Sars Tax Rebate Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Note 1 Trusts for the benefit of ill or disabled persons and testamentary trusts

Web Tax rates from 1 March 2021 to 28 February 2022 Individuals and special trusts Trusts other than special trusts rate of tax 45 Rebates Primary Secondary Persons 65 and Web 27 juin 2023 nbsp 0183 32 Tax rebates A taxpayer is entitled to so called tax rebates that are deducted from tax payable The rebates have the effect of establishing tax thresholds below which

Sars Tax Rebate

Sars Tax Rebate

https://i.ytimg.com/vi/ZZjVYJlYUSY/sddefault.jpg

SARS Tax Rates For Individuals South African Tax Consultants

https://www.tax-consultant.co.za/wp-content/uploads/2020/03/Tax-Rebates-and-Thresholds.png

Sars Paye Annual Tax Tables 2017 Review Home Decor

https://www.taxtim.com/za/images/media-za/IRP5-1-AnnotatedSARS.gif

Web 22 February 2023 Today the Minister of Finance is announcing the National Budget for 2023 including changes in tax rates duties and levies To see the changes visit the Web A tax rebate to individuals for solar PV panels of 25 of the cost for a limited period subject to certain conditions and capped at R15 000 per individual RENEWABLE ENERGY TAX INCENTIVE Corporate

Web Individuals will be able to claim a rebate to the value of 25 of the cost of new and unused solar photovoltaic PV panels up to a maximum of R15 000 per individual For example Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201

Download Sars Tax Rebate

More picture related to Sars Tax Rebate

Tax Rebate For Individual China Individual Income Tax IIT Reform

https://cawinners.com/wp-content/uploads/2017/02/how-to-claim-rebate-us-87A-of-Income-tax-act-1961.jpg

SARS Tax Rates For Individuals South African Tax Consultants

https://www.tax-consultant.co.za/wp-content/uploads/2021/08/image-1.png

How The SARS Income Tax Brackets Work In 2022 Income Tax Brackets

https://i.pinimg.com/originals/28/df/2e/28df2e48fde63dc7e6d71c71080741ba.jpg

Web 18 avr 2023 nbsp 0183 32 SARS will use info from solar installers to make sure you qualify for tax rebates Individuals can claim 25 in tax deductions for their rooftop solar but SARS Web 8 mai 2023 nbsp 0183 32 The rebate is only available for solar PV panels and not inverters or batteries to focus on the promotion of additional generation It can be used to offset the individual s personal income tax liability to

Web Congruent with this tradition and common practice the current Minister of Finance Mr Tito Mboweni delivered the budget speech on Wednesday 24 February 2023 laying out Web The National Treasury and the South African Revenue Service SARS today publish for public comment the draft legislative amendments to give effect to the two renewable

Sars Tax Tables 2017 18 Brokeasshome

https://www.taxtim.com/za/images/media-za/23.png

SARS Archives Pay Solutions

https://www.paysol.co.za/wp-content/uploads/2020/05/SARS-1.png

https://www2.deloitte.com/content/dam/Deloitte/za/Documen…

Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Note 1 Trusts for the benefit of ill or disabled persons and testamentary trusts

https://www.sars.gov.za/wp-content/uploads/Docs/Budget/2…

Web Tax rates from 1 March 2021 to 28 February 2022 Individuals and special trusts Trusts other than special trusts rate of tax 45 Rebates Primary Secondary Persons 65 and

