Seniors School Tax Rebate Web Seniors School Tax Rebate Up to 470 Minus 2 0 on family net income over 40 000 Up to 353 Minus 1 5 on family net income over 40 000 Up to 294 Minus 1 25 on family net income over 40 000

Web To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own Web To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own

Seniors School Tax Rebate

Seniors School Tax Rebate

https://www.winnipegfreepress.com/wp-content/uploads/sites/2/2022/04/776759.jpg

Tax Credits Could Replace Senior Freeze Rebates New Jersey Monitor

https://newjerseymonitor.com/wp-content/uploads/2022/09/seniorfreeze-scaled.jpeg

School Tax Rebates Are In The Mail Winnipeg For Free

https://wpgforfree.ca/wp-content/uploads/2023/06/school-tax-rebate-1.png

Web Seniors School Tax Rebate will be up to 235 minus 1 0 on family net income over 40 000 Seniors Education Property Tax Credit will be up to 200 minus 0 5 of family Web Back to top Manitoba Family Tax Benefit The sum of 2 065 basic amount 2 065 for a spouse common law partner or eligible dependent if claimed 2 065 if the taxpayer is

Web Seniors school tax rebate Individuals who qualify You can claim this rebate if all of the following conditions are met You or your spouse or common law partner were Web Even if you do not have to pay tax you may be entitled to the primary caregiver tax credit personal tax credit education property tax credit renters tax credit seniors school tax

Download Seniors School Tax Rebate

More picture related to Seniors School Tax Rebate

School tax Rebate Clawback Was A Surprise Pallister Winnipeg Free Press

https://www.winnipegfreepress.com/wp-content/uploads/sites/2/2022/04/NEP845011.jpg?w=1000

Happy Chinese New Year

https://content.govdelivery.com/attachments/fancy_images/NVLASVEGAS/2022/01/5470504/util-tax-rebate-2022_original.png

LPS Honors 10 And 20 Years Of Service In Senior Citizen Tax Rebate

https://littletonpublicschools.net/sites/default/files/SCTR 2016.jpg

Web a school tax credit of up to 175 for persons aged 55 and up whose family income is less than 23 750 a seniors school tax rebate of up to 470 for a senior whose family Web Seniors School Tax Rebate Seniors Education Property Tax Credit fore senior homeowners to an income tested maximum of 294 in 2022 235 in 2023 Further

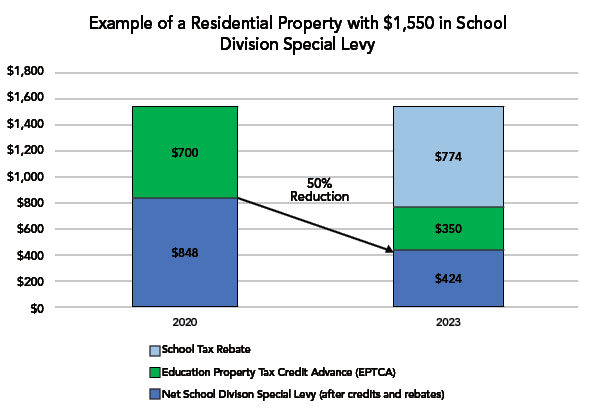

Web Seniors School Tax Rebate The Seniors School Tax Rebate is a Provincial rebate done only through your income tax return For more information please contact the Web Tax Credit and Rebate Amounts 2020 2021 2022 2023 Education Property Tax Credit and Advance Up to 700 Up to 525 Up to 438 Up to 350 Seniors School Tax

Senior Citizen Tax Rebate Program Participants Honored By LPS Board

https://littletonpublicschools.net/sites/default/files/NR_SCTR 2019.png

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/schooltaxrebate-header.jpg

https://www.gov.mb.ca/schooltaxrebate

Web Seniors School Tax Rebate Up to 470 Minus 2 0 on family net income over 40 000 Up to 353 Minus 1 5 on family net income over 40 000 Up to 294 Minus 1 25 on family net income over 40 000

https://www.gov.mb.ca/finance/tao/sstr_faq.html

Web To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own

Abington School Board Approves Senior Citizen Real Estate Tax Rebate

Senior Citizen Tax Rebate Program Participants Honored By LPS Board

Province Of Manitoba School Tax Rebate

Province Of Manitoba School Tax Rebate

Property Tax Rebate For Seniors Bc PropertyRebate

Province Of Manitoba School Tax Rebate

Province Of Manitoba School Tax Rebate

A Tax Rebate That Tasted Like Hot Dogs Our Communities

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

No Rebate For High income Seniors Under Province s New Tax Plan

Seniors School Tax Rebate - Web Seniors School Tax Rebate will be up to 235 minus 1 0 on family net income over 40 000 Seniors Education Property Tax Credit will be up to 200 minus 0 5 of family