School Tax Rebate Checks 2024 Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

You can use your STAR benefit to pay your school taxes You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000 or less STAR exemption a reduction on your school tax bill The 2024 filing season opens January 29th 2024 Good news for 2023 We ve partnered with the Free File Alliance again to offer you more options to e file your New York State income tax return at no cost Am I eligible to Free File

School Tax Rebate Checks 2024

School Tax Rebate Checks 2024

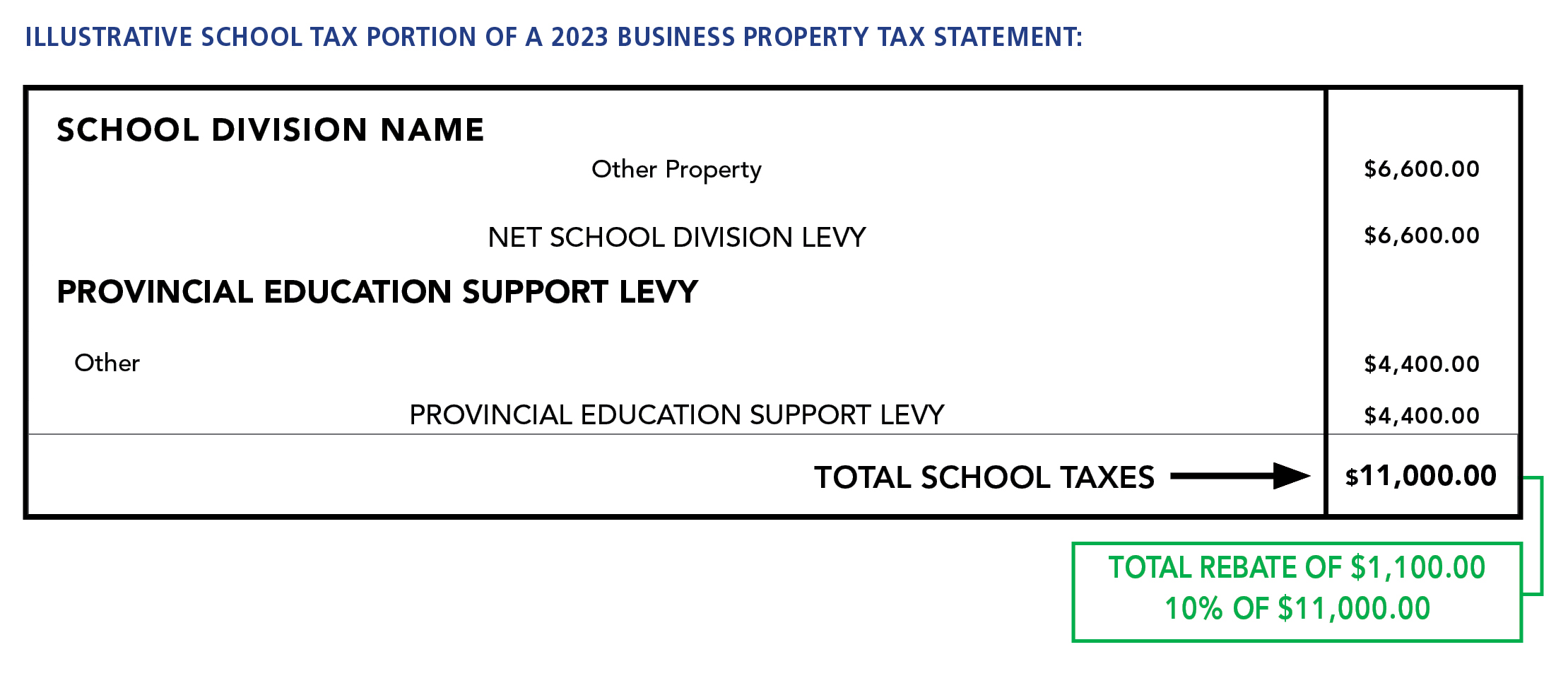

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

Back To School Tax Rebate YouTube

https://i.ytimg.com/vi/ZLpDOxH1d-c/maxresdefault.jpg

WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

These states plan to send child tax credit checks to families in 2024 Note that not all are fully refundable which means you may need an income to receive the full amount owed to you California More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress iStock 7 min Comment 295 Congressional negotiators announced a roughly 80 billion

Download School Tax Rebate Checks 2024

More picture related to School Tax Rebate Checks 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

When Is Alabam Initiating Distribution 300usd Tax Rebate Checks

https://www.lamansiondelasideas.com/wp-content/uploads/2023/08/Alabama-Tax-Rebate-Checks.jpg

