Service Tax Payment Due Date Due Dates for Filing Returns and Making Tax Payments Valsts ie mumu dienests Published 19 10 2022 Type of return report Due date Term of tax payment VAT return on taxation period VAT

The service tax return SST 02 and payment is due by the last day of the month following the end of the taxable period A taxable person can apply to the DG of Customs to vary the taxable period When is Service Tax required to be paid 1 Payments through Bank 2 Electronic Payments through Internet 3 Under what circumstances provisional assessment is resorted to What is the procedure to be followed for payment of Service Tax if full details are not available to assess correct tax

Service Tax Payment Due Date

Service Tax Payment Due Date

https://i.pinimg.com/736x/84/2d/77/842d7791f81e5b601fba4be53626da11--due-date-filing.jpg

Service Tax Return And Payment Due Date 2016 MyOnlineCA

https://www.myonlineca.in/wp-content/uploads/2016/09/Service-Tax-Return-Due-Date.jpg

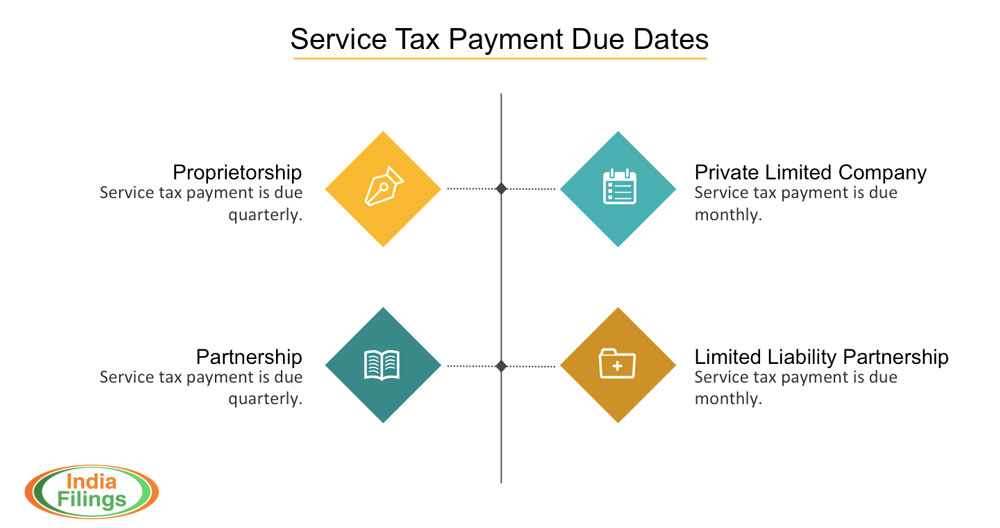

Service Tax Payment Due Dates

https://www.indiafilings.com/learn/wp-content/uploads/2015/04/Service-Tax-Payment-Due-Dates-Chart.jpg

The due date for payment of service tax is the 5 th of the month immediately following the respective quarter in case of e payment by 6 th of the month immediately following the respective quarter For this purpose quarters are April to June July to September October to December and January to March The due date for payment of service tax is the 5th of the month immediately following the respective quarter in case of e payment by 6 th of the month immediately following the respective quarter For this purpose quarters are April to June July to September October to December and January to March

Need More Time to Pay Avoid a penalty by filing and paying your tax by the due date even if you can t pay what you owe For individuals and businesses Apply online for a payment plan including installment agreement TX 2024 08 July 22 2024 The Internal Revenue Service announced today tax relief for individuals and businesses in 67 Texas counties affected by Hurricane Beryl that began on July 5 2024 These taxpayers now have until Feb 3 2025 to file various federal individual and business tax returns and make tax payments

