Should Llcs Receive 1099s Generally speaking LLCs are not required to receive 1099s However some exceptions depending on specific circumstances should be reviewed With this

LLCs can be trickier to determine whether a 1099 is needed because they don t all receive the same tax treatment For example a single member LLC is taxed like a sole proprietorship so Single member LLCs that have not elected to be treated as a corporation for tax purposes generally do not receive 1099 forms Instead the income and expenses of the LLC are reported on the

Should Llcs Receive 1099s

Should Llcs Receive 1099s

https://www.levibath.co.il/wp-content/uploads/2019/02/1099.jpg

Using The 1099 Wizard To Create 1099s

https://qblittlesquare.com/wp-content/uploads/2020/12/1099-wizardscreenMISC-1-1536x1063.png

Everything You Need To File Your 1099 MISC Save Time And Frustrating

https://i.pinimg.com/originals/38/a1/28/38a128b109ac8126b9c0b03c706688bb.jpg

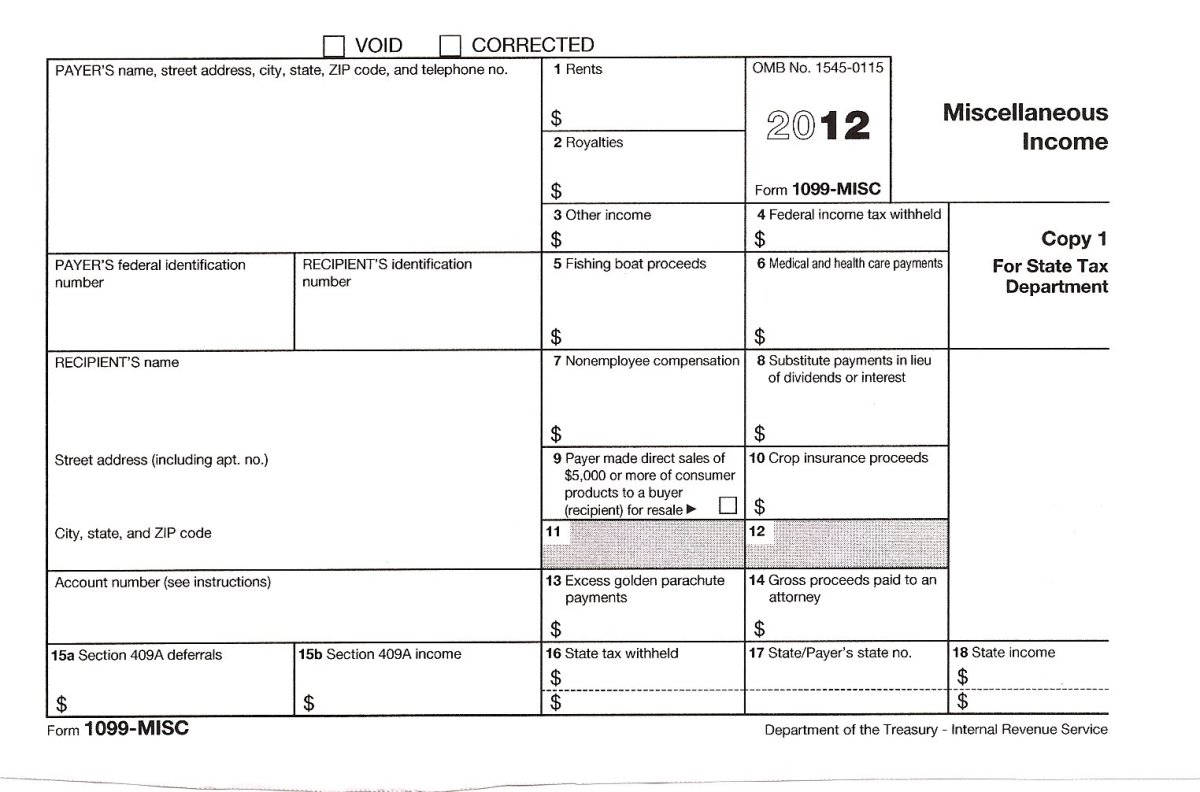

LLCs do not receive 1099 forms for merchandise transaction costs including postage delivery storage and the cost of the item itself Wages do not require If you re wondering Do LLCs get 1099s the answer depends on the type of business structure In general sole proprietorships may need to file these but

There is nothing in the tax code that says LLCs specifically are exempt from 1099 reporting and many payers issue 1099s to LLCs whether they are required or not But here s the kicker LLCs should Do LLC s get a form 1099 MISC If you re a single member LLC or taxed as a partnership you will receive a 1099 from a company that pays you 600 or more in annual income Meanwhile LLC s taxed as an

