Should An Llc Receive A 1099 Misc You have the 1099 INT form for interest you ve received the 1099 DIV for share dividends and a general 1099 MISC form for miscellaneous income For most LLCs though the

Generally C corporations S Corporations and LLCs formed as corporations or S Corps don t need to receive a 1099 NEC or 1099 MISC On irs gov check the 1099 NEC LLCs can be trickier to determine whether a 1099 is needed because they don t all receive the same tax treatment For example a single member LLC is taxed like a sole proprietorship so

Should An Llc Receive A 1099 Misc

Should An Llc Receive A 1099 Misc

https://www.pdffiller.com/preview/608/781/608781885/big.png

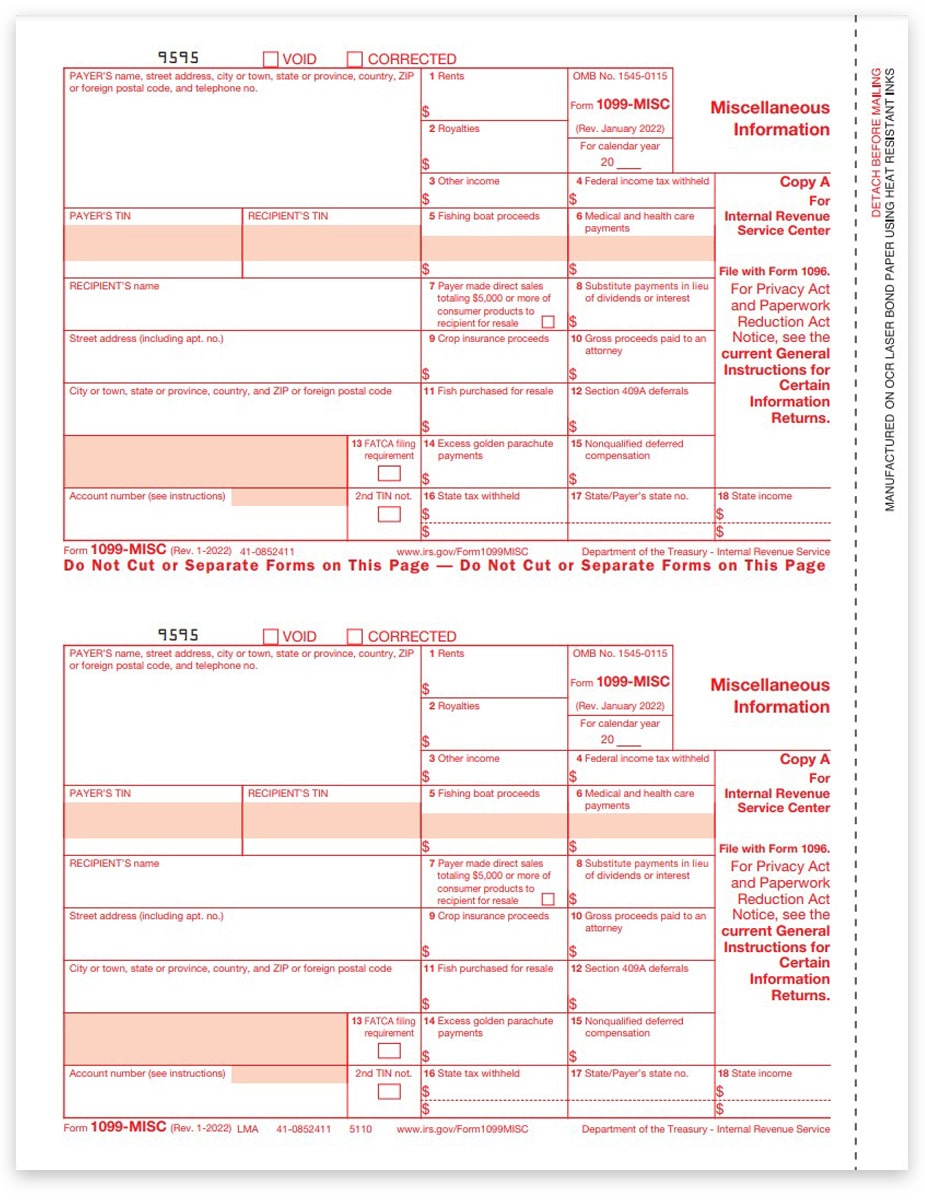

1099MISC Tax Forms Red Copy A For IRS Filing ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/11/1099MISC-Form-Copy-A-Federal-Red-LMA-FINAL-min.jpg

