Sars Rebates 2023 Verkko Rebates 2023 2024 2022 2023 Primary R17 235 R16 425 Secondary Persons 65 and older R9 444 R9 000 Tertiary Persons 75 and older R3 145 R2 997 Age Tax threshold Below age 65 R95 750 R91 250 Age 65 to below 75 R148 217 R141 250 Age 75 and over R165 689 R157 900

Verkko 17 marrask 2022 nbsp 0183 32 Valtioneuvosto on vahvistanut sairausvakuutusmaksujen maksuprosentit vuodelle 2023 Sairaanhoitomaksut Vakuutettujen sairaanhoitomaksu on 0 60 prosenttia kunnallisverotuksessa verotettavasta ansiotulosta vuonna 2023 Verotettavista el 228 ke ja etuustuloista peritt 228 v 228 maksu on 1 57 prosenttia Verkko 22 February 2023 Today the Minister of Finance is announcing the National Budget for 2023 including changes in tax rates duties and levies To see the changes visit the Budget 2023 and Tax Rates webpages The highlights for this year are Granting tax relief by adjusting personal income tax brackets and rebates for the

Sars Rebates 2023

Sars Rebates 2023

https://www.elancorebates.net/wp-content/uploads/2023/04/Elanco-Rebates-2023-Seresto.png

SARS Tax Rates For Individuals South African Tax Consultants

https://www.tax-consultant.co.za/wp-content/uploads/2021/08/image-768x264.png

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

Verkko SARS Important Links SARS Ordinarily Resident Test SARS Physical Presence Test SARS Interpretation Note No 34 issue 2 SARS Common Reporting Standard Rebates 2022 2023 2021 2022 Primary R16 425 R15 714 Secondary Persons 65 and older R9 000 R8 613 Tertiary Persons 75 and older R2 997 R2 871 Age Tax Verkko 15 hein 228 k 2023 nbsp 0183 32 It s simple first you must register on the SARS eFiling website The system automatically generates your 2023 income tax return form ITR12 for you based off statements of accounts from your

Verkko 8 toukok 2023 nbsp 0183 32 As from 1 March 2023 through to 28 February 2025 Section 12B of the Income Tax Act South Africa was amended by SARS from a one year accelerated depreciation allowance on renewable energy to include an additional 25 rebate on the cost of renewable energy assets Under the expanded incentive businesses will be Verkko This SARS tax pocket guide provides a synopsis of the most important tax duty and levy related information for 2022 23 INCOME TAX INDIVIDUALS AND TRUSTS Tax rates from 1 March 2022 to 28 February 2023 Individuals and special trusts Trusts other than special trusts rate of tax 45 Rebates Primary R16 425

Download Sars Rebates 2023

More picture related to Sars Rebates 2023

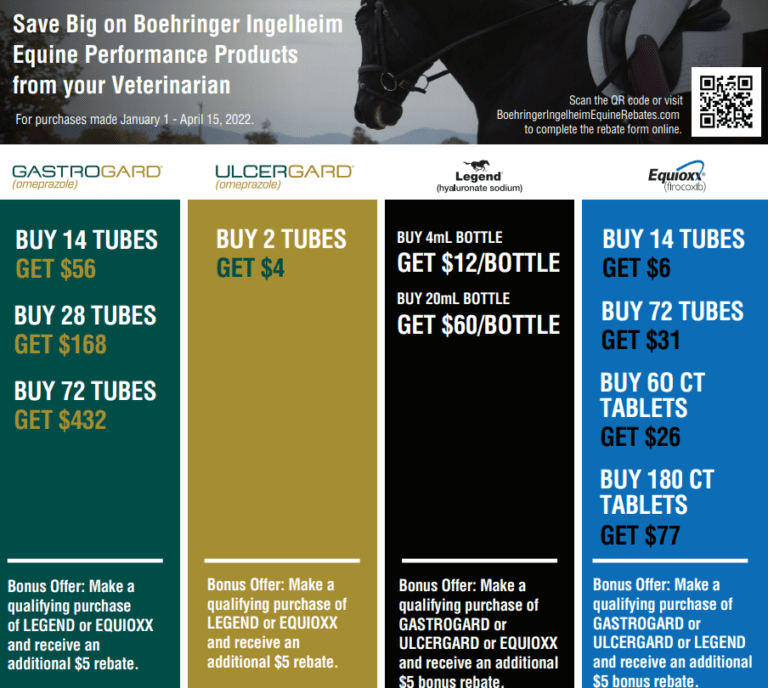

Elanco Rebates Form 2023 How To Access Fill Out And Track Your

https://www.elancorebates.net/wp-content/uploads/2023/05/Elanco-Rebates-Form-2023-1024x714.png

