School Tax Rebate 2023 Ny State Verkko 30 lokak 2023 nbsp 0183 32 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via

Verkko 30 lokak 2023 nbsp 0183 32 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either a STAR exemption which is a reduction on your school tax bill or a STAR credit which is paid to you by check or direct deposit Verkko 11 syysk 2023 nbsp 0183 32 Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school

School Tax Rebate 2023 Ny State

School Tax Rebate 2023 Ny State

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/Missouri-Rent-Rebate-2023.png

Province Of Manitoba Your Manitoba School Tax Affordability Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/schooltaxrebate-header.jpg

2023 PA Rent Rebate Form Your Key To Financial Relief Rent Rebates

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/2023-PA-Rent-Rebate-Form.jpg

Verkko 11 marrask 2023 nbsp 0183 32 Your school taxes can be paid using your STAR benefit If you own your house use it as your principal residence and your combined income with your spouse s is 500 000 or less you are eligible for the STAR credit STAR exemption is a lower amount due for school taxes Verkko 9 huhtik 2022 nbsp 0183 32 Under this program basic School Tax Relief STAR exemption and credit beneficiaries with incomes below 250 000 and Enhanced STAR recipients are eligible for the property tax rebate where the benefit is a percentage of the homeowners existing STAR benefit

Verkko 9 huhtik 2022 nbsp 0183 32 Under this program basic School Tax Relief STAR exemption and credit beneficiaries with incomes below 250 000 and Enhanced STAR recipients are eligible for the property tax rebate where the benefit is a percentage of the homeowners existing STAR benefit Verkko 8 syysk 2022 nbsp 0183 32 Make 92 000 or less in the 2022 2023 school year About 657 000 New York households After initially promising to send the tax rebate checks in the fall the state decided to start

Download School Tax Rebate 2023 Ny State

More picture related to School Tax Rebate 2023 Ny State

Most Residential Properties To Incur Higher Tax From Jan 1 2023

https://onecms-res.cloudinary.com/image/upload/s--ljAe074S--/f_auto%2Cq_auto/v1/mediacorp/tdy/image/2022/12/02/20221202-sw-hdbtax3.png?itok=IFvC-aSJ

Minnesota Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Minnesota-Renters-Rebate-2023.jpg

Maryland Renters Rebate 2024 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/Maryland-Renters-Rebate-2023-768x684.png

Verkko 2 elok 2023 nbsp 0183 32 The STAR Credit Eligible Report is now available in the Online Assessment Community for localities where school tax bills are issued on or around September 1 The STAR Credit Eligible Report lists property owners who will receive a check for the 2023 STAR credit from our department Verkko 22 maalisk 2023 nbsp 0183 32 Maximum 2023 2024 STAR exemption savings Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings of the prior year However STAR credits can rise as much as 2 percent annually For more information see Star credit and exemption savings amounts

Verkko The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York State homeowners Who Can Apply Verkko 18 tammik 2022 nbsp 0183 32 School Aid The FY 2023 Executive Budget provides 31 3 billion in total School Aid for SY 2023 the highest level of State aid ever This investment represents a year to year increase of 2 1 billion 7 1 percent compared to School Year SY 2022 including a 1 6 billion Foundation Aid increase and a 466 million

Printable Rebate Forms Fillable Form 2024

https://fillableforms.net/wp-content/uploads/2022/09/printable-rebate-forms.jpg

Estimate Kentucky Tax Refund Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Kentucky-Tax-Rebate-2023-768x683.png

https://www.tax.ny.gov/star

Verkko 30 lokak 2023 nbsp 0183 32 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via

https://www.tax.ny.gov/pit/property/star/star-check-delivery-schedule.htm

Verkko 30 lokak 2023 nbsp 0183 32 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either a STAR exemption which is a reduction on your school tax bill or a STAR credit which is paid to you by check or direct deposit