1099 Misc Tax Form Printable Printable Forms Free Online

https://jumbotron-production-f.squarecdn.com/assets/11075493e5b6812373621.png

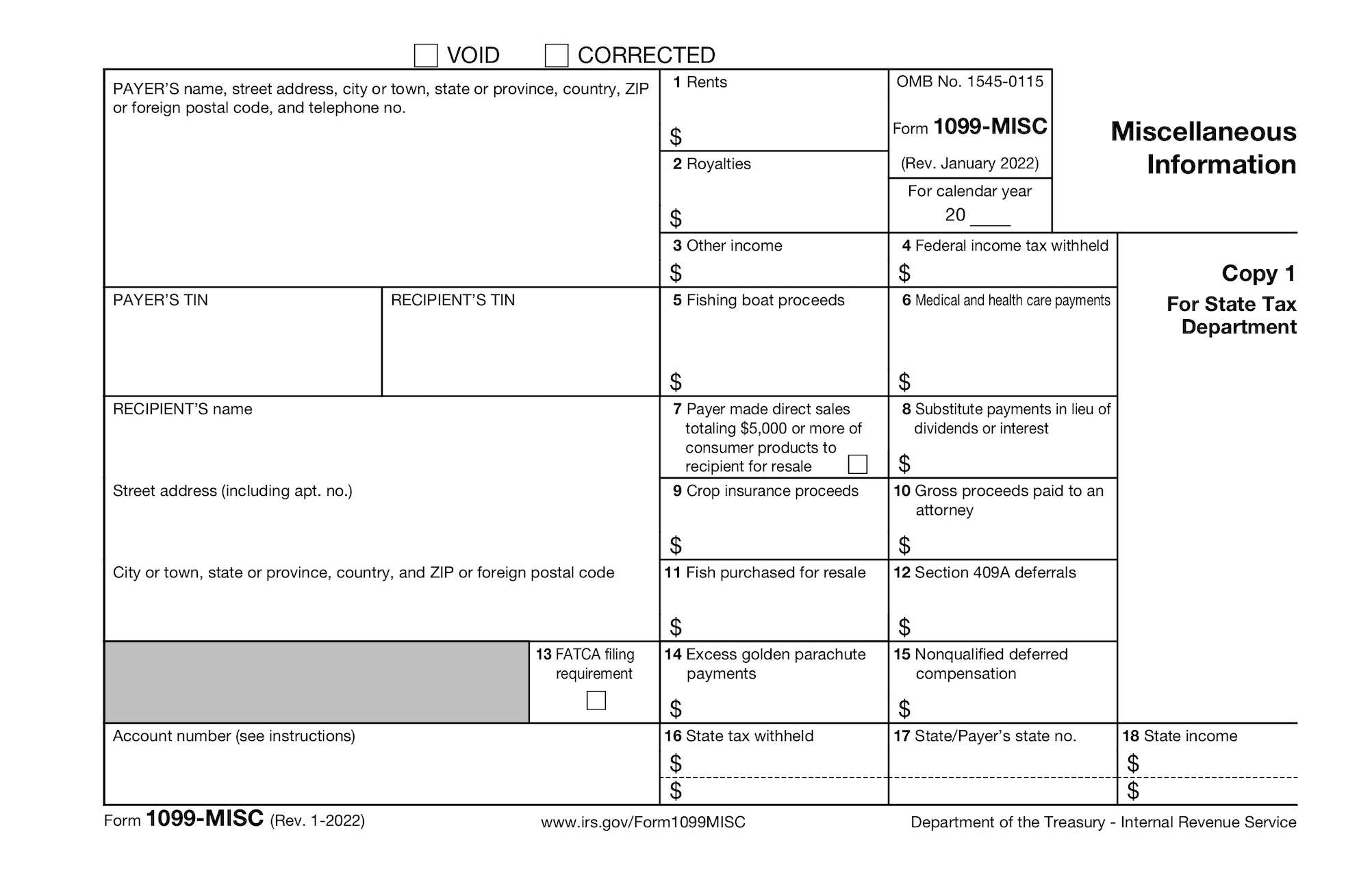

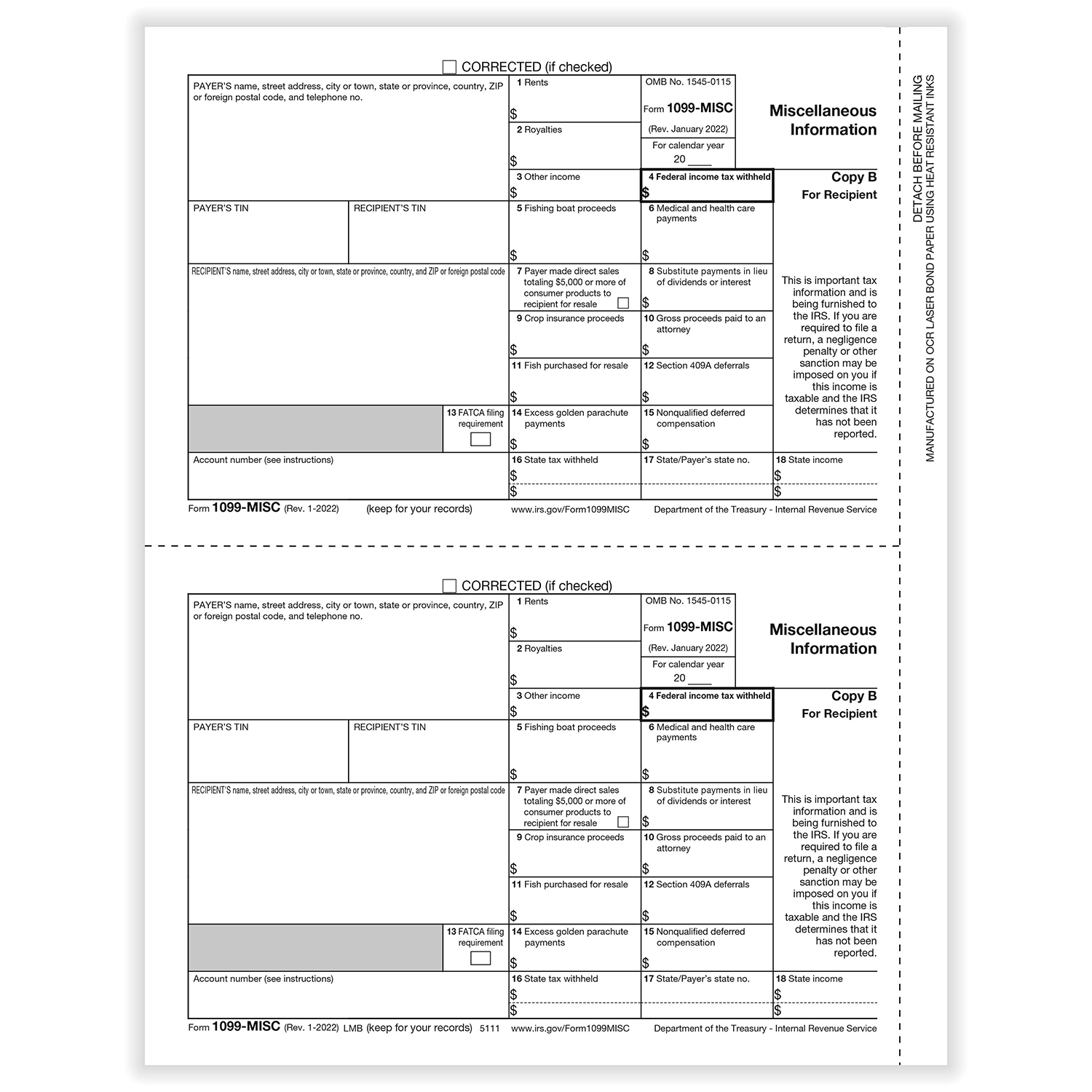

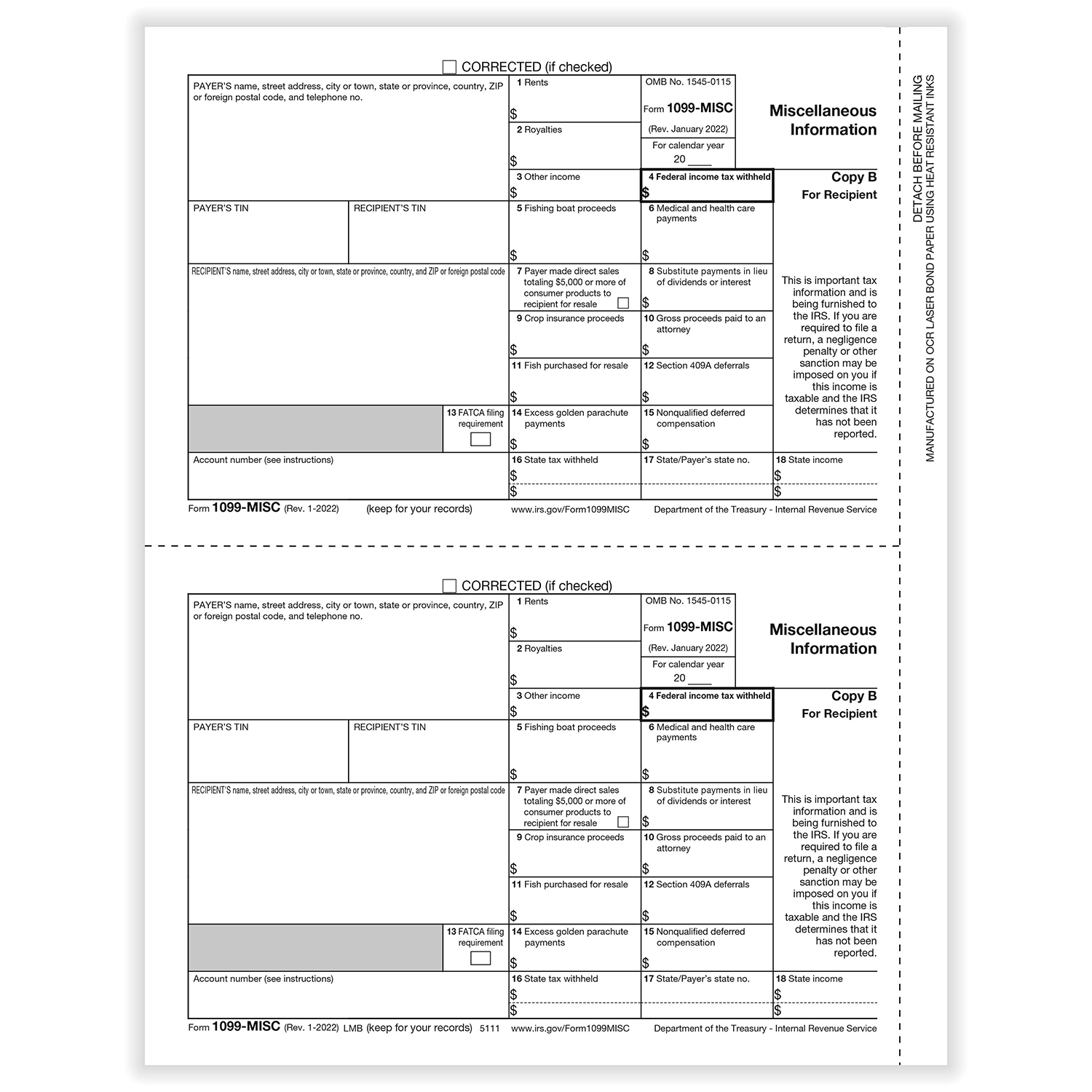

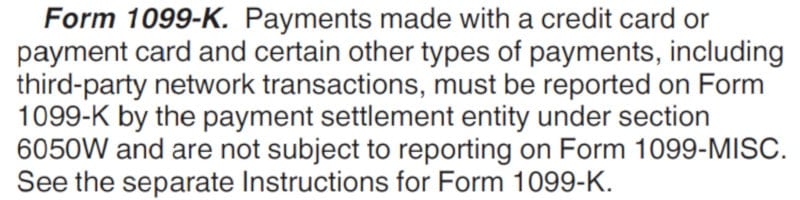

If an LLC pays an individual contractor 600 or more for services rendered during the year it must provide the contractor with a 1099 MISC form The LLC must obtain the contractor s Taxpayer Information about Form 1099 MISC Miscellaneous Information including recent updates related forms and instructions on how to file Form 1099 MISC is used to report rents

