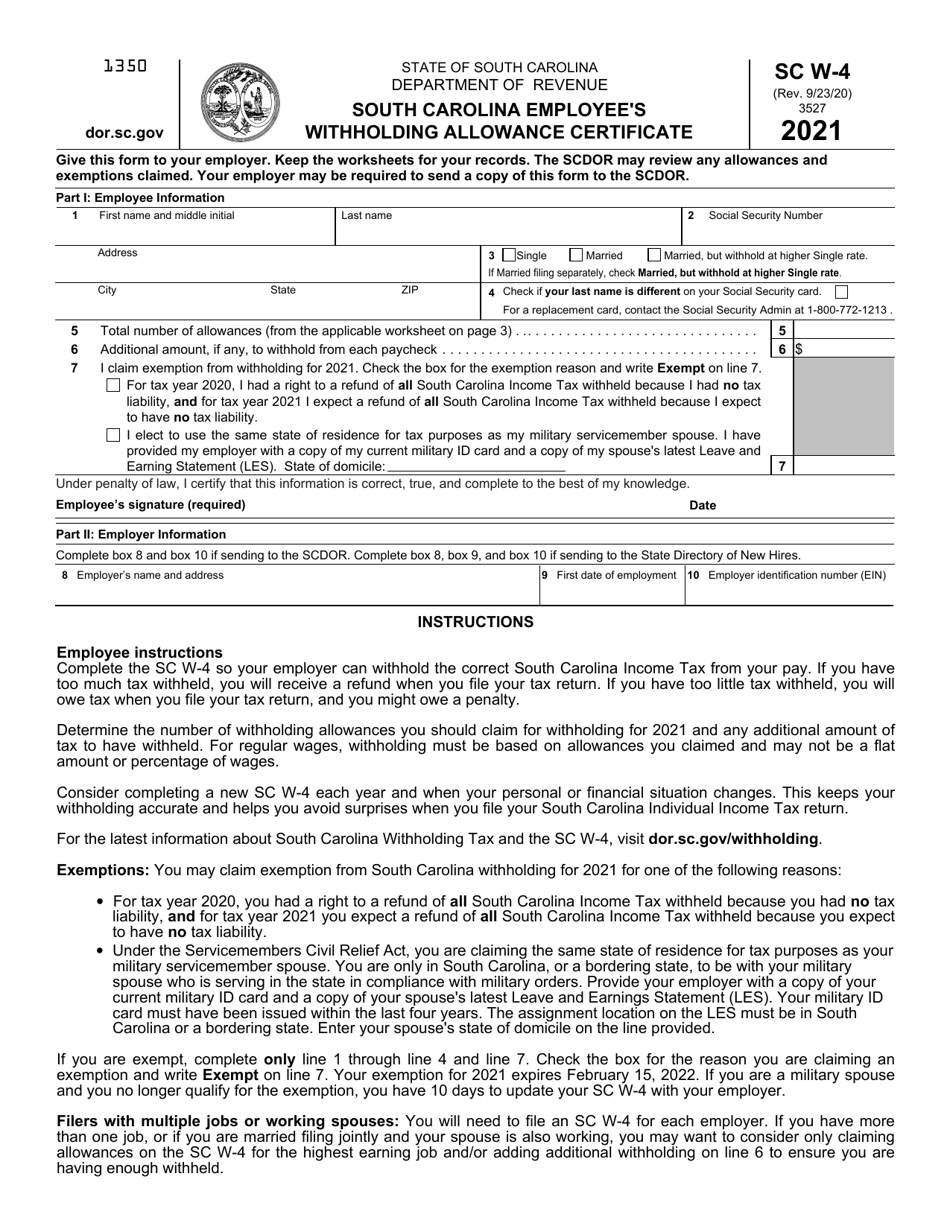

Sc State Tax Rebate 2024 For those who owed money on their returns or who received small refunds in 2023 changing withholding can prevent a tax bill in 2024 The SCDOR recommends that taxpayers contact their employer s payroll department to see if they need to adjust their withholding amount Keep in mind

