Senior Citizen Medical Insurance Tax Rebate Web As per Section 80D medical expenses paid on the maintenance of senior citizens without any health insurance policy are eligible for a tax deduction of up to Rs 50 000 per

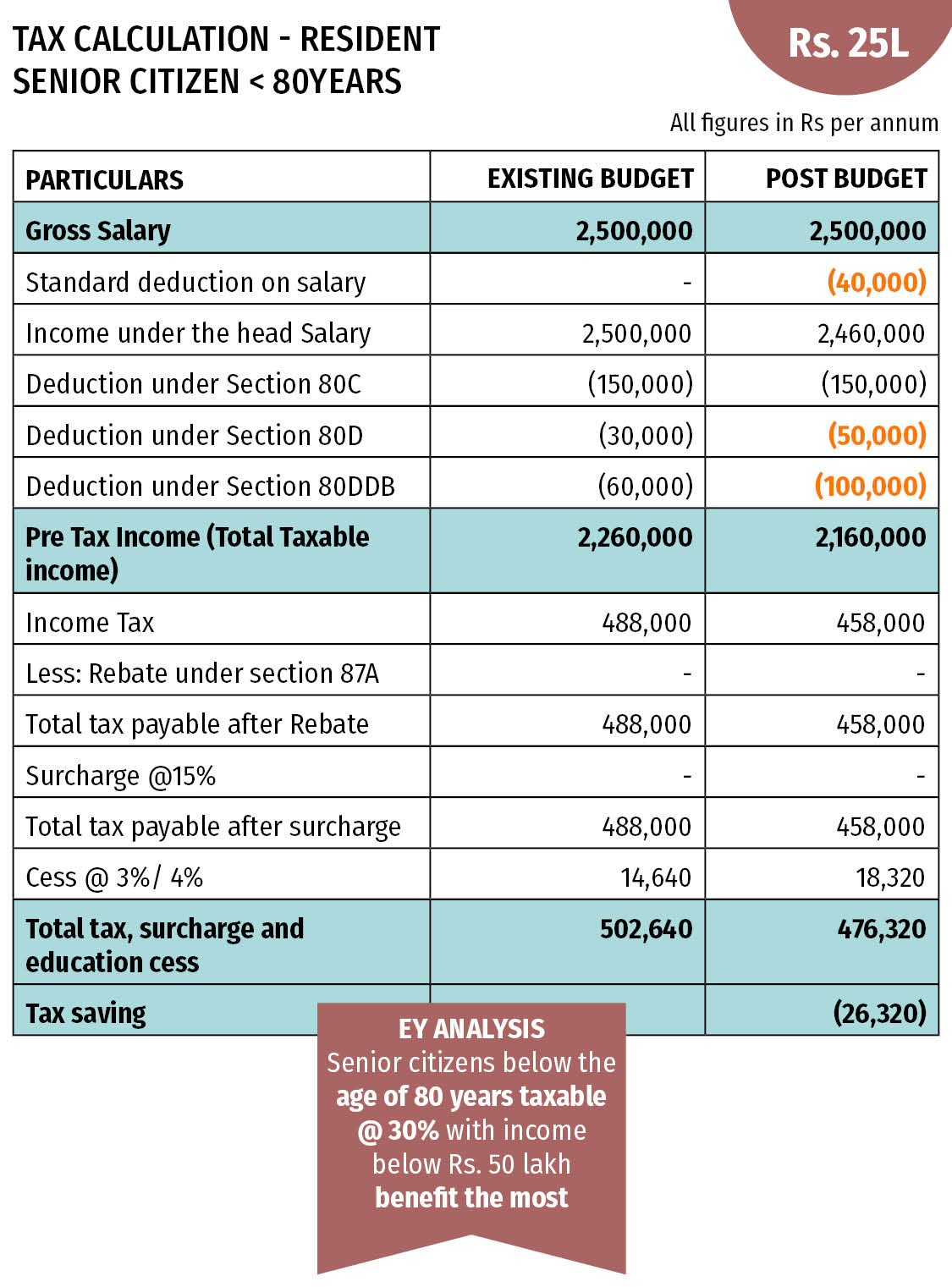

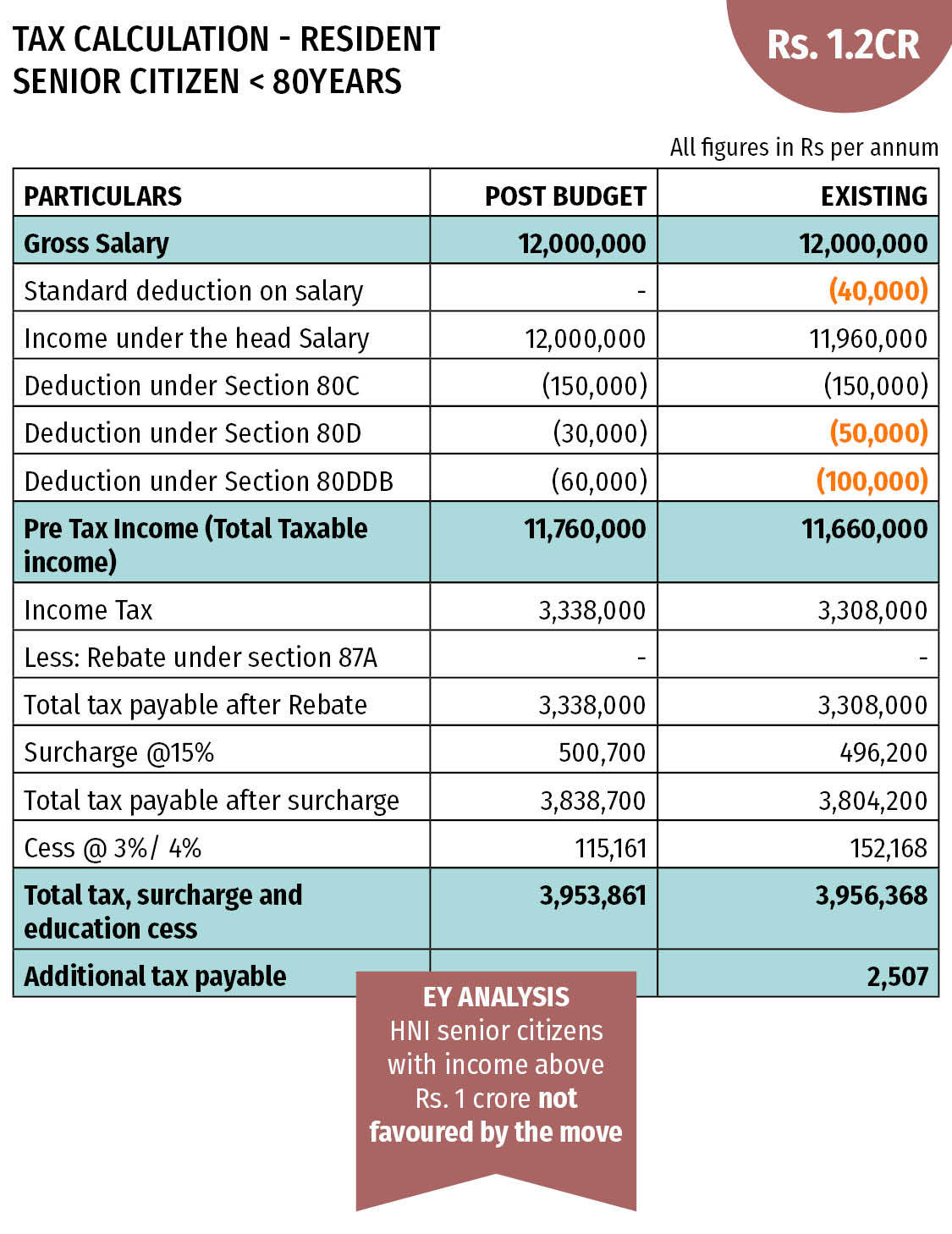

Web The Income Tax Act allows you to claim a maximum deduction of Rs 50 000 as of FY 2021 22 on medical expenses incurred on the healthcare of senior citizens eligible parents Web Budget 2018 amended Section 80D of the Income tax Act which allows a deduction for medical expenditure incurred on senior citizens However senior citizens must not be

Senior Citizen Medical Insurance Tax Rebate

Senior Citizen Medical Insurance Tax Rebate

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

World Senior Citizen s Day 2022 From Tax Rebates To Medical Insurance

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2022/08/21/2531804-dna-72.png

