Seniors And Pensioners Tax Offset Parenting Payment Single Verkko 10 syysk 2021 nbsp 0183 32 Your eligibility for a senior and pensioner tax offset is based on whether you re eligible to receive an Australian government pension or allowance

Verkko 25 toukok 2022 nbsp 0183 32 you may not get the seniors and pensioners tax offset even if you meet all the eligibility conditions as the amount of the tax offset is based on your Verkko 31 hein 228 k 2022 nbsp 0183 32 Seniors and pensioners Column 1 Maximum tax offset threshold Column 2 Cut out threshold Single 32 279 50 119 Each member of a couple

Seniors And Pensioners Tax Offset Parenting Payment Single

Seniors And Pensioners Tax Offset Parenting Payment Single

http://static1.squarespace.com/static/6039ed18dca90b29a89eff0c/t/60ffe0e8d85b051f21dc7b82/1627381992592/shutterstock_316065857.jpg?format=1500w

Single parenting payment 5 TeachingBrave

https://teachingbrave.com/wp-content/uploads/2023/09/Single-parenting-payment-5-edited.jpg

Seniors And Pensioners Tax Offset YourLifeChoices

https://assets.yourlifechoices.com.au/2022/07/22095547/seniors-pensioners-tax-offset.png

Verkko 29 kes 228 k 2023 nbsp 0183 32 You can claim the seniors and pensioners tax offset SAPTO if you met all the conditions relating to eligibility for Australian Government pensions and Verkko 24 toukok 2023 nbsp 0183 32 Seniors and pensioners tax offset code letters Code letter Explanation A You were single separated or widowed B You and your spouse

Verkko 31 toukok 2022 nbsp 0183 32 Seniors and pensioners tax offset SAPTO codes Your eligibility and circumstance at any time in 2021 22 Code You met the eligibility conditions for Verkko Reliefs for Low and Middle Income Earners A tax offset worth a maximum of AUD 1 080 is available for taxpayers with earnings up to AUD 126 000 called the Low and Middle

Download Seniors And Pensioners Tax Offset Parenting Payment Single

More picture related to Seniors And Pensioners Tax Offset Parenting Payment Single

What Is A Tax Offset

https://www.yellowpages.com.au/wp-content/uploads/2022/06/what-is-tax-offset-2048x1365.jpg

How Much Can I Earn Before It Affects My Single Parent Pension

https://takeatumble.com.au/wp-content/uploads/2022/10/How-Much-Can-I-Earn-Before-It-Affects-My-Single-Parent-Pension-1.jpg

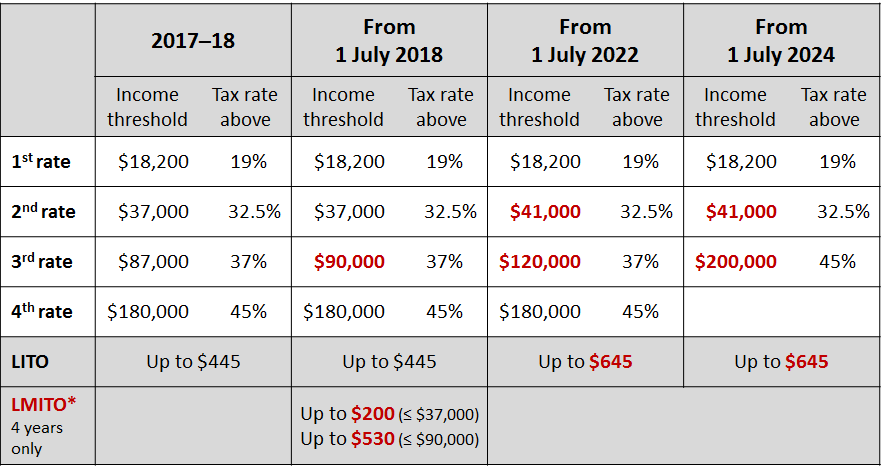

Unenacted Tax Measures At 30 June 2018 Bills Wrap Up TaxBanter Blog

https://taxbanter.com.au/wp-content/uploads/2022/11/table-for-blog.png

Verkko Relief for pensioners and seniors The Seniors and Pensioners Tax Offset SAPTO is available to recipients of taxable Government Pensions including Parenting Payment Single The SAPTO is also Verkko 16 kes 228 k 2022 nbsp 0183 32 The SAPTO can reduce the amount of income tax you pay allowing you to earn more money before you are required to pay tax or the Medicare levy The offset affects pensioners and seniors with

Verkko How to determine your eligibility for the seniors and pensioners tax offset when you lodge your return using myTax Verkko 27 kes 228 k 2023 nbsp 0183 32 Barbara DruryUpdated 27 June 2023 Reading time 4 minutes On this page The Senior Australians and Pensioners Tax Offset SAPTO won t shower you

Solved Problem 7 1 Child Tax Credit LO 7 1 Calculate The Total

https://www.coursehero.com/qa/attachment/14536840/

Government Don t Have Regards For Us Pensioniers Speak

https://cdn.vanguardngr.com/wp-content/uploads/2019/10/pensioners.jpg

https://community.ato.gov.au/s/question/a0J9s0000001KFy

Verkko 10 syysk 2021 nbsp 0183 32 Your eligibility for a senior and pensioner tax offset is based on whether you re eligible to receive an Australian government pension or allowance

https://www.ato.gov.au/.../t1-seniors-and-pensioners-tax-offset-2022

Verkko 25 toukok 2022 nbsp 0183 32 you may not get the seniors and pensioners tax offset even if you meet all the eligibility conditions as the amount of the tax offset is based on your

How To Save On Tax When Retirement Planning Claiming SAPTO TNR Wealth

Solved Problem 7 1 Child Tax Credit LO 7 1 Calculate The Total

Australia 2019 2020 Income Tax Year Les Imp ts Sur Les Salaires

Who Isn t Eligible For The Foreign Pensioners Tax Break IIA

What Is A Tax Offset

Transferring The Seniors And Pensioners Tax Offset CKG Partners Media

Transferring The Seniors And Pensioners Tax Offset CKG Partners Media

Why Special Tax Breaks For Seniors Should Go ABC News

Table Of Contents GPB Partners Pty Ltd

Tax Changes For Seniors Now On The Table Trusted Aged Care Services

Seniors And Pensioners Tax Offset Parenting Payment Single - Verkko 31 toukok 2022 nbsp 0183 32 Seniors and pensioners tax offset SAPTO codes Your eligibility and circumstance at any time in 2021 22 Code You met the eligibility conditions for