Sec 87a Rebate Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Web 26 avr 2022 nbsp 0183 32 Taxpayers can reduce their tax liability through the rebate under Section 87A of the Income Tax Act Individuals can claim the rebate if the total income after Chapter

Sec 87a Rebate

Sec 87a Rebate

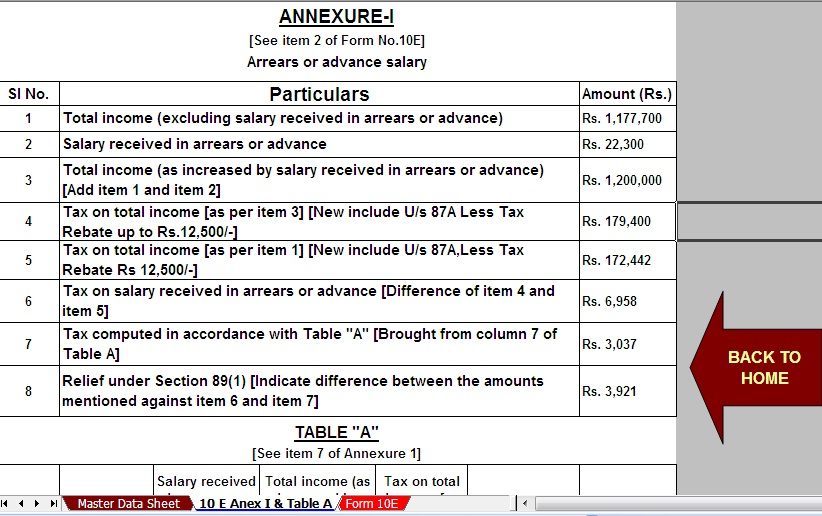

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Decoding Section 87A Rebate Provision Under Income Tax Act

https://taxguru.in/wp-content/uploads/2021/08/Decoding-Section-87A.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Web Any individual whose annual net income does not exceed Rs 5 Lakh qualifies to claim tax rebate under Section 87a of the Income Tax Act 1961 This implies an individual can get Web 25 janv 2022 nbsp 0183 32 Tue Jan 25 2022 Last updated Tue Jan 25 2022 Section 87A of the Income Tax Act allows taxpayers to claim a rebate on the payable income tax and

Web 6 sept 2023 nbsp 0183 32 Section 87A of the income tax act 1961 was launched to give relief to the taxpayers who fall under the 10 percent tax slab If a person whose total net income does not cross INR 5 lakh can claim the tax Web 4 ao 251 t 2023 nbsp 0183 32 The amount of tax rebate u s 87A is restricted to the maximum of Rs 12 500 or Rs 25 000 In case the computed tax payable is less than Rs 12 500 say Rs 10 000

Download Sec 87a Rebate

More picture related to Sec 87a Rebate

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/DECODING-SECTION-87A.png

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

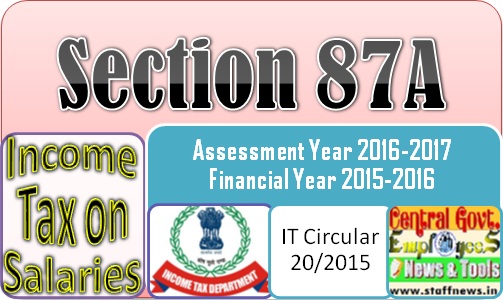

Section 87A Rebate Of Rs 2000 For Income Upto Rs 5 Lakh IT

https://www.staffnews.in/wp-content/uploads/2016/01/section-87a2Bit2Bcircular2B202B2015.jpg

Web 3 f 233 vr 2023 nbsp 0183 32 How is Section 87a Rebate calculated Let s take a few examples of how the Section 87A Rebate will make income of Rs 7 lakh tax free under the new tax regime As a reminder of the new tax slab Web 11 ao 251 t 2023 nbsp 0183 32 Rebate under Sec 87A of Income Tax AY 2024 25 Old Regime amp New Regime00 00 What is Rebate under Sec 87A 04 18 Calculation of Rebate under Sec 87A26

Web 25 ao 251 t 2020 nbsp 0183 32 Section 87A was introduced for the first time in 2013 allowing taxpayers to avail rebate if their net taxable income was below the threshold levels What is an Web VDOM DHTML tml gt What is a rebate under Section 87A and who can claim it Quora Something went wrong Wait a moment and try again

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-section-87a-tax-rebate-fy-2019-20-how-to-check-rebate-eligibility-from-87a-rebate-ay-2023-20-post.jpg?w=979&ssl=1

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

New Tax Regime Sec 87 A Rebate For Taxable Income More Than Rs 7

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Rebate Under Sec 87A Income Tax May June And Nov Dec 2023

Health Care Tax Rebate Calculator 2022 Carrebate

Sec 87A Rebate Income Tax Malayalam AY 2022 23 CA Subin VR YouTube

Sec 87A Rebate Income Tax Malayalam AY 2022 23 CA Subin VR YouTube

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Rebate Under Sec 87A On Basic Income Tax PY 2022 23 AY 2023 24

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a

Sec 87a Rebate - Web 4 ao 251 t 2023 nbsp 0183 32 The amount of tax rebate u s 87A is restricted to the maximum of Rs 12 500 or Rs 25 000 In case the computed tax payable is less than Rs 12 500 say Rs 10 000