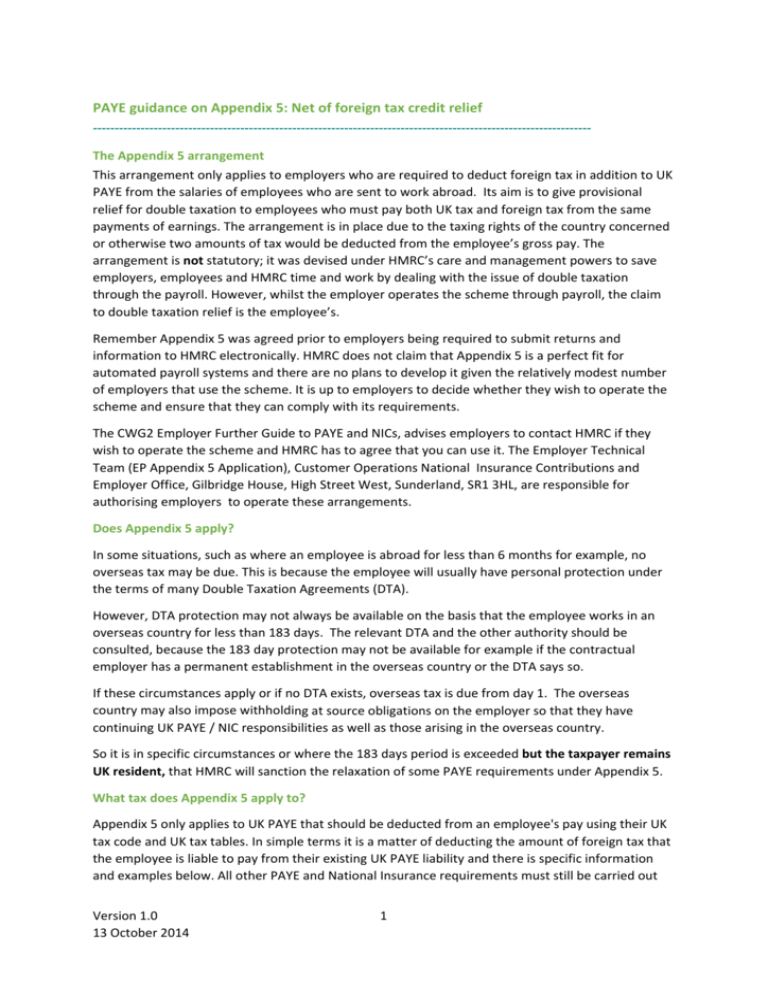

Should I Claim Foreign Tax Credit Relief You can usually claim Foreign Tax Credit Relief when you report your overseas income in your tax return How much relief you get depends on the UK s double taxation

How to Claim the Foreign Tax Credit File Form 1116 Foreign Tax Credit to claim the foreign tax credit if you are an individual estate or trust and you paid or The general objective is to help taxpayers avoid double taxation on foreign income Taxpayers can deduct the foreign income tax they paid or claim those taxes

Should I Claim Foreign Tax Credit Relief

Should I Claim Foreign Tax Credit Relief

https://i.ytimg.com/vi/D2Da55iEpXA/maxresdefault.jpg

Foreign Tax Credit Relief Explained YouTube

https://i.ytimg.com/vi/FWkkktgFhhE/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGEwgVChlMA8=&rs=AOn4CLBRkaHfcSBQW1BqeB4mEIGoMtrdrA

File

https://s2.studylib.net/store/data/010052453_1-7db53f4f4f719eafe31b10899d4f6169-768x994.png

It is generally better to take a credit for qualified foreign taxes than to deduct them as an itemized deduction This is because A credit reduces your actual U S In a nutshell you can claim foreign tax credit relief or FTCR for short if you have paid overseas taxes on gains or income source which is chargeable to the UK

If you choose to claim a credit for your foreign taxes in 2023 you would be allowed a credit of 700 consisting of 600 paid in 2023 and 100 of the 200 carried over from 2022 You will have a credit Two of the biggest tax savings tools expats should know about are the Foreign Tax Credit FTC and the Foreign Earned Income Exclusion FEIE If you re a

Download Should I Claim Foreign Tax Credit Relief

More picture related to Should I Claim Foreign Tax Credit Relief

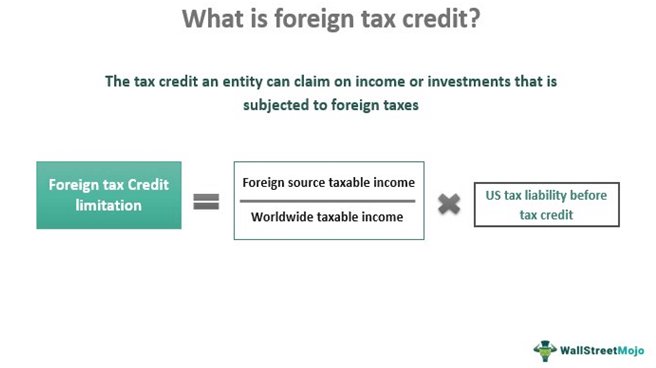

Foreign Tax Credit Meaning Example Limitation Carryover

https://www.wallstreetmojo.com/wp-content/uploads/2021/02/what-is-foreign-tax-credit.png

