Should A Healthcare Rebate Be Taxed Web When an employee pays premiums with pre tax dollars and receives a portion of the rebates the rebate is considered taxable income and is subject to employment taxes When a rebate is distributed as a premium

Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking Web As with most tax matters the answer is It depends The principle here is easy to understand If you got a tax break for money spent in 2011 and you get some of that

Should A Healthcare Rebate Be Taxed

Should A Healthcare Rebate Be Taxed

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Anthem Releases Medical Loss Ratio Rebate Information Hometown

https://i1.wp.com/hometowninsurancepros.com/wp-content/uploads/2020/08/Anthem-2019-MLR.jpg?resize=790%2C1024&ssl=1

Australian Government Private Health Insurance Rebate Insurance

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Web 17 mai 2023 nbsp 0183 32 A health savings account HSA is an account you can use to pay a variety of medical costs An HSA is only available to people who have a high deductible health insurance plan The contributions to Web 23 sept 2019 nbsp 0183 32 Employers who sponsor a fully insured group health plan may soon be receiving a Medical Loss Ratio MLR rebate from their insurers Self insured medical

Web 10 mars 2023 nbsp 0183 32 Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get heath Web 13 d 233 c 2022 nbsp 0183 32 Health taxes Health taxes are levied on products that have a negative public health impact for example tobacco alcohol and sugar sweetened beverages SSBs These taxes are considered win win win

Download Should A Healthcare Rebate Be Taxed

More picture related to Should A Healthcare Rebate Be Taxed

How Does Private Health Insurance Affect My Tax Return Compare Club

https://asset.compareclub.com.au/content/guides/health-insurance/tax-return/private-health-rebate-levels.jpg

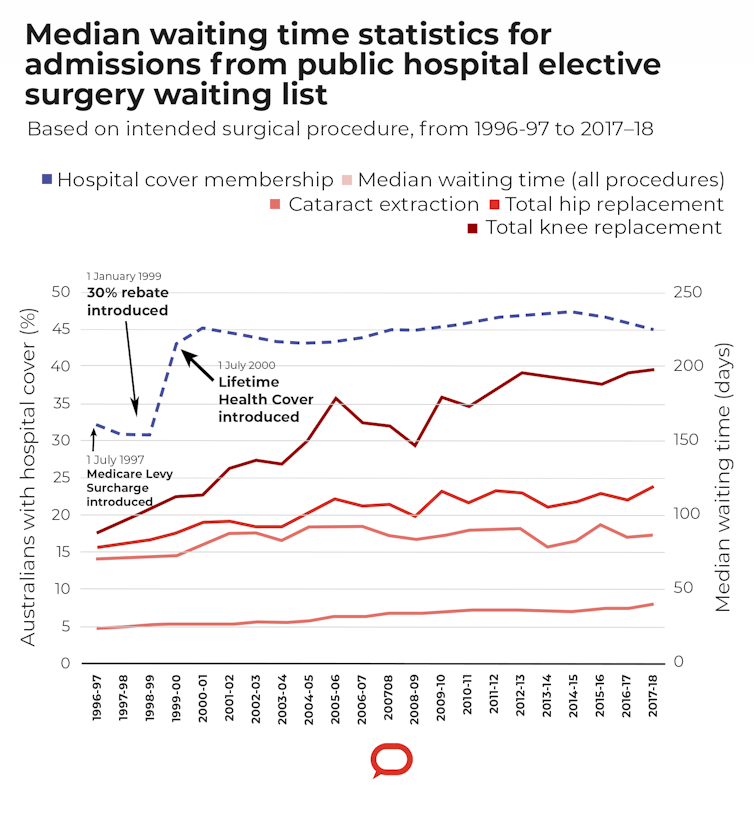

What Should Happen To The Private Health Insurance Rebate This Election

https://images.theconversation.com/files/458508/original/file-20220419-24-8c9jju.png?ixlib=rb-1.1.0&q=45&auto=format&w=754&fit=clip

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

Web How health coverage affects your 2021 federal income tax return If you haven t filed your 2021 taxes or filed but failed to reconcile your premium tax credit use the information Web 25 oct 2022 nbsp 0183 32 When employers reimburse out of pocket healthcare costs or medical insurance coverage premiums using a stipend they pay payroll tax on those funds But you aren t required to withhold Social Security or

Web 11 oct 2021 nbsp 0183 32 This plan can save you up to 40 on income taxes and payroll taxes Also pre tax medical premiums are excluded from federal income tax Social Security tax Web 11 janv 2023 nbsp 0183 32 No Unlike a healthcare stipend with a health insurance reimbursement employers don t have to pay payroll taxes and employees don t have to recognize

The Private Health Insurance Rebate Has Cost Taxpayers 100 Billion And

https://images.theconversation.com/files/458097/original/file-20220414-24-s9hvgo.jpg?ixlib=rb-1.1.0&q=15&auto=format&w=754&h=503&fit=crop&dpr=3

The Private Health Insurance Rebate Has Cost Taxpayers 100 Billion And

https://images.theconversation.com/files/458099/original/file-20220414-14-xrkzlw.jpg?ixlib=rb-1.1.0&q=45&auto=format&w=600&h=404&fit=crop&dpr=1

https://www.healthplanrate.com/advice/are-ac…

Web When an employee pays premiums with pre tax dollars and receives a portion of the rebates the rebate is considered taxable income and is subject to employment taxes When a rebate is distributed as a premium

https://donotpay.com/learn/are-rebates-taxable

Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking

Rebate Superstar Healthcare Assistant 8 946 Tax Back

The Private Health Insurance Rebate Has Cost Taxpayers 100 Billion And

Rebate Form Instructions ViiV Healthcare ViiVConnect Savings Card

Fees Rebates Consultation With Top Life Psychologists

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Your Healthcare Might Be Taxed OPINION

Your Healthcare Might Be Taxed OPINION

Star Health Reimbursement Policy Printable Rebate Form

What Should Happen To The Private Health Insurance Rebate This Election

I m Getting A Health Insurance Rebate Chris Schiffner s Corner Of

Should A Healthcare Rebate Be Taxed - Web 12 ao 251 t 2022 nbsp 0183 32 Health insurers send rebates to meet medical loss ratio So why are the rebates going out Basically insurance companies that sell group or individual policies