Singapore Corporate Income Tax Rebate Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax

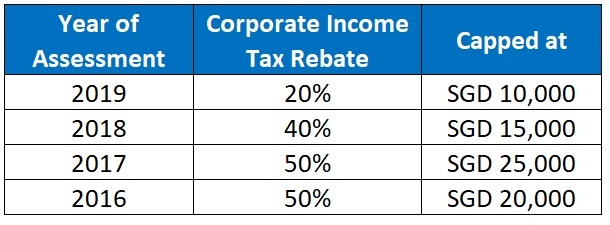

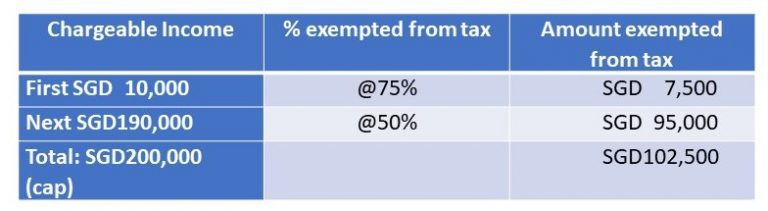

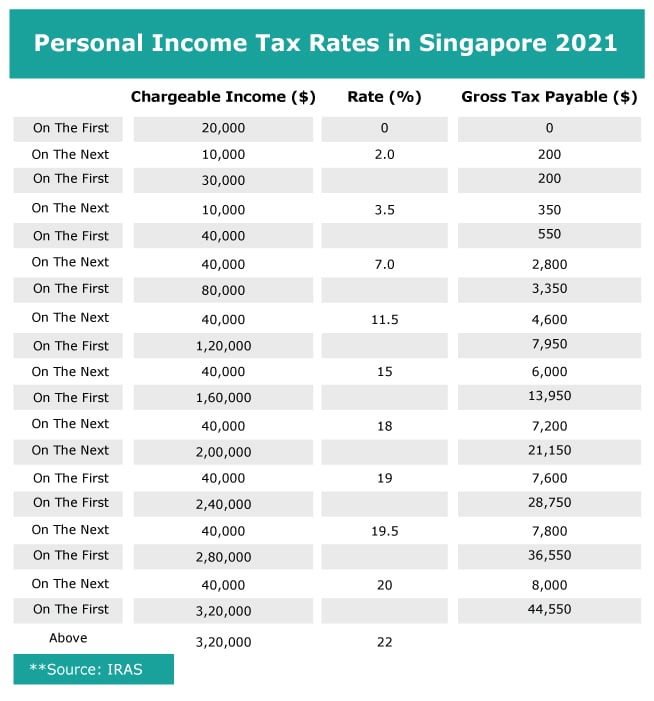

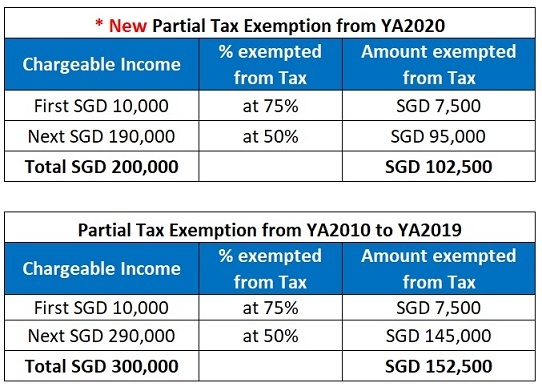

