Should State Tax Be More Than Federal Regarding income tax there are both state and federal taxes Let s first look at state income taxes which are based on your income Tax rates may vary from state to state There are also states where residents pay zero state income tax on their income though they do pay federal income taxes

Federal tax rates are typically higher than state tax rates States can have different credits and deductions States also tax people whether they are a resident or Knowing why your state tax is more than your federal tax is the first step to becoming an educated taxpayer with a Tax resolution specialist consultant Knowing the difference between state and federal taxes helps you make better financial choices and prepare for state tax changes

Should State Tax Be More Than Federal

Should State Tax Be More Than Federal

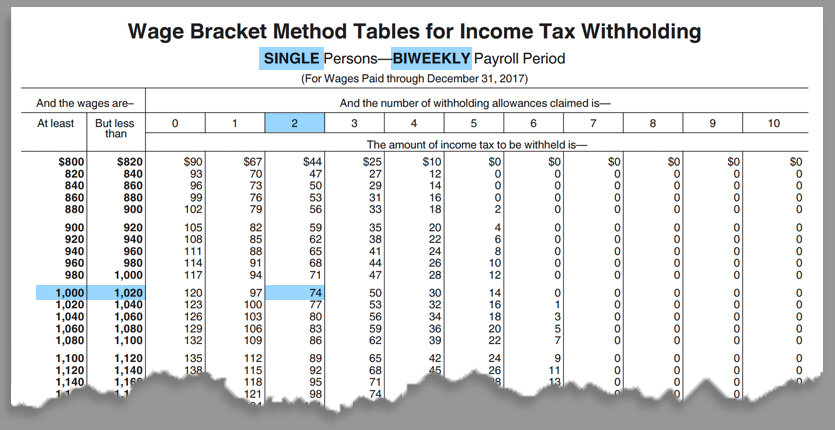

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-withheld-table-2017-awesome-home.jpg

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What s The Difference

https://www.investopedia.com/thmb/9xFmEb6FVlX0hIqe4MC_vVtlHLk=/1355x1142/filters:no_upscale():max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg

