Sell House Tax Rebate Web Periods that always qualify for relief No matter how many homes you own or where you lived at the time you always get relief for the last 9 months before you sold your home

Web Work out if you need to pay Capital Gains Tax Once you know your gain and have worked out how much tax relief you get you can calculate if you need to report and pay Capital Web 25 janv 2023 nbsp 0183 32 163 250 000 to 163 400 000 163 12 000 5 stamp duty and 3 surcharge on the final 163 150 000 This means your total stamp duty bill 163 22 000 What is the stamp duty

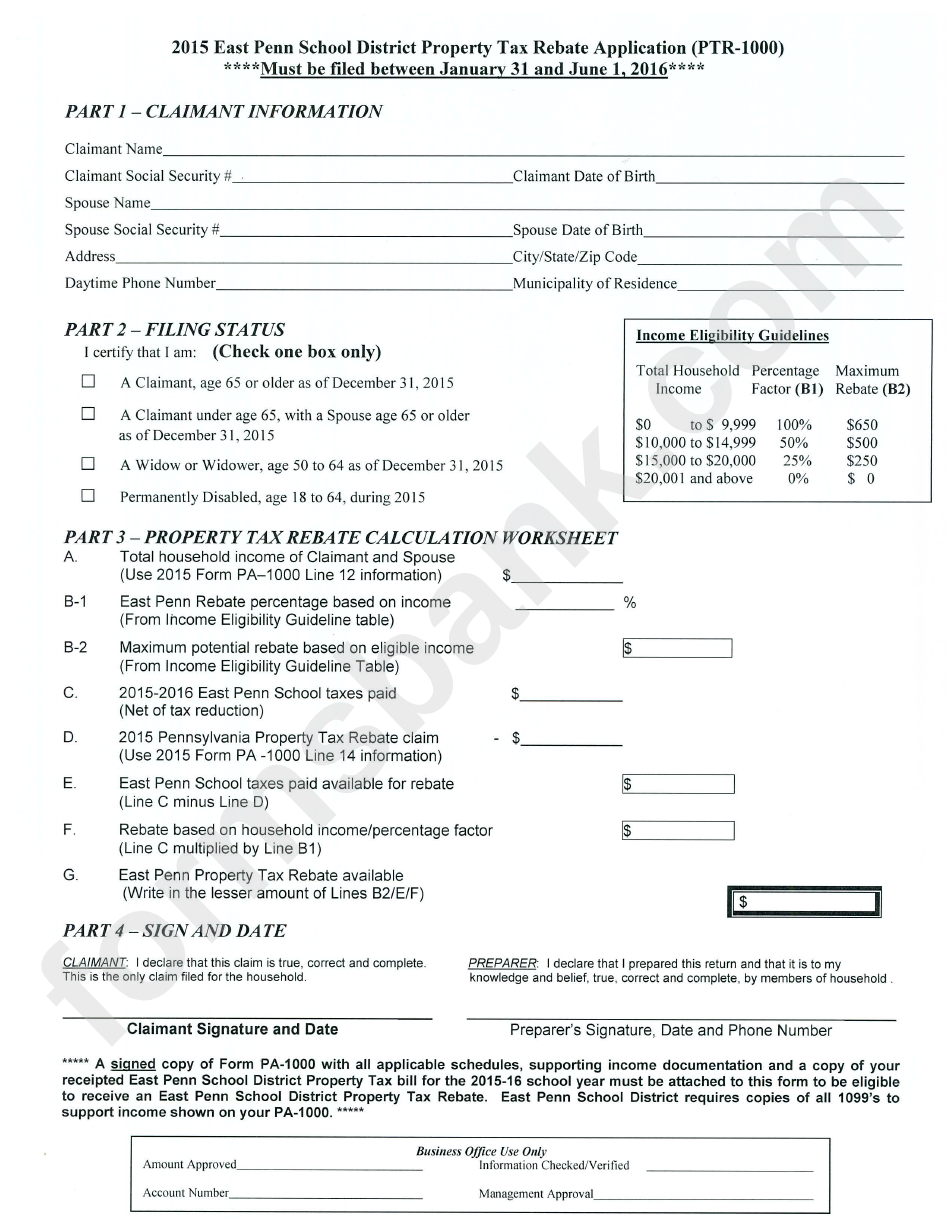

Sell House Tax Rebate

Sell House Tax Rebate