Download Service Tax Payment Due Date

More picture related to Service Tax Payment Due Date

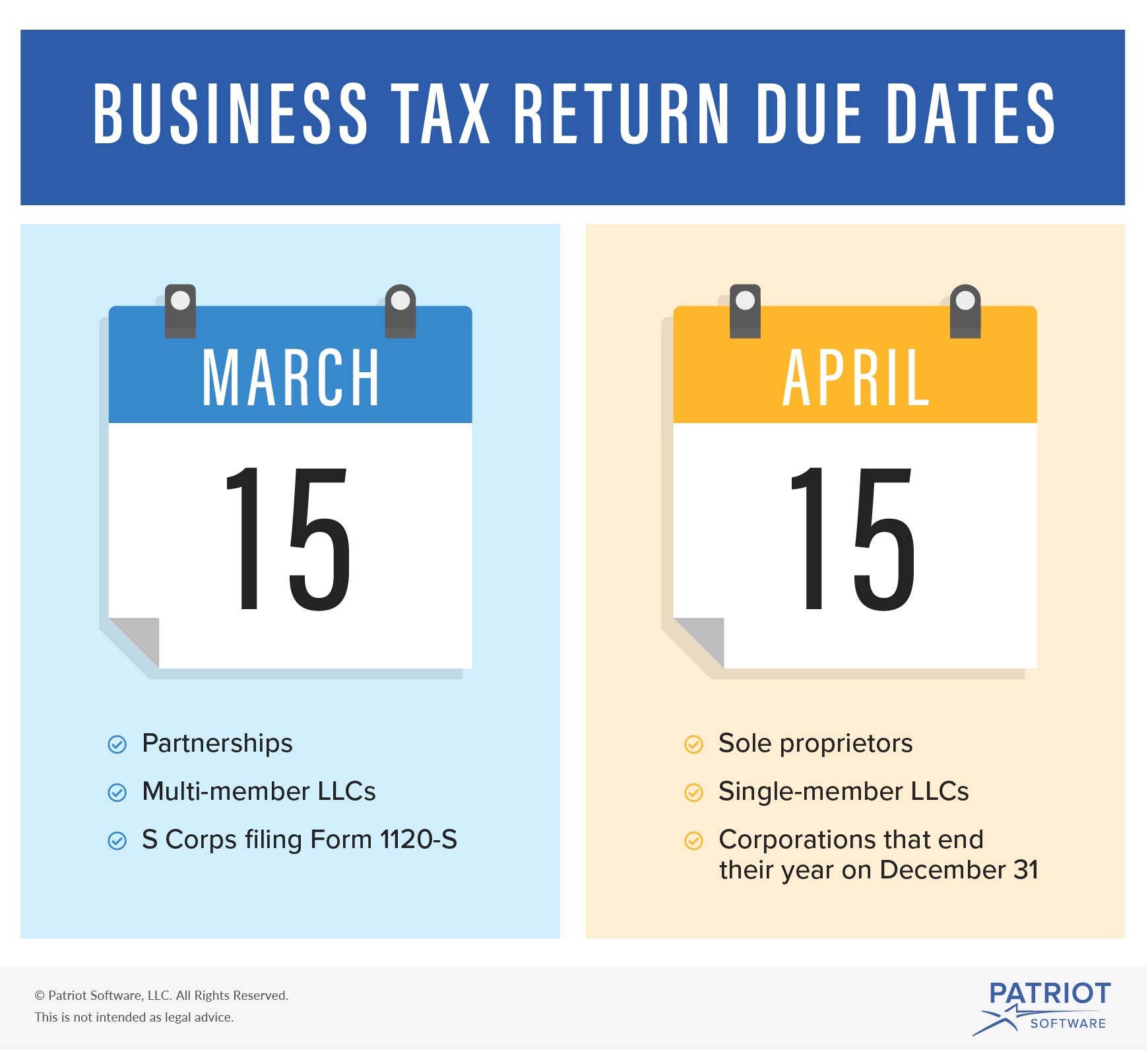

Business Tax Return Due Date By Company Structure

https://www.patriotsoftware.com/wp-content/uploads/2019/12/taxes_due_for_business_75653-01.jpg