Download Should Llcs Receive 1099s

More picture related to Should Llcs Receive 1099s

The New 1099 Tax Rule Contractors Should Know IronGate

https://irongateess.com/wp-content/uploads/2023/01/93.LI_.jpg

Do LLCs Need To Issue Or Receive A 1099 At Tax Time Tax Time

https://i.pinimg.com/originals/04/4e/da/044edad0c20dead85097b16fb15fb4ec.jpg

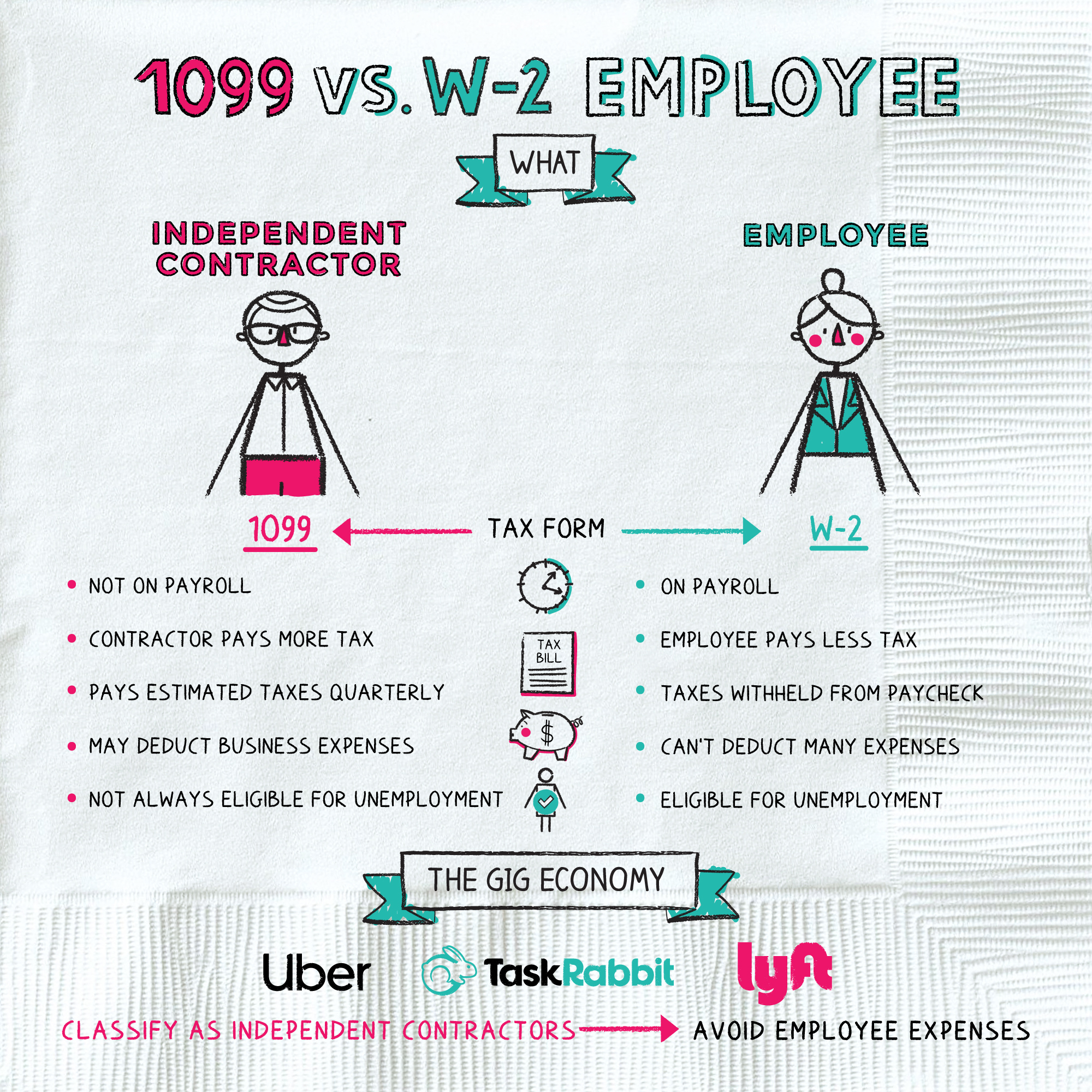

1099 Vs W 2 Napkin Finance

https://napkinfinance.com/wp-content/uploads/2016/11/NapkinFinance-1099vsW2-01-07-19-v03.jpg

If your business pays an LLC more than 600 a year for rent business services or independent contractors you ll need to issue a federal form 1099 to report those payments to the Internal Revenue Service Should an LLC receive 1099 Copies If your business makes payments to an LLC that are required to be reported to the IRS you may need to file a 1099 and

Complete guide to multi member LLC taxation Discover the essentials of 1099 forms for LLCs including when to issue or receive them exemptions and the Generally C corporations S Corporations and LLCs formed as corporations or S Corps don t need to receive a 1099 NEC or 1099 MISC On irs gov check the 1099 NEC

IRS Opens A Free Portal To File Information Returns New Electronic

https://davidjccutler.net/wp-content/uploads/2023/01/1099-form-illustration.jpg

How To File A 1099 Form For Vendors Contractors And Freelancers

https://assets-global.website-files.com/60a6b551be6130e4e5b19b98/6184e97fc0fca378123537f5_Screen Shot 2021-11-03 at 8.41.45 AM.png

https://formationscorp.com/blog/llcs-get-a-1099

Generally speaking LLCs are not required to receive 1099s However some exceptions depending on specific circumstances should be reviewed With this

https://www.marketwatch.com/guides/…

LLCs can be trickier to determine whether a 1099 is needed because they don t all receive the same tax treatment For example a single member LLC is taxed like a sole proprietorship so

1099 s For 501 c 3 s How To Issue 1099s And More 1099 Basics For

IRS Opens A Free Portal To File Information Returns New Electronic

2022 Blue Summit Supplies Tax Forms 1099 MISC 4 Part Tax Forms Bundle

1099s Your Top Question What To Do Is You Don t Receive 1099s From

File 1099 5 Important Facts To Know Before Filing Your 1099s

2022 Blue Summit Supplies Tax Forms 1099 NEC 5 Part Tax Form BUNDLE

2022 Blue Summit Supplies Tax Forms 1099 NEC 5 Part Tax Form BUNDLE

What Is A 1099 And Why Did I Get One ToughNickel

FAQs 1099 Vs W 2 Workers SBAM Small Business Association Of Michigan

The Ultimate 1099 Guide For Entrepreneurs Who Give And Receive 1099s

Should Llcs Receive 1099s - There is nothing in the tax code that says LLCs specifically are exempt from 1099 reporting and many payers issue 1099s to LLCs whether they are required or not But here s the kicker LLCs should