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

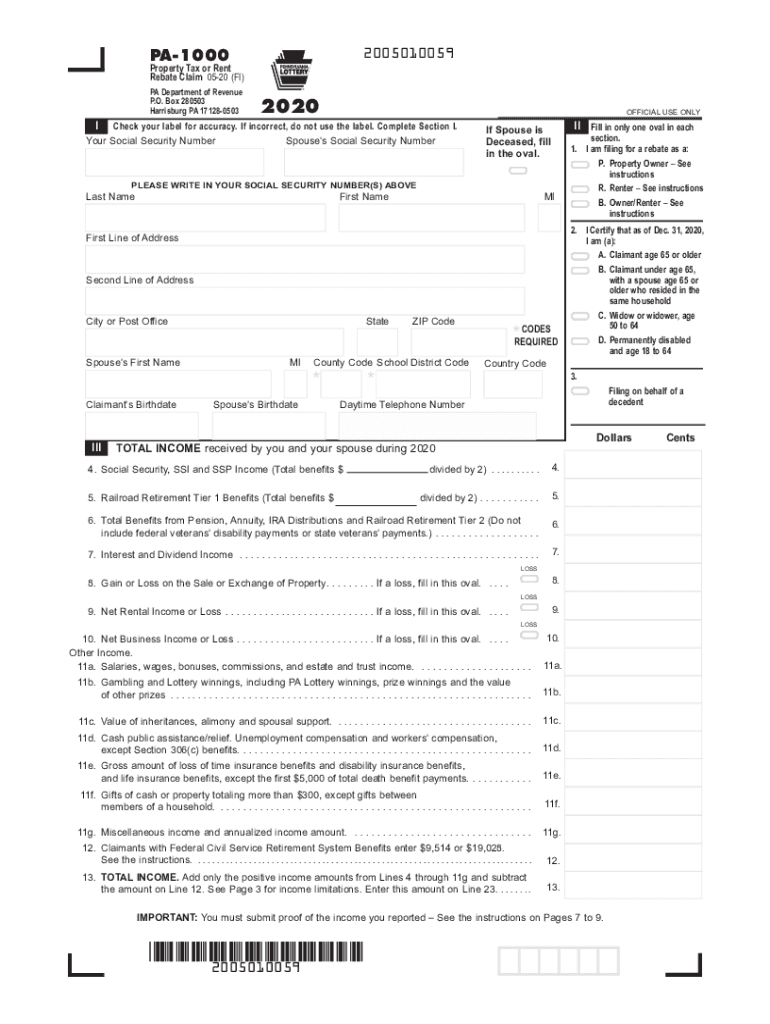

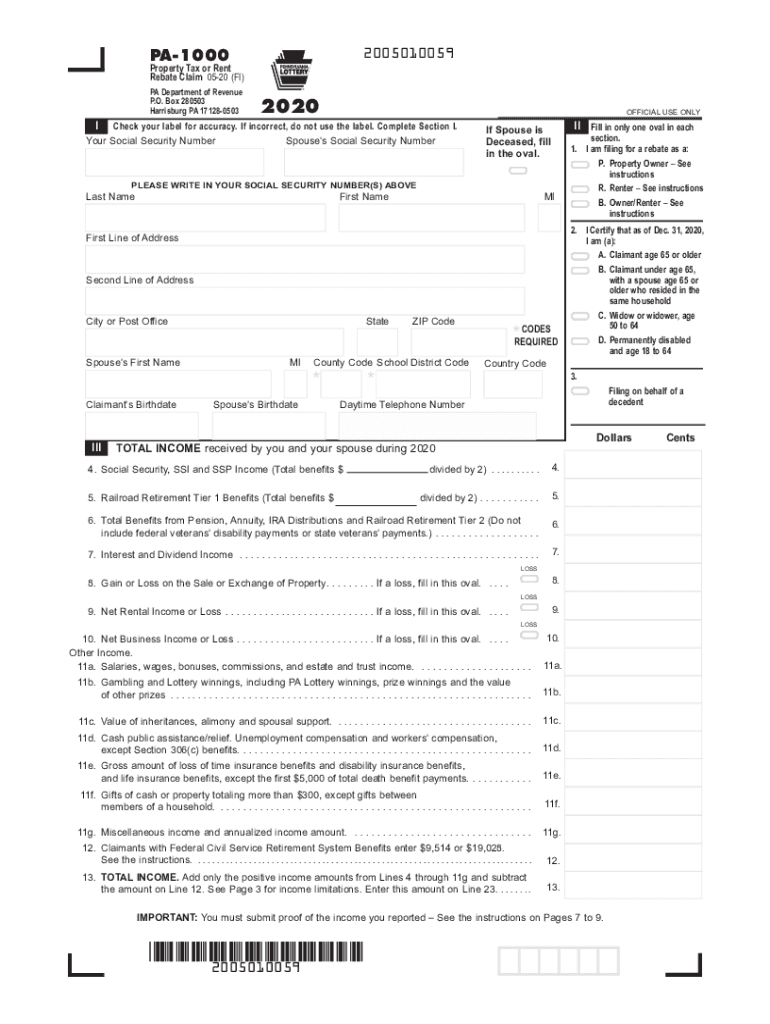

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

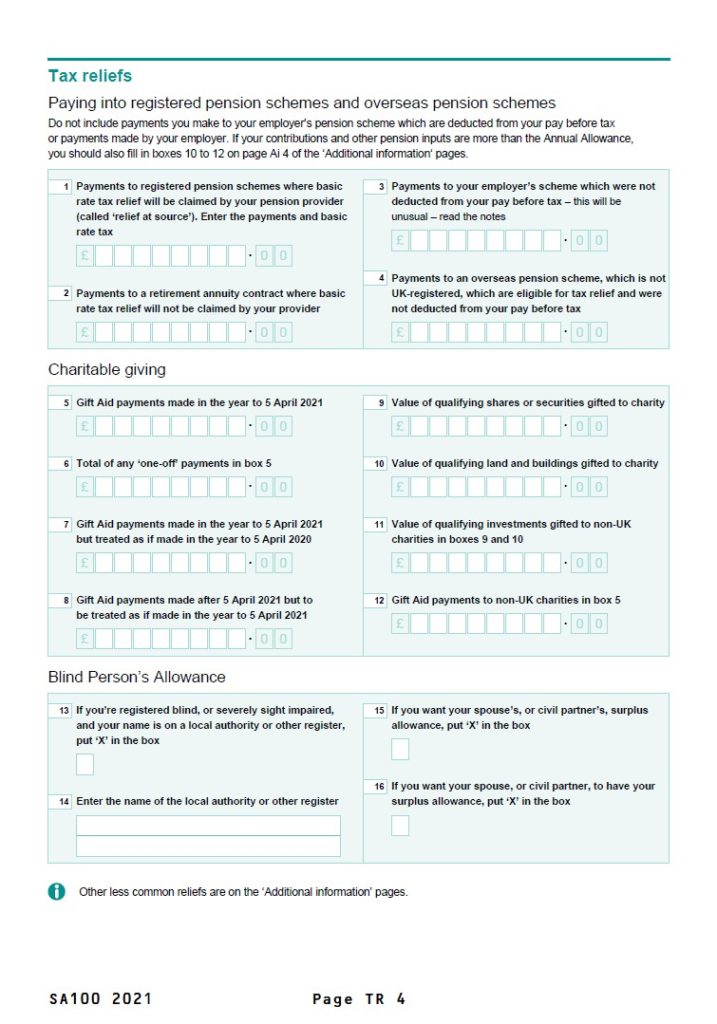

Rebate Form Download Printable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