Rural Blog Report Shows Some Of Nation s Most Conservative States Lead

http://www.nkytribune.com/wp-content/uploads/2016/01/federal-aid.png

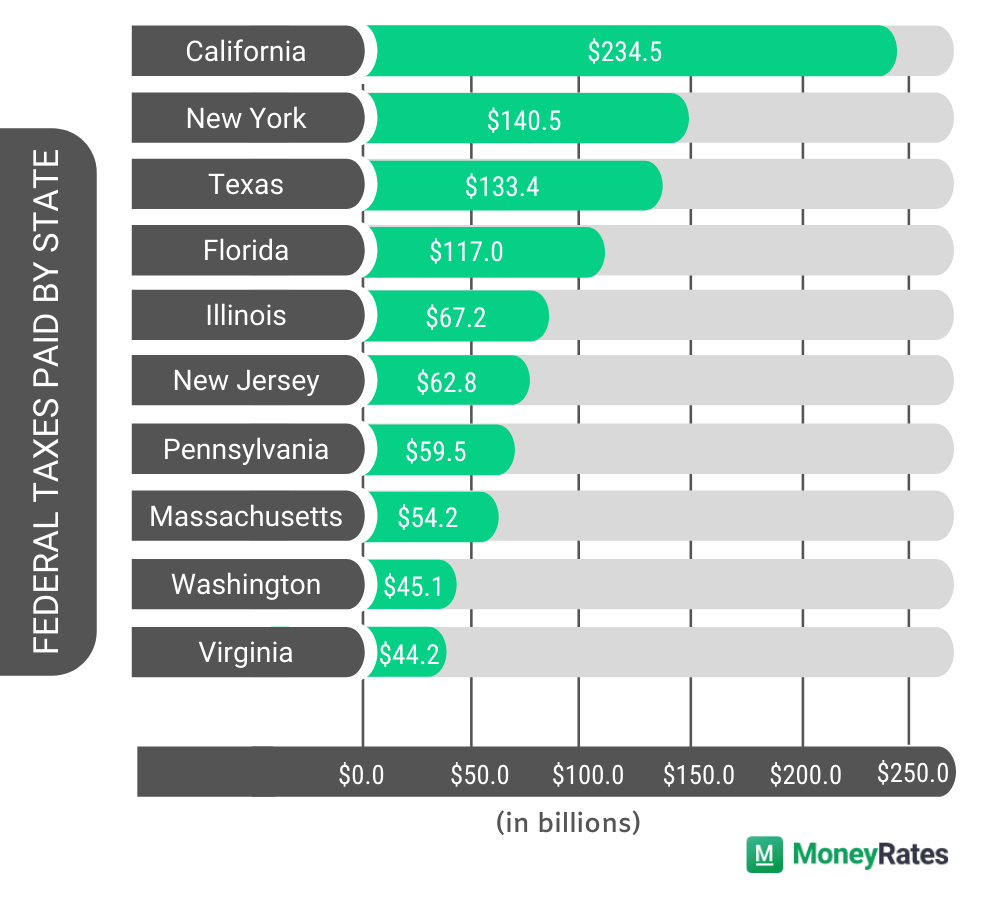

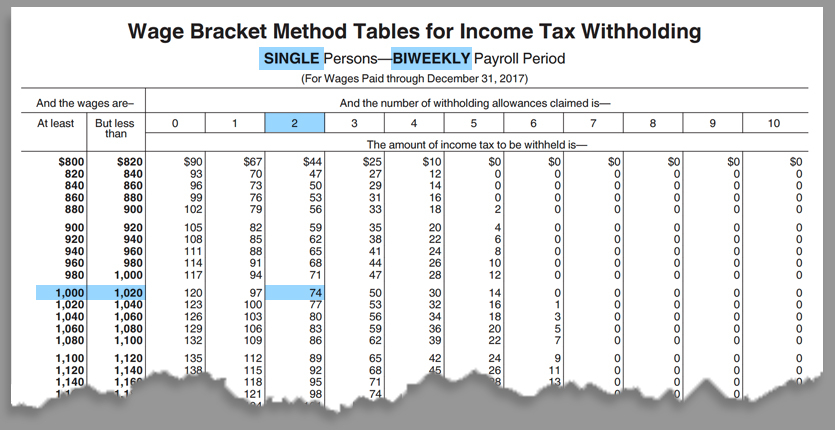

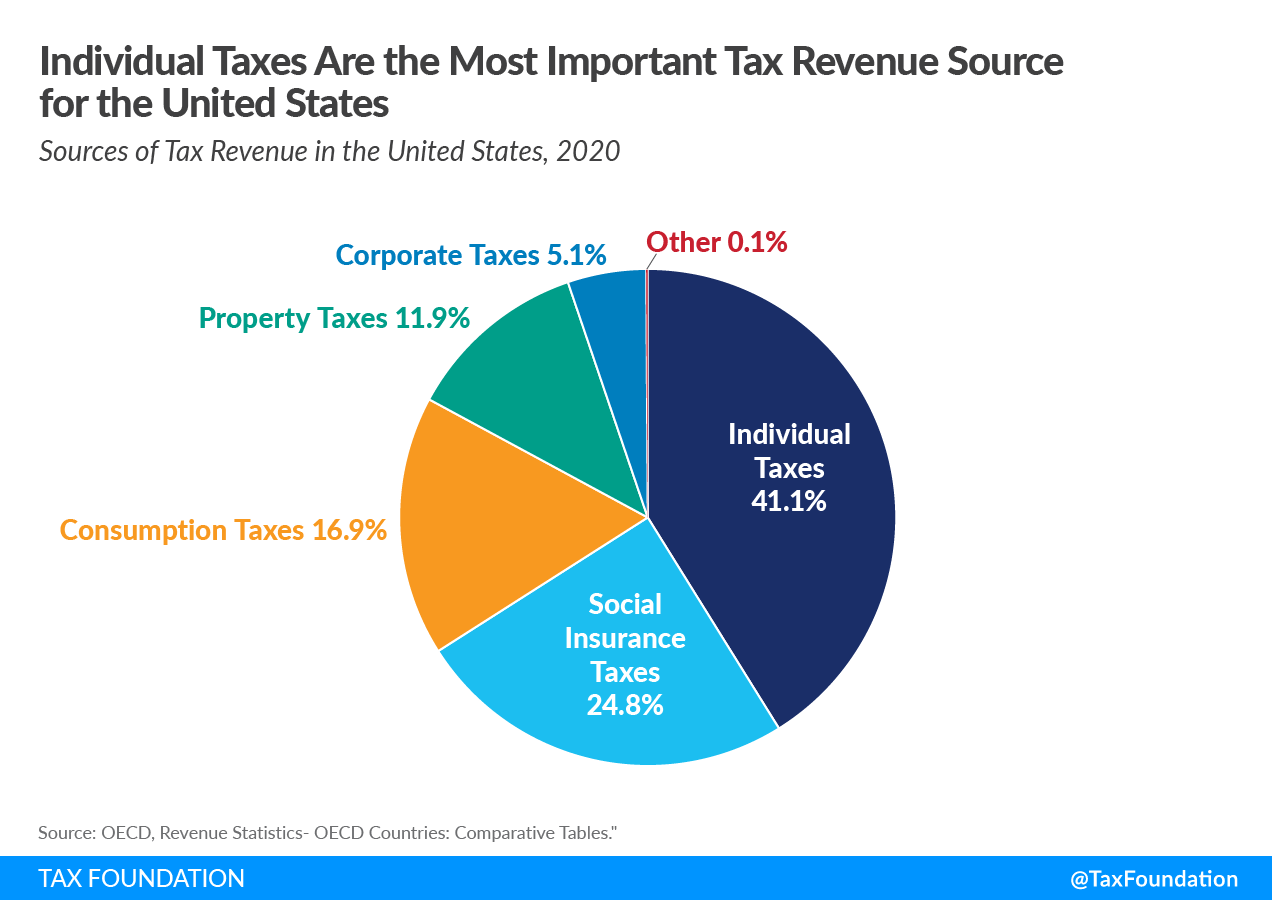

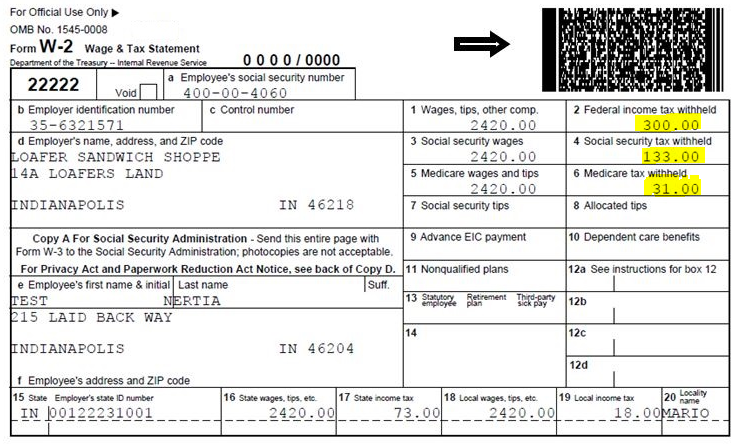

The chief distinction is that state withholding is based on state level taxable income while federal withholding is based on federal taxable dollars State withholding rules tend to No Federal taxes are usually higher than state taxes because federal income taxes serve as the primary source of revenue for the federal government State taxes are generally lower than federal taxes since property taxes local taxes and sales tax are routinely collected throughout the year

