Sc State Tax Rebate 2024 Why The department is reminding families to review all deductions and tax credits to see what they may be able to claim on their returns Tax season begins on Jan 29 2024 and returns are due Monday

CHARLOTTE N C South Carolina s Department of Revenue announced it will begin accepting 2023 individual income tax returns on Jan 29 and there are three changes you need to know about The South Carolina Department of Revenue SCDOR will begin distributing almost 1 billion in state tax rebates later this year What you nee d to know You must file a South Carolina Individual Income Tax return SC1040 for tax year 2021 by October 17 2022 You must have a tax liability

Sc State Tax Rebate 2024 Why

Sc State Tax Rebate 2024 Why

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

Rebate Check 2023 Sc RebateCheck

https://www.rebatecheck.net/wp-content/uploads/2023/04/stimulus-check-update-sc-rebate-2022-up-to-800-stimulus-check-who-8.jpg

Nebraska Tax Rebate 2024 Eligibility Application Deadline Status PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Nebraska-Tax-Rebate-2023-768x678.png

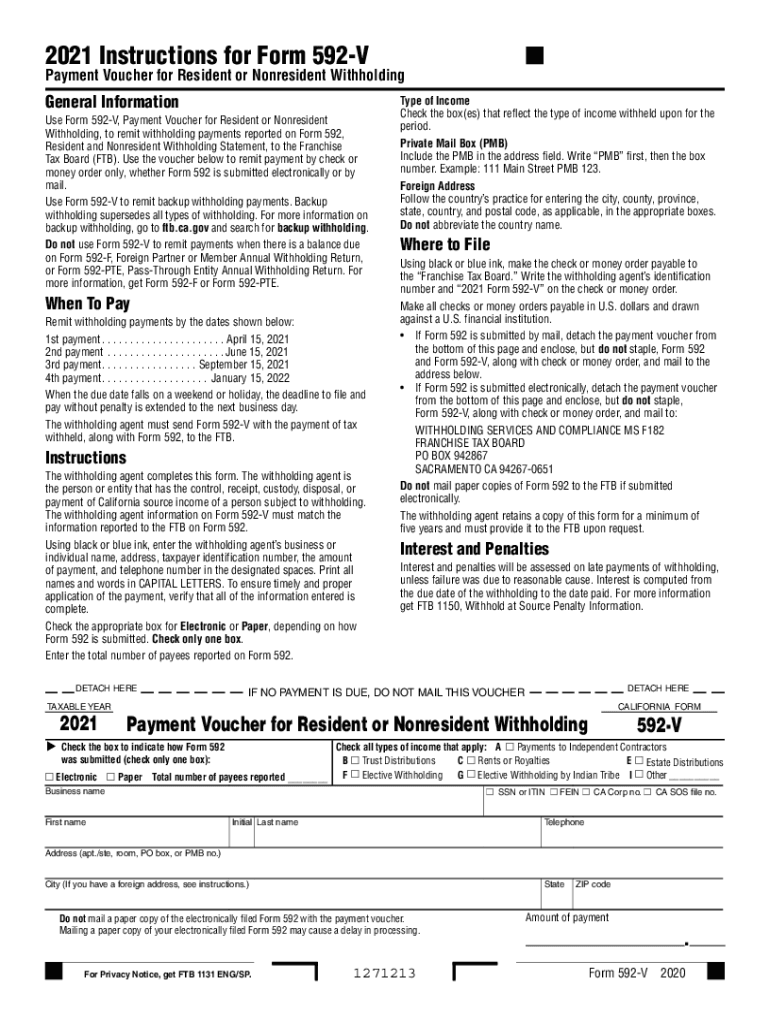

Meanwhile the filing deadline for both federal and state returns is April 15 So when is the soonest a South Carolina taxpayer can get a tax refund IRS The IRS will begin processing tax returns on Jan 29 If you file your tax return online and opt for direct deposit on Jan 29 then you can expect your refund from the IRS in less than 21 days Taxpayers in the state now have until Feb 15 2024 to file certain tax returns and make tax payments that were originally due between Aug 29 2023 and Feb 15 2024 The extensions