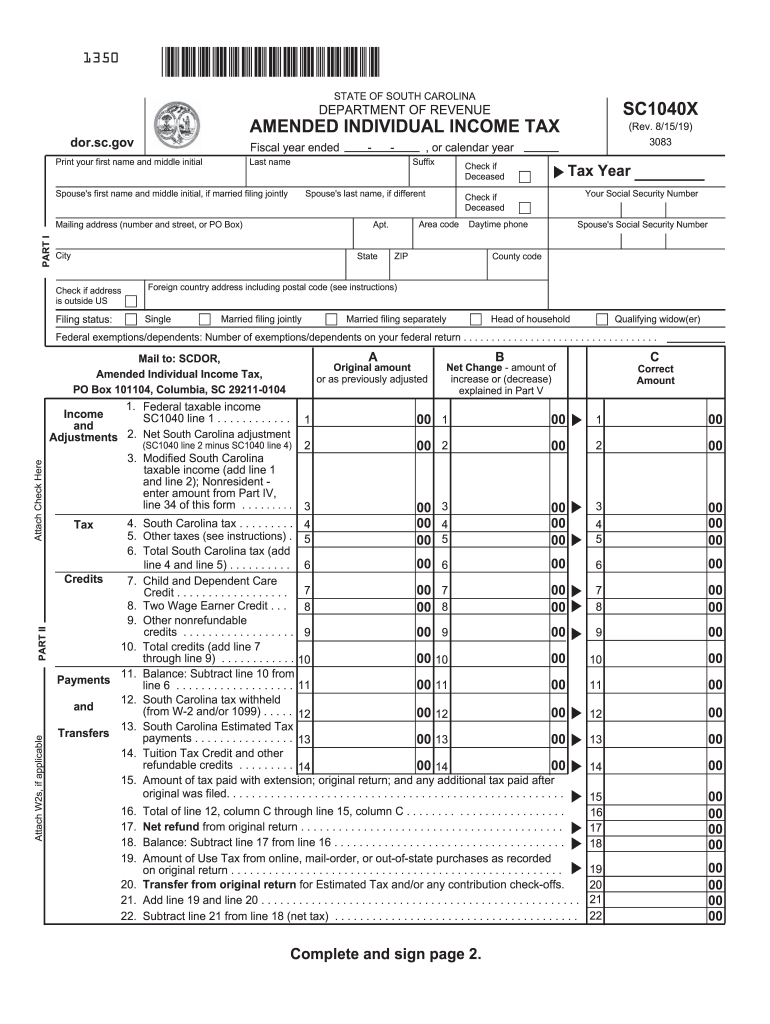

The South Carolina Department of Revenue SCDOR will begin distributing almost 1 billion in state tax rebates later this year What you nee d to know You must file a South Carolina Individual Income Tax return SC1040 for tax year 2021 by October 17 2022 You must have a tax liability This year the state two wage earner credits has increased with the maximum credit now being 350 Also the exemption for dependents has increased to more than 4 thousand The department is

