Sez Tax Exemption Rules Direct Tax benefits to the Units in SEZ Income Tax Exemption under Section 10 AA for a period of 15 years on Export Income as follows 100 IT exemption for first 5 years

In 1951 it passed the tax exemption law The concept of Free Zone has greatly impacted the economy Per Capita GNP grew over 45 times in 40 years 100 Income Tax exemption on export income for SEZ units under Section 10AA of the Income Tax Act for first 5 years 50 for next 5 years thereafter and 50 of the

Sez Tax Exemption Rules

Sez Tax Exemption Rules

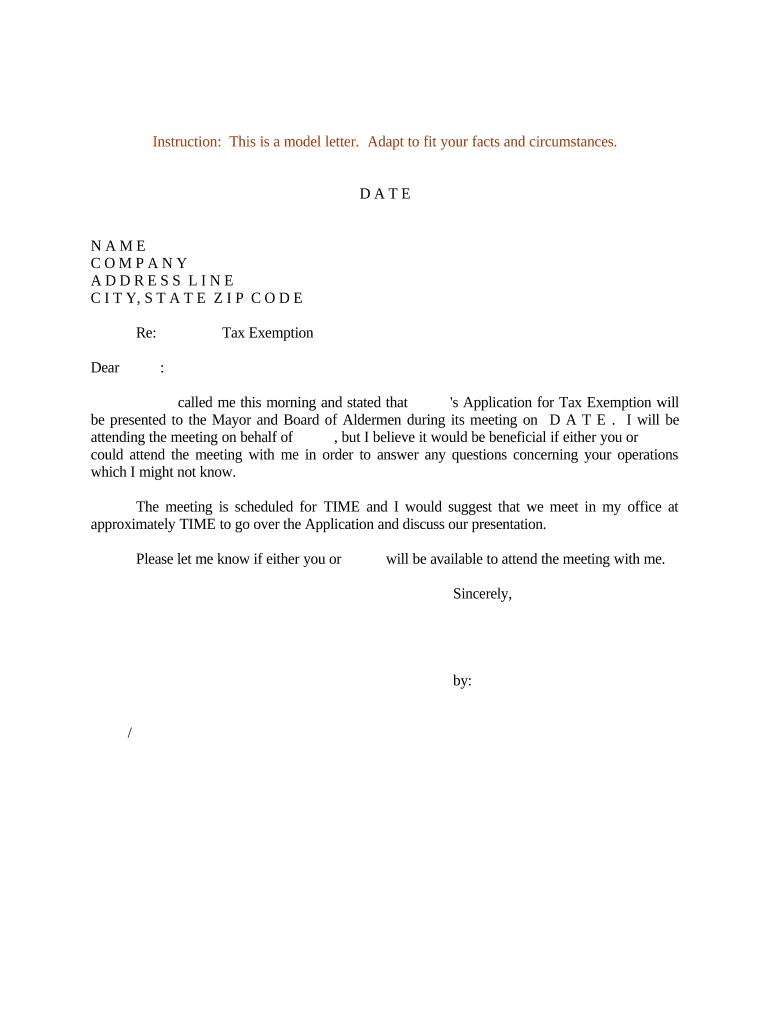

https://www.signnow.com/preview/497/332/497332566/large.png

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

https://i.pinimg.com/originals/4b/35/2c/4b352c55ac0959e4b980ff968f94f4f0.jpg

Revocation Of Federal Tax Exemption Grant Management Nonprofit Fund

https://mygrantmanagement.com/wp-content/uploads/2019/07/tax_exemption_1563850735.png

Special Economic Zones SEZ are treated as foreign territory for tax purposes under GST SEZ supplies considered An SEZ developer will be able to avail income tax exemption so long as the SEZ becomes operational before 31 Mar 17 In the event the SEZ becomes operational

Exemption from the State and local taxes State Goods and Services Tax levies and duties including stamp duty and taxes levied by local bodies on goods required 100 Income Tax exemption on export income for SEZ units under Section 10AA of the Income Tax Act for first 5 years 50 for next 5 years thereafter and 50 of

Download Sez Tax Exemption Rules

More picture related to Sez Tax Exemption Rules

Will Apply For Tax Exemption For Dangal Aamir

https://assets-cdn.kathmandupost.com/uploads/source/news/2016/entertainment/29112016024813a888cad0f66c41f56de3025e1d84a627.JPG

Seven Ways Nonprofits Can Lose Their IRS Tax Exemption

https://lifeboataccounting.com/images/8 tax exempt.jpg

Authors Alliance Petitions For New Exemption To Section 1201 Of The

https://www.authorsalliance.org/wp-content/uploads/2017/07/privacy-policy-445156_1920.jpg

The Special Economic Zone Rules 2006 Act No 28 of 2005 Amended upto February 2020 size 7 26 MB Amendment in SEZ Rules 2006 dated 16th June 2021 size Exemption from the Goods and Service Tax GST and levies imposed by state government supplies to SEZs are zero rated under the IGST Act 2017 meaning they

Income tax exemptions to SEZs Newly started enterprises or units located in SEZs are eligible for a 15 year tax advantage under Section 10AA of the Income Tax Exemption from Service Tax Section 7 26 and Second Schedule of the SEZ Act Supplies to SEZ are zero rated under IGST Act 2017 6 Are Foreign Companies

