Sars Tax Exemption On Interest Earned This calculator is to assist you on calculating the amount of interest that will reflect as taxable on your income tax assessment Individual taxpayers enjoy an annual exemption on all South

Dividends received by individuals from South African companies are generally exempt from income tax but dividends tax at a rate of 20 is withheld by the entities paying the dividends You will only be taxed on interest if your interest earned in any one tax year exceeds R23 8k This tax exemption increases to R34 5k per annum if you are 65 or older The amount of tax you

Sars Tax Exemption On Interest Earned

Sars Tax Exemption On Interest Earned

https://i.ytimg.com/vi/AGChsY66zt8/maxresdefault.jpg

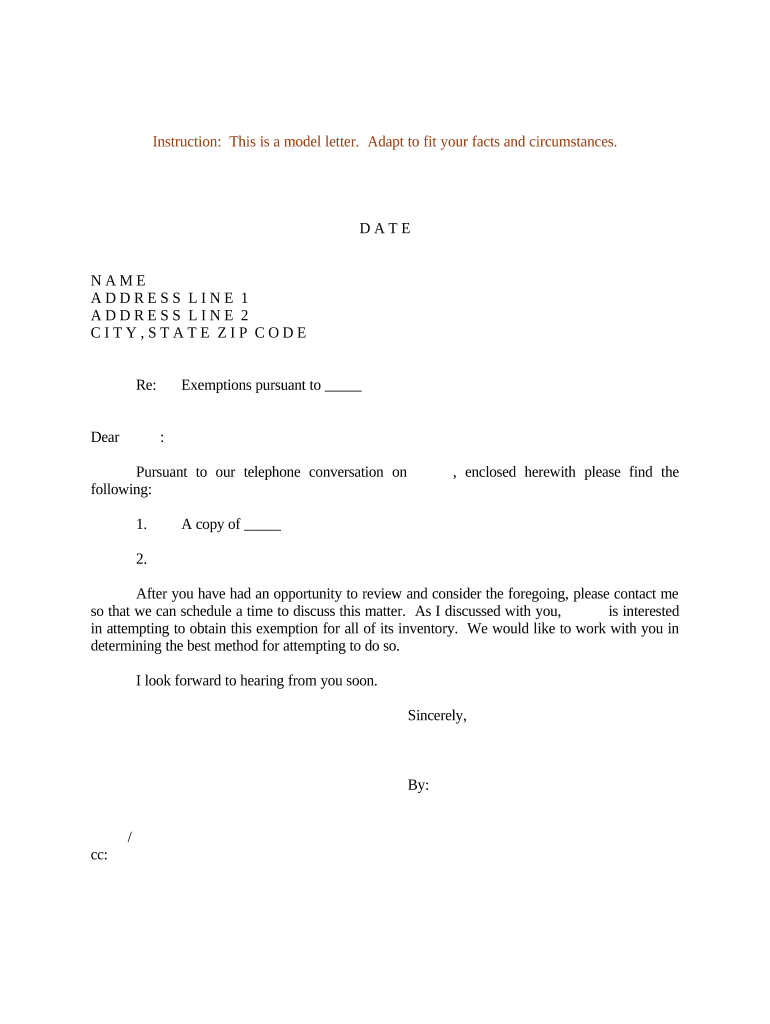

Tax Exemption The Joint Venture

https://thejointventure.co.za/wp-content/uploads/2016/06/tax-exempt1.jpg

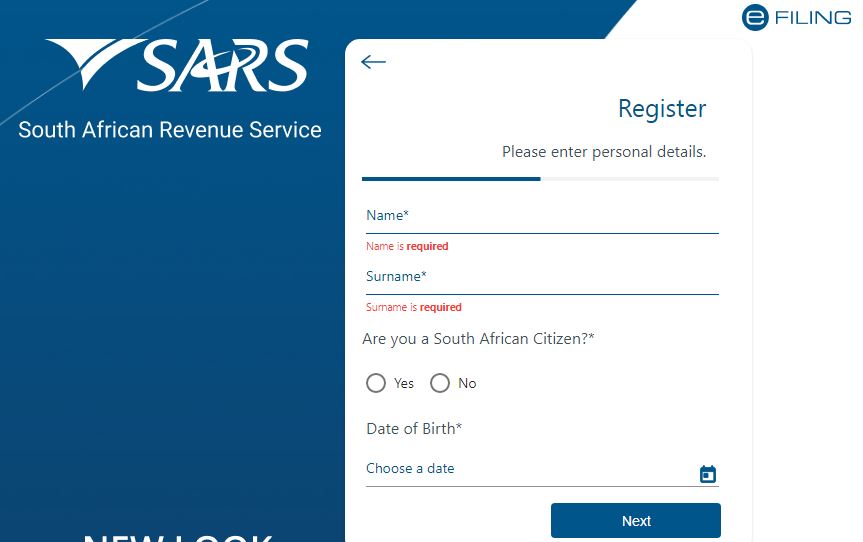

SARS Tax Number Registration Www sars gov za Ujuzi Tz

https://ujuzitz.com/wp-content/uploads/2021/10/efilling.jpg

What exemptions or reduced rates apply for WTI The exemptions relevant to WTI fall into three broad groups The foreign person the recipient of the interest Payor An In both options set out above the interest earned is taxable in the year that it accrues You are absolutely correct in terms of the interest exemption of R23 800 per year although

It s also worth mentioning that certain interest income may be exempt or receive special treatment based on specific circumstances or investment types For example interest Income from investments must be reported to the South African Revenue Service SARS as part of the annual income tax return Section 12T of the Income Tax Act provides that amounts received by or accrued to a natural person from a

Download Sars Tax Exemption On Interest Earned

More picture related to Sars Tax Exemption On Interest Earned

Download SARS TPPOA Form Tax Practitioner Power Of Attorney

https://formfactory.co.za/wp-content/uploads/2017/04/sars-tppoa-special-poa-tax-practitioner.jpg