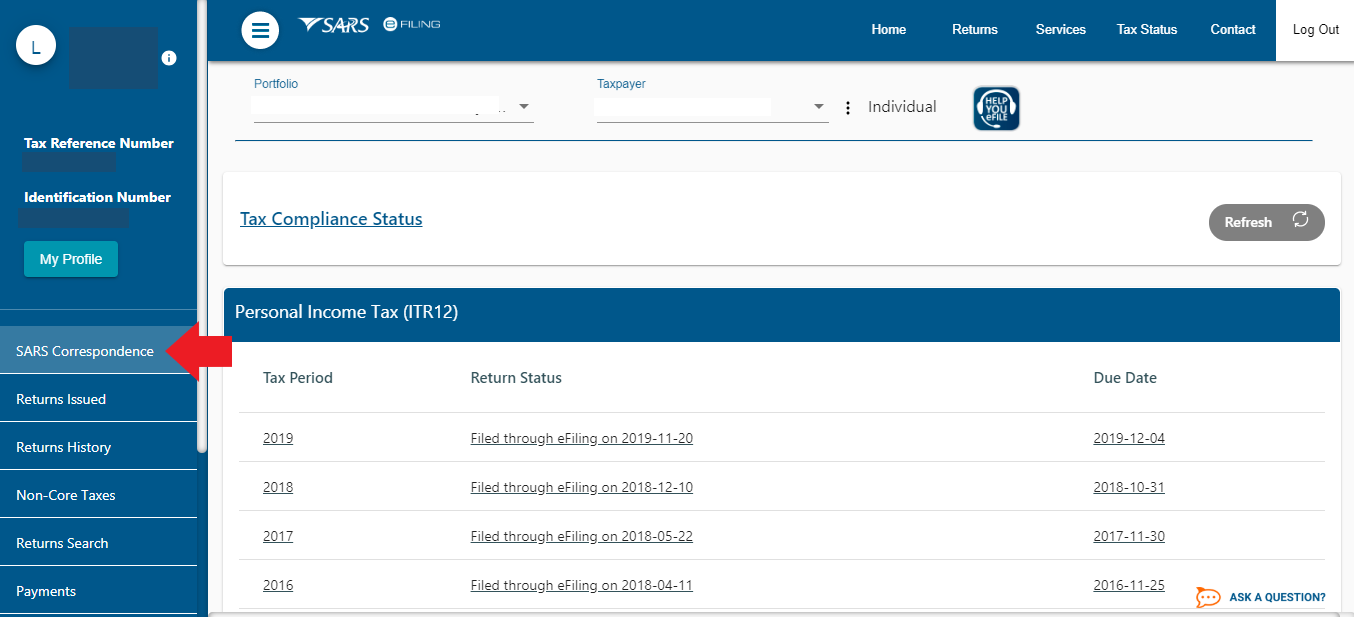

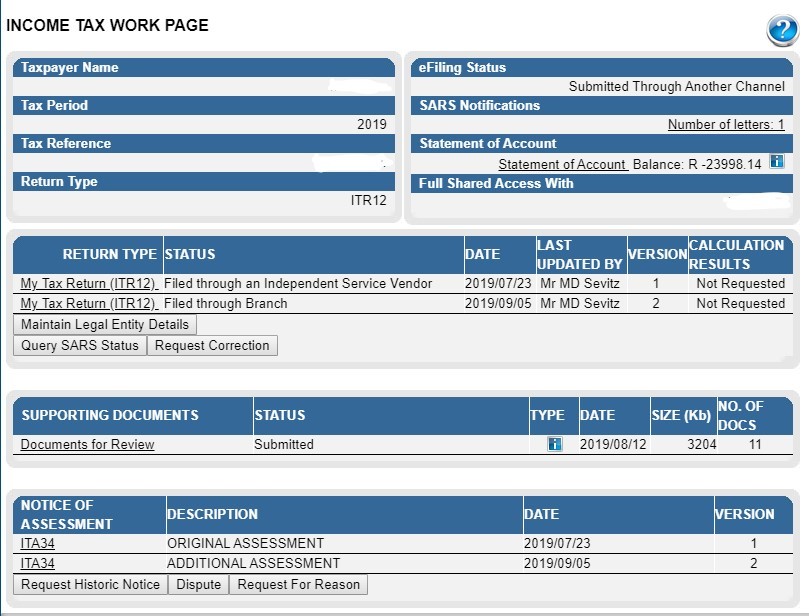

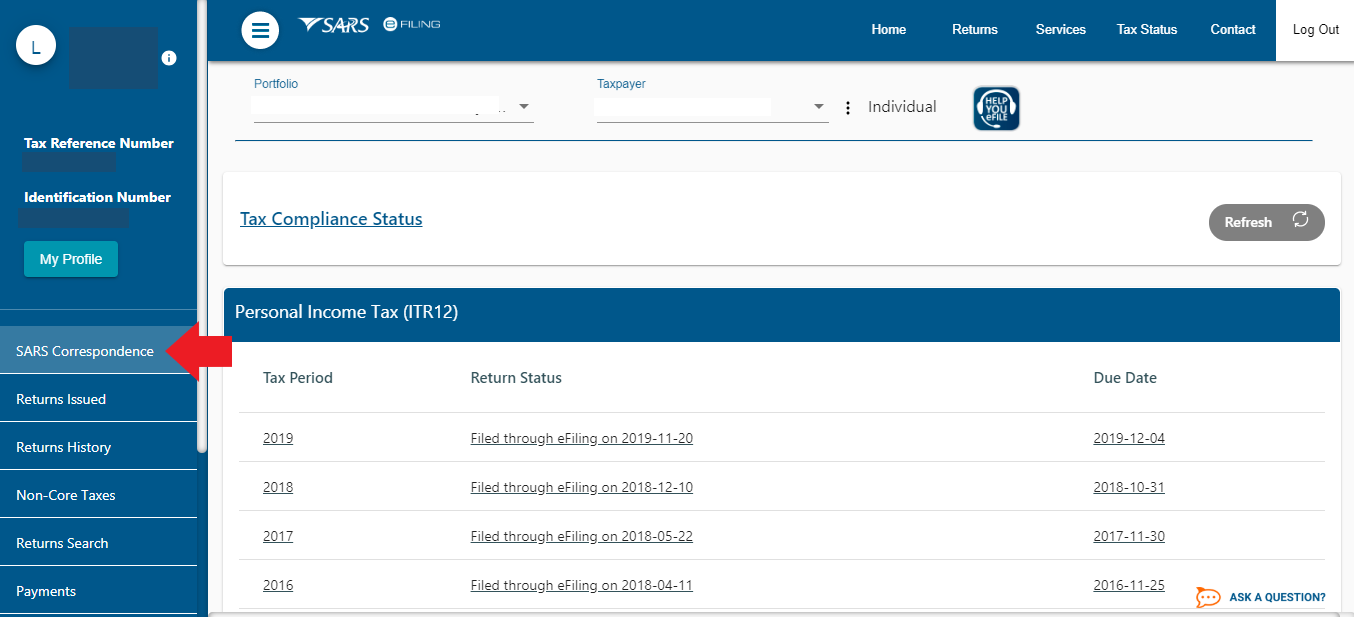

Return Status Filed Through Branch What Does This Mean Taxtim Blog Sa

Sars Tax Tables 2017 18 Brokeasshome

