Sez Tax Benefit Verkko Accelerated depreciation is a key tax benefit for businesses operating in SEZs It not only allows for faster recovery of investment but also enhances cash flow encourages

Verkko 8 kes 228 k 2023 nbsp 0183 32 Special Economic Zone SEZ A special economic zone SEZ refers to designated areas in countries with special economic Verkko SEZ legal frameworks almost always define the package of benefits for investors in zones especially exemptions from customs tax and other national regulatory

Sez Tax Benefit

Sez Tax Benefit

https://life.futuregenerali.in/media/2zmp035j/tax-benefit-on-loans.jpg

Taxlinked Special Economic Zones SEZ Series UAE Taxlinked

https://taxlinked.net/sites/default/files/inline-images/shutterstock_1187022295.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Verkko 20 jouluk 2023 nbsp 0183 32 This article highlights the benefits of establishing a presence with a notified SEZ Special Economic Zone SEZ constitutes a defined and delineated Verkko 16 maalisk 2023 nbsp 0183 32 Deduction under Section 10AA of the Income Tax Act is calculated via the following formula Profit from Export Profits of Business x Export Turnover of the Unit Total Turnover of the

Verkko Tax Benefit to the units set up in Special Economic Zone SEZ The Government thus declared that any entrepreneur who sets up business in SEZ will be provided tax concessions In order to claim deduction Verkko The flow down benefits for states hosting successful SEZs can be significant a high performing zone with strong foreign investment can create thousands of jobs while

Download Sez Tax Benefit

More picture related to Sez Tax Benefit

Huge Tax Benefit Macdonald Group Real Estate

https://images.squarespace-cdn.com/content/v1/5f68d97d7e85dd55cedcae22/f73ac24c-ca11-4a11-bf43-1853683916cc/Huge+Tax+Benefit+Thumbnail.jpg

Tax Benefit Rule PDF

https://imgv2-2-f.scribdassets.com/img/document/334165753/original/4856f8773a/1667482597?v=1

Commerce Ministry Seeks Extension For SEZ Direct Tax Benefit Till FY23

https://i.ytimg.com/vi/NHjMTf_gwu0/maxresdefault.jpg

Verkko 5 marrask 2019 nbsp 0183 32 SEZ plays a vital role in giving impetus to manufacturing The government to simplify the tax regime did away with the tax incentives and Verkko SEZ units allowed to write off unrealized export bills Exemption from interest rate surcharge on import finance Service Tax Exemption from service tax to SEZ units

Verkko 17 jouluk 2016 nbsp 0183 32 In order to avail Income Tax benefit a SEZ operating unit in an SEZ has to fulfil the following conditions Condition 1 The assesse will be deemed to be an Verkko 1 March 2022 5 min read Key takeaways The SEZ scheme in India has shown tremendous growth in infrastructure investment employment and exports since its

Whether Supply From SEZ To EOU Is Import For EOU Custom Duty Applicable

https://taxguru.in/wp-content/uploads/2023/01/Supply-from-SEZ-to-EOU.jpg

Tax Reduction Company Inc

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064489757770

https://fastercapital.com/content/Tax-Benefits--Driving-Business...

Verkko Accelerated depreciation is a key tax benefit for businesses operating in SEZs It not only allows for faster recovery of investment but also enhances cash flow encourages

https://www.investopedia.com/terms/s/sez.asp

Verkko 8 kes 228 k 2023 nbsp 0183 32 Special Economic Zone SEZ A special economic zone SEZ refers to designated areas in countries with special economic