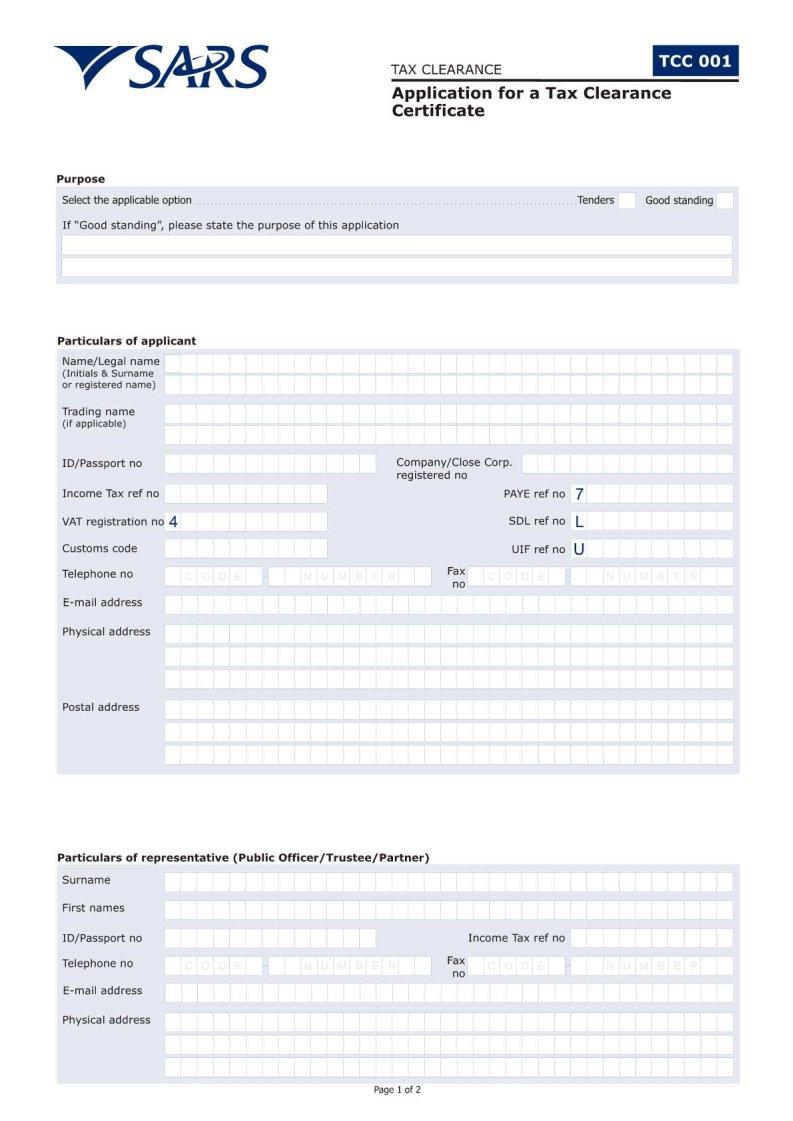

Sars Form Tcc 001 Fill Out Printable PDF Forms Online

https://formspal.com/data/LandingPageImages/Image/2/239/239637.JPEG

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/06/sars-monthly-tax-tables-2021-mansa-digital-1.jpg

Interest earned from Fixed deposit investment is taxable Interest Exemptions There is some good news though To encourage savings SARS provides interest exemptions For the 2020 Exempt Interest Some types of interest income may be exempt from tax For example interest earned on certain government bonds certain retail savings bonds and

Interest from a South African source earned by any natural person under 65 years of age up to R23 800 per annum and persons 65 and older up to R34 500 per annum is exempt from Does interest form part of the R75000 threshold or R30000 Are you older or younger than 65 the interest exemption is R23 800 for under 65 year old and R34 500 for

