Should I Use The Tax Credit For Health Insurance A tax credit for health insurance reduces your monthly health insurance costs To be eligible you need to buy your plan through HealthCare gov or a state marketplace and you can t earn more than 60 240 per year 124 800 for a family of four

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC Getting a lump sum at year end can help you save on taxes but most elect to have advance sums applied to monthly premiums potentially altering their tax burden The health insurance

Should I Use The Tax Credit For Health Insurance

Should I Use The Tax Credit For Health Insurance

https://www.theunionjournal.com/wp-content/uploads/2021/04/tax-credit1-1920x1286.jpg

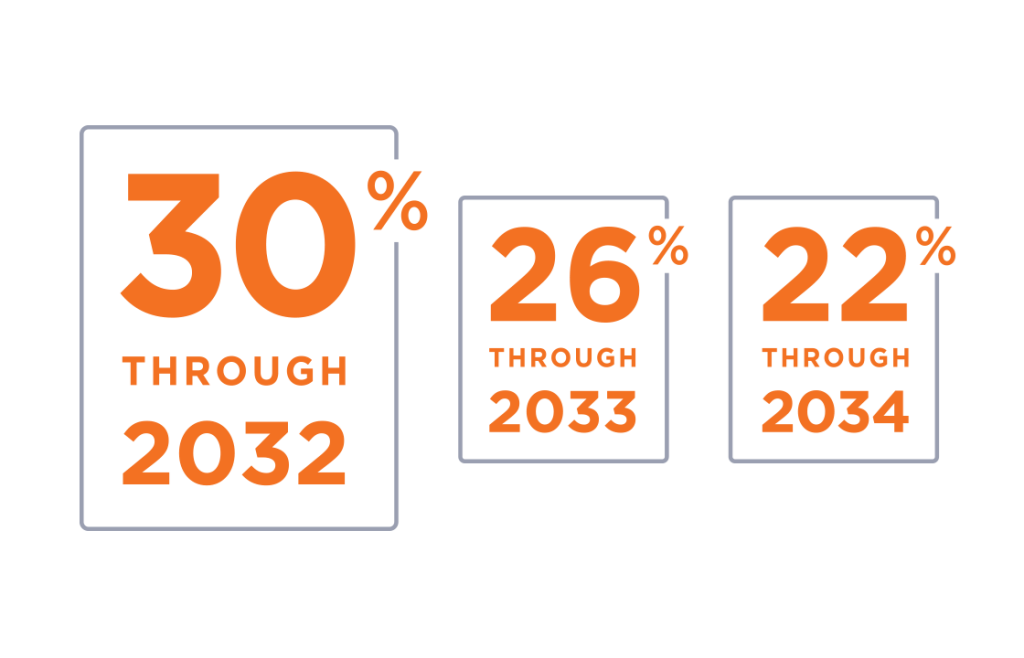

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Premium tax credits can help reduce what you pay for an Affordable Care Act ACA Obamacare health insurance plan depending on your household size and income The IRS offers you two options Take the credit now or get it later If you buy a health plan on the health insurance marketplace and your income is between 100 and 400 percent of the federal poverty level currently 11 490 to 45 960 for an individual you may qualify for a tax credit to reduce the cost of your premium

You may be allowed a Premium Tax Credit if You or a tax family member enrolled in health insurance coverage through the Marketplace for at least one month of a calendar year in which the enrolled individual was not eligible for affordable coverage through an eligible employer sponsored plan that provides minimum value or eligible to enroll in The premium tax credit is a refundable tax credit that helps cover the cost of health insurance premiums It s available to taxpayers who have purchased a health insurance plan from the

Download Should I Use The Tax Credit For Health Insurance

More picture related to Should I Use The Tax Credit For Health Insurance

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

8 Incredible Tips What Is The Tax Credit For Health Insurance Premiums

https://i2.wp.com/www.peoplekeep.com/hs-fs/hubfs/Premium_Tax_Credit_Eligibility_2015.png

Are Payroll Deductions For Health Insurance Pre Tax Details More

https://www.patriotsoftware.com/wp-content/uploads/2021/06/health-insurance-pre-tax-1.png

The premium tax credit helps qualifying individuals and families afford health insurance purchased from the federally regulated marketplace better known as the Affordable Care Act ACA You can have tax credits paid directly to your health plan each month to reduce your monthly premium right away or if you can afford to you can pay the entire health plan premium

[desc-10] [desc-11]