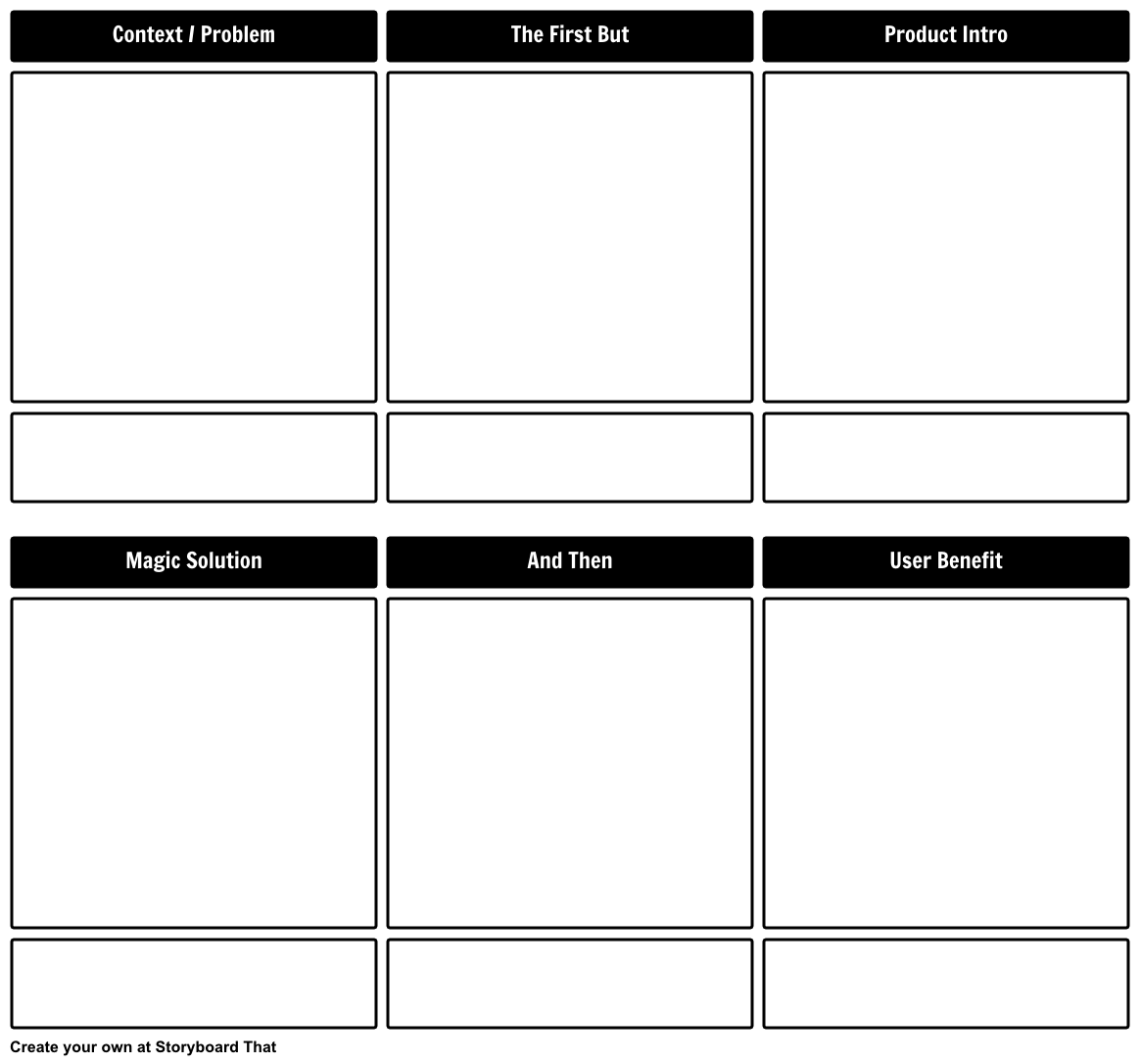

Product Solution Benefit Template Storyboard Par Aaron sherman

Whether Supply From SEZ To EOU Is Import For EOU Custom Duty Applicable

Govt Considering Changes In SEZ Tax Benefits Trade Norms Business

Expense Management Software Expense Reimbursements

Where Could Interest And Tax Rates Be Headed Mercer Advisors

Government Should Not SEZ Tax Breaks Abruptly

Government Should Not SEZ Tax Breaks Abruptly

Refund On Account Of Supplies Made To SEZ Unit SEZ Developer Without

Bharat Bank

3 Major Tax Benefits Of An LLC Don t Miss Out

Sez Tax Benefit - Verkko The flow down benefits for states hosting successful SEZs can be significant a high performing zone with strong foreign investment can create thousands of jobs while