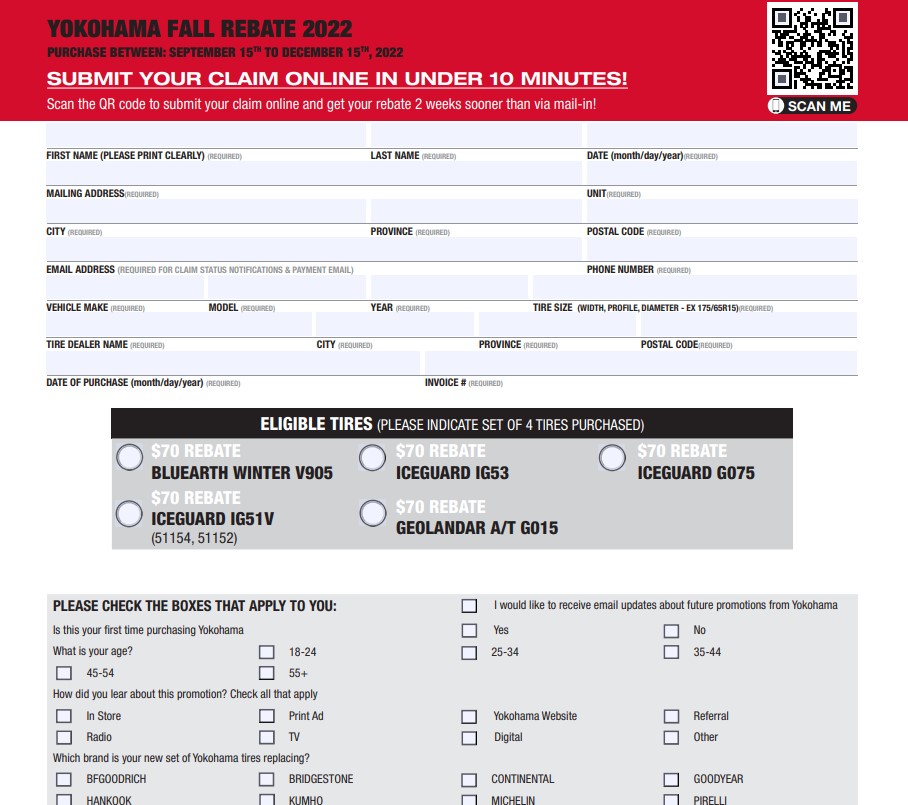

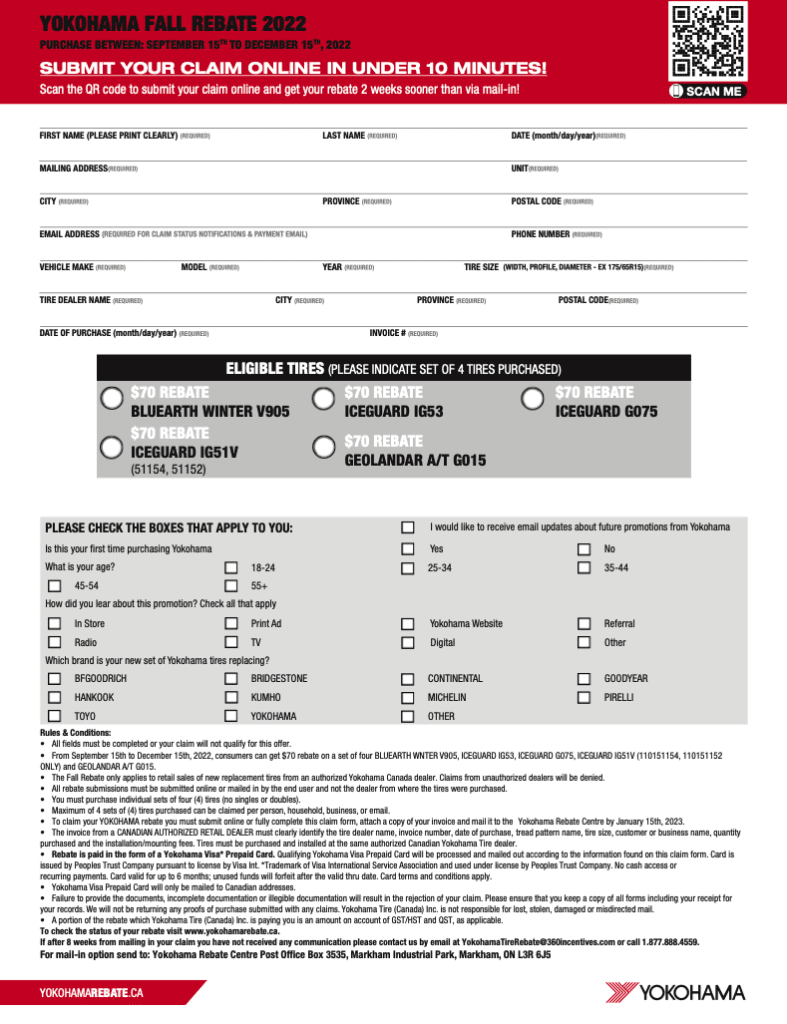

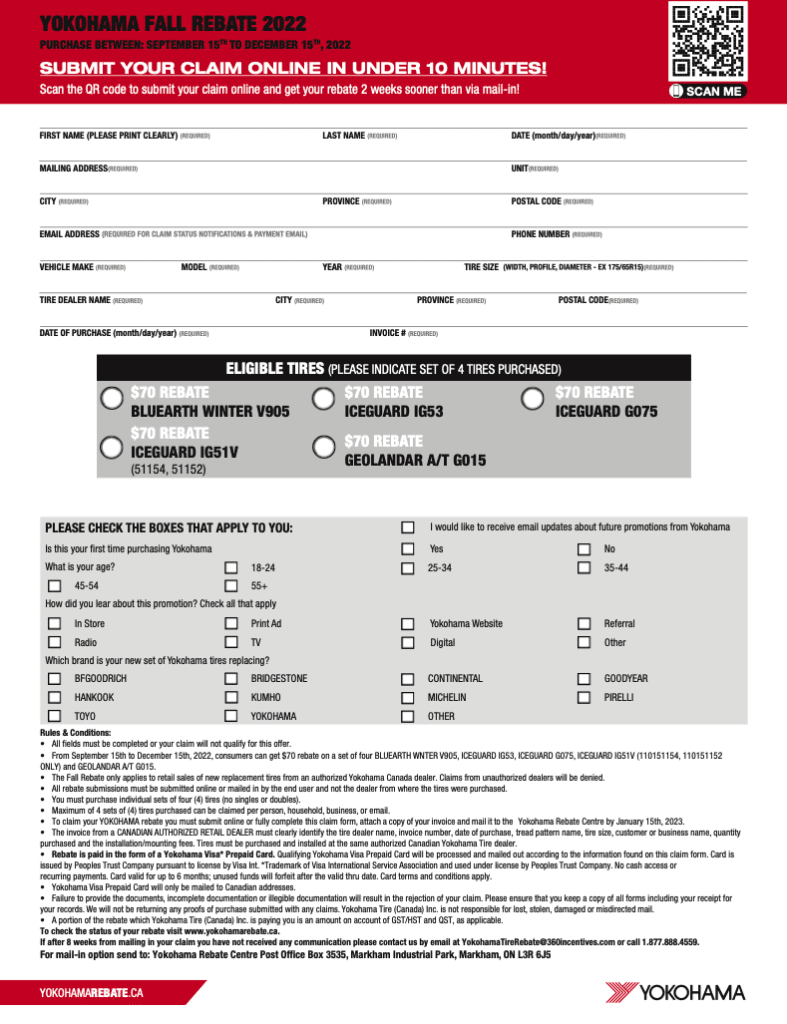

Yokohama Tire Rebate 2023 How To Qualify And Claim Your Rebate

https://www.tirerebate.org/wp-content/uploads/2023/03/Yokohama-Tire-Rebate-2023.jpg

