Singapore Chagne In Corporate Tax Rebate Web 45 Singapore Budget 2022 Snapshot Shaping our sustainable future DRIVING SECTORAL GROWTH For aviation Aviation Support Package to preserve core capabilities and

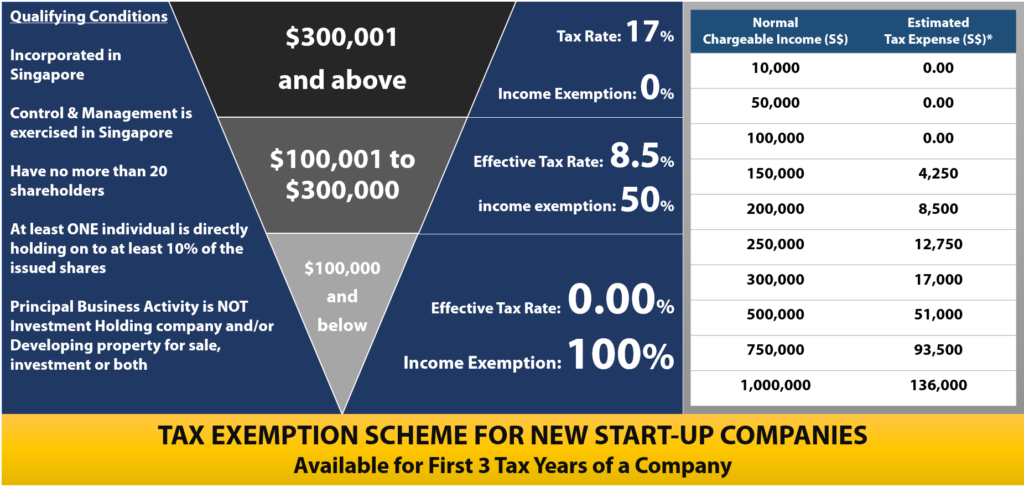

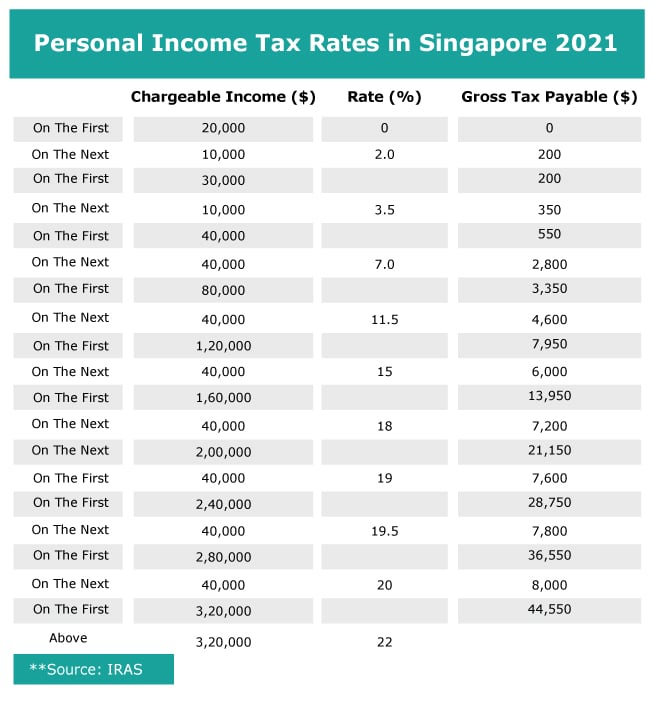

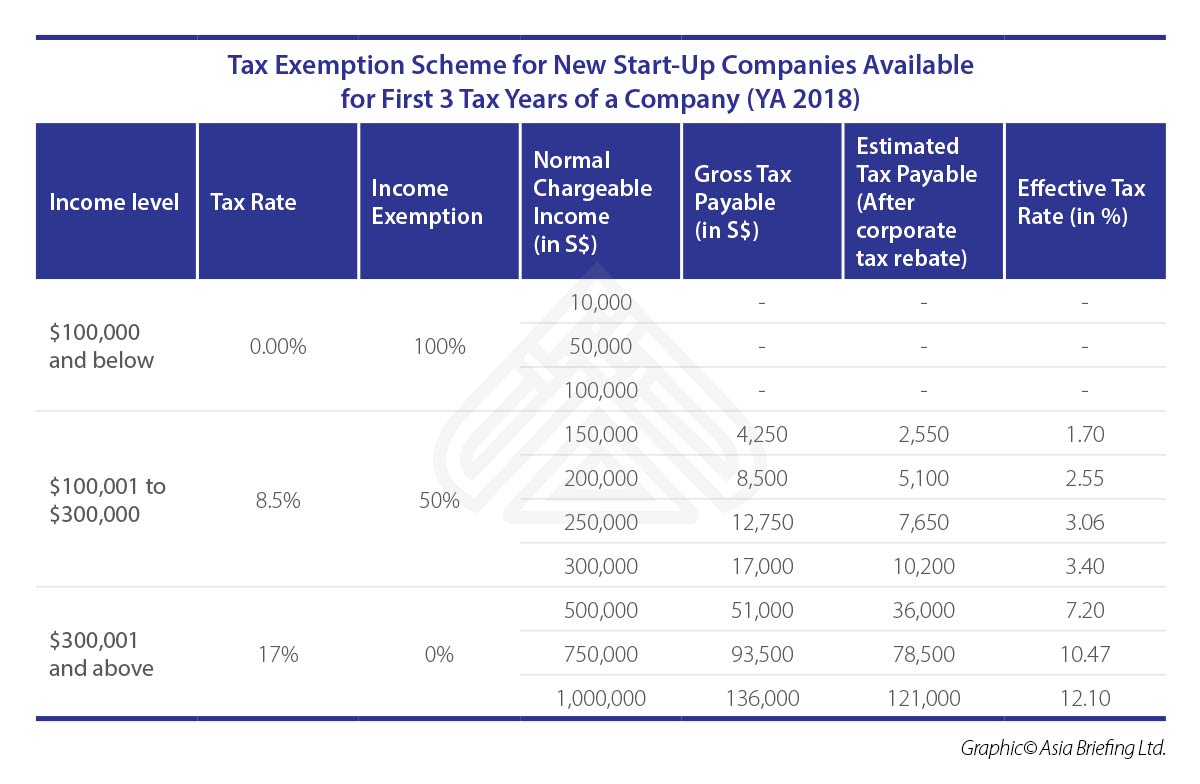

Web 18 f 233 vr 2020 nbsp 0183 32 As a simple illustration if a company s chargeable income is SGD250 000 for YA2020 the total income exempted from tax would be Web Summary The Scheme is extended by one year to 2021 with the government co funding ratio at 15 and the qualifying gross wage ceiling at 5 000 Gross monthly wage

Singapore Chagne In Corporate Tax Rebate

Singapore Chagne In Corporate Tax Rebate

https://www.rebate2022.com/wp-content/uploads/2023/05/singapore-corporate-tax-rate-singapore-taxation-guide-2021.jpg

Understanding Corporate Tax In Singapore ContactOne

https://www.contactone.com.sg/wp-content/uploads/2017/11/Illustration-Tax-Exemption-Scheme-New-StartUp-Companies-1024x493.png

Expanding Your Indian Startup In Singapore Business Blog

https://www.singaporecompanyincorporation.sg/wp-content/uploads/singapore-corporate-tax-system.jpg