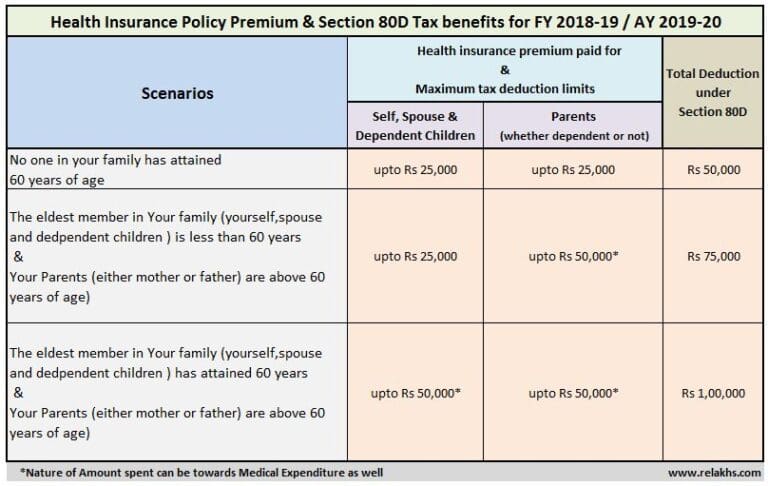

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills-768x486.jpg

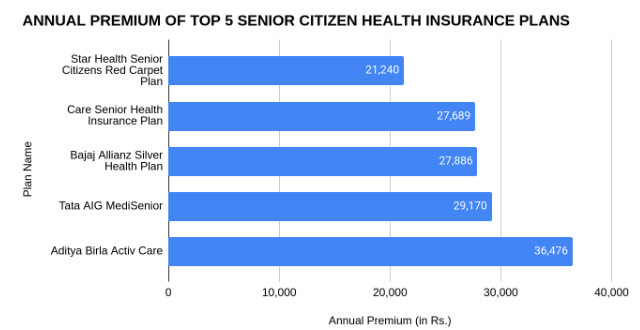

Web 2 d 233 c 2022 nbsp 0183 32 Under the amended 80D for senior citizens tax rebate of up to 50 000 can be claimed for the following health related expenses Preventative health check ups Web Tax benefits with respect to medical insurance and expenditure According to Section 80D of the Income Tax Act Senior Citizens may avail a higher deduction of up to 50 000

Web 9 mars 2022 nbsp 0183 32 When you file income tax returns do not forget to include the income tax rebate for senior citizens that you can avail of under Section 80D of the Income Tax Web 20 janv 2023 nbsp 0183 32 As per Section 80D of the Income Tax Act senior citizens can claim a maximum deduction of Rs 50 000 per annum incurred on medical expenses provided

Download Senior Citizen Medical Insurance Tax Rebate

More picture related to Senior Citizen Medical Insurance Tax Rebate

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

https://i.ytimg.com/vi/rfW84weCMCs/maxresdefault.jpg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://img.etimg.com/photo/msid-62914737,quality-100/tax_calculation_80yr_senior_citizen_25l-1.jpg

Web 5 nov 2019 nbsp 0183 32 If your father or mother is a senior citizen then you are eligible to get a deduction of Rs 50 000 in a financial year Therefore the total deduction which can be Web After the introduction of this amendment the total deduction allowed to super senior citizens for payment Medical Insurance Premium Medical Expenses is Rs 30 000

Web 27 juil 2023 nbsp 0183 32 Medical expenses that are tax deductible include Items such as false teeth eyeglasses hearing aids artificial limbs and wheelchairs Hospital service fees such as Web 20 d 233 c 2022 nbsp 0183 32 Under Section 80D the policyholder gets a deduction for preventive health check ups of up to INR 5 000 This deduction is included within the total limit of INR 25 000 for policyholders below 60 years In case of senior citizens the deduction available is INR 50 000 on medical expenses

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

https://i.ytimg.com/vi/GHq5DhLzRhQ/maxresdefault.jpg

Health Insurance For Senior Citizens Life Insurance

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/04/Health-Insurance-for-Senior-Citizens.jpg

https://www.policybazaar.com/health-insurance/section80d-deductions

Web As per Section 80D medical expenses paid on the maintenance of senior citizens without any health insurance policy are eligible for a tax deduction of up to Rs 50 000 per

https://www.policybazaar.com/health-insurance/senior-citizen-health...

Web The Income Tax Act allows you to claim a maximum deduction of Rs 50 000 as of FY 2021 22 on medical expenses incurred on the healthcare of senior citizens eligible parents

What s The Distinction Between PMI And Home Loan Defense Insurance

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Actualizar 54 Imagen Senior Citizen Tax Deduction Ecover mx

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Best Health Insurance Plan For Senior Citizens In India Aug 2022

Senior Citizen Medical Insurance Tax Rebate - Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and