Missouri Rent Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

Verkko 10 marrask 2023 nbsp 0183 32 This issue of the ECDC Communicable Disease Threats Report CDTR covers the period 5 11 November 2023 and includes updates on SARS CoV 2 variants an overview of respiratory virus epidemiology in the EU EEA West Nile Virus measles diphtheria Middle East respiratory virus syndrome chikungunya and dengue Verkko Deloitte US Audit Consulting Advisory and Tax Services

Verkko 14 jouluk 2022 nbsp 0183 32 Jos palkka ja yritt 228 j 228 tulon yhteism 228 228 r 228 j 228 228 alle 15 703 euron p 228 iv 228 rahamaksu on 0 00 prosenttia Yritt 228 j 228 n el 228 kelain mukaisesti vakuutettujen yritt 228 jien YEL maksama lis 228 rahoitusosuus on 0 23 prosenttia eli maksu on yhteens 228 1 59 prosenttia vuonna 2023 Sairausvakuutuksen p 228 iv 228 rahamaksua ei perit 228 alle 16 Verkko 4 tammik 2023 nbsp 0183 32 Ty 246 el 228 kemaksuihin korotus Vuonna 2023 ty 246 nantajan keskim 228 228 r 228 inen ty 246 el 228 kevakuutusmaksu on 17 4 prosenttia Vuonna 2020 ty 246 el 228 kevakuutusmaksun tasoa alennettiin koronaepidemian vuoksi Ty 246 el 228 kemaksun alennuksesta syntynyt vaje kompensoidaan korottamalla ty 246 nantajan ty 246 el 228 kevakuutusmaksua vuosina 2022 2025

Yokohama Rebates 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/04/Yokohama-Rebate-Form-2023-787x1024.png

P G Rebate 2023 Get The Best Deals On Eligible Products Save Big

https://printablerebateform.net/wp-content/uploads/2023/03/PG-Rebate-2023.png

https://www.taxconsulting.co.za/tax-guide-2023-2024

Verkko Rebates 2023 2024 2022 2023 Primary R17 235 R16 425 Secondary Persons 65 and older R9 444 R9 000 Tertiary Persons 75 and older R3 145 R2 997 Age Tax threshold Below age 65 R95 750 R91 250 Age 65 to below 75 R148 217 R141 250 Age 75 and over R165 689 R157 900

https://valtioneuvosto.fi/-//1271139/sairausvakuutusmaksut-vahvistettu...

Verkko 17 marrask 2022 nbsp 0183 32 Valtioneuvosto on vahvistanut sairausvakuutusmaksujen maksuprosentit vuodelle 2023 Sairaanhoitomaksut Vakuutettujen sairaanhoitomaksu on 0 60 prosenttia kunnallisverotuksessa verotettavasta ansiotulosta vuonna 2023 Verotettavista el 228 ke ja etuustuloista peritt 228 v 228 maksu on 1 57 prosenttia