NY Will Pay You Interest If STAR Check Is Late

https://www.gannett-cdn.com/-mm-/95e0ee22a1b3a0a8f536028aaea7b0cb1e53a7d3/c=0-0-3862-2182/local/-/media/2015/06/27/Westchester/Westchester/635710114656326876-MOney7.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child For tax year 2021 the expanded child

The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued as a credit by the State of New York or in some cases as a tax exemption by the City of New York People with kids under the age of 17 may be eligible to claim a tax credit of up to 2 000 per qualifying dependent For taxes filed in 2024 1 600 of the credit is potentially refundable

Thumbs Up Help Onschool Tax Rebates Checks

https://www.gannett-cdn.com/-mm-/8fde38af10db261eee600cfa2ccf6857d3f71bc9/c=284-759-4481-3130/local/-/media/Ithaca/2015/03/13/B9316591608Z.1_20150313123708_000_GA3A78S1J.1-0.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Ny Property Tax Rebate Checks 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/tax-rebate-checks-come-early-this-year-yonkers-times-7.jpg

https://taxfoundation.org/blog/bipartisan-tax-deal-2024-tax-relief-american-families-workers-act/

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

https://www.tax.ny.gov/star/

You can use your STAR benefit to pay your school taxes You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000 or less STAR exemption a reduction on your school tax bill

State Mailing Out 2 5M Property Tax Rebate Checks Newsday

Thumbs Up Help Onschool Tax Rebates Checks

New Mexico Tax Rebate 2022 How To Claim The New 500 Checks Marca

Income Tax Rebate Under Section 87A

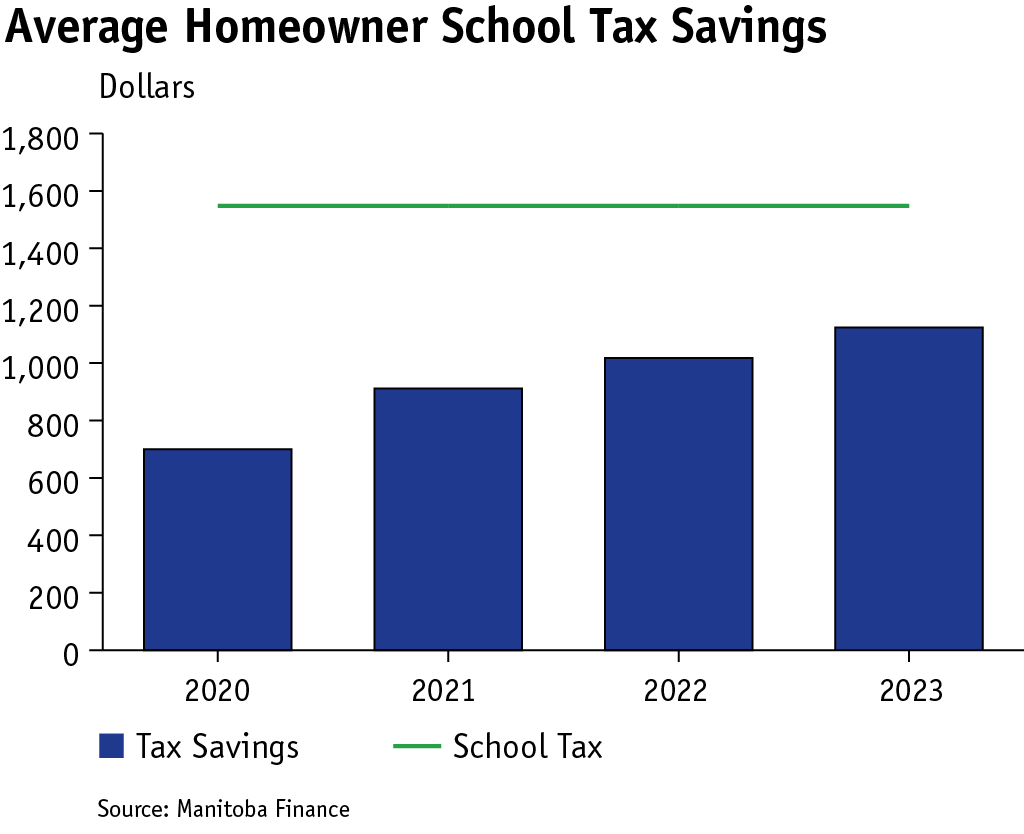

Fiscally Responsible Outcomes And Economic Growth Strategy Budget 2022 Province Of Manitoba

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Minnesota Tax Rebate Checks May Look Like Junk Mail

500 Virginia Tax Rebate Checks You Still Have 10 Days To Claim It TrendRadars

Minnesota Rebate Checks Are On The Way Kiplinger

School Tax Rebate Checks 2024 - On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax