Senior Discount For Property Taxes In Florida Florida offers property tax exemptions and discounts for seniors aged 65 and older Benefits include additional homestead exemptions and discounts for disabled veterans Application for these tax breaks can be made through the

An exemption equal to the assessed value of the property to an owner who has title to real estate in Florida with a just value less than 250 000 as determined in the first tax year that the owner applies and is eligible for the exemption and who has maintained permanent residence on the property for at least 25 years is 65 or older and As of 2021 the income limitation is 31 100 00 meaning you cannot qualify for this additional homestead exemption for seniors if your adjusted gross income exceeds this amount

Senior Discount For Property Taxes In Florida

Senior Discount For Property Taxes In Florida

https://www.hegwoodgroup.com/wp-content/uploads/2022/11/pay-commercial-property-taxes-in-the-fall.jpg

CA Parent Child Transfer California Property Tax NewsCalifornia

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/10/California-Property-Taxes-scaled.jpg?resize=2048%2C1192&ssl=1

How Our Local Taxes Really Work The JOLT

https://cdn2.creativecirclemedia.com/jolt/original/20210323-203543-IMG_0713.jpg

The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year Further benefits are available to property owners with disabilities senior citizens veterans and active duty military service members disabled first responders and properties with specialized uses There are two ways that seniors in Florida may get an additional exemption from property taxes or even be completely exempt from property taxes Here s how they work Long Term Resident Senior Exemption The Long Term Resident Senior Exemption allows certain low income seniors to be completely exempt from most property taxes

Senior Citizen Exemption Property tax benefits are available to persons 65 or older in Florida Seniors may qualify for an extra exemption for an additional 50 000 of home value Widow Widower Exemption Starting January 1 2023 a 5 000 exemption is available on property owned by a widow widower who is a permanent Florida resident A majority of Broward seniors are eligible to receive the maximum possible tax savings under this law The cities listed below have adopted the Senior Citizen s Additional Homestead Exemption note the granting of the additional exemption is a local option under Florida law

Download Senior Discount For Property Taxes In Florida

More picture related to Senior Discount For Property Taxes In Florida

Circuit Breaker Tax Exemption Archives California Property Tax

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/11/The-History-of-Property-Taxes-in-California-scaled.jpg?resize=1200%2C1006&ssl=1

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Property Taxes By State County Median Property Tax Bills Tax

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

Resources for Seniors The following taxing districts adopted this additional exemption Low Income Senior 65 25 Year Residency Veteran Service Connected Total and Permanent Disability or their Surviving Spouse The Senior Exemption is an additional property tax benefit available to home owners who meet the following criteria The property must qualify for a homestead exemption At least one homeowner must be 65 years old as of January 1 Total Household Adjusted Gross Income for everyone who lives on the property cannot exceed statutory limits

Each year the Property Appraiser s Office provides tax exemptions on the homesteads of thousands of permanent residents in Alachua County In addition some of those 65 and older qualify for a special senior exemption if their total household adjusted gross income is less than 31 100 for 2021 The Florida Property Tax Exemptions for Senior Citizens Amendment also known as Amendment 5 was on the November 8 2016 ballot in Florida as a legislatively referred constitutional amendment The discount shall be in a percentage equal to the percentage of the veteran s permanent service connected disability as

What County Has The Lowest Property Taxes In Florida YouTube

https://i.ytimg.com/vi/bbACfVEYpyo/maxresdefault.jpg

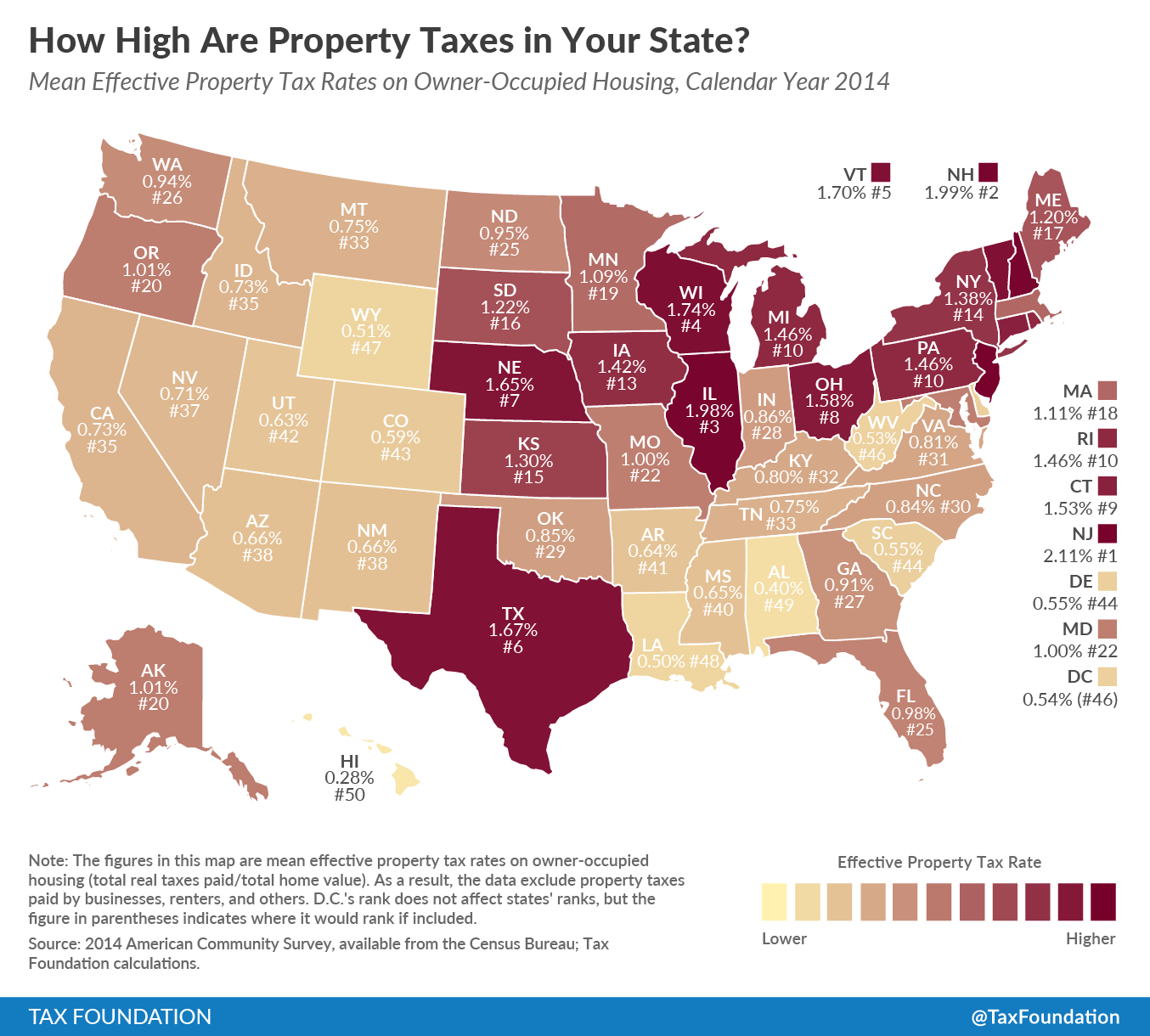

How High Are Property Taxes In Your State 2016 Tax Foundation

https://files.taxfoundation.org/20170113143210/Property-01.png

https://greatsenioryears.com/florida-property-tax...

Florida offers property tax exemptions and discounts for seniors aged 65 and older Benefits include additional homestead exemptions and discounts for disabled veterans Application for these tax breaks can be made through the

https://floridarevenue.com/property/Documents/...

An exemption equal to the assessed value of the property to an owner who has title to real estate in Florida with a just value less than 250 000 as determined in the first tax year that the owner applies and is eligible for the exemption and who has maintained permanent residence on the property for at least 25 years is 65 or older and