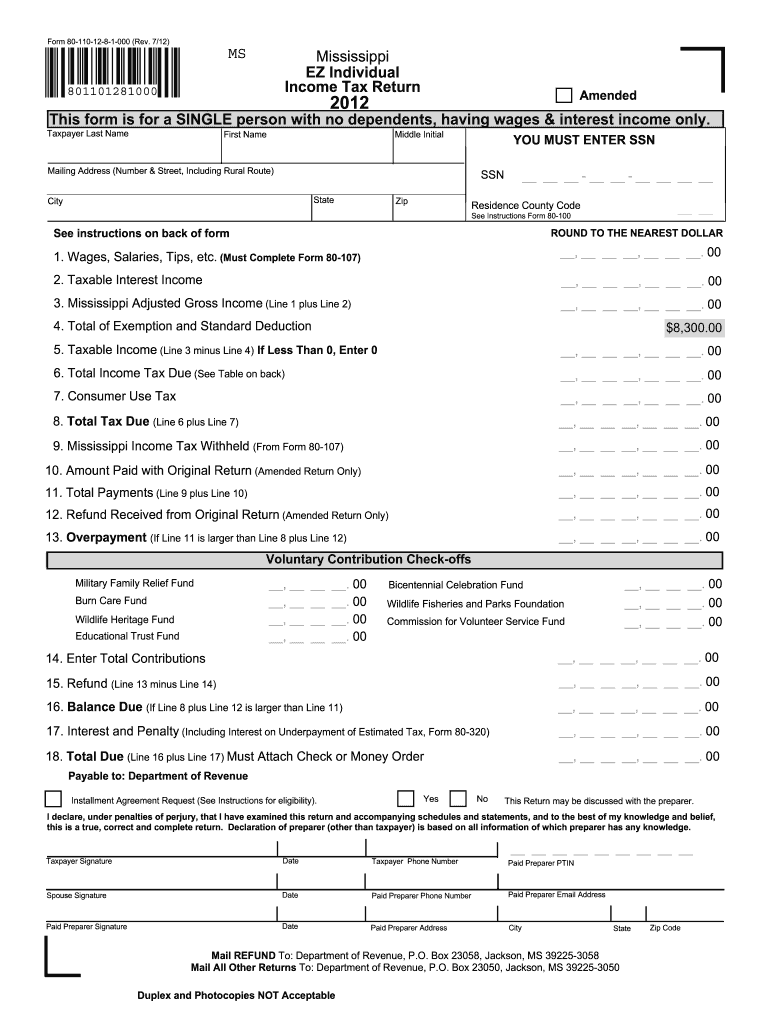

Like federal income tax state taxes are imposed on businesses and individuals and collected from the annual income you earn in your state The percentage of state income tax withheld varies from state to state each has its own tax laws and tax rates The main difference between federal and state income taxes is that federal taxes fund the federal government and state taxes fund the government in your state All U S taxpayers process their federal income taxes through the IRS but each state has its own taxing authority

Download Should State Tax Be More Than Federal

More picture related to Should State Tax Be More Than Federal

2022 Income Tax Rate Tables Printable Forms Free Online

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-1.png

Federal Laws Versus States Rights Re Visited US RENEW DEMOCRACY NEWS

https://www.usrenewnews.org/wp-content/uploads/2022/01/Federal-vs-State-Scale.jpg