Form 1099 MISC is for reporting payments like rent or prizes that are not subject to self employment tax while Form 1099 NEC is for reporting nonemployee compensation that is most likely subject to self An LLC that instead opts to be taxed as a partnership the default must receive a 1099 MISC form if it receives more than 600 in payment for services or rent

Download Should An Llc Receive A 1099 Misc

More picture related to Should An Llc Receive A 1099 Misc

Who Should Receive Form 1099 MISC Global Business Related News Tips

https://www.krdotv.com/wp-content/uploads/2022/05/Who-Should-Receive-Form-1099-MISC.jpg

TaxFormFiling 1099 MISC

https://assets.website-files.com/5fb6ec85b83fa3bde36cee80/63a218b56e14ea45be6342d6_20__-1099-misc-builder.png

1099 MISC User Interface Miscellaneous Income Data Is Entered Onto

https://i.pinimg.com/originals/61/c3/ed/61c3ed9afad426ba854555347fb9f89a.gif

If your business made payments of this nature to an LLC you will only need to file a 1099 MISC and furnish a copy if the LLC elects to be taxed as a partnership or if Unfortunately there s no cut and dried answer to the question Do LLCs get 1099s because not every LLC gets the same tax treatment If a contractor files

Determine the need for a 1099 Based on the information on Form W 9 and the total payments made to the LLC determine if a 1099 NEC or 1099 MISC is The IRS 1099 MISC rules say corporations and LLCs don t normally receive a MISC for work they do However the rules list a few exceptions Buying fish

Form 1099 MISC For Independent Consultants 6 Step Guide

https://global-uploads.webflow.com/58868bcd2ef4daaf0f072902/5ab4028e9825160f3b4e4824_Screen Shot 2018-03-22 at 3.22.21 PM.png

Form 1099 R Printed IRS Form 1099 R Formstax

https://cdn.formstax.com/Images/Products/L1391-5144_LMRNB-2023-BL_xl.jpg

https://bizee.com/blog/post/do-llcs-get-1099

You have the 1099 INT form for interest you ve received the 1099 DIV for share dividends and a general 1099 MISC form for miscellaneous income For most LLCs though the

https://tipalti.com/tax-hub/who-gets-a-1099

Generally C corporations S Corporations and LLCs formed as corporations or S Corps don t need to receive a 1099 NEC or 1099 MISC On irs gov check the 1099 NEC