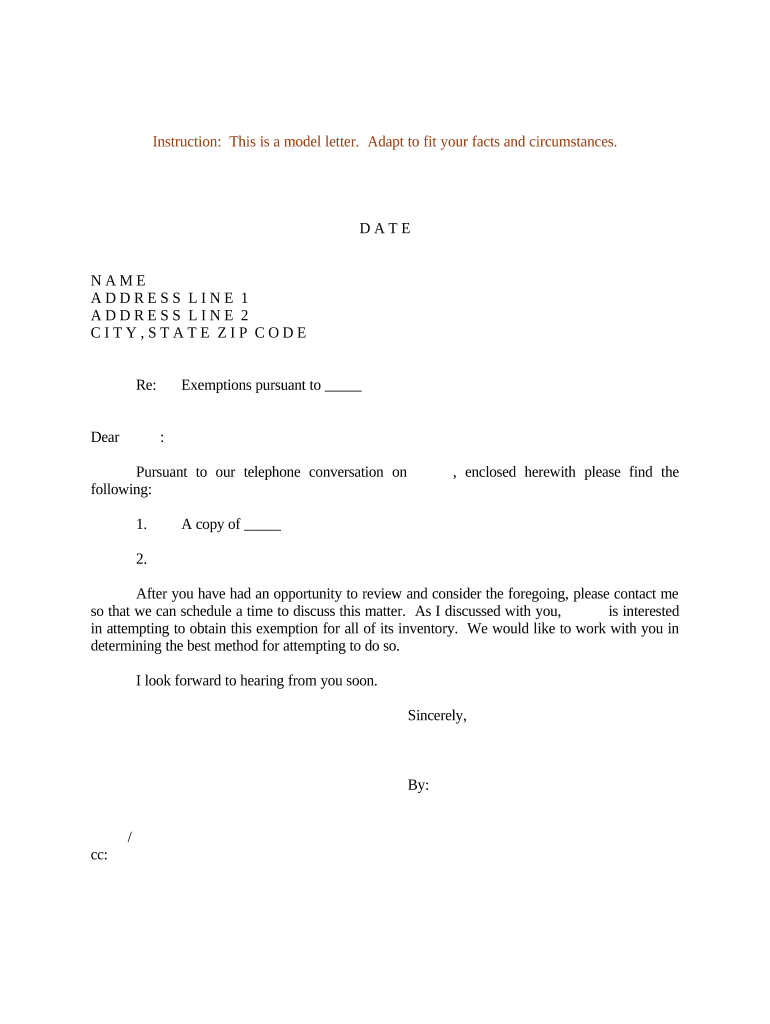

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/331/497331433/large.png

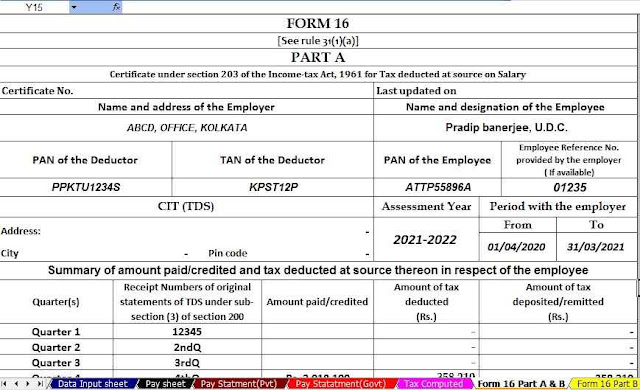

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

https://1.bp.blogspot.com/-Jy3Z02QCNwo/YL5GsKSOyzI/AAAAAAAAQxE/SilH8g_onbwsXDWMBME8njjuec7yWjNDQCNcBGAsYHQ/w640-h390/Form%2B16%2BPart%2BA%2Band%2BB.jpg

https://www.taxtim.com › za › calculators › local-interest

This calculator is to assist you on calculating the amount of interest that will reflect as taxable on your income tax assessment Individual taxpayers enjoy an annual exemption on all South

https://www.sataxguide.co.za › sars-interest-and-dividends-tax-rates

Dividends received by individuals from South African companies are generally exempt from income tax but dividends tax at a rate of 20 is withheld by the entities paying the dividends

