Sez Tax Incentives SEZ legal frameworks almost always define the package of benefits for investors in zones especially exemptions from customs tax and other national regulatory regimes As SEZs

In many jurisdictions companies operating in special economic zones SEZs benefit from permanent or temporary corporate tax exemptions or reduced tax rates Special economic zones SEZs are a popular policy tool for the promotion of economic development However questions remain about their economic contribution

Sez Tax Incentives

Sez Tax Incentives

https://www.asa.in/wp-content/uploads/2021/08/SEZ-1.jpg

Tax Incentives Free Of Charge Creative Commons Financial 3 Image

https://pix4free.org/assets/library/2021-04-28/originals/tax_incentives.jpg

Tax Incentives A Guide To Saving Money For U S Small Businesses

https://www.freshbooks.com/wp-content/uploads/2022/04/tax-incentives-examples.jpg

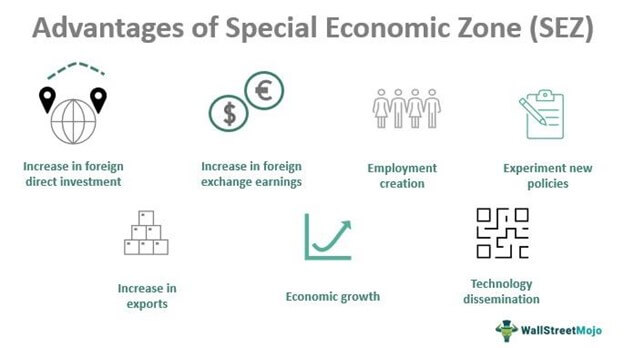

A special economic zone SEZ is an area in a country that is designed to generate positive economic growth An SEZ is normally subject to different and more Under Section 10AA of the Income Tax Act 1961 SEZ units are eligible for deduction of up to 100 percent of export profits for the first five years from the year of

Incentives for investment in Special Economic Zones 01 Jan 2017 In his 2017 national budget statement presented to the Parliament on 8 December 2016 the As part of the regulatory framework of SEZs this chapter shows that both fiscal and non fiscal incentives were widely used In particular international experience

Download Sez Tax Incentives

More picture related to Sez Tax Incentives

Tax Incentives Archives InsideSources

https://insidesources.com/wp-content/uploads/2017/06/tax-incentives.jpg

Special Economic Zone SEZ Meaning Types India China

https://www.wallstreetmojo.com/wp-content/uploads/2021/09/Special-Economic-Zones-SEZ.jpg

Financial And Tax Incentives Making A Difference Works

https://makingadifference.works/wp-content/uploads/2017/05/WyJxPfUl.jpeg

SEZ incentives are available to Investors who Have been licensed by the relevant licensing authority to carry on business in an SEZ Export 100 of the business Corporate Tax credits and incentives Last reviewed 14 December 2023 Tax incentive provisions normally have conditions applicable for the period within which

According to current regulations the deadline for utilising the available tax credit from the previous SEZ system is the end of 2026 previously 2020 Tax relief for The Commerce Ministry is proposing a host of direct and indirect incentives such as deferral of import duties and exemption from export taxes to revamp Special

11 Types Of Tax Incentives How They Differ In Their Functionality

https://www.fincyte.com/wp-content/uploads/2020/10/Tax-Incentives-You-Need-To-know.jpg

How An Outsourced Tax Consultant Helps Capture Employment Incentives

https://www.ctillc.com/hs-fs/hubfs/CTI56.jpg?width=800&name=CTI56.jpg

https://unctad.org/system/files/official-document/...

SEZ legal frameworks almost always define the package of benefits for investors in zones especially exemptions from customs tax and other national regulatory regimes As SEZs

https://academic.oup.com/jiel/article/24/2/473/6246114

In many jurisdictions companies operating in special economic zones SEZs benefit from permanent or temporary corporate tax exemptions or reduced tax rates

Tax Incentives That Could Be Available For Your Business Magma

11 Types Of Tax Incentives How They Differ In Their Functionality

Tax Incentives YouTube

Good News For Small And Medium Enterprises In Form Of Tax Incentives

Topic 4 Tax Incentives PDF Tax Exemption Taxes

Benefits That Come With Special Economic Zones SPPI Blog

Benefits That Come With Special Economic Zones SPPI Blog

Incentives In Rescheduling Payments In Accordance With Emergency

3 Expert Tax Consultant Processes That Complement Your CPA Firm

3 Tax Incentives Staffing Agencies Need To Consider COATS Staffing

Sez Tax Incentives - The SEZ tax incentives are granted for the following period subject to the cost and project categories category A the cost of the project is up to 3 000 000 times the monthly