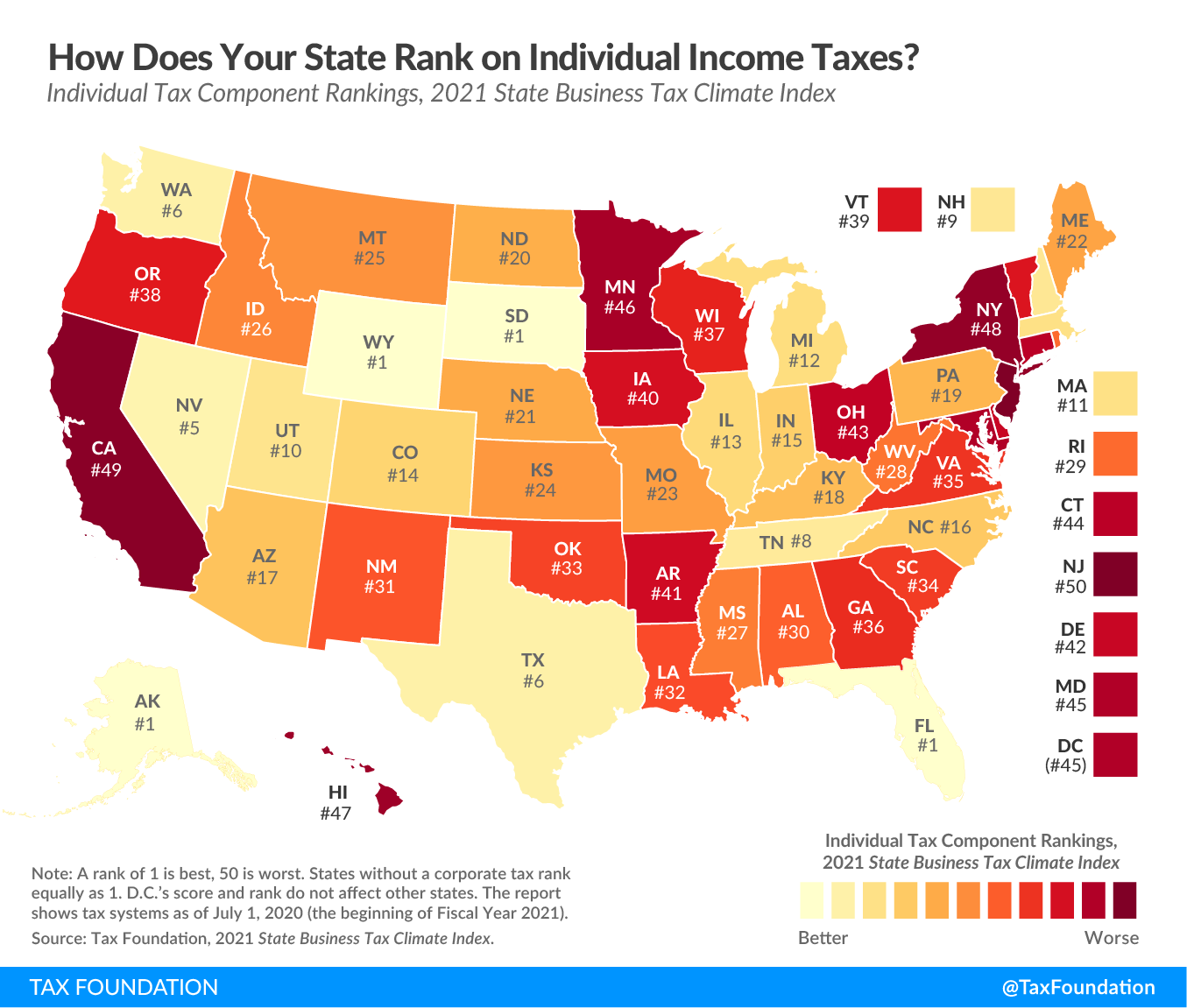

Best Worst State Income Tax Codes Tax Foundation

https://files.taxfoundation.org/20201111153823/Ranking-state-tax-codes-state-individual-income-taxes-2020-FV-01.png

Usually state income tax laws are more simplified compared to the federal tax code with fewer tax brackets and generally lower tax rates Tax brackets vary by each state and certain states even have tax laws that routinely adjust tax brackets and rates based on inflation Although it may sound confusing at first once you are familiar with the basic differences between State taxes and Federal taxes you can develop a more efficient tax strategy and even lower your income tax liability

State taxes are used to pay for more localized state government programs and state level infrastructure among others Federal taxes are higher than state level taxes as states and localities have other methods of collecting revenue through property and payroll taxes There is no reason to expect that the state tax would be less than the federal tax or that they would be the same One has nothing to do with the other There are many factors that affect the amount of tax for both state and federal

Best Worst State Property Tax Codes Tax Foundation

https://files.taxfoundation.org/20201209123711/Comparing-State-Tax-Codes-Property-Taxes.-Best-and-worst-state-property-tax-codes-2021.png

California Power Grid Compromised Volley Talk

https://www.moneyrates.com/wp-content/uploads/imagesrv_wp/5015/Federal-tax-by-state.png

https://www.bestmoney.com/tax-relief/learn-more/...