Goodyear Tire Rebate 2023 Claim Your Discount Today Goodyear Rebates

Printable Rebate Forms Fillable Form 2024

South Carolina Tax Rebate 2023 Claim Your Rebate Comprehensive Guide

State Of New Mexico Rebate Checks 2023 Printable Rebate Form

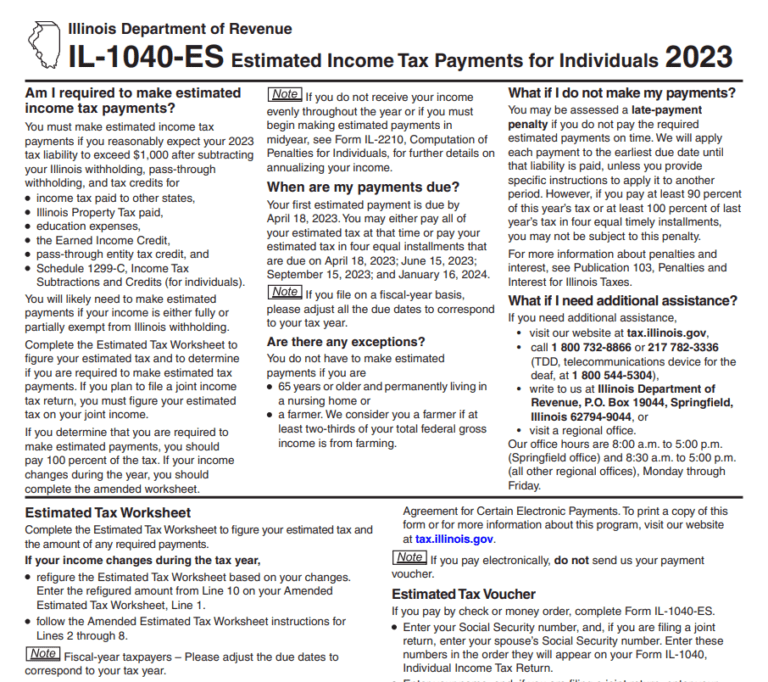

Illinois Tax Rebate 2023 Printable Rebate Form

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And

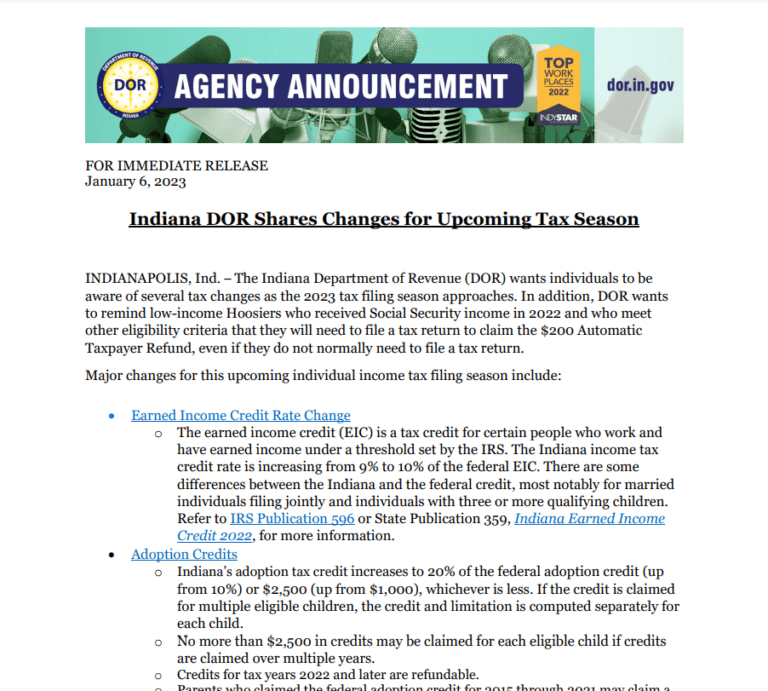

State Of Indiana Tax Rebate 2023 PrintableRebateForm

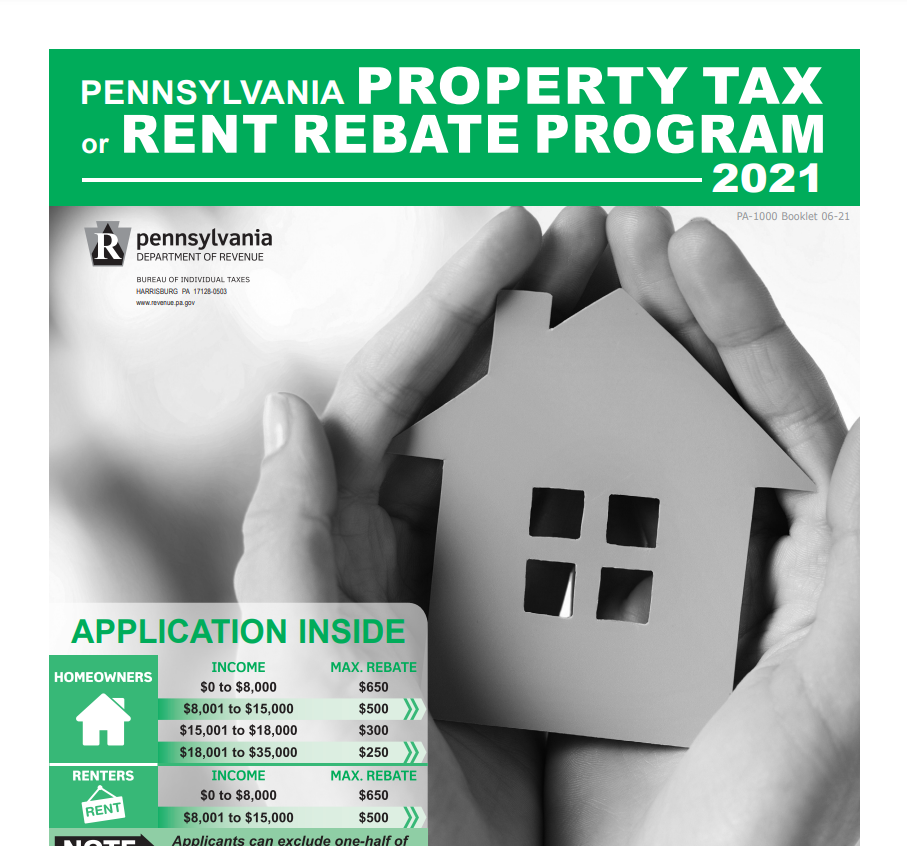

Where To Mail Pa Property Tax Rebate Form Printable Rebate Form

Rent Rebate Missouri Printable Rebate Form

School Tax Rebate 2023 Ny State - Verkko 11 marrask 2023 nbsp 0183 32 Your school taxes can be paid using your STAR benefit If you own your house use it as your principal residence and your combined income with your spouse s is 500 000 or less you are eligible for the STAR credit STAR exemption is a lower amount due for school taxes