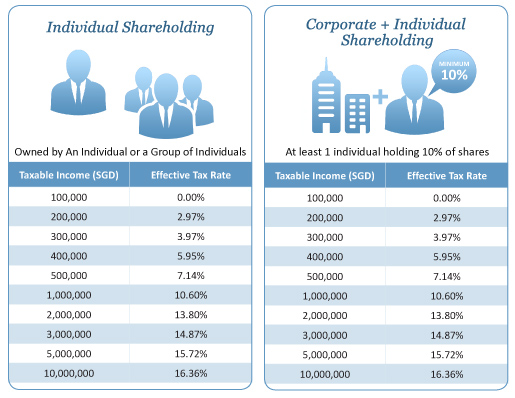

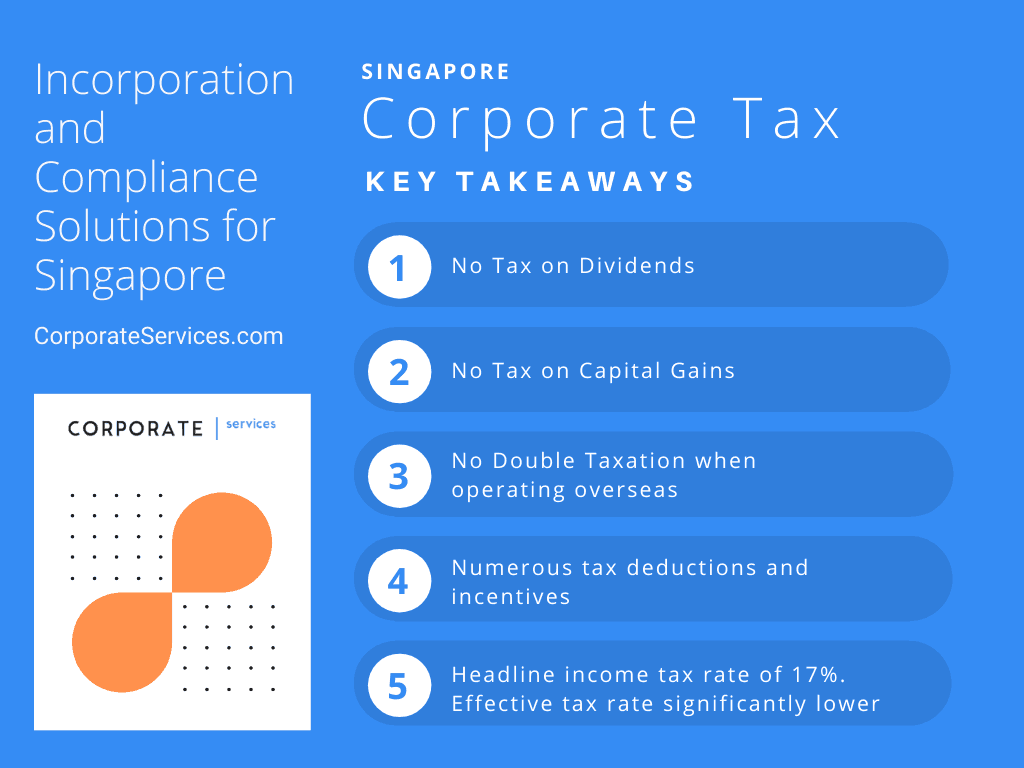

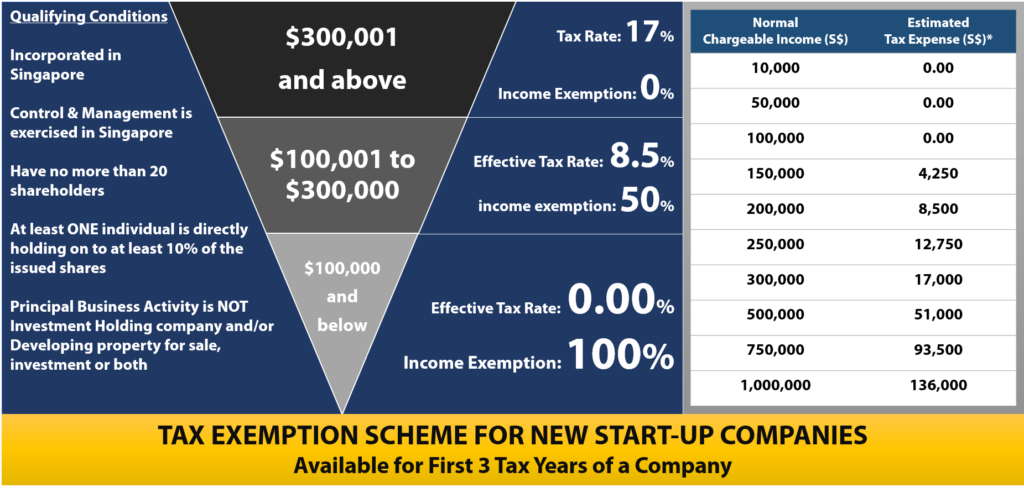

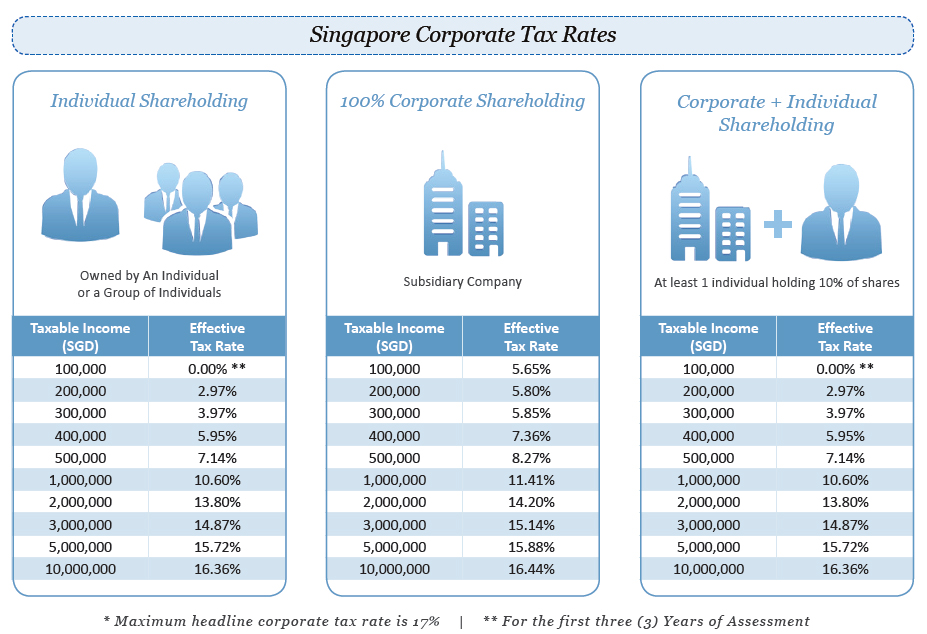

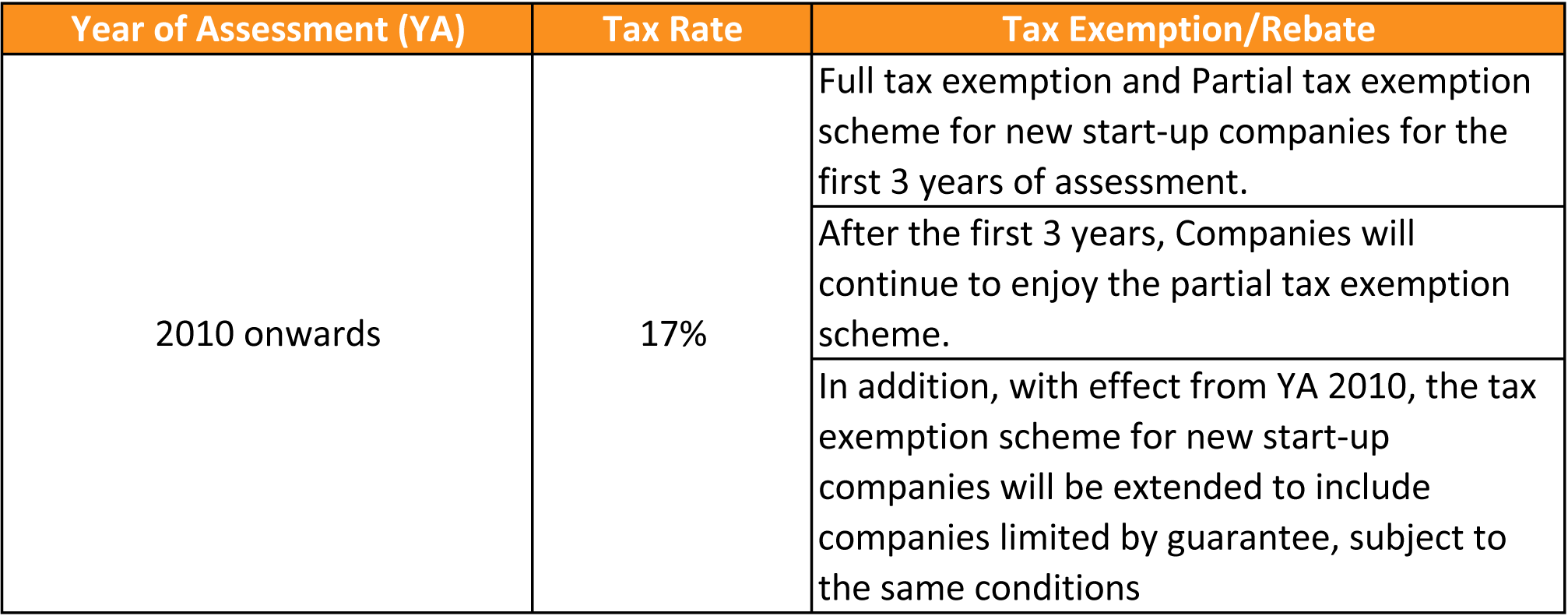

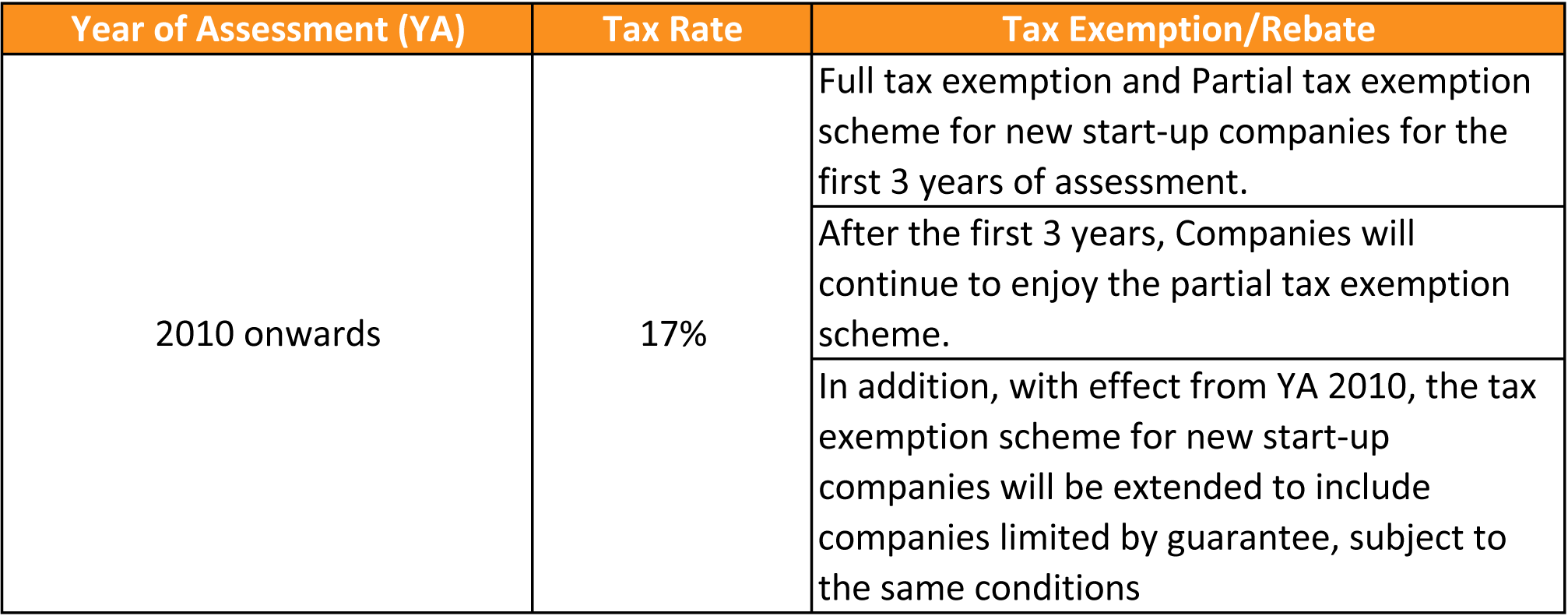

Web General Corporate Income Tax Rules Corporate Income Tax is assessed on a preceding year basis in Singapore Singapore s Corporate Income Tax rate is 17 Web 15 mars 2020 nbsp 0183 32 Corporate Income Tax Rebate Singapore Budget 2020 15 03 2020 To help businesses cushion the economic impact of the COVID 19 outbreak the Stabilisation

Web 14 f 233 vr 2023 nbsp 0183 32 Corporate tax changes proposed include Introduction of a new Enterprise Innovation Scheme Intention to implement Global Anti base Erosion rules and domestic Web 23 f 233 vr 2022 nbsp 0183 32 The corporate income tax rate would remain at 17 for year of assessment 2022 with no corporate income tax rebate proposed A minimum effective tax rate

Download Singapore Chagne In Corporate Tax Rebate

More picture related to Singapore Chagne In Corporate Tax Rebate

Reasons For Setting Up A Business In Singapore Registration Guide

https://www.singaporecompanyincorporation.sg/wp-content/uploads/effective-corporate-tax-rate-full-exemption.jpg

Singapore Corporate Tax Rate Exemptions Filing Requirements

https://www.corporateservices.com/wp-content/uploads/Singapore-Corporate-Taxes-Key-Takeaway.png

