Security Officer Tax Rebate Web The rules for security officer tax rebates allow Stuart to claim tax back on expenses over the last 4 years Those 4 years cover both the initial 163 220 application fee and the 163 220 extra he paid to renew his licence 3 years

Web Work in Security Claim a tax rebate for your SIA badge CCTV licence uniform and travel You can claim for the last four years Find out more today Web Security Guards Tax Rebate Form TAXBack UK Tax Rebate Tax Refund HMRC Claim back Security Guards tax back An SIA licence is required if you undertake the

Security Officer Tax Rebate

Security Officer Tax Rebate

https://www.pdffiller.com/preview/46/88/46088304/large.png

Heritage Site Security Officer s Tax Refund

https://api.onlinetaxrebates.co.uk/api/siteimages/14

Uniform Tax Rebate Official Website Claim Tax Relief Refunds

https://api.onlinetaxrebates.co.uk/api/siteimages/get/wilf-chq_jpg

Web Bihebdo Semaine Journ 233 e Heure Combien un Security Officer gagne t il en France 5 417 Mois Bas 233 sur 136 salaires Le salaire m 233 dian pour les emplois security officer Web Claim your Security Tax refund for your expenses incurred when working in the Security Trade QuickRebates will organise a fast tax refund hassle free

Web 22 mars 2014 nbsp 0183 32 Security Industry Tax Rebate If you are a worker in the security industry you may be able to obtain a tax refund This is because you are entitled to claim tax relief Web Tax rebates on your SIA licence fee and other work expenses can be backdated for the last four tax years only It s best to make a claim as soon as you can to ensure you don t

