Section 24 Income Tax Benefit On Interest On Home Loan The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs 1 50 000 under Section 80EEA Principal repayment can be claimed under Section 80C Section 24 provides for deduction for interest on a home loan of up to Rs 2 00 000 in a financial year The assessee can claim a deduction up to Rs 2 lakh while computing his her total taxable income under the head of house property

Section 24 Income Tax Benefit On Interest On Home Loan

Section 24 Income Tax Benefit On Interest On Home Loan

https://i.ytimg.com/vi/M-wUkSDKAfk/maxresdefault.jpg

Income Tax Benefit Of A Housing Loan Section 24

http://www.commonfloor.com/articles/wp-content/uploads/2012/07/gdchswcg1.jpg

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

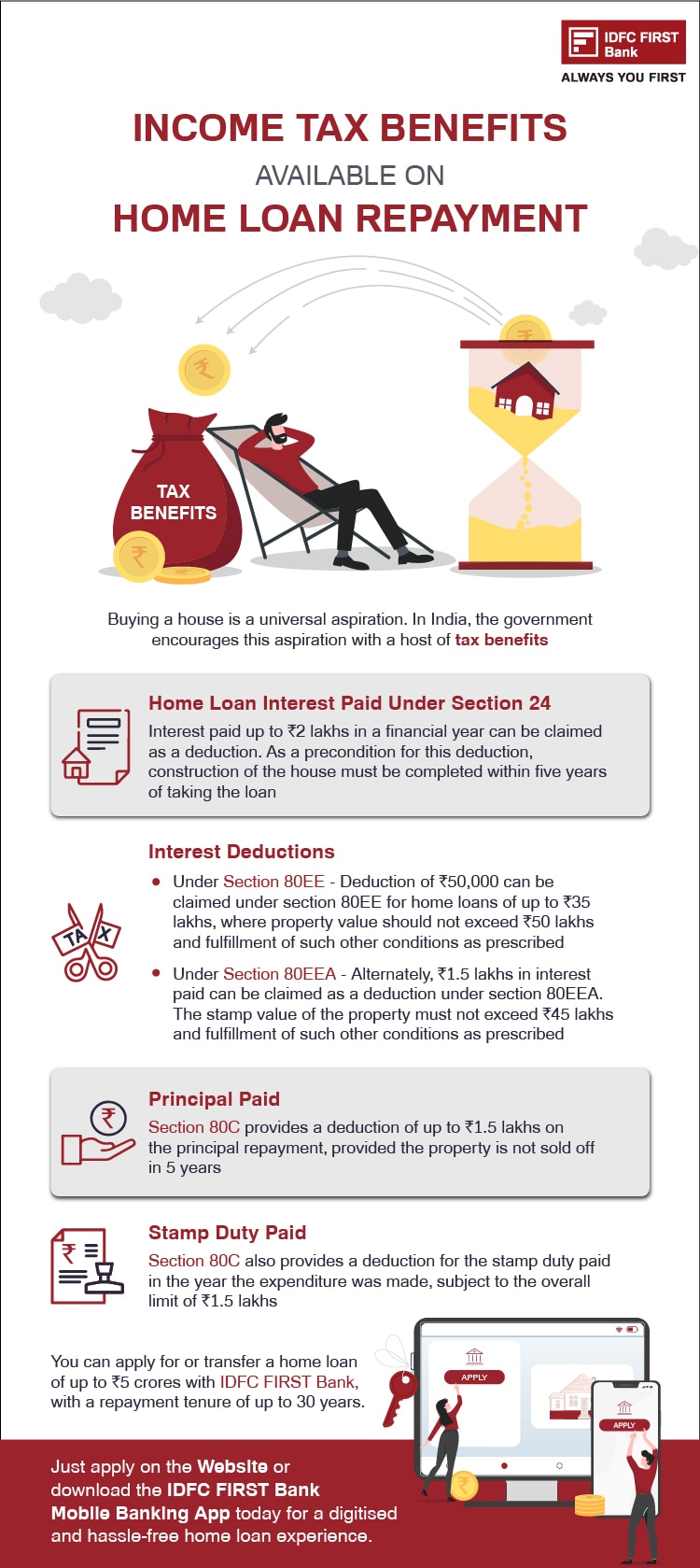

Interest on the home loan is deductible for the property Property owners who live in their home or where their family resides can deduct up to Rs 2 lakh from the interest paid on their home loan When the house is unoccupied the same rules are in effect Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

Section 24 b Standard Deduction This is the most common deduction for housing loan interest Deduction Amount You can claim a deduction of up to 2 lakhs every financial year on the interest paid towards your home loan Eligibility Criteria The property must be self occupied you or your family resides there Section 24 b of the Income Tax Act allows for a deduction of up to Rs 2 lakh on the interest paid towards your home loan in a financial year To avail of this deduction you need to make

Download Section 24 Income Tax Benefit On Interest On Home Loan

More picture related to Section 24 Income Tax Benefit On Interest On Home Loan

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/Home-Loan-Comparison-768x513.png

Section 24 Of Income Tax Act Deduction For Home Loan Interest

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/09/section-24-of-income-tax-act.jpg

What Is Section 24 Of Income Tax Act Save More Worry Less

https://www.nitsotech.com/wp-content/uploads/Understanding-deduction-under-Section-24-of-Income-Tax-Act.jpg