2023 Equinox Rebates Printable Rebate Form

Yokohama Rebates 2023 Printable Rebate Form

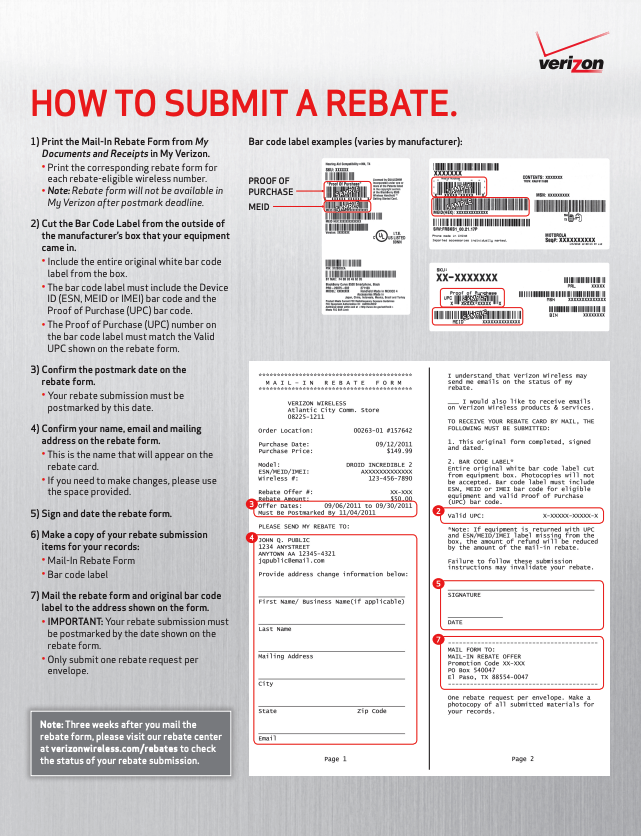

Raking In The Savings Unraveling The Mystery Of Verizon Rebates

Elanco Rebates Galliprant 2023 Relief For Canine Arthritis Pain

Oral B Rebate 2023 Get Money Back On Your Toothbrush Purchase

Raking In The Savings Unraveling The Mystery Of Verizon Rebates

Raking In The Savings Unraveling The Mystery Of Verizon Rebates

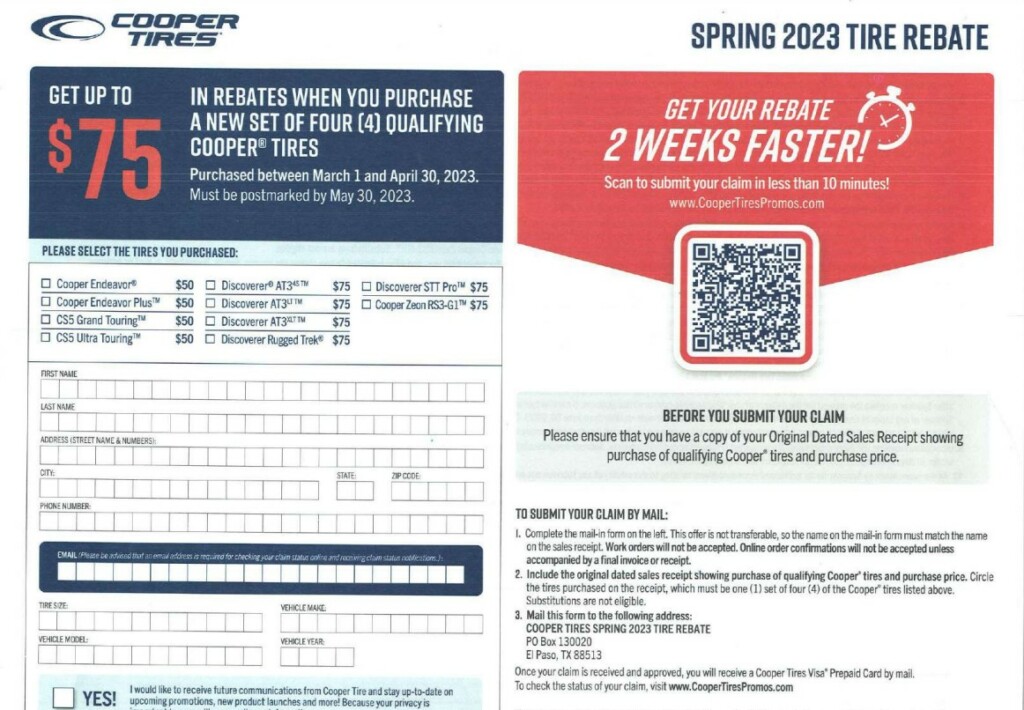

Cooper Tire Rebate 2023 Eligibility Criteria Rebate Process And

Goodyear Rebate Form Guide October 2023 Steps To Apply And Track

The Ultimate Guide To Sentinel Spectrum Rebate Code 2023 How To Save

Sars Rebates 2023 - Verkko 15 hein 228 k 2023 nbsp 0183 32 It s simple first you must register on the SARS eFiling website The system automatically generates your 2023 income tax return form ITR12 for you based off statements of accounts from your