Section 16 Deductions Income Tax India Verkko 31 hein 228 k 2023 nbsp 0183 32 Explore Standard Deduction under Section 16 ia and in the new tax regime Standard deduction of Rs 40 000 reintroduced

Verkko 4 hein 228 k 2023 nbsp 0183 32 Rs 40 000 Rs 50 000 Net Taxable Income Rs 9 65 800 Rs 9 60 000 Rs 9 50 000 Hence with standard deduction under Section 16 ia for 2021 22 Arun Verkko Standard Deduction Rs 50 000 or the amount of salary whichever is lower Individual Salaried Employee amp Pensioners 16 ii Entertainment allowance actual or at the rate

Section 16 Deductions Income Tax India

Section 16 Deductions Income Tax India

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

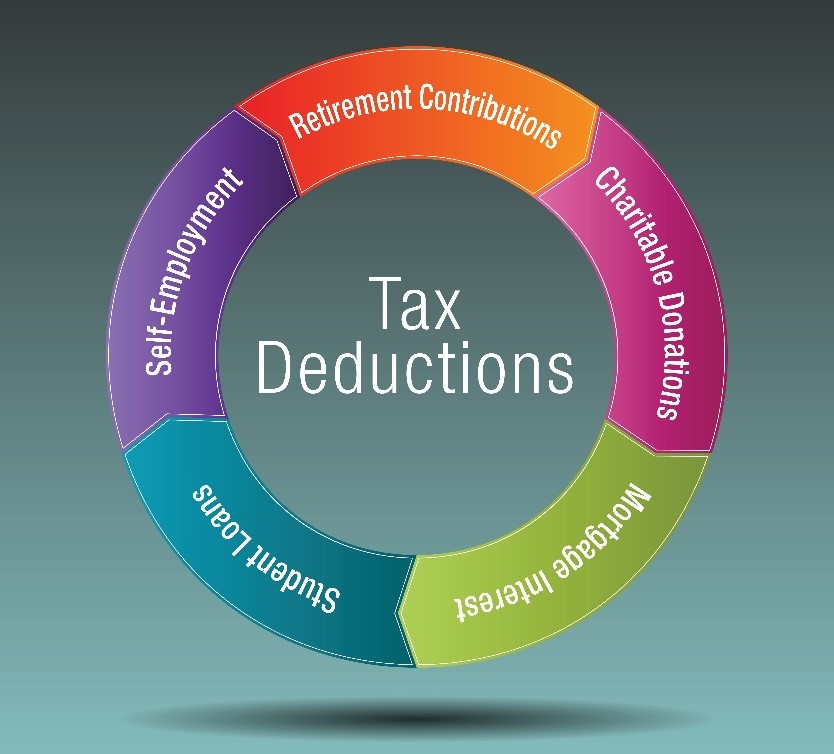

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

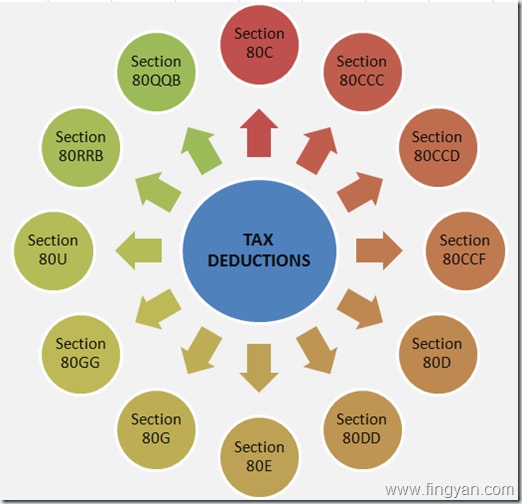

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Verkko The standard deduction under section 16 ia of the Income Tax Act 1961 is a flat deduction of Rs 50 000 or the amount of salary whichever is less It was introduced Verkko 21 kes 228 k 2022 nbsp 0183 32 Standard Deduction Provisions of Section 16 ia of the IT Act allows a standard deduction of up to INR 50 000 to every salaried individual for a particular

Verkko 8 toukok 2023 nbsp 0183 32 Payment under Section 16 of the Income Tax Act protects salaried taxpayers from paying higher taxes by reducing their taxable income The criteria for claiming this deduction is simple and Verkko 23 helmik 2021 nbsp 0183 32 What Deductions are offered by section 16 It offers three types of deductions Standard deduction of 50 000 or salary whichever is less

Download Section 16 Deductions Income Tax India

More picture related to Section 16 Deductions Income Tax India

Tax Savings Deductions Under Chapter VI A Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03105750/FigJam-Basics-1-1024x870.jpg

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

https://www.bmp-cpa.com/wp-content/uploads/2019/01/tax-deductions.jpg

Online Salary Tax Calculator MckenzyJoani

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

Verkko 17 maalisk 2023 nbsp 0183 32 Section 16 of the Income Tax Act 1961 mentions allowances and deductions on your taxable salary According to Section 16 salaried taxpayers and pensioners irrespective of the Verkko Standard deduction under Section 16 ia is a flat deduction that is allowed from the salary income The concept of standard deduction was introduced in the Union