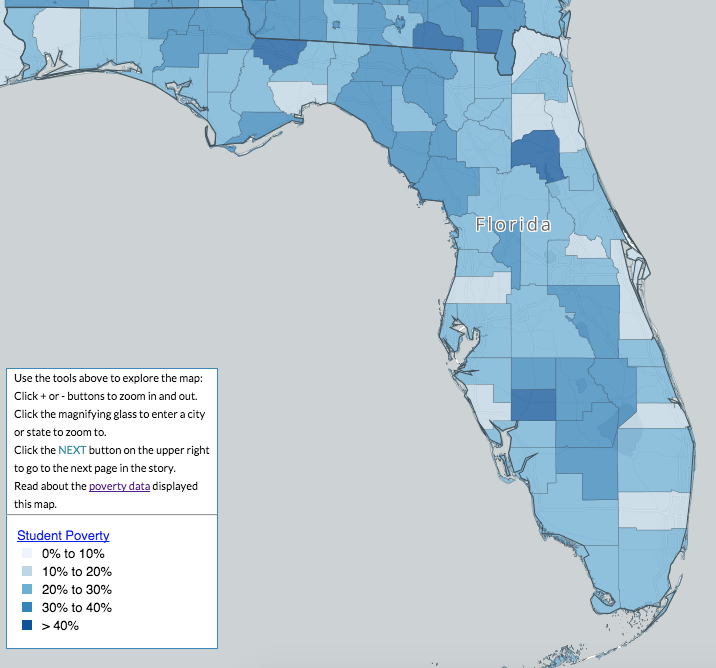

How Property Taxes Keep Florida Students In Impoverished School

What County Has The Lowest Property Taxes In Florida YouTube

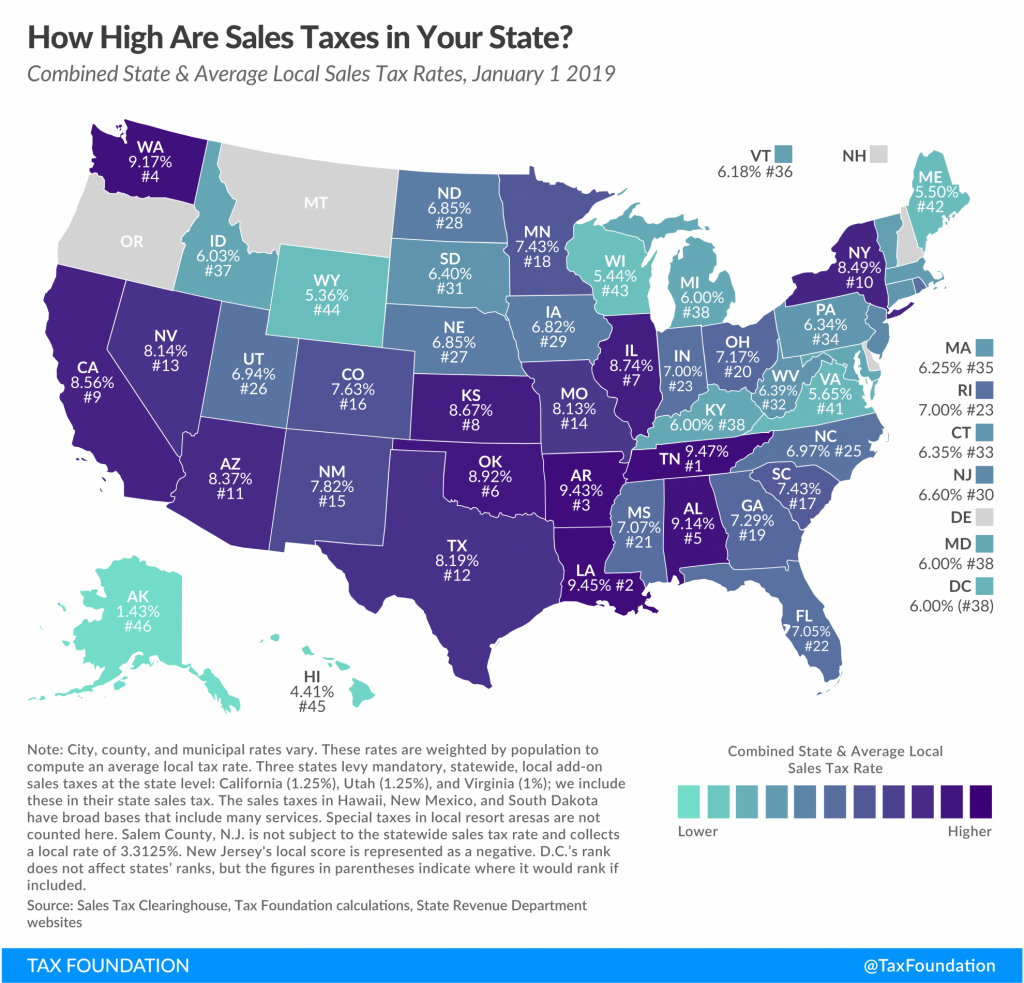

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

State By State Guide To Taxes On Retirees Florida Property Tax Map

/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

K hl Schulische Ausbildung Billig States Of Jersey Tax R ckstand Tappen

2022 Property Tax Portability Exemptions For Seniors And Homeowners

2022 Property Tax Portability Exemptions For Seniors And Homeowners

How To Keep Parents Property Taxes California Property Tax

Senior Discount For Those As Young As 50 Senior Discounts Family

Property Tax 101 infographic Bizagility

Senior Discount For Property Taxes In Florida - The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year Further benefits are available to property owners with disabilities senior citizens veterans and active duty military service members disabled first responders and properties with specialized uses