Interest on Home Loan Interest payable on loans borrowed for the purpose of acquisition construction repairs renewal or reconstruction can be claimed as deduction Whereas Section 80C benefit is applicable for the principle amount of the loan in case of residential house property In India taxpayers can claim tax deductions on home loan interest under Section 24 b of the Income Tax Act This deduction is available for self occupied properties that are completed within five years and for which the loan was taken for acquisition or construction

Deductions allowed on home loan interest Deductions for home loan interest repayment are offered under various sections of the income tax law Deductions under Section 24 B Available for Property construction property purchase Can be claimed for Self occupied rented deemed to be rented properties As a home loan borrower you can claim tax exemption on principal repayment every year under Section 80C interest payments under Section 24 b and an additional benefit on interest under Section 80EE if you are a first time homebuyer

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Section 24 Of Income Tax Act Types Deductions Exceptions And How To

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/What-is-Section-24-of-the-income-tax-act.jpg

https://cleartax.in/s/home-loan-tax-benefit

The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

https://cleartax.in/s/steps-claim-interest-home-loan-deduction

Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs 1 50 000 under Section 80EEA Principal repayment can be claimed under Section 80C

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

What Is Section 24 Of The Income Tax Act AccountingPreneur

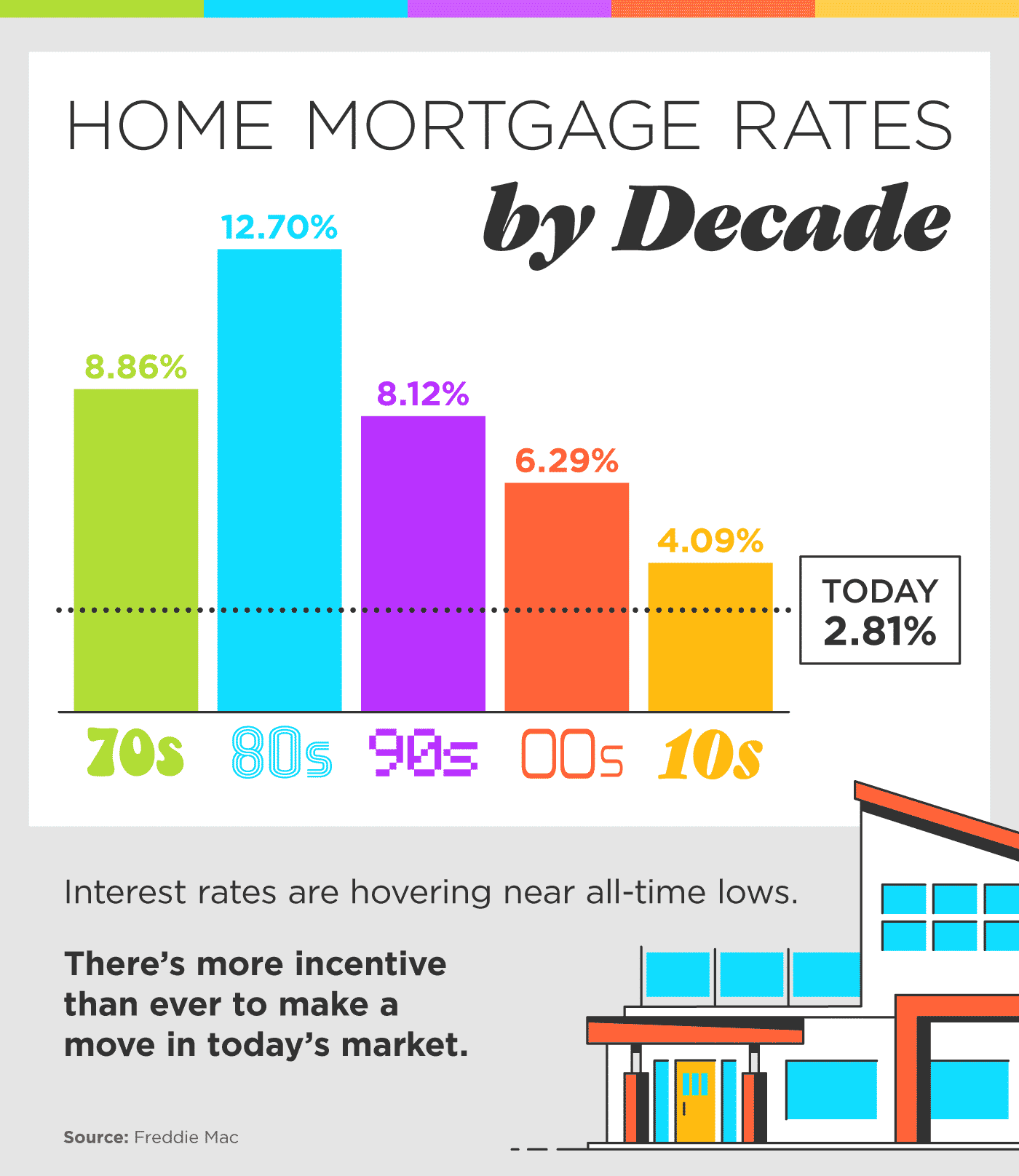

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

What Are The Tax Benefit On Home Loan FY 2020 2021

What Are The Tax Benefit On Home Loan FY 2020 2021

Income Tax Benefit On Home Loan Interest Section 80EE YouTube

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Section 24 Of Income Tax Act House Property Deduction

Section 24 Income Tax Benefit On Interest On Home Loan - Section 24 b Standard Deduction This is the most common deduction for housing loan interest Deduction Amount You can claim a deduction of up to 2 lakhs every financial year on the interest paid towards your home loan Eligibility Criteria The property must be self occupied you or your family resides there