Tax Exemption Certificate SACHET Pakistan

http://sachet.org.pk/wp-content/uploads/2016/01/Exemption-236.jpg

Tax Reduction Company Inc

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064489757770

https://mihansez.org/Pages/details/sez-policies-and-procedures

Direct Tax benefits to the Units in SEZ Income Tax Exemption under Section 10 AA for a period of 15 years on Export Income as follows 100 IT exemption for first 5 years

http://kb.icai.org/pdfs/PDFFile5b28bc18e58045.93474488.pdf

In 1951 it passed the tax exemption law The concept of Free Zone has greatly impacted the economy Per Capita GNP grew over 45 times in 40 years

Tax Benefit

Tax Exemption Certificate SACHET Pakistan

The Estate Tax The Motley Fool

Government Should Not SEZ Tax Breaks Abruptly

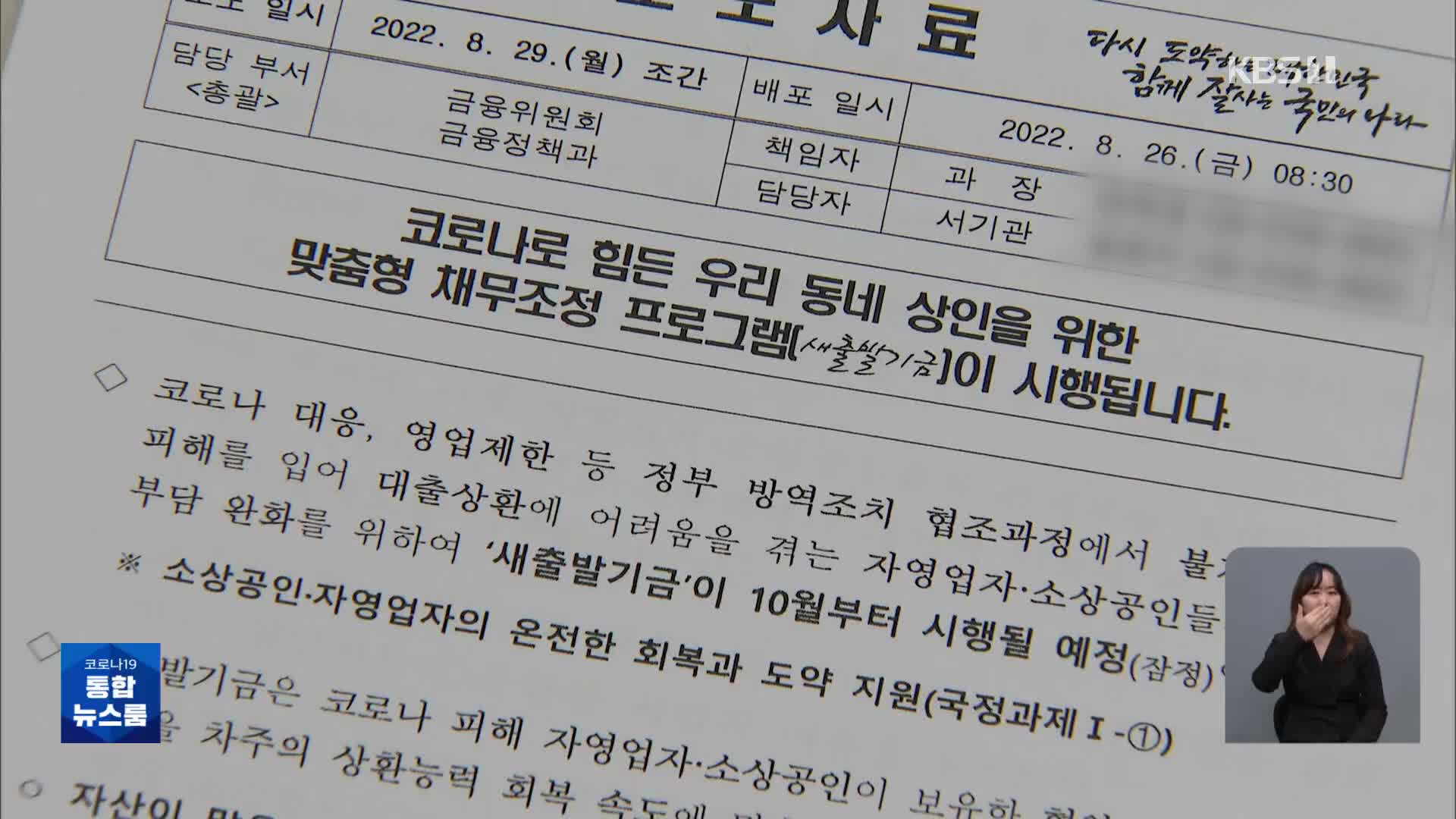

Debt Adjustments Such As principal Reduction Or Exemption For Small

Free Tax Prep Assistance And Forms At Birmingham Public Library

Free Tax Prep Assistance And Forms At Birmingham Public Library

Exemption From Meaning

What Are Tax Exemptions Tax Deducted At Source Tax Exemption Federal

What Is An IRS Group Exemption Who Can Qualify

Sez Tax Exemption Rules - 100 Income Tax exemption on export income for SEZ units under Section 10AA of the Income Tax Act for first 5 years 50 for next 5 years thereafter and 50 of