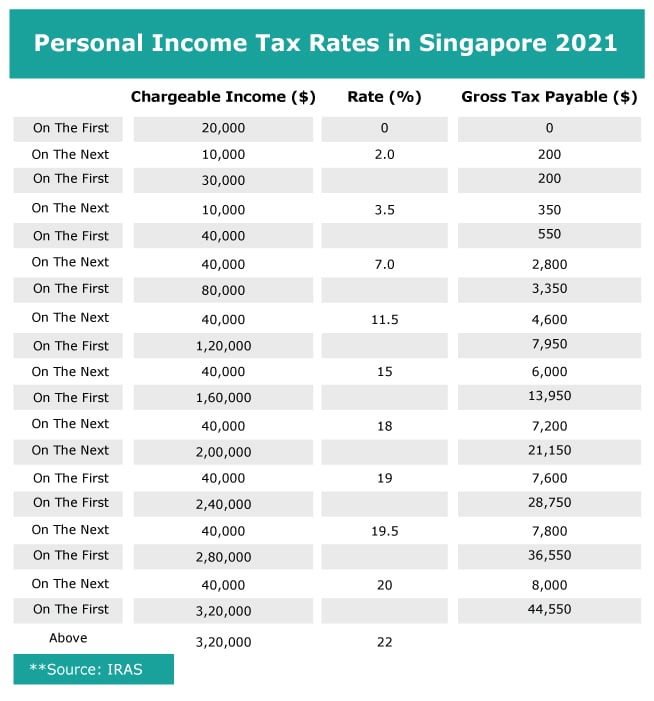

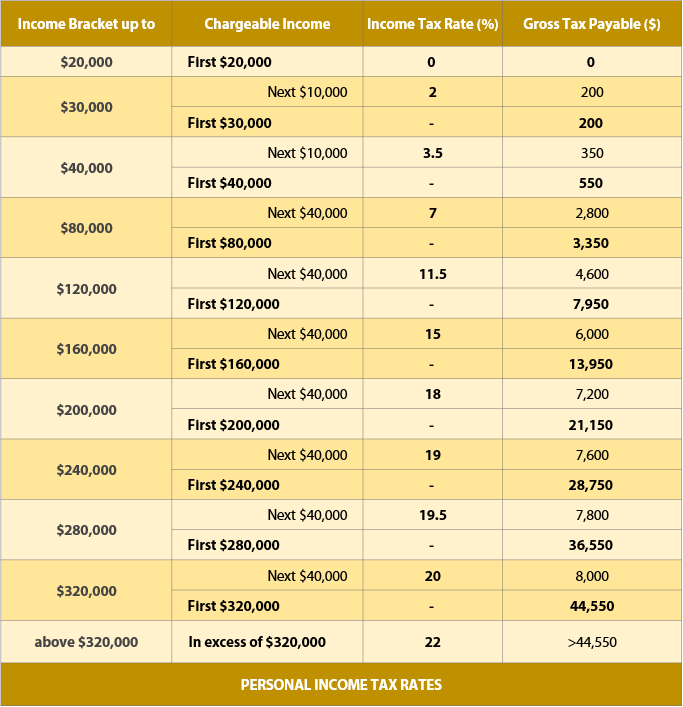

All Income Earned In Singapore Is Subject To Tax However Singapore

https://i.pinimg.com/originals/02/cc/ee/02cceeb8209cfe3f959b1480f37a5c15.jpg

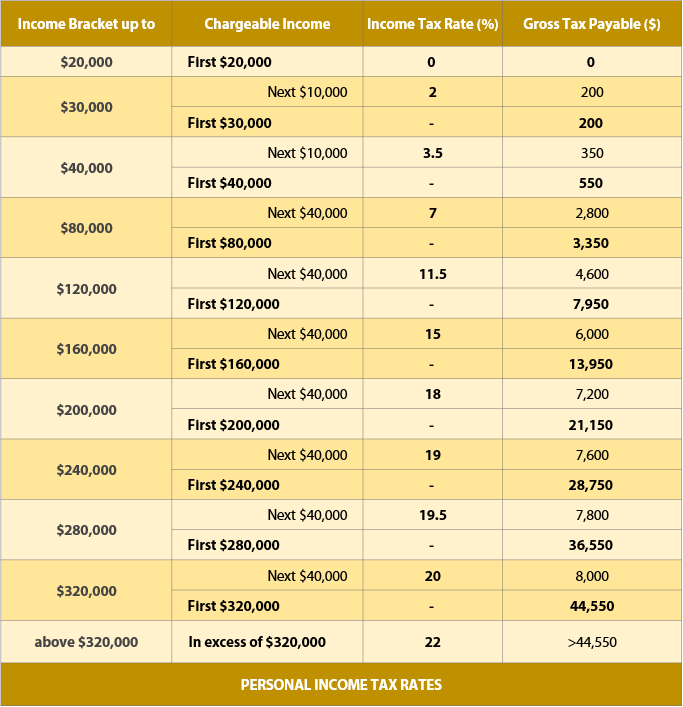

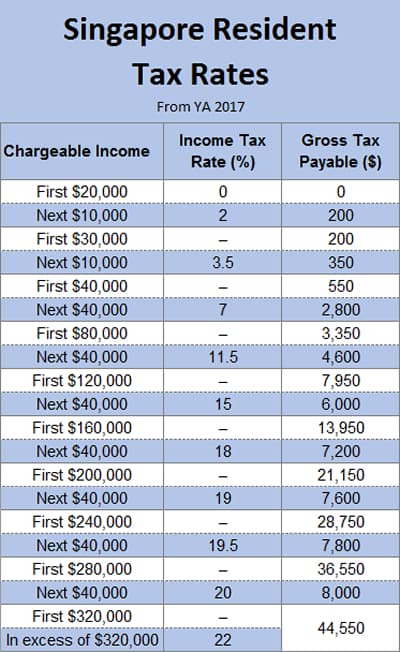

Web 16 f 233 vr 2021 nbsp 0183 32 No corporate income tax rebate is proposed for the year of assessment YA 2021 Extension of a number of Budget 2020 measures including Web 18 f 233 vr 2020 nbsp 0183 32 Singapore s corporate income tax rate has been maintained at a flat 17 over the last 10 years By applying a 17 corporate tax rate to the chargeable income

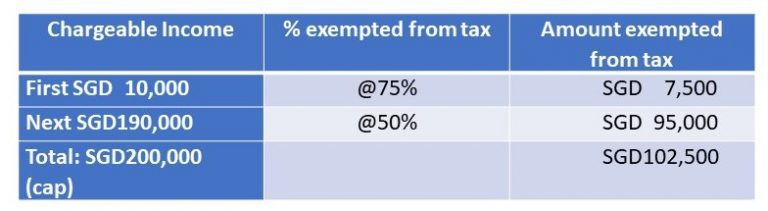

Web 28 f 233 vr 2023 nbsp 0183 32 From YA2020 new start ups will be eligible for 75 tax exemption on the first 100 000 of normal chargeable income and 50 tax exemption for the next Web 29 avr 2020 nbsp 0183 32 Singapore Corporate Income Tax Rebate In the latest update for YA2020 corporate tax rebate amounting to 25 of tax payable capped at SGD15 000 is

Singapore Corporate Tax Rate Slideshare

https://www.contactone.com.sg/wp-content/uploads/2017/12/Illustration-Personal-Tax-Rates-Residents-2017.png

2020 Singapore Corporate Tax Update Singapore Taxation

