/images/simple-sales.jpg

A Discount Allowed B Discount Received A Discount Allowed When at the time of sales or receiving cash any concession is given to the customers it is called discount allowed Journal Entry Example Goods sold 50 000 for cash discount allowed 10 1 Video Me Poora TALLY PRIME Full Course Video https youtu be o1cmhwXYELsDiscount Allowed Discount Paid Entry in Sales Voucher in Tally PrimeSal

In Tallyprime you can record discounts on each item either by mentioning the discount percentage against each item or mentioning the discount percentage for each item and then showing the total discount amount against the discount ledger Use TallyPrime s reports to analyze discounts granted and their impact on revenue By following these steps you can effectively record receipts with discounts in TallyPrime ensuring accurate accounting and tracking of your sales transactions

How To Enter Tally Journal YouTube

https://i.ytimg.com/vi/C4JRtgEWaeY/maxresdefault.jpg

in TallyErp9.jpg)

Sales Return Credit Note Ctrl F8 In Tally Erp9

https://tallyerp9book.com/tallytutorial/tutorial-images/Vouchers/81- Sales Return Credit Note ( Ctrl+F8) in TallyErp9.jpg

https://help.tallysolutions.com › ... › gst_discount.htm

While recording a sales transaction you can easily enter the discount rate or amount for each stock item To consider discounts for GST sales you have to create a discount ledger and then select it in the invoice

https://accountinguide.com › sale-discount-journal-entry

Sale discount journal entry The company can make sale discount journal entry by debiting cash account and sales discounts account and crediting accounts receivable Sales discounts is a contra account to sales revenues in which its normal balance is on the debit side

Technikita

How To Enter Tally Journal YouTube

How To Record Sales Purchase Entry In Tally With GST

How To Pass Journal Entry In Tally Tally And Accounting Demo

Asiento De Diario Para Descuento Permitido Y Recibido Barcelona Geeks

Entr e De Journal Pour Remise Autoris e Et Re ue StackLima

Entr e De Journal Pour Remise Autoris e Et Re ue StackLima

LO 6 4a Analyze And Record Transactions For The Sale Of Merchandise

How To Pass Purchase And Sale Entry With Gst In Tally Prime Caknowledge

Creating A Sales Entry

Sales Discount Journal Entry In Tally - To record a sale with such trade discounts in Tally ERP 9 you can show the discount percentage against the quantity of the item You can also enter the discount percentage or amount for each selected item and show the total discount using a ledger account