Tax Payment Due Date For FY 2019 20 Professional Utilities

https://professionalutilities.com/advice/upload/tax-payment-due-date.jpg

Did You Know The Estimated Tax Payment Due Dates tax TaxAdvisors

https://i.pinimg.com/originals/a9/a6/ec/a9a6ec233064bd7453b37a81bc2347cd.png

The Canada Revenue Agency has started sending out Canada Child Benefit CCB payments but the federal government is warning recipients those payments may be delayed due to a worldwide IT IR 2024 190 July 18 2024 WASHINGTON The Department of the Treasury and the Internal Revenue Service today issued final regulations updating the required minimum distribution RMD rules The final regulations reflect changes made by the SECURE Act and the SECURE 2 0 Act impacting retirement plan participants IRA owners and their

[desc-10] [desc-11]

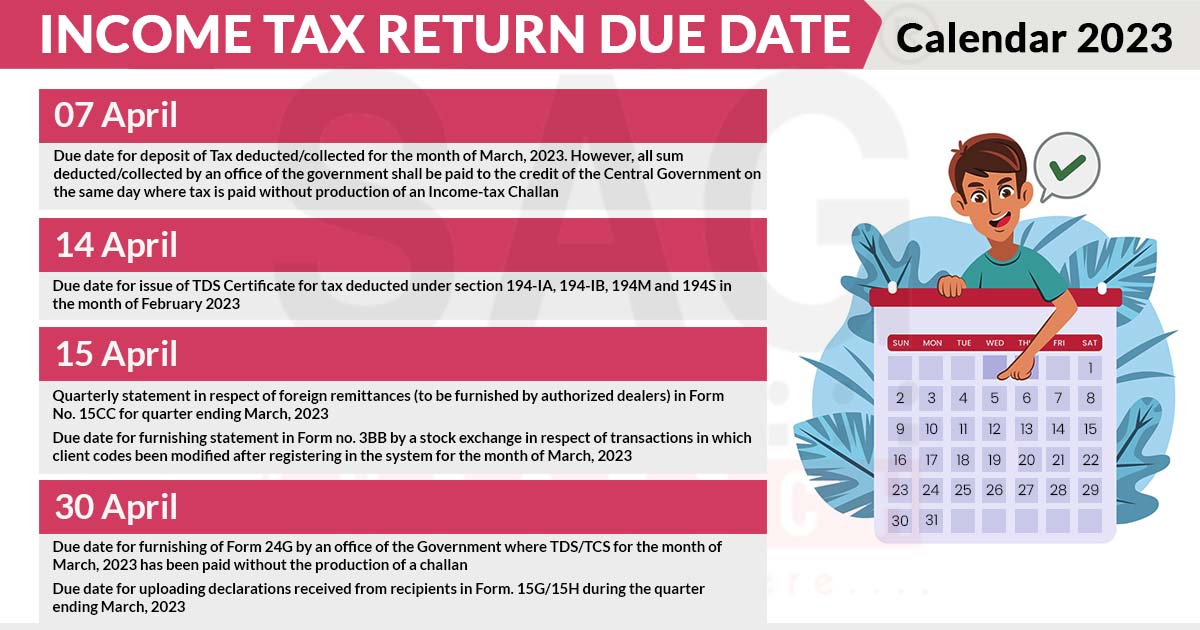

2023 Tax Due Dates Decimal

https://uploads-ssl.webflow.com/5e41d080471798e913648c3e/63b5e591f30ddf62c7b5d0c9_tax due date.jpg

Professional Tax Payment Due Date In West Bengal For Fy 2021 22 Pay

https://studycafe.in/wp-content/uploads/2022/09/STUDYCAFE-IMAGES-Autosaved-10.jpg

https://www.vid.gov.lv/en/due-dates-filing-returns-and-making-tax...