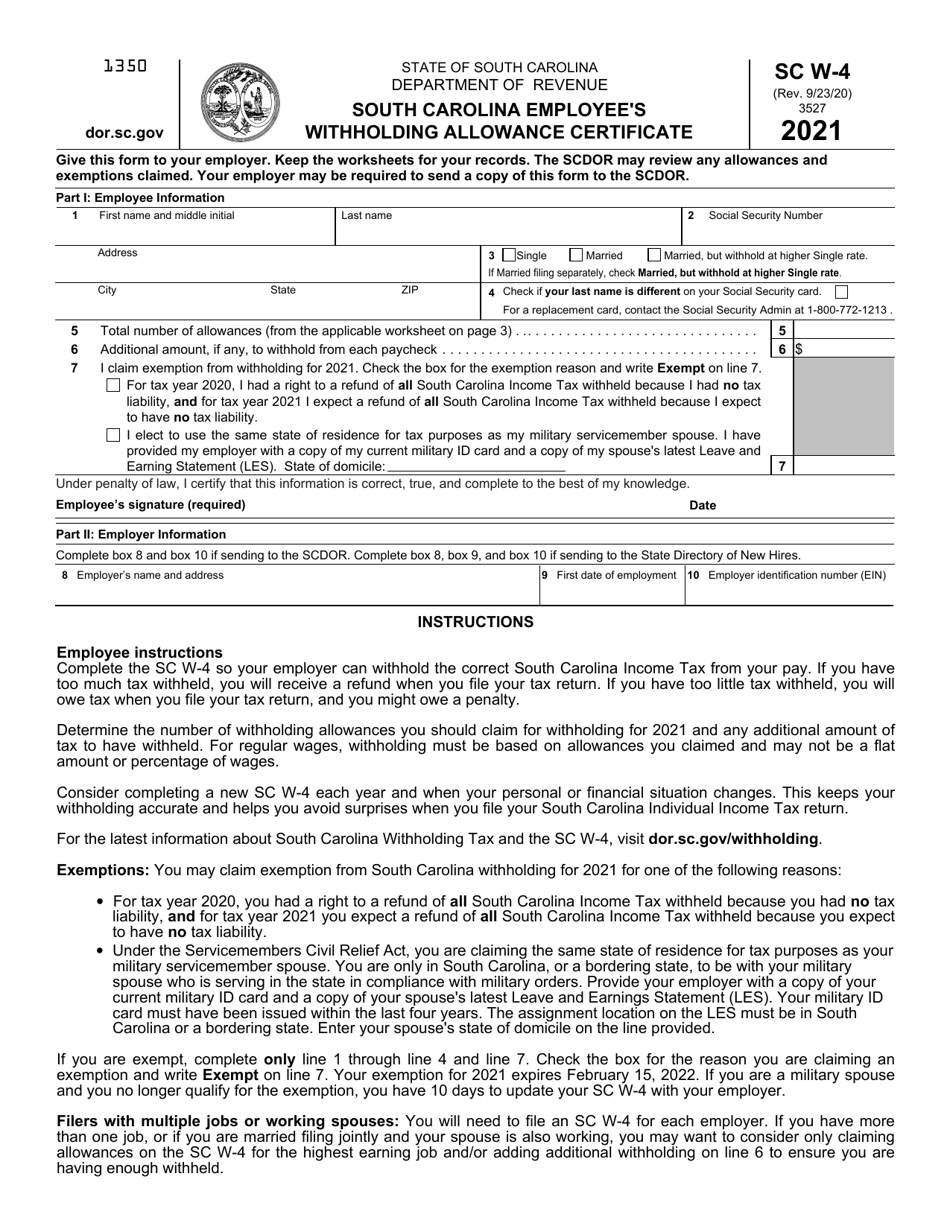

For those who owed money on their returns or who received small refunds in 2023 changing withholding can prevent a tax bill in 2024 The SCDOR recommends that taxpayers contact their employer s payroll department to see if they need to adjust their withholding amount South Carolina Your SC tax refund may be smaller next year Here s why By Patrick McCreless June 13 2023 9 27 AM South Carolina taxpayers could see smaller refunds next year Giorgio

Download Sc State Tax Rebate 2024 Why

More picture related to Sc State Tax Rebate 2024 Why

Form W 4 Employee S Withholding Allowance Certificate Fill Out And Sign Printable Pdf Template

https://data.templateroller.com/pdf_docs_html/2177/21779/2177955/form-sc-w-4-south-carolina-employee-s-withholding-allowance-certificate-south-carolina_print_big.png

One time Tax Rebate Checks For Idaho Residents KLEW

https://klewtv.com/resources/media2/16x9/full/1015/center/80/bcd0e069-efe3-406d-b87f-b52ab4b43fd3-large16x9_IdahoTaxRebateCheckpic.jpg