Verkko 2 tammik 2023 nbsp 0183 32 Standard Deduction of Section 16 ia Income Tax Act is straight line deductions that individuals can claim against their income to reduce their tax liability Salaried individuals and Verkko 29 toukok 2023 nbsp 0183 32 Deduction under section 16 ia states that a taxpayer having income chargeable under the head Salaries shall be allowed a deduction of Rs 50 000 or

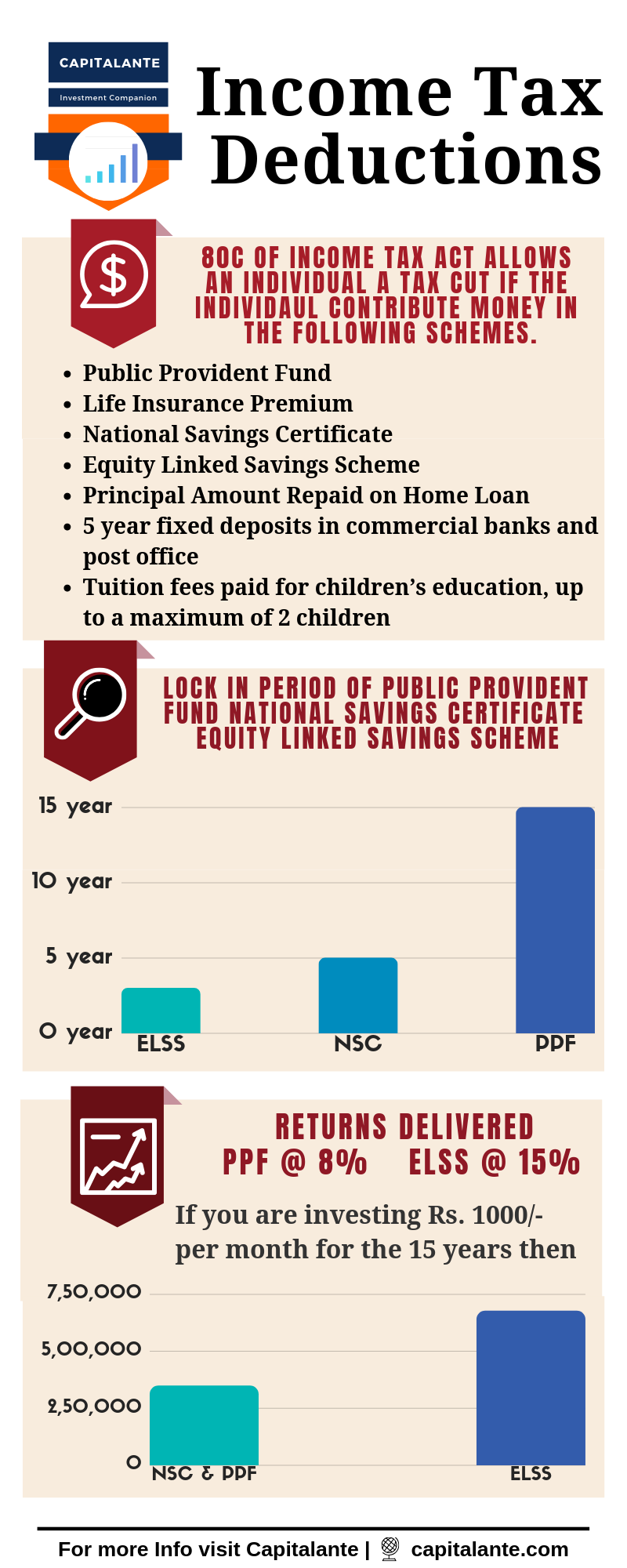

Income Tax Deductions In India Capitalante

https://capitalante.com/wp-content/uploads/2019/02/Income-Tax-Deductions-In-India.png

Donation Exemption For Income Tax Malaysia Amy Dyer

https://ebizfiling.com/wp-content/uploads/2021/12/Section-80G-Deduction.png

https://cleartax.in/s/standard-deduction-salary

Verkko 31 hein 228 k 2023 nbsp 0183 32 Explore Standard Deduction under Section 16 ia and in the new tax regime Standard deduction of Rs 40 000 reintroduced

https://www.indmoney.com/.../personal-finance/standard-deductions-in-tax

Verkko 4 hein 228 k 2023 nbsp 0183 32 Rs 40 000 Rs 50 000 Net Taxable Income Rs 9 65 800 Rs 9 60 000 Rs 9 50 000 Hence with standard deduction under Section 16 ia for 2021 22 Arun

Standard Deduction For Salaried Employees Impact Of Standard

Income Tax Deductions In India Capitalante

Income Tax Deductions In India Capitalante

Income Tax India On Twitter Govt Announces Tax Exemption For

Tax Savings Under Section 80 Provisions You Need To Know

Section 16 Deductions From Salaries Direct And Indirect Taxes With

Section 16 Deductions From Salaries Direct And Indirect Taxes With

Taxation Updates On Twitter Circular No 11 Of 2022 Clarification

Income Tax India On Twitter Income Tax Department To Launch Its New E

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Section 16 Deductions Income Tax India - Verkko 20 jouluk 2021 nbsp 0183 32 The exemption of Standard deduction is entitled to under section 16 ia of the Income tax Act In other words The standard deduction against the