File 1099 5 Important Facts To Know Before Filing Your 1099s

Form 1099 MISC For Independent Consultants 6 Step Guide

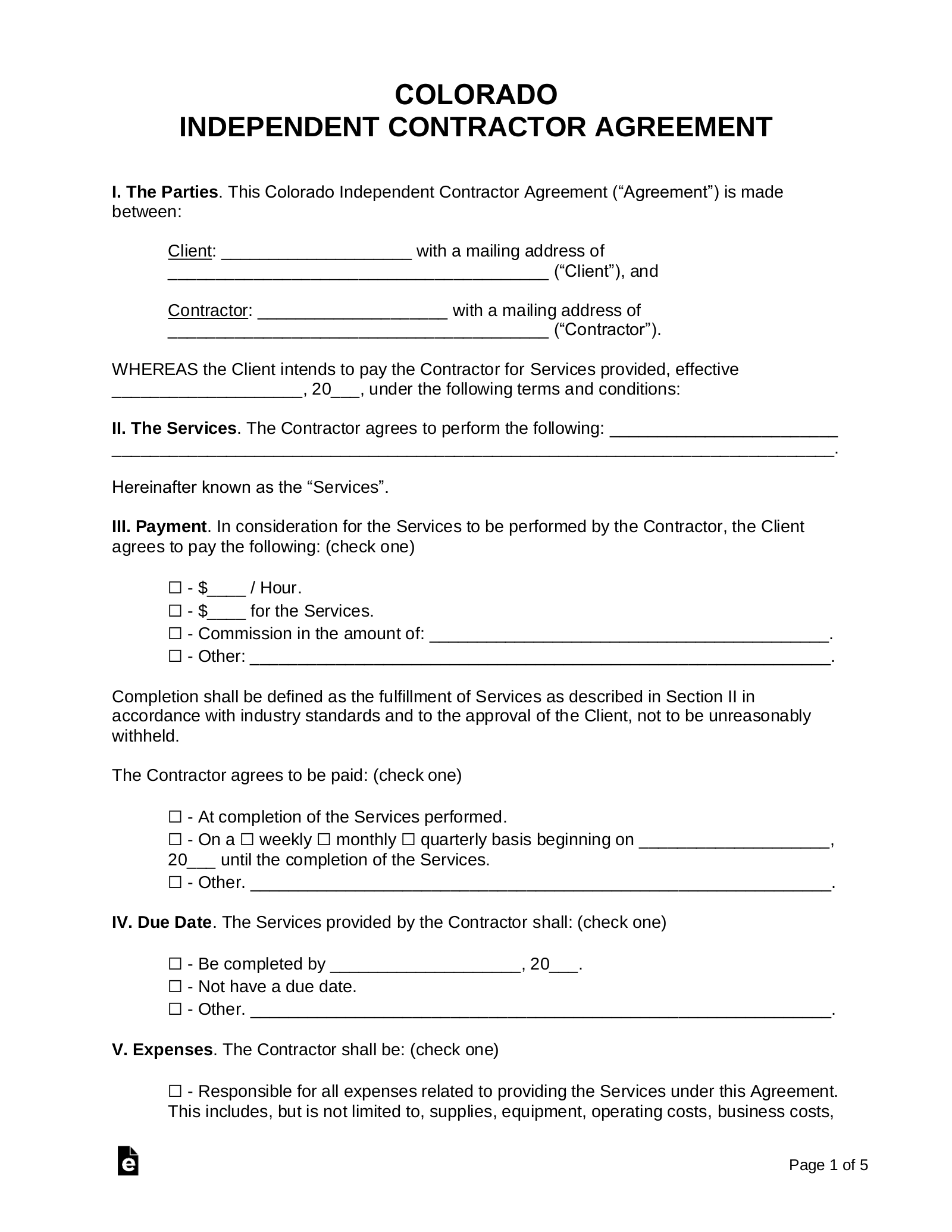

1099 Form Independent Contractor Free

What Type Of Payment Is Considered Miscellaneous Leia Aqui What Are

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

Form 1099 G Definition

1099 MISC 2 Up Individual Recipient Copy B Formstax

1099 MISC 2 Up Individual Recipient Copy B Formstax

Why Did I Receive Form 1099 MISC PriorTax

What To Do When You Wrongly Receive A 1099 MISC Or 1099 NEC Eric Nisall

1099 MISC Form Copy A Federal LMA

Should An Llc Receive A 1099 Misc - Do I need a 1099 for an LLC There are several instances where a business must issue a 1099 MISC if it has made payments to a limited liability company The