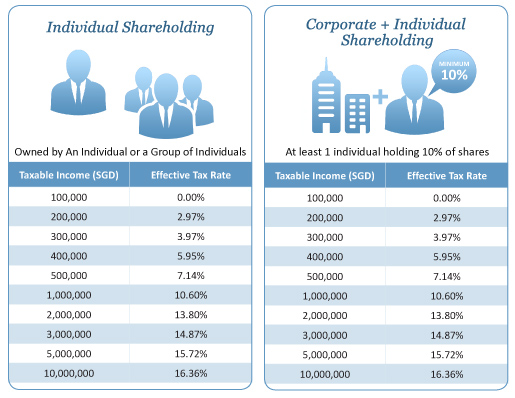

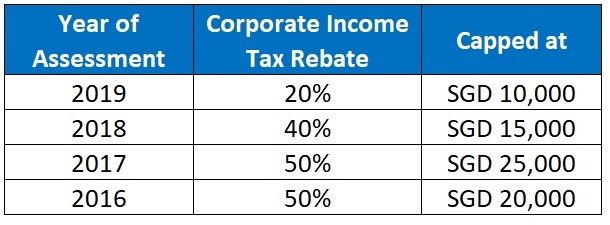

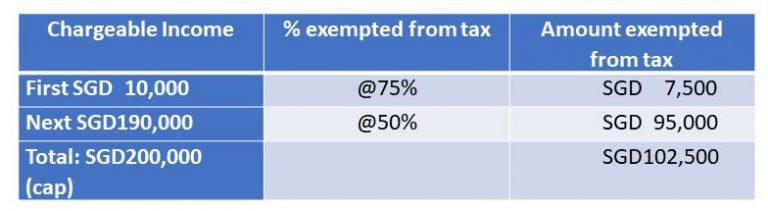

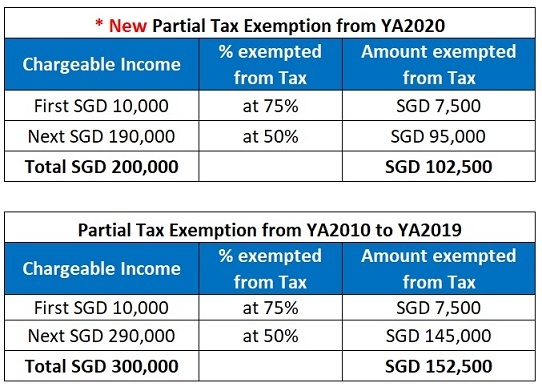

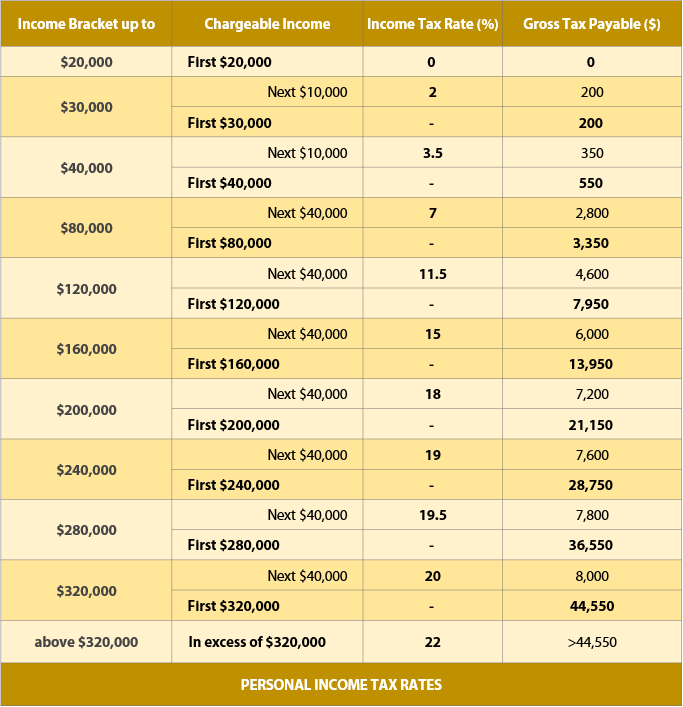

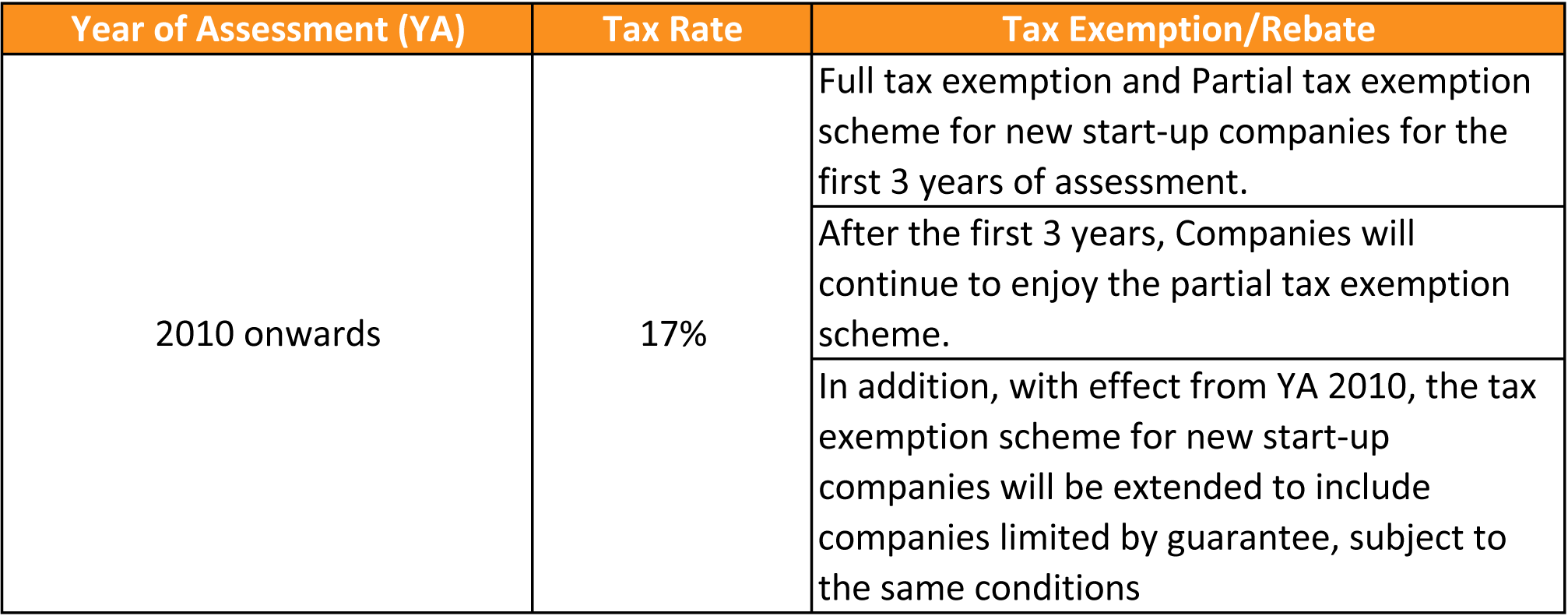

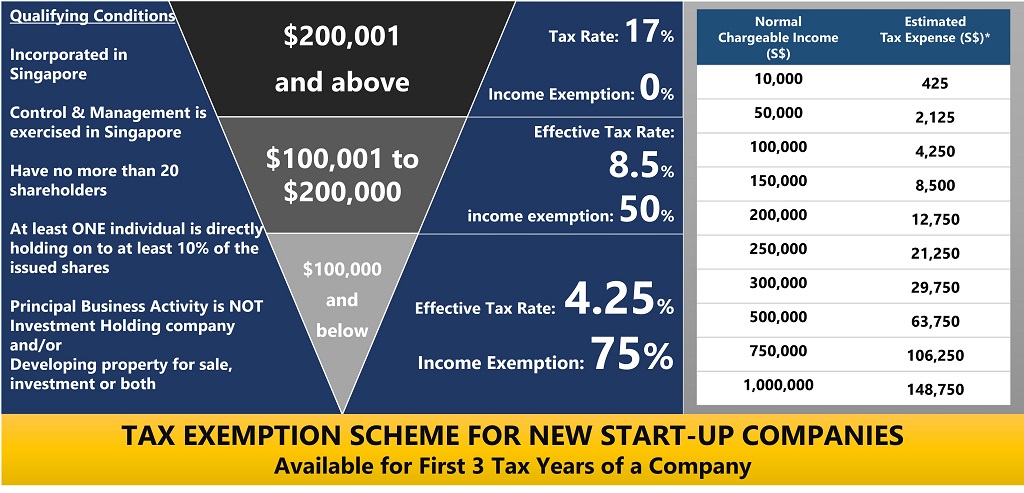

Web 4 mai 2023 nbsp 0183 32 Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are Web 10 janv 2022 nbsp 0183 32 3 Corporate income tax rebates While the above two schemes reduce the chargeable income tax rebates offset the tax payable In YA 2020 all companies were