https://www.paulhypepage.my/wp-content/uploads/2020/05/Infographic-Tax-Corporate-Relief-Singapore-New-Startup.jpg

https://www2.deloitte.com/content/dam/Deloitte/sg/Documen…

Web 45 Singapore Budget 2022 Snapshot Shaping our sustainable future DRIVING SECTORAL GROWTH For aviation Aviation Support Package to preserve core capabilities and

https://pwco.com.sg/guides/corporate-tax-ex…

Web 18 f 233 vr 2020 nbsp 0183 32 As a simple illustration if a company s chargeable income is SGD250 000 for YA2020 the total income exempted from tax would be

Overview Of Singapore Corporate Taxation System JSE Office

Singapore Corporate Tax Rate Slideshare

Doing Business In Singapore Vs India Comparative Report

Corporate Tax In Singapore

Asiapedia Singapore s Corporate Income Tax Quick Facts Dezan

Facts About Corporate Taxes In Singapore Singapore Taxation

Facts About Corporate Taxes In Singapore Singapore Taxation

Corporate Tax In Singapore Company Incorporation In Singapore

Ca Individual Tax Rate Table 2021 2020 Brokeasshome

Corporate Taxation In Singapore CIT Rebate Start Up Tax Exemption

Singapore Chagne In Corporate Tax Rebate - Web 14 mars 2023 nbsp 0183 32 The Singapore corporate income tax rebate is no longer available for YA 2023 This is based on the Singapore Budget 2023 which was delivered by