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

The maximum rebate cap is 800 meaning if your tax liability is more than that you will get an 800 rebate If you filed your 2021 SC Individual Income Tax return by October 17 you will receive your rebate by the end of the year and can track your rebate status online Updated 11 57 PM EDT August 10 2022 COLUMBIA S C South Carolina Department of Revenue announced Wednesday morning nearly one billion dollars in state tax rebates will be issued to

They have until Feb 15 2023 to file their tax returns State lawmakers approved the distribution of the tax rebates during a session in June including it in a 13 8 billion budget bill The rebates are projected to cost roughly 1 billion Married couples who filed joint 2021 individual income tax returns will receive only one rebate WPDE Some taxpayers could see a rebate before the end of the year The South Carolina Dept of Revenue SCDOR will issue close to one billion dollars in state tax rebates to those who have filed their 2021 SC Individual Income Tax returns by Oct 17 which is the filing extension deadline

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

SC 2022 Rebate How To Calculate Your Rebate Amount YouTube

https://i.ytimg.com/vi/E9XarfIfXzQ/maxresdefault.jpg

https://www.abccolumbia.com/2024/01/25/scdor-gives-tips-on-tax-deductions-credit-for-sc-families/

The department is reminding families to review all deductions and tax credits to see what they may be able to claim on their returns Tax season begins on Jan 29 2024 and returns are due Monday

https://www.wcnc.com/article/money/personal-finance/income-tax-season-2024-tips-to-file-and-changes-you-need-to-know/275-07791b2d-5e6b-4630-8360-710bf531f6b0

CHARLOTTE N C South Carolina s Department of Revenue announced it will begin accepting 2023 individual income tax returns on Jan 29 and there are three changes you need to know about

State Tax Rebate Details Emerge

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Sc 1065 Instructions 2023 Form Fill Out And Sign Printable PDF Template SignNow