Singapore Corporate Income Tax Rebate

Singapore Corporate Income Tax Rebate

https://www.accountingsolutionssingapore.com/wp-content/uploads/CIT-2018.jpg

Overview Of Singapore Corporate Taxation System JSE Office

https://jseoffices.com/wp-content/uploads/2018/06/no-11-768x211.jpg

Understanding Corporate Tax In Singapore ContactOne

https://i2.wp.com/www.contactone.com.sg/wp-content/uploads/2017/11/Illustration-Tax-Exemption-Scheme-Partial.png?resize=1024%2C494&ssl=1

Web 15 mars 2020 nbsp 0183 32 All companies will receive a 25 CIT rebate for the Year of Assessment YA 2020 The rebate is capped at S 15 000 The CIT rebate is available to all Web 16 janv 2023 nbsp 0183 32 Who is eligible for the corporate income tax rebate in Singapore As of the Singapore Budget 2023 the corporate income tax rebate is no longer available for

Web 18 f 233 vr 2020 nbsp 0183 32 In YA2019 companies were granted 20 Corporate Income Tax rebate which is capped at a maximum of SGD10 000 If a Singapore company s tax payable for Web 3 lignes nbsp 0183 32 14 mars 2023 nbsp 0183 32 To help businesses grow Singapore offers various incentives including the Singapore Corporate

Download Singapore Corporate Income Tax Rebate

More picture related to Singapore Corporate Income Tax Rebate

Singapore Corporate Tax Rebate Ya 2022 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2023/05/singapore-corporate-tax-rate-singapore-taxation-guide-2021.jpg

Why Invest In India Through A Singapore Company Rikvin Pte Ltd

https://www.rikvin.com/wp-content/uploads/singapore-corporate-tax-rate-infographic.jpg

All Income Earned In Singapore Is Subject To Tax However Singapore

https://i.pinimg.com/originals/02/cc/ee/02cceeb8209cfe3f959b1480f37a5c15.jpg

Web YA 2016 Corporate Income Tax Rebate SGD Chargeable income B 560 000 Less Exempt income 75 of rst 10 000 7 500 50 of next 290 000 145 000 Web 23 f 233 vr 2022 nbsp 0183 32 The corporate income tax rate would remain at 17 for year of assessment 2022 with no corporate income tax rebate proposed A minimum effective tax rate

Web Corporate income tax rate and rebate The corporate income tax rate would remain at 17 for year of assessment YA 2023 with no corporate income tax rebate proposed Web 30 juil 2021 nbsp 0183 32 Budget 2021 Update Corporate Income Tax Rebate As announced in Budget 2021 there will no longer be corporate income tax rebate in 2021 for

Tax Guide For Singapore Companies Company Tax Services Singapore

https://www.accountingsolutionssingapore.com/wp-content/uploads/PTE-2018.jpg

Reasons For Setting Up A Business In Singapore Registration Guide

https://www.singaporecompanyincorporation.sg/wp-content/uploads/effective-corporate-tax-rate-full-exemption.jpg

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax

https://taxsummaries.pwc.com/singapore/corporate/taxes-on-corporate …

Web 4 mai 2023 nbsp 0183 32 Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are

2020 Singapore Corporate Tax Update Singapore Taxation

Tax Guide For Singapore Companies Company Tax Services Singapore

Singapore Tax Rates

Facts About Corporate Taxes In Singapore Singapore Taxation

Understanding Corporate Tax In Singapore ContactOne

Singapore Budget 2019 GST Vouchers More CHAS Subsidies Income Tax

Singapore Budget 2019 GST Vouchers More CHAS Subsidies Income Tax

Understanding Singapore Taxes In 5 Minutes

Singapore Corporate Tax Rate Slideshare

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Singapore Corporate Income Tax Rebate - Web 15 mars 2020 nbsp 0183 32 All companies will receive a 25 CIT rebate for the Year of Assessment YA 2020 The rebate is capped at S 15 000 The CIT rebate is available to all