Web 22 oct 2021 nbsp 0183 32 SHARE Tax reform has made it confusing as to what home sellers can and cannot deduct Some deductions no longer exist while others are only possible if you are Web 26 f 233 vr 2020 nbsp 0183 32 The first 250 000 of any income you earn at home is tax free The tax free amount increases to 500 000 if you are married and you and your spouse file a tax

Web 1 avr 2016 nbsp 0183 32 Details You can apply for a repayment of the higher rates of SDLT for additional properties if you ve sold what was previously your main home if you re either Web You may need to pay Stamp Duty Land Tax SDLT when you buy a home in England and Northern Ireland Land Transaction Tax when you buy a home in Wales Capital Gains

Download Sell House Tax Rebate

More picture related to Sell House Tax Rebate

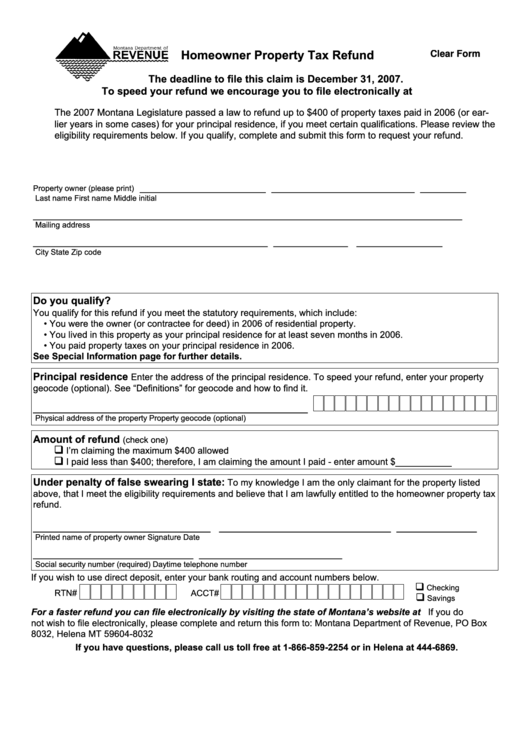

Fillable Homeowner Property Tax Refund Form Montana Department Of

https://data.formsbank.com/pdf_docs_html/177/1774/177484/page_1_thumb_big.png

Government Rebate Program Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/11/983/11983077/large.png

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Web 27 mai 2023 nbsp 0183 32 The long term capital gains tax rate varies between 0 15 and 20 There are a few higher rates for particular items but they don t apply to a home sale In Web 24 mars 2021 nbsp 0183 32 Claim the GST HST rebate on a new build You may be able to claim a new housing rebate for some of the GST HST you paid on your home if one of the following

Web 4 avr 2014 nbsp 0183 32 Use form IHT38 to claim relief if you re liable for Inheritance Tax on the value of land or buildings that were part of the deceased s estate if you sell the land or Web You may be the builder of the house and claim the rebate if you had a primary or secondary intention to sell the house instead of using it as your or your relation s primary place of

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

https://www.signnow.com/preview/540/488/540488148/large.png

Work From Home Tax Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Work-from-Home-Tax-Rebate-Form-2021-717x1024.jpg

https://www.gov.uk/tax-sell-home/absence-from-home

Web Periods that always qualify for relief No matter how many homes you own or where you lived at the time you always get relief for the last 9 months before you sold your home

https://www.gov.uk/tax-sell-home/work-out-your-gain

Web Work out if you need to pay Capital Gains Tax Once you know your gain and have worked out how much tax relief you get you can calculate if you need to report and pay Capital