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

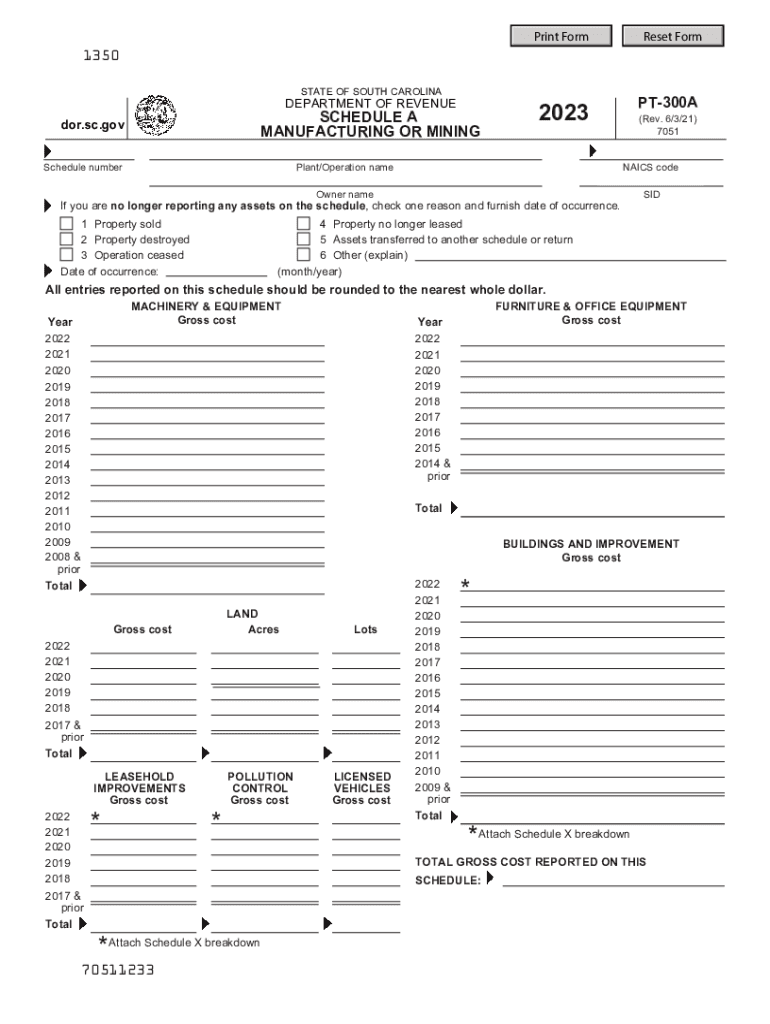

8453 2015 2023 Form Fill Out And Sign Printable PDF Template SignNow

SOUTH CAROLINA TAX REBATES ARE COMING TO ELIGIBLE TAXPAYERS WHO FILE RETURNS BY OCTOBER 17

SOUTH CAROLINA TAX REBATES ARE COMING TO ELIGIBLE TAXPAYERS WHO FILE RETURNS BY OCTOBER 17

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

South Carolina State Tax Withholding Form 2022 WithholdingForm

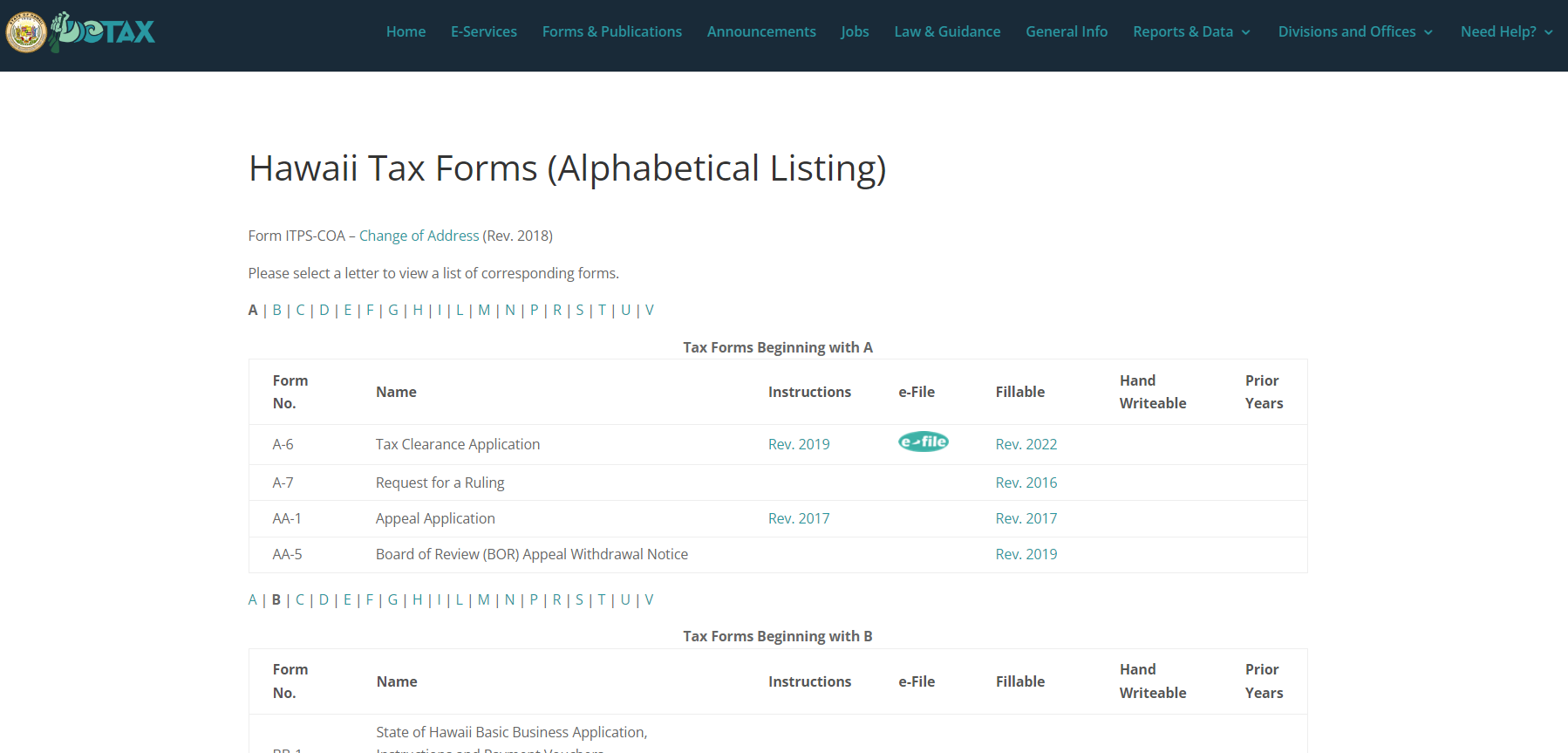

Hawaii Tax Rebate 2023 Comprehensive Guide To Claim Tax Benefits Printable Rebate Form

Sc State Tax Rebate 2024 Why - January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to