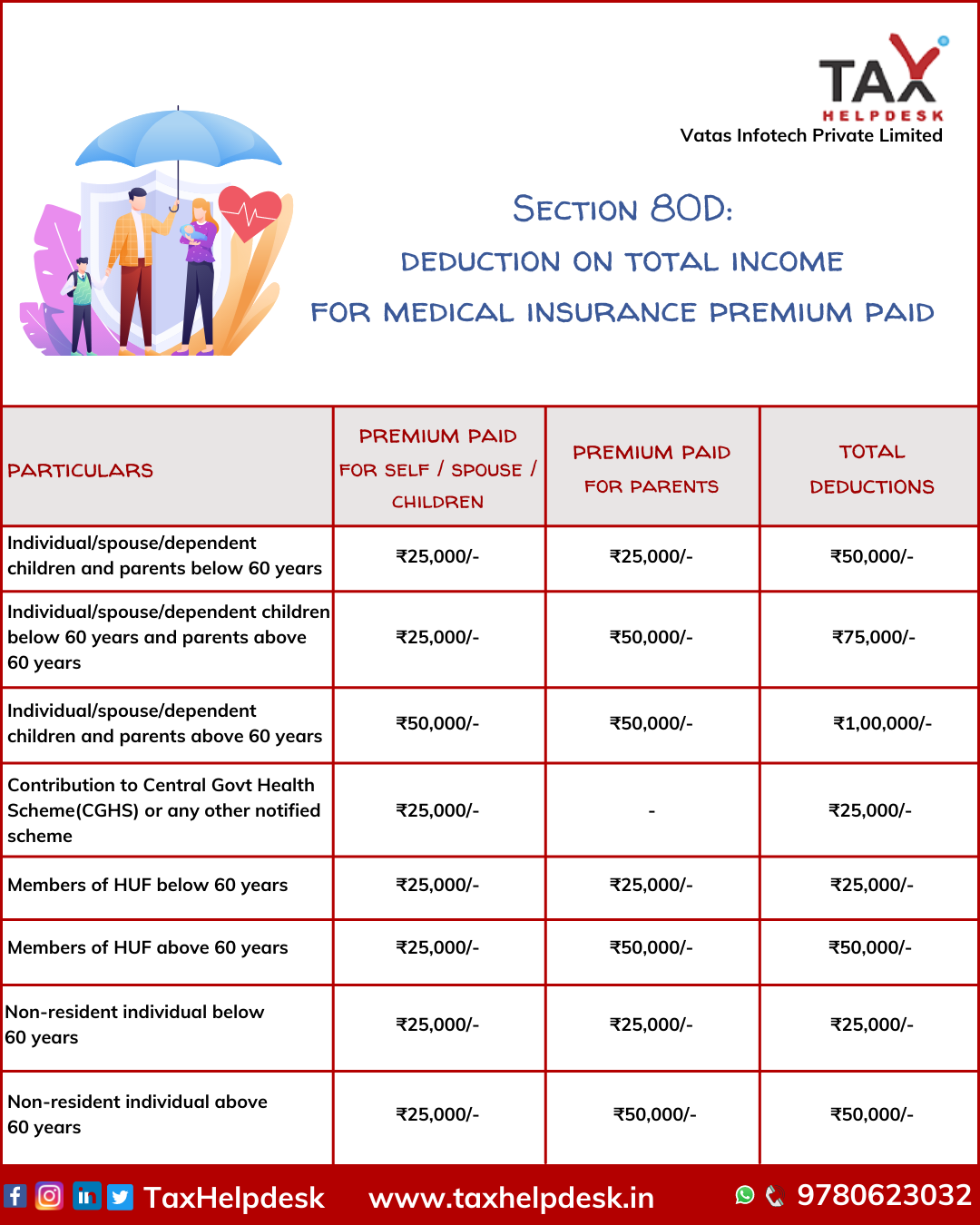

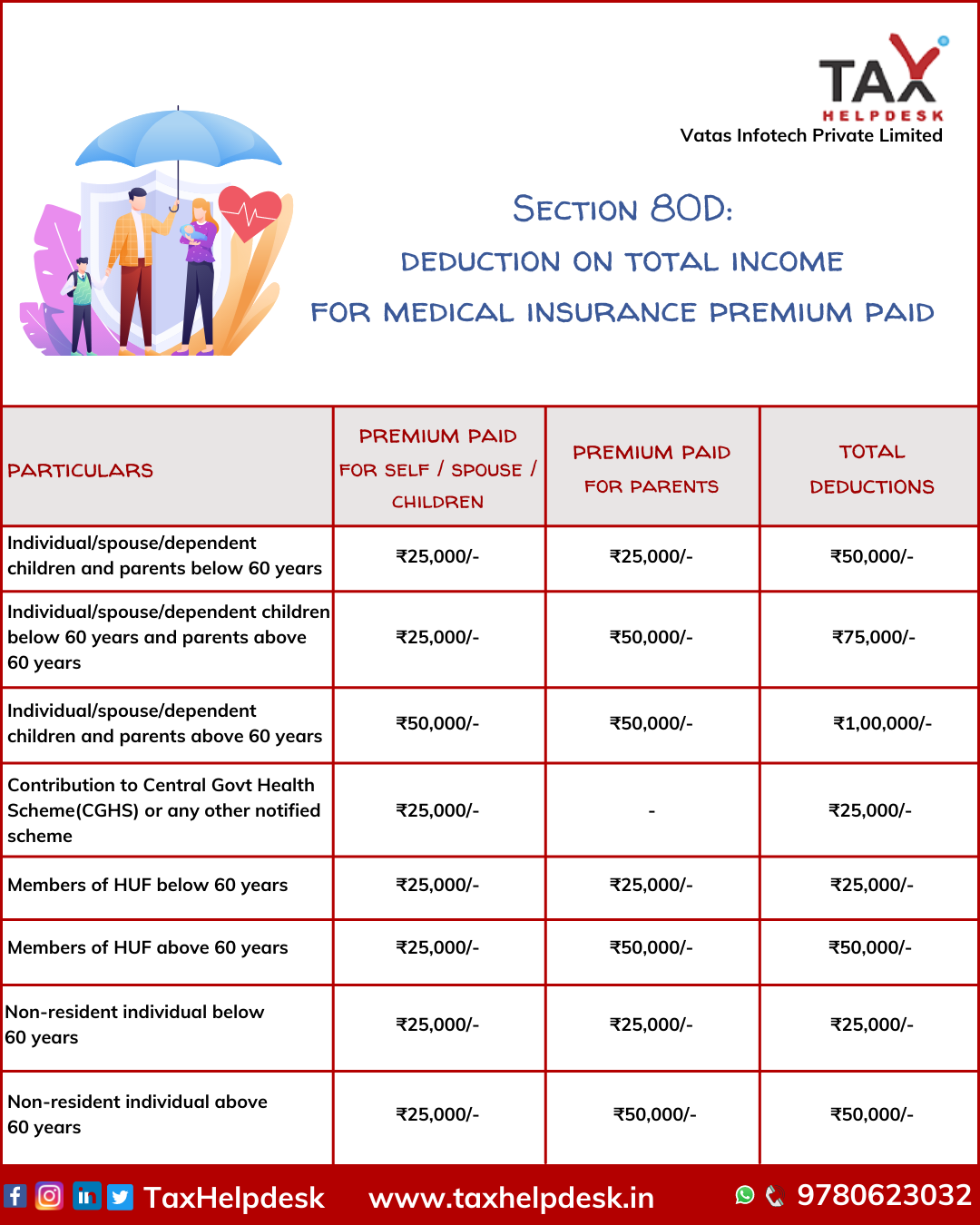

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/tax-benefits-on-medical-insurance.png

How Do I Get A Tax Credit For Health Insurance Tax Walls

https://s.marketwatch.com/public/resources/images/MW-HV858_groovy_NS_20191124102401.png

https://www.valuepenguin.com › health-insurance-tax-credit

A tax credit for health insurance reduces your monthly health insurance costs To be eligible you need to buy your plan through HealthCare gov or a state marketplace and you can t earn more than 60 240 per year 124 800 for a family of four

https://www.irs.gov › affordable-care-act › individuals...

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

Solar Tax Credit Industry Updates Ameco Solar USA

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

Tax Credits Save You More Than Deductions Here Are The Best Ones

Claiming The Small Employer Health Insurance Tax Credit For 2015

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Can I Use The Tax Credit How Does The Tax Credit Work YouTube

Can I Use The Tax Credit How Does The Tax Credit Work YouTube

Geothermal Tax Credits Incentives A B Mechanical

Ontario Newsroom

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

Should I Use The Tax Credit For Health Insurance - [desc-14]