How To Get A Tax Number From SARS

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

SARS Tax Questions Answered I Have Forgotten My Tax Number

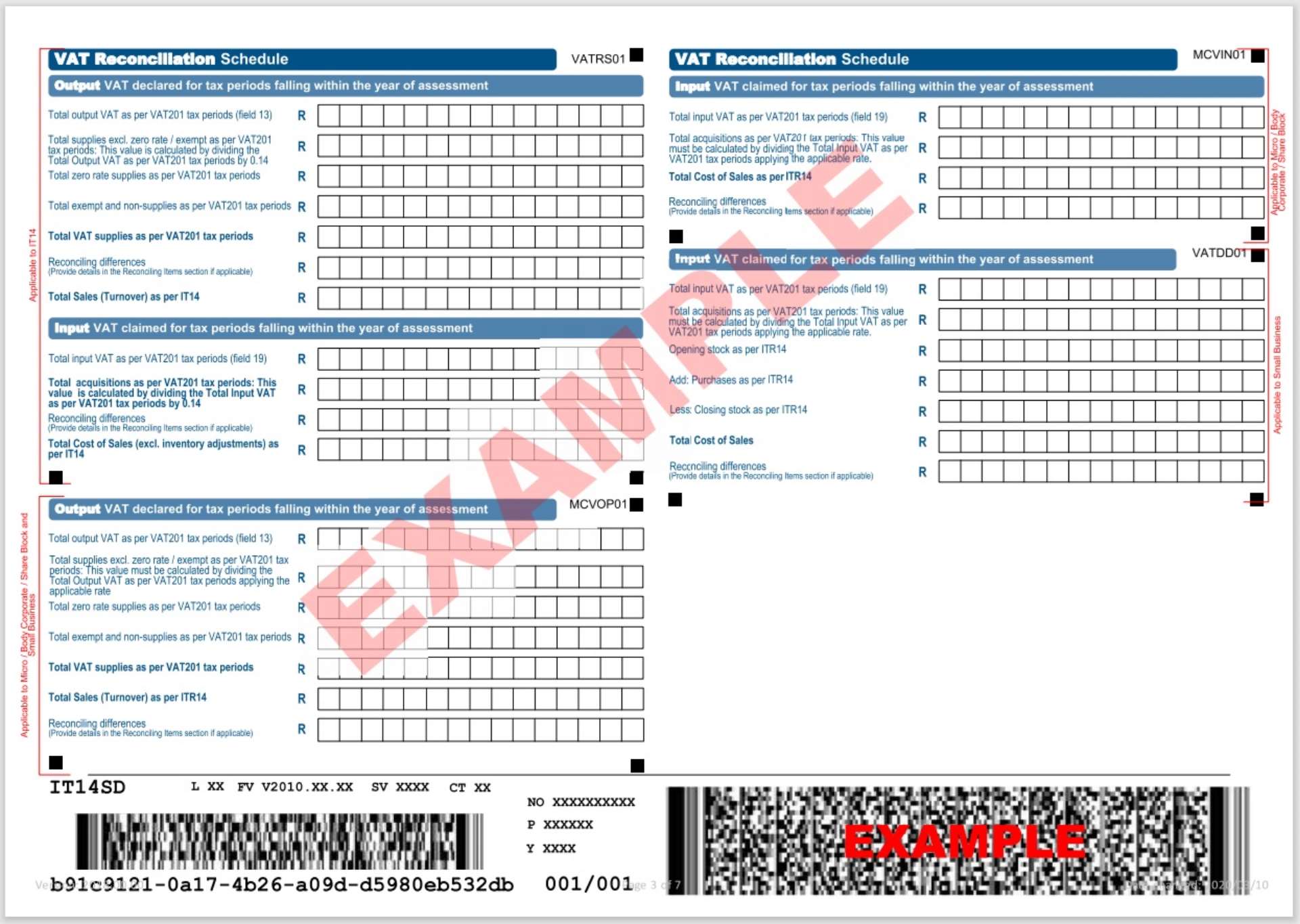

Understanding SARS IT14SD VATSolve

How To Get A Tax Clearance Certificate From SARS Finite Solutions

UPDATED How To Get A Tax Clearance Certificate SARS EFiling Tutorial

UPDATED How To Get A Tax Clearance Certificate SARS EFiling Tutorial

