Sars Diesel Rebate Calculation 2023 Verkko 10 lokak 2022 nbsp 0183 32 What is it Qualifying entities that carries on eligible activities in the categories and industries listed below and that are registered for VAT purposes under

Verkko 27 October 2022 The Manage Diesel Refund Calculations Policy has been revised to include All criteria that a prospective claimant must meet to qualify for a diesel Verkko nearest SARS Customs office closest totheir manufacturing facility The refund claim amounts will be calculated as follows April 2023 Diesel actually used 1 000 litres

Sars Diesel Rebate Calculation 2023

Sars Diesel Rebate Calculation 2023

https://content.app-sources.com/s/34475581104370771/uploads/Images/omid-roshan-Evss0Whf5OI-unsplash-7645432.jpg

Accton Oct 2023 Sales Revenue Report Accton Technology

https://www.accton.com/wp-content/uploads/2023/11/Accton-Website-Thumbnail-Company-Report.jpeg

26 02 2023 P sala

https://www.pasala.com.mx/wp-content/uploads/2023/02/7870f670-9127-4dbb-b714-aa29929077d5.jpg

Verkko 30 lokak 2023 nbsp 0183 32 In the 2023 budget speech the Minister of Finance announced a tax relief measure to address the load shedding problem the country is facing A diesel Verkko SARS will administer the new refund to the extent of 80 of the RAF levy for diesel purchased for use and used in the manufacturing of foodstuffs through the DA66

Verkko 31 lokak 2022 nbsp 0183 32 On 27 October 2022 the South African Revenue Service SARS announced that the Manage Diesel Refund Calculations Policy had been revised Verkko automatically calculated as follows A Non eligible litres are deductedfrom the total litres purchased and usedto establish eligible litres B For On Land purchases only

