Saving Account Interest Tax Rebate Web 17 juil 2019 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is

Web 8 mai 2023 nbsp 0183 32 The IRS taxes interest from high yield savings accounts and traditional interest bearing savings accounts at the same rate they tax other income e g from your job Any money you Web 6 mars 2023 nbsp 0183 32 Savings account interest is taxable at your slab rate in case the interest amount exceeds Rs 10 000 in a financial year Interest earned up to Rs 10 000 is exempted from tax under Section

Saving Account Interest Tax Rebate

Saving Account Interest Tax Rebate

http://www.saving-sally.co.uk/wp-content/uploads/2012/11/saving-account-interest-rate.jpg

Axis Bank Saving Account Interest Rate Full Detail In Hindi Savings

https://skyeduclub.com/wp-content/uploads/2021/05/Axis-Bank-Saving-Account.jpg

Saving Account Interest Tax Free Taxation In India Sarthak Ahuja

https://i.ytimg.com/vi/D0nv1n4JQlQ/maxresdefault.jpg

Web 10 mars 2022 nbsp 0183 32 Savings account interest will be taxed at the same marginal income tax rate as the rest of your earned income Here s a look at the tax rates for the 2022 tax Web 6 avr 2023 nbsp 0183 32 Since 6 April 2016 most people have no tax to pay on interest they receive from a bank or building society account due to the personal savings allowance PSA of 163 1 000 or 163 500 for higher rate

Web 26 avr 2023 nbsp 0183 32 Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned even if it s Web Basic rate taxpayers can earn up to 163 1 000 of interest tax free each tax year If you re a higher rate taxpayer you get a 163 500 allowance Additional rate taxpayers don t get a PSA There are other allowances that may

Download Saving Account Interest Tax Rebate

More picture related to Saving Account Interest Tax Rebate

Bank Savings Account Interest Rates InterestProTalk

https://www.interestprotalk.com/wp-content/uploads/which-us-bank-has-the-highest-interest-rate-for-a-savings-account-quora.jpeg

Is Savings Account Interest Tax Deductible

https://s.yimg.com/uu/api/res/1.2/evO7M0dUmFwjNGktKceIXQ--~B/aD0xNDYzO3c9MjA0OTtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/motleyfool.com/cbdf5e307d50f0dbe4cdc22816aa633e

How You Can Earn Saving Account Interest

https://www.tradesd.com/wp-content/uploads/2015/06/Saving-Account-Interest-520x330.jpg

Web 6 avr 2023 nbsp 0183 32 You earn 163 60 000 a year and get 163 1 100 in account interest you won t pay tax on your interest up to 163 500 But you ll need to pay higher rate tax 40 on the 163 600 above this Be more money savvy Is all Web 25 d 233 c 2022 nbsp 0183 32 There are two ways that savings accounts can reduce your tax bill Some accounts let you deposit pre tax money reducing your taxable income in the year you

Web 26 juil 2022 nbsp 0183 32 An individual can claim maximum deduction of Rs 10 000 for interest earned from all the savings account held with a bank co operative bank or post office How to Web Interest generated on a savings bank account is tax free up to 10 000 under section 80TTA of the Income Tax Act It makes an account with a balance of less than 10 000

Saving Account Interest Tax Free Taxation In India Sarthak Ahuja

https://i.ytimg.com/vi/D0nv1n4JQlQ/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AYwCgALgA4oCDAgAEAEYZSBYKEswDw==&rs=AOn4CLA50ns7T-xfcWEl358hL5Ygw1F7ew

How To Report Saving Account Interest In Your Tax Return

https://figyan.com/wp-content/uploads/2022/06/saving-account-interest-tax-return.png

https://tax2win.in/guide/section-80tta

Web 17 juil 2019 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is

https://www.kiplinger.com/taxes/how-saving…

Web 8 mai 2023 nbsp 0183 32 The IRS taxes interest from high yield savings accounts and traditional interest bearing savings accounts at the same rate they tax other income e g from your job Any money you