Regarding income tax there are both state and federal taxes Let s first look at state income taxes which are based on your income Tax rates may vary from state to state There are also states where residents pay zero state income tax on their income though they do pay federal income taxes

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg?w=186)

https://money.usnews.com/money/personal-finance/...

Federal tax rates are typically higher than state tax rates States can have different credits and deductions States also tax people whether they are a resident or

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png)

2023 W4 Tax Form Printable Forms Free Online

Best Worst State Property Tax Codes Tax Foundation

Free Printable State Tax Forms Printable Forms Free Online

Sources Of US Tax Revenue By Tax Type 2022 Tax Foundation

W2 Withholding Calculator Tax Withholding Estimator 2021

How To Look Up State Id Number Nda or ug

How To Look Up State Id Number Nda or ug

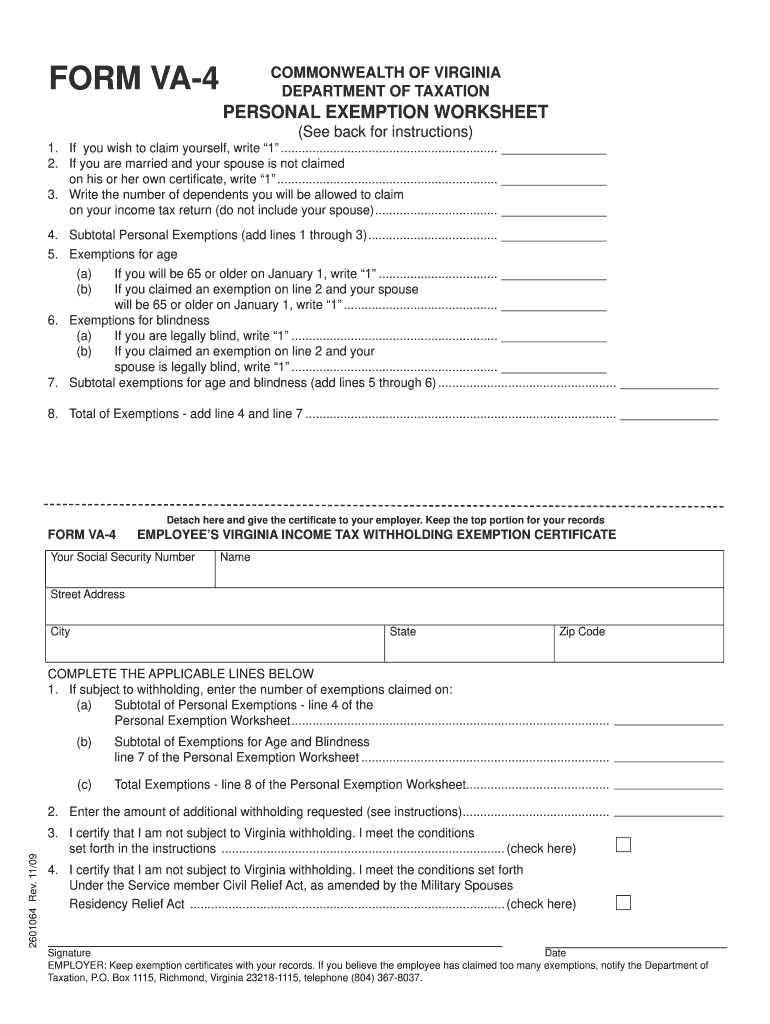

Va 4 State Tax Form Fillable Fill Out And Sign Printable PDF Template

10 Rules Of Money Wealth Learn About The 10 Rules Of Money That I

Yes The Top 1 Percent Do Pay Their Fair Share In Income Taxes U S

Should State Tax Be More Than Federal - The main difference between federal and state income taxes is that federal taxes fund the federal government and state taxes fund the government in your state All U S taxpayers process their federal income taxes through the IRS but each state has its own taxing authority