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

Application For Rebate Of Property Taxes Niagara Falls Ontario

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

How To Calculate Tax Rebate On Home Loan Grizzbye

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

How Do I Claim The Recovery Rebate Credit On My Ta

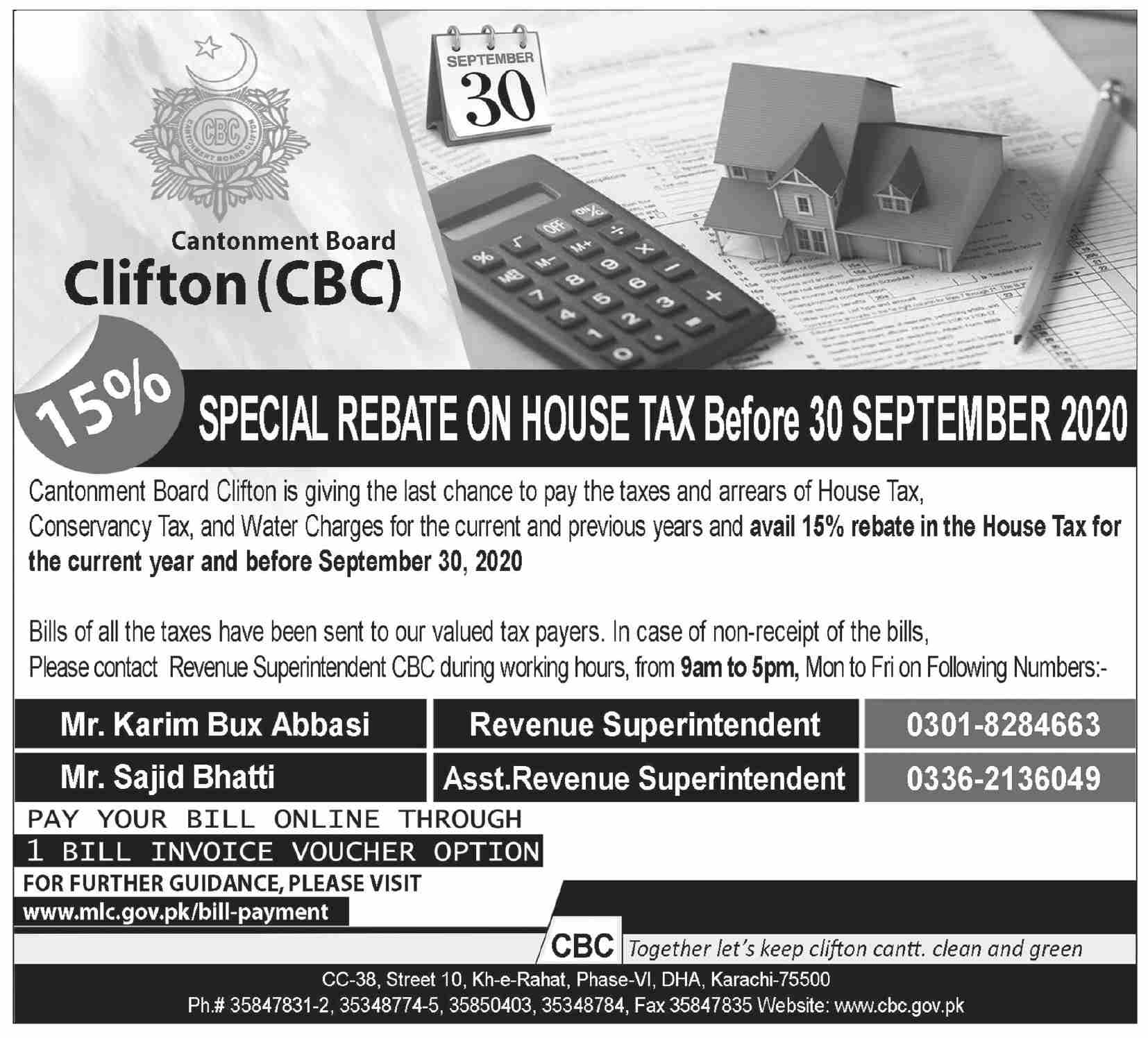

15 Special Rebate On House Tax CBC Karachi EmployeesPortal

1099 Reporting And Thresholds Taxed Right

Sell House Tax Rebate - Web 22 oct 2021 nbsp 0183 32 SHARE Tax reform has made it confusing as to what home sellers can and cannot deduct Some deductions no longer exist while others are only possible if you are