Due Dates for Filing Returns and Making Tax Payments Valsts ie mumu dienests Published 19 10 2022 Type of return report Due date Term of tax payment VAT return on taxation period VAT

https://www.pwc.com/my/en/publications/mtb/service-tax.html

The service tax return SST 02 and payment is due by the last day of the month following the end of the taxable period A taxable person can apply to the DG of Customs to vary the taxable period

Professional Tax Payment Due Date In West Bengal For Fy 2021 22 Pay

2023 Tax Due Dates Decimal

Advance Tax Due Dates Exemptions Interest On Late Payment

2021 E calendar Of Income Tax Return Filing Due Dates For Taxpayers

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

Installment Of Advance Tax Payment Due Date For FY 2020 21 SAG Infotech

Installment Of Advance Tax Payment Due Date For FY 2020 21 SAG Infotech

Advance Tax Payment Due Date Know The Deadlines In 2020 Tax Payment

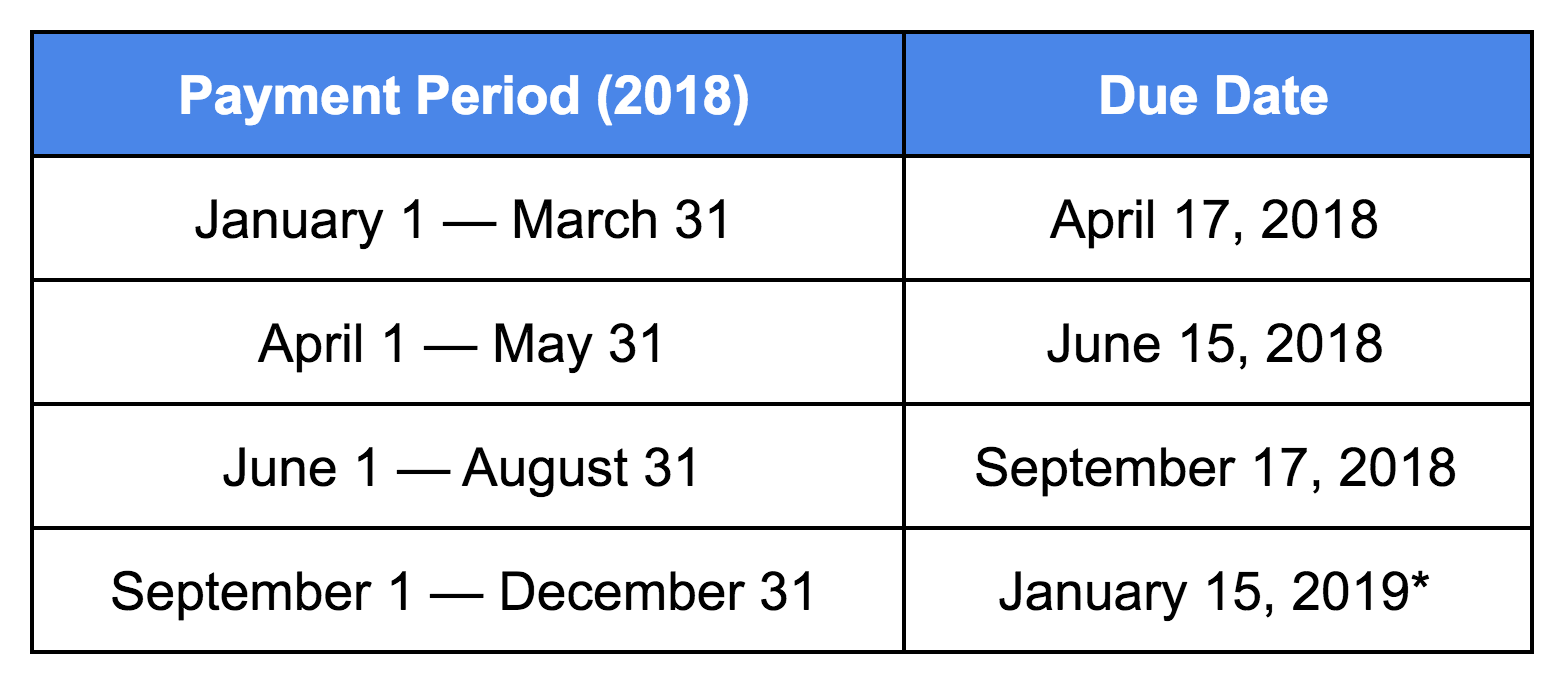

2018 Federal Quarterly Estimated Tax Payments Chandan Lodha Medium

Payment Agreement How To Set Up A Payment Plan With The IRS Marca

Service Tax Payment Due Date - [desc-12]