Sc State Tax Rebate 2024

Sc State Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

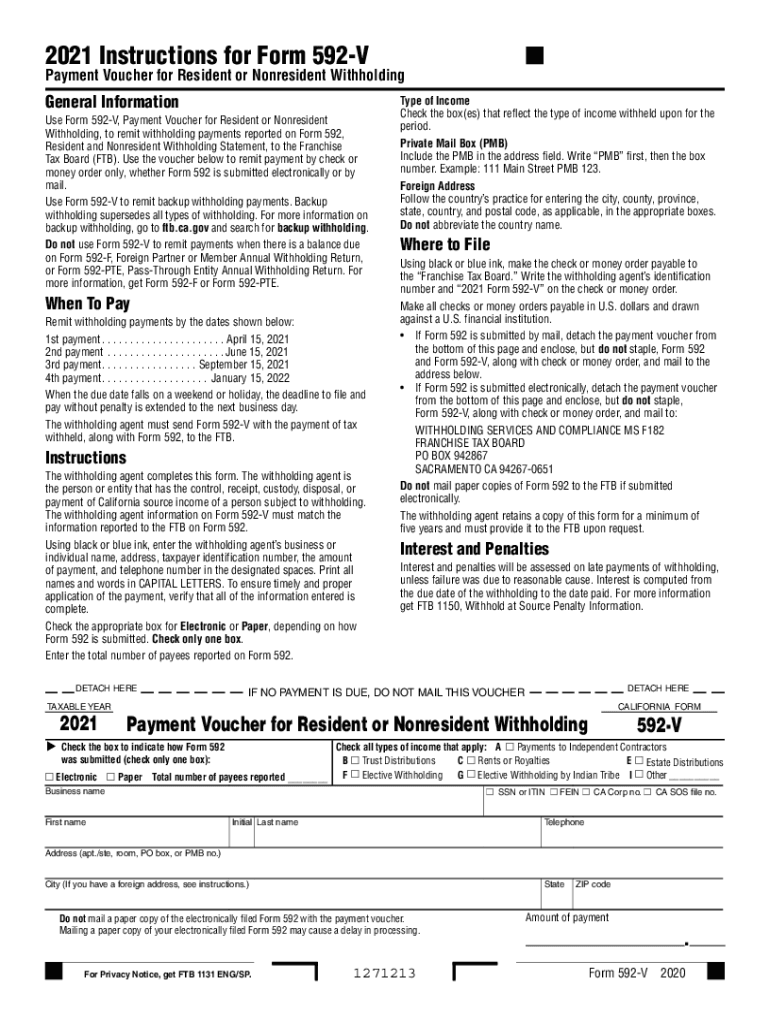

South Carolina State Tax Withholding Form 2022 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/ca-ftb-592-v-2021-fill-out-tax-template-online-us-legal-forms.png

SC 2022 Rebate How To Calculate Your Rebate Amount YouTube

https://i.ytimg.com/vi/E9XarfIfXzQ/maxresdefault.jpg

CHARLOTTE N C South Carolina s Department of Revenue announced it will begin accepting 2023 individual income tax returns on Jan 29 and there are three changes you need to know about Meanwhile the filing deadline for both federal and state returns is April 15 So when is the soonest a South Carolina taxpayer can get a tax refund IRS The IRS will begin processing tax returns on Jan 29 If you file your tax return online and opt for direct deposit on Jan 29 then you can expect your refund from the IRS in less than 21 days

South Carolina tax relief The IRS has announced tax relief for South Carolina residents impacted by Idalia Taxpayers in the state now have until Feb 15 2024 to file certain tax South Carolina Your SC tax refund may be smaller next year Here s why By Patrick McCreless June 13 2023 9 27 AM South Carolina taxpayers could see smaller refunds next year Giorgio