Download Sars Diesel Rebate Calculation 2023

More picture related to Sars Diesel Rebate Calculation 2023

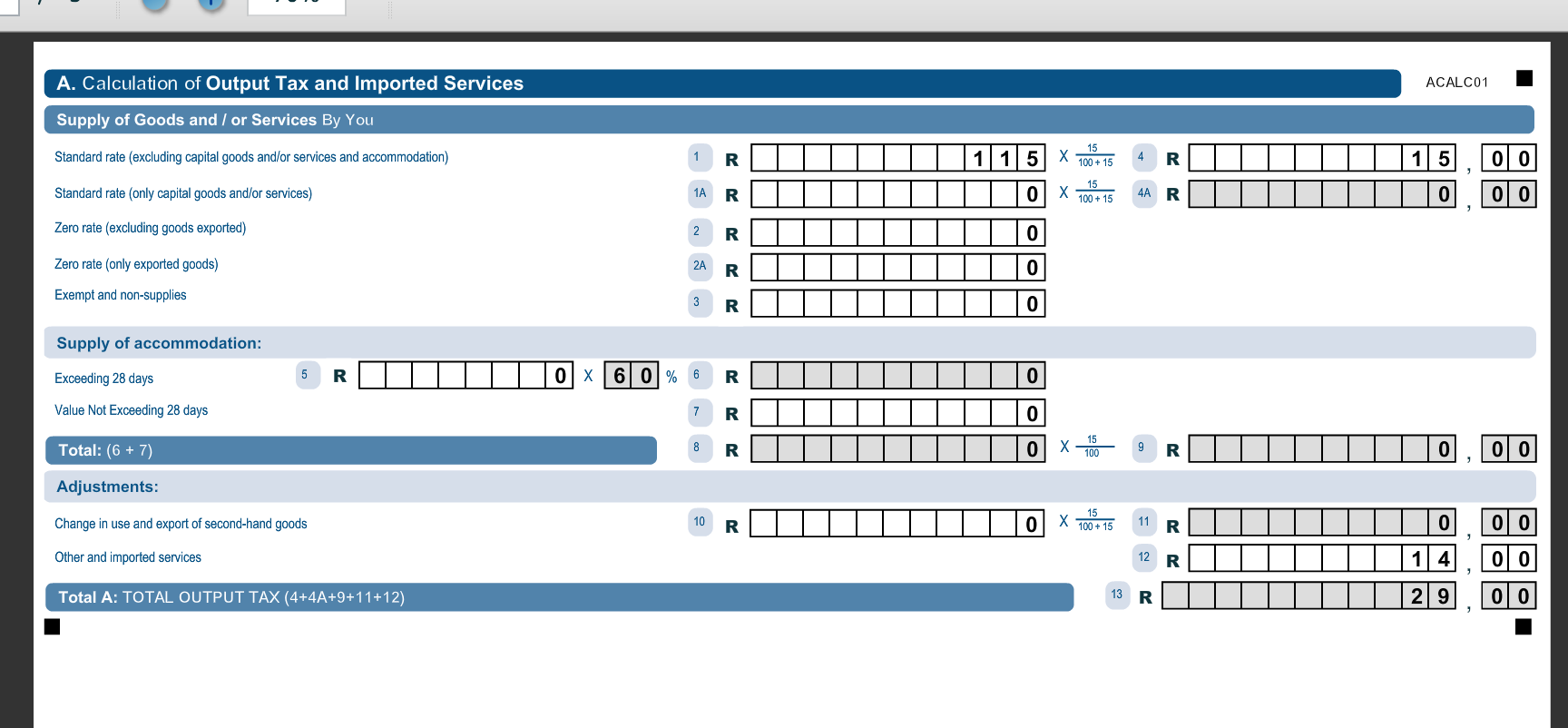

SARS Diesel Rebate Claim

https://info.gilbarco.com/hs-fs/hubfs/SARS-header.png?width=2000&height=486&name=SARS-header.png

Maillots Narrow 2023

https://cdn.footballkitarchive.com/2023/04/27/UaFRFDSeObcx26s.jpg

Sars Vat 201 Form Download Greekcaqwe

http://greekcaqwe.weebly.com/uploads/1/3/3/6/133620189/191015509_orig.png

Verkko 13 kes 228 k 2022 nbsp 0183 32 Mode of calculation of refund is as follows aa For 1 000 litres eligible purchases 1 000 x 80 per cent equals 800 litres on which a refund of 336 0 cent per Verkko 12 huhtik 2021 nbsp 0183 32 On 06 April 2021 the South African Revenue Service SARS announced the release of its updated Excise External Policy Manage Diesel Refund

Verkko On 18 March 2022 the South African Revenue Service SARS informed of amendments to Part 3 of Schedule No 6 to the Customs and Excise Act 1964 by the substitution of Verkko 29 marrask 2022 nbsp 0183 32 Diesel Rebates What the future holds 29 November 2022 Kagiso Nonyane Tax Manager Over the past 5 years there have been various discussions

Vol 1 No 5 2023 June 2023 International Journal Of Scientific

https://journal.formosapublisher.org/public/journals/55/cover_issue_288_en_US.jpg

The Last Of Us 2023

https://m.media-amazon.com/images/M/MV5BMjAwMjhkNmYtZDA2My00ZjY4LTg1MTMtZmUzZWRhM2M3NmMyXkEyXkFqcGdeQXVyMTEyMjM2NDc2._V1_.jpg

https://www.sars.gov.za/customs-and-excise/excise/diesel-refund-system

Verkko 10 lokak 2022 nbsp 0183 32 What is it Qualifying entities that carries on eligible activities in the categories and industries listed below and that are registered for VAT purposes under

https://www.sars.gov.za/latest-news/manage-diesel-refunds-calculations

Verkko 27 October 2022 The Manage Diesel Refund Calculations Policy has been revised to include All criteria that a prospective claimant must meet to qualify for a diesel

2023

Vol 1 No 5 2023 June 2023 International Journal Of Scientific

Exam Reviewer 2023

National Budget Speech 2022 SimplePay Blog

.png#keepProtocol)

SARS Diesel Rebate Claim

AASP 2023

AASP 2023

2022 Tax Brackets DhugalKillen

DML 2023 Canada

Pin On Pharmacology Nursing

Sars Diesel Rebate Calculation 2023 - Verkko SARS will administer the new refund to the extent of 80 of the RAF levy for diesel purchased for use and used in the manufacturing of foodstuffs through the DA66