Income Tax Exemption On Interest Of Education Loan YouTube

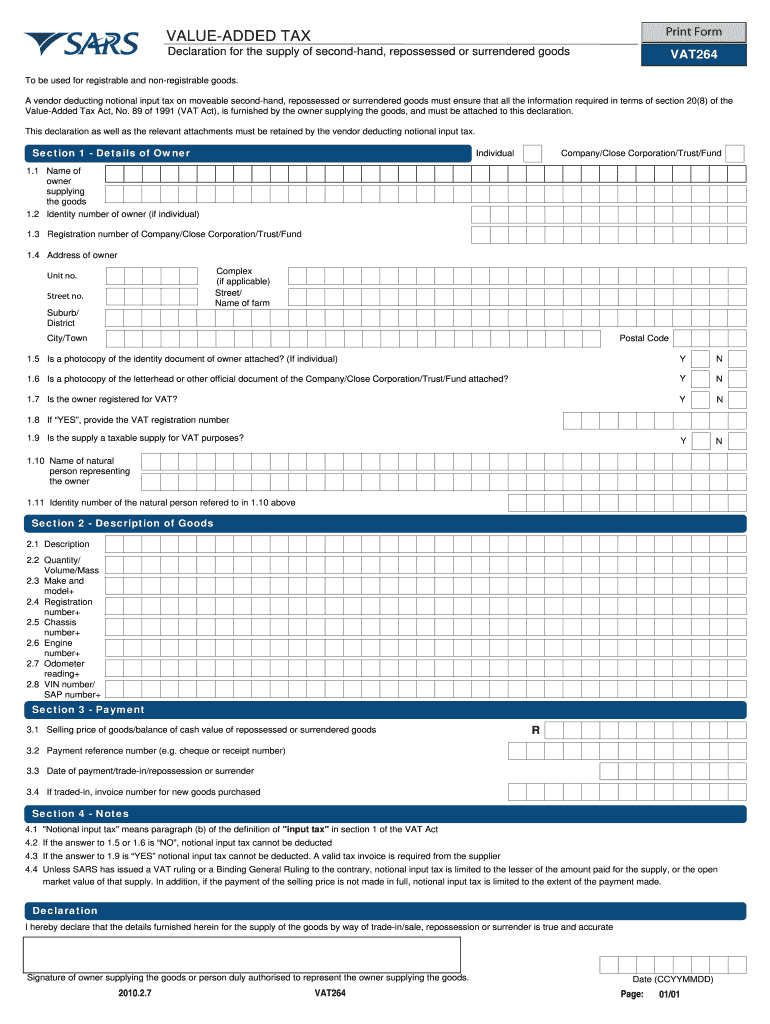

Vat264 Form Fill Out And Sign Printable PDF Template AirSlate SignNow

Power Of Attorney Form Sars 2 Proctor Othered

Sars Tax Exemption On Interest Earned - SARS exempts from income tax any interest income earned from a South African source by any individual under 65 years up to R23 800 per annum and individuals 65 and older up to R34