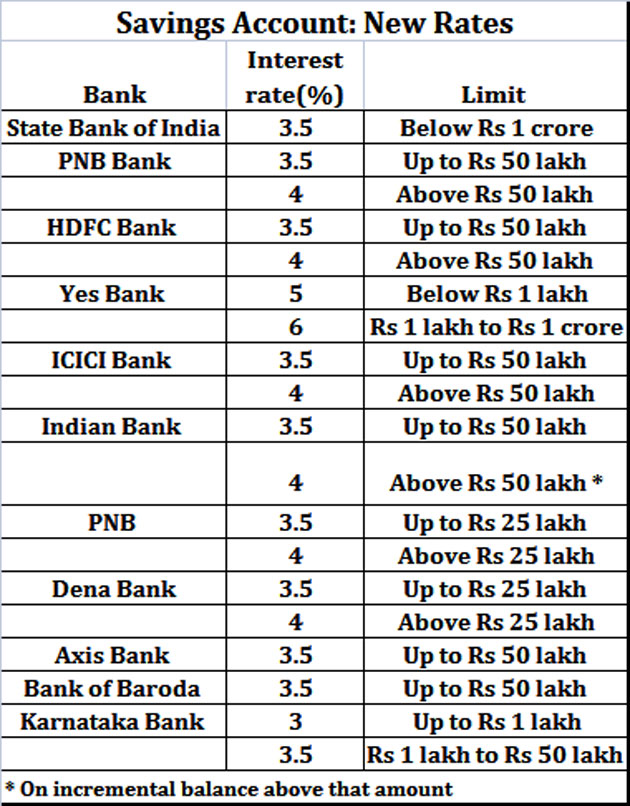

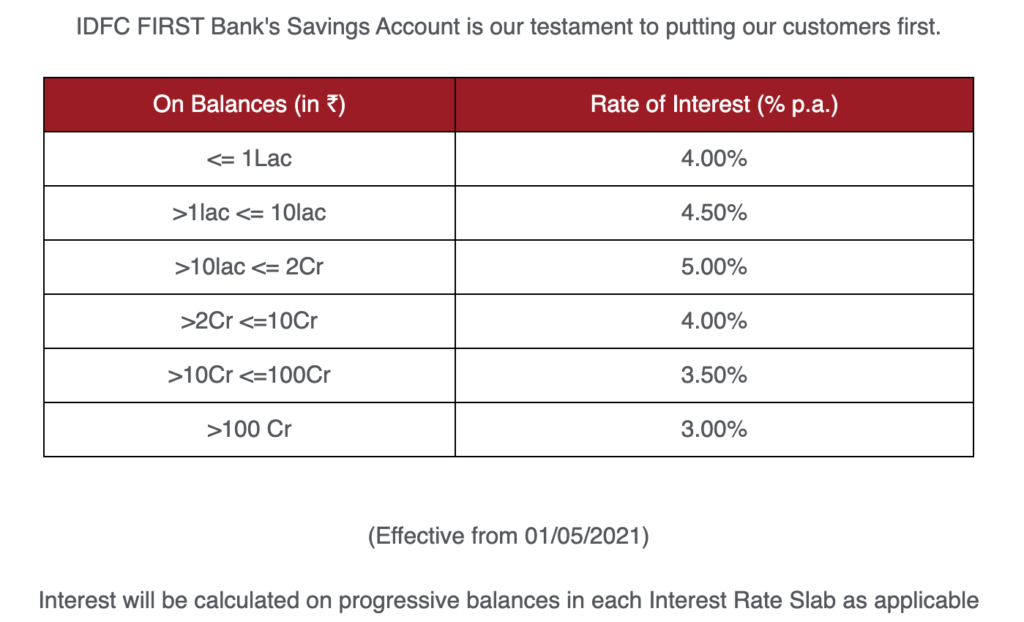

Which Bank Give The Highest Interest Rate On Savings Account In India 2022

Saving Account Interest Tax Free Taxation In India Sarthak Ahuja

Savings Account Banks Are Cutting Interest Rate On Savings Account

Retirement Savings Plan Saving For Retirement Retirement Planning

SBI Saving Account Interest Rate

Saving Account Interest Rates 5

Saving Account Interest Rates 5

Which Bank Gives Highest Interest Rate On Saving Account In India

State Bank Of India SBI Zero Balance Saving Account Penalty For

Pnb Saving Account Interest Rate

Saving Account Interest Tax Rebate - Web The Standard Personal Allowance is 163 12 570 2023 24 This means you re able to earn or receive up to 163 12 570 in the 2023 24 tax year 6 April to 5 April and not pay any tax