Download Security Officer Tax Rebate

More picture related to Security Officer Tax Rebate

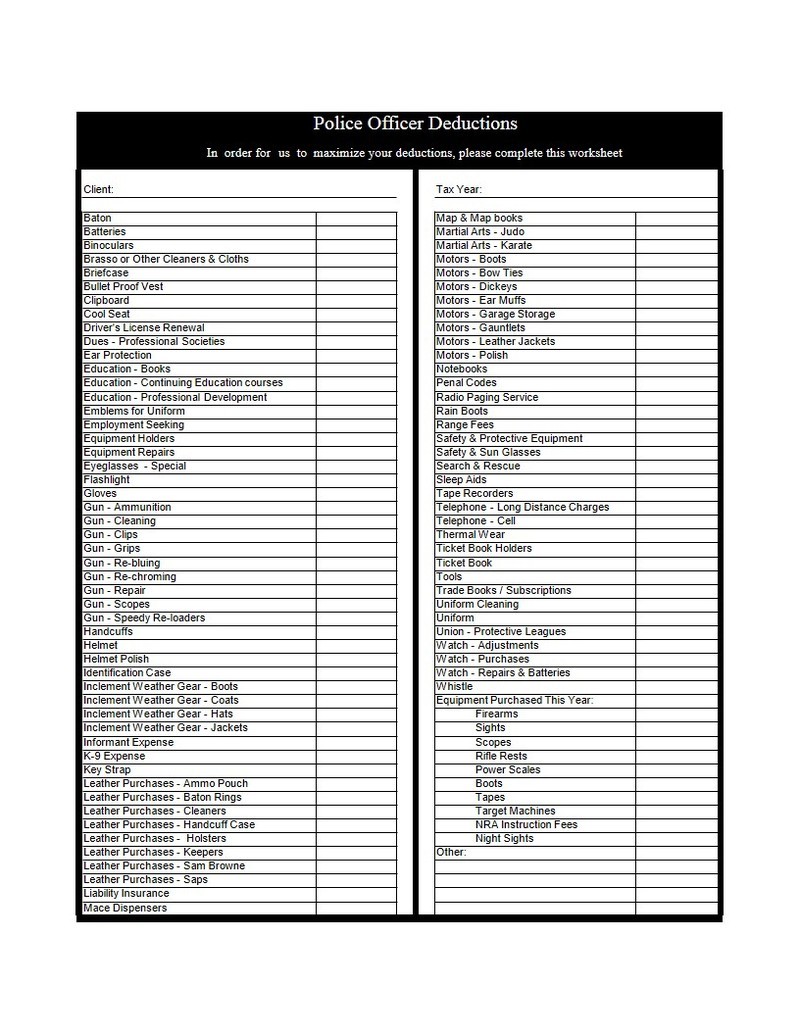

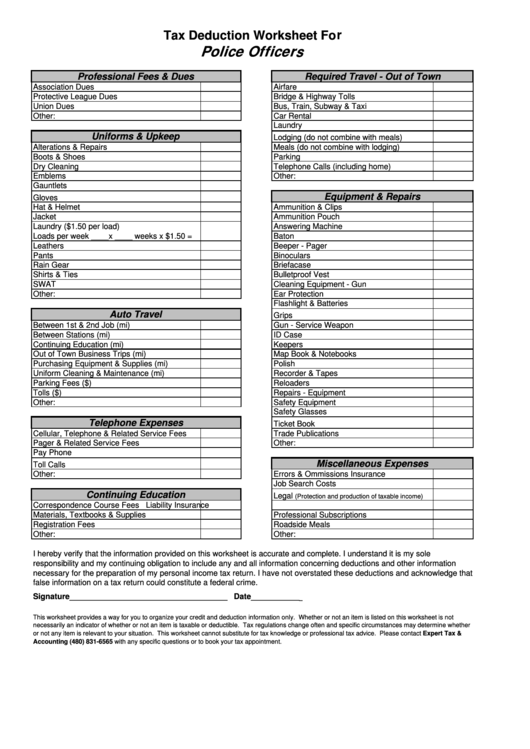

Tax Deductions For Federal Law Enforcement Officers

https://www.anchor-tax-service.com/s/cc_images/cache_2322056.jpg?t=1395578743

How To Apply For Uniform Tax Rebate Tax Walls

https://cdn.images.express.co.uk/img/dynamic/130/590x/martin-lewis-mse-money-saving-expert-uniform-work-tax-rebate-savings-961611.jpg

Uniform Tax Rebate Police Officer

https://api.onlinetaxrebates.co.uk/content/images/Crop-001.jpg

Web Taxpayers in the security sector are eligible to claim for the cost of laundering uniform and buying any protective clothing Your first tax rebate claim can be backdated for the last Web Modify the bank details used for withholding your income tax social security deductions instalments and any outstanding payments and for payments by the tax authorities

Web 13 ao 251 t 2023 nbsp 0183 32 La r 233 mun 233 ration additionnelle moyenne pour un Security Officer Paris est de 7 433 allant de 253 224 17 000 Les estimations de salaires sont bas 233 es sur 21 Web Workers in the security industry who travel to different workplaces could well be owed a tax refund If your employer doesn t pay you the full allowance that you re entitled to for

Security Tax Rebate

https://www.taxreturned.co.uk/wp-content/uploads/2015/12/13209108_small.png

Tax Deductions For Law Enforcement

http://4.bp.blogspot.com/_XDiOFHJScng/S7S2r7LiJEI/AAAAAAAAAZw/j2bowzIEjLA/s1600/IRS.JPG

https://www.riftrefunds.co.uk/tax-rebates/sec…

Web The rules for security officer tax rebates allow Stuart to claim tax back on expenses over the last 4 years Those 4 years cover both the initial 163 220 application fee and the 163 220 extra he paid to renew his licence 3 years

https://www.taxrebateservices.co.uk/tax-faqs/security-industry-tax...

Web Work in Security Claim a tax rebate for your SIA badge CCTV licence uniform and travel You can claim for the last four years Find out more today

Pin On Tigri

Security Tax Rebate

Uniform Tax Rebates Tax Rebate Services

Fillable Police Officer Tax Deduction Worksheet Printable Pdf Download

What Are The Best Ways To Manage Tax Rebates

What Tax Relief Is Available For Police Officers Tax Banana

What Tax Relief Is Available For Police Officers Tax Banana

Ptr Tax Rebate Libracha

15 Reasons Why You Could Be Due A Tax Rebate QuickRebates

Tax Rebates Made Simple YouTube

Security Officer Tax Rebate - Web Bihebdo Semaine Journ 233 e Heure Combien un Security Officer gagne t il en France 5 417 Mois Bas 233 sur 136 salaires Le salaire m 233 dian pour les emplois security officer