Download Sc State Tax Rebate 2024

More picture related to Sc State Tax Rebate 2024

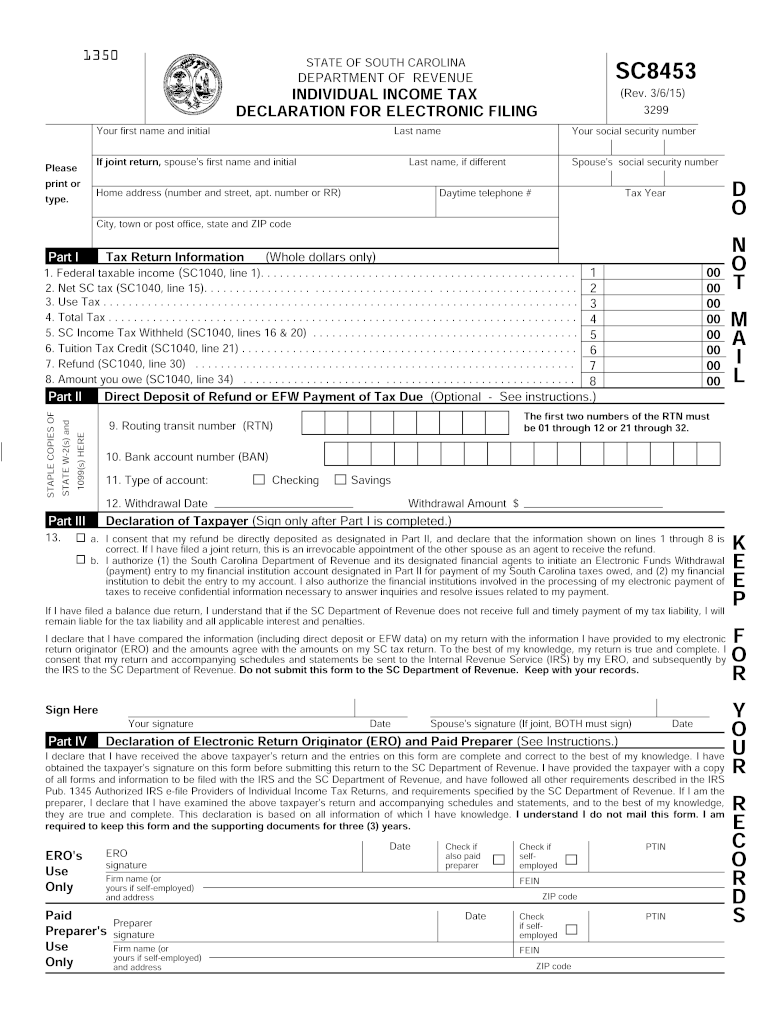

8453 2015 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/967/6967362/large.png

Rebate Check 2023 Sc RebateCheck

https://www.rebatecheck.net/wp-content/uploads/2023/04/stimulus-check-update-sc-rebate-2022-up-to-800-stimulus-check-who-8.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

South Carolina s current top state tax rate is seven percent The new spending plan will immediately lower that to 6 5 percent for the 2022 tax year Over the next five years the top rate will gradually decrease 0 1 percent every year until it s six percent provided the state economy meets certain performance measures Find forms and instructions for state taxes Tax Publications Guides updates and summaries for South Carolina taxes Tax Refund Status Check the status of your South Carolina tax refund Manage Your South Carolina Tax Accounts Online Securely file pay and register most South Carolina taxes using the SCDOR s free online tax portal MyDORWAY

Updated 11 57 PM EDT August 10 2022 COLUMBIA S C South Carolina Department of Revenue announced Wednesday morning nearly one billion dollars in state tax rebates will be issued to Watch on Until recently South Carolina had the highest personal income tax rate in the Southeast and the 12th highest in the nation

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

South Carolina Governor Offers Tax Swap Tax Foundation Bank2home

https://image.slidesharecdn.com/1293053/95/south-carolina-tax-tables-3-728.jpg?cb=1239778011

https://dor.sc.gov/reminder-your-state-tax-refund-may-be-lower-next-year-due-to-withholding-adjustments

For those who owed money on their returns or who received small refunds in 2023 changing withholding can prevent a tax bill in 2024 The SCDOR recommends that taxpayers contact their employer s payroll department to see if they need to adjust their withholding amount Keep in mind

https://dor.sc.gov/communications/how-to-know-if-you-are-eligible-for-a-state-tax-rebate

The South Carolina Department of Revenue SCDOR will begin distributing almost 1 billion in state tax rebates later this year What you nee d to know You must file a South Carolina Individual Income Tax return SC1040 for tax year 2021 by October 17 2022 You must have a tax liability

Free Printable Will Forms South Carolina

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Homeowner Renters District 16 Democrats

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Pa State Income Tax Form 2023 Printable Forms Free Online

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

California Tax Rebate 2023 How To Claim And Eligibility Criteria Tax Rebate

Property Tax Rebate Pennsylvania LatestRebate

Taxable Social Security Worksheet 2021 Fill Online Printable 6AB

Sc State Tax Rebate 2024 - Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2024 Step 1 Enter Personal Information a First name and middle initial Last name Address City or town state and ZIP code b Social