How To Claim Credit On Foreign Tax Paid

https://www.diligen.in/wp-content/uploads/2022/10/Diligen-Blog-Images-July-22-64.jpg

Form 1118 Foreign Tax Credit Corporations 2014 Free Download

https://www.formsbirds.com/formhtml/a48b0ecbc6a9c3da67eb/6d43f7bc4894e1dd94ba9b6ec1/bga.png

Raymond Stahl of Ernst Young discusses concerns about the final regulations for claiming foreign tax credits particularly how they affect creditability Foreign tax relief UK residents are usually able to claim a credit for foreign taxes suffered on overseas income or gains that are taxable in the United Kingdom This

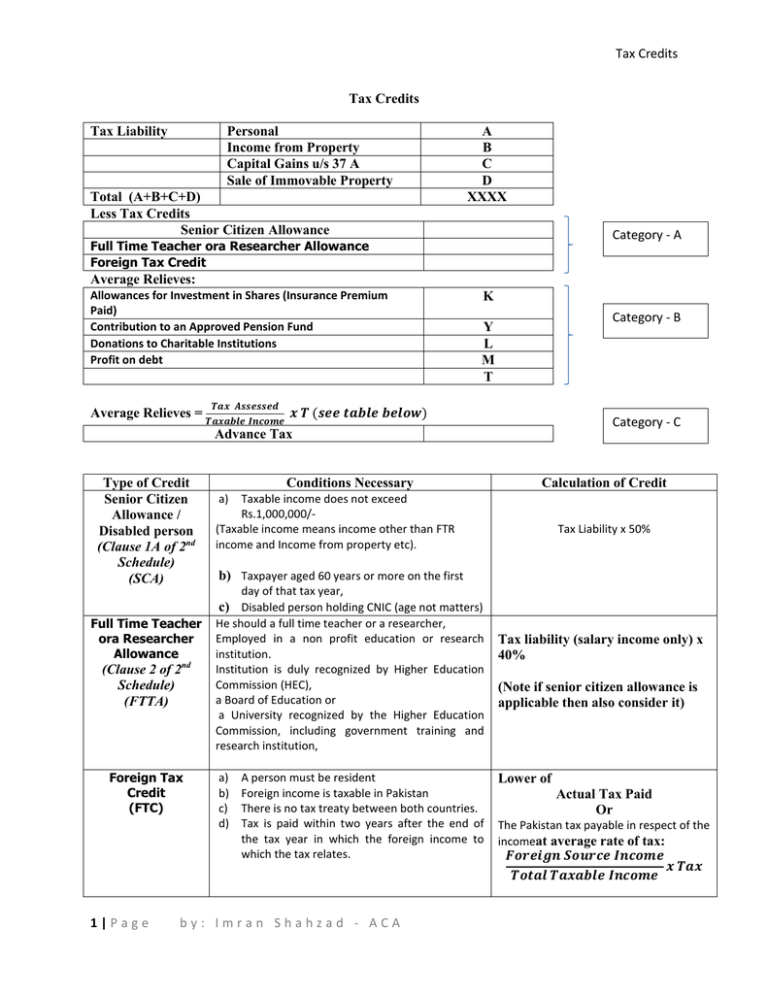

The relief can be applied to any relief year if taxpayers apply it to all foreign taxes paid in the year including taxes paid by controlled foreign corporations Only a resident taxpayer is eligible to claim FTC if he paid tax or had tax deducted in a foreign country on foreign income FTC shall be granted only in the year in which the

Foreign Tax Credit Carryover Worksheet

https://i1.wp.com/1040abroad.com/wp-content/uploads/2019/02/How-to-file-Foreign-Tax-Credit-passive-category-income-part-3-and-part-4.png

The Tax Implications Of Investing In Foreign Securities

https://static.wixstatic.com/media/32c0ef_77bd7192c7f64666bcc7bb8687e0ff05~mv2.jpg/v1/fill/w_1000,h_667,al_c,q_85,usm_0.66_1.00_0.01/32c0ef_77bd7192c7f64666bcc7bb8687e0ff05~mv2.jpg

https://www.gov.uk/tax-foreign-income/taxed-twice

You can usually claim Foreign Tax Credit Relief when you report your overseas income in your tax return How much relief you get depends on the UK s double taxation

https://www.irs.gov/.../foreign-tax-credit

How to Claim the Foreign Tax Credit File Form 1116 Foreign Tax Credit to claim the foreign tax credit if you are an individual estate or trust and you paid or

The Basics Of The Foreign Tax Credit What It s For How To Claim It

Foreign Tax Credit Carryover Worksheet

Is Foreign Tax Credit Allowed For Taxes That Are Paid Or Accrued

PAYE Guidance On Appendix 5 Net Of Foreign Tax Credit Relief

Foreign Tax Credit How To Claim Tax Credit On Foreign Income

Sample Letter To Claim Car Insurance SemiOffice Com

Sample Letter To Claim Car Insurance SemiOffice Com

Foreign Tax Credit Form 1116

Foreign Tax Credit Relief For U S Expats Expat Tax Professionals

So How Do Foreign Tax Credits Work Let s Fix The Australia US Tax

Should I Claim Foreign Tax Credit Relief - If you paid foreign taxes on overseas investments you may be able to avoid a double hit on your U S tax return by claiming either a credit or deduction But which is