SARS Collections Rebate Store

Sars 2022 Tax Tables Brokeasshome

National Budget Speech 2023 SimplePay Blog

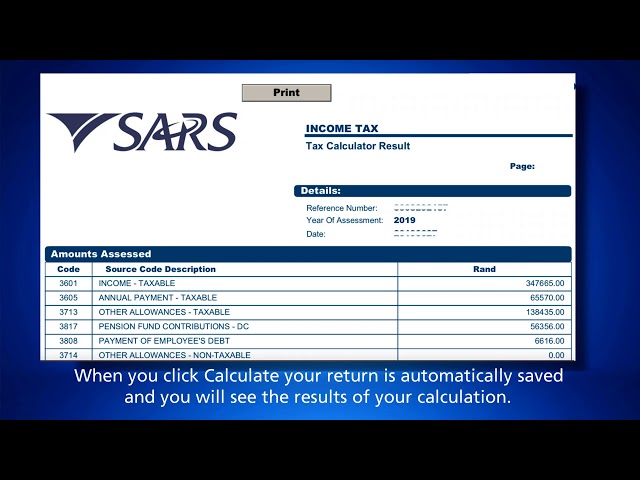

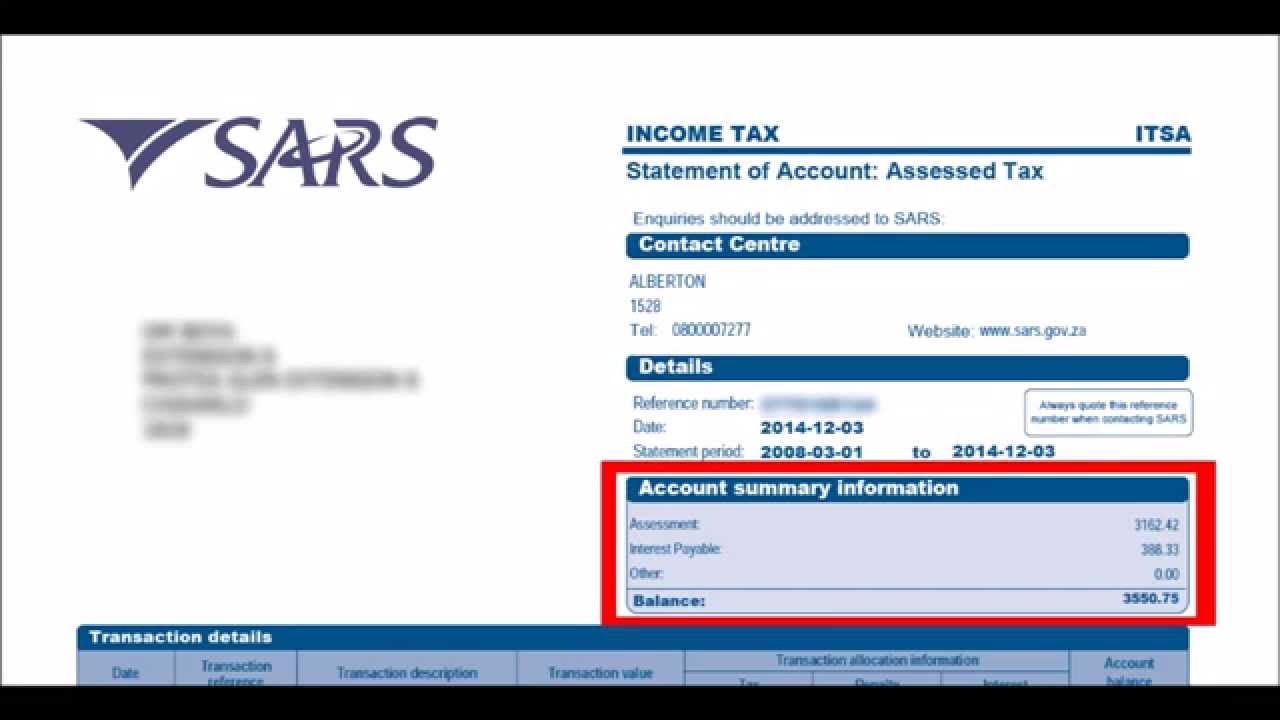

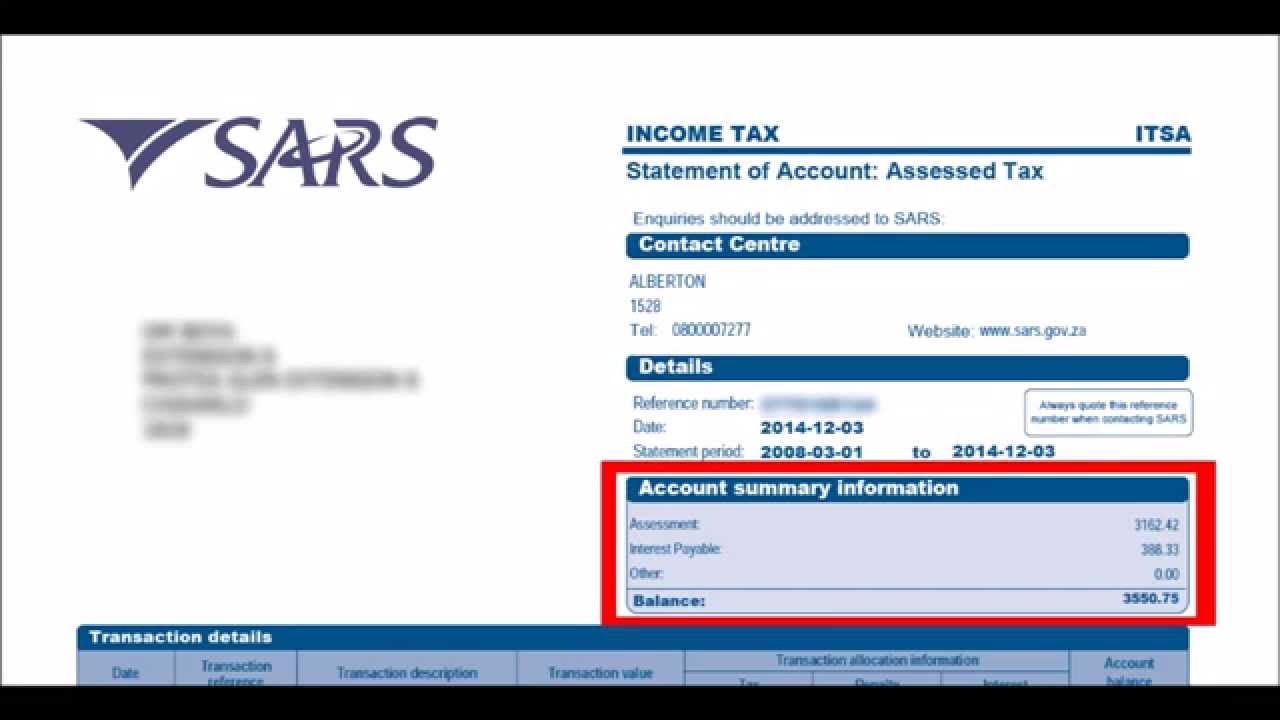

Do I Owe SARS Money YouTube

Do I Owe SARS Money YouTube

SARS Will Use Info From Solar Installers To Make Sure You Qualify For

How You Can Get A Rebate From SARS YouTube

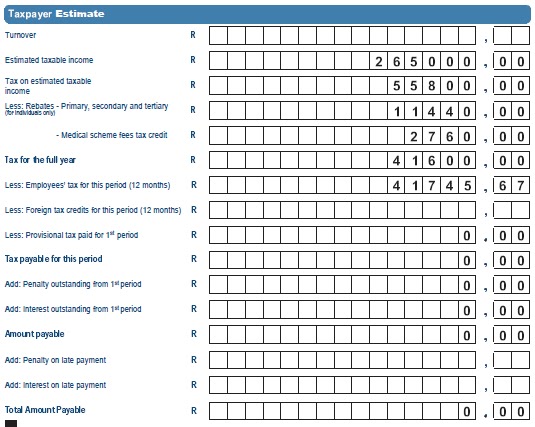

Accounting And Financial Updates SARS Provisional Tax Claim Your

Sars Tax Rebate - Web Individuals will be able to claim a rebate to the value of 25 of the cost of new and unused solar photovoltaic PV panels up to a maximum of R15 000 per individual For example