Small Business Fees And Charges Rebate Web The Small Business Fees and Charges Rebate is open to small businesses that have a total wages bill below the new 2020 21 1 2 million payroll tax threshold The rebate is

Web 8 sept 2023 nbsp 0183 32 Small business fees and charges rebate A 3 000 rebate for small businesses sole traders and not for profit organisations to help pay for government Web 1 mars 2021 nbsp 0183 32 Small businesses are reminded they only have until 24 June 2022 to register for the 3 000 small business fees and charges rebate You must be registered for the

Small Business Fees And Charges Rebate

Small Business Fees And Charges Rebate

https://allworths.com.au/wp/wp-content/uploads/2022/01/fcr.jpg

NSW Small Business Fees And Charge Rebate 2

https://www.mycity24.com.au/mycityko/pad_img/34a0cb53929c9bf81525d6ec10701a3b3011443f.jpg

Understanding The Small Business Fees And Charges Rebate

https://openainews.co/wp-content/uploads/2023/03/small-business-fees-and-charges-rebate-01.jpg

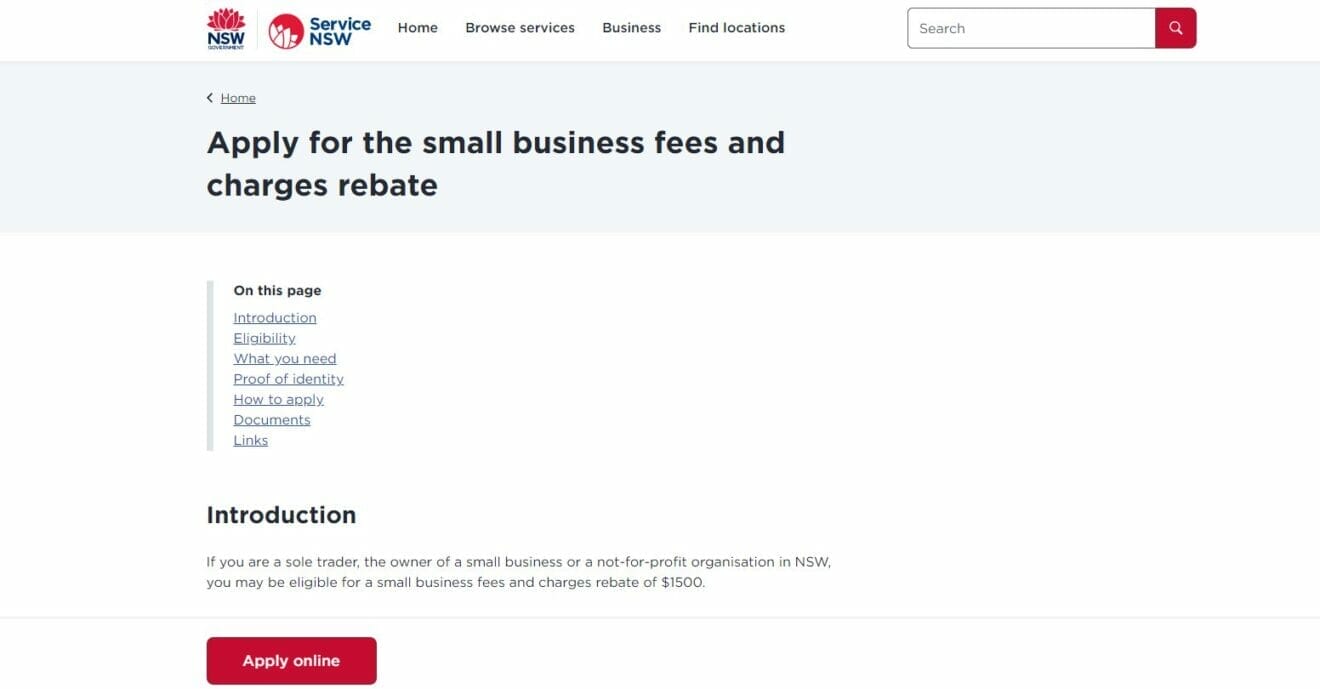

Web If your business received the 1500 small business fees and charges rebate you can still be eligible for this grant For more information on the eligibility criteria and how to Web 31 mars 2021 nbsp 0183 32 To further support businesses in NSW in the recovery from the impacts of COVID 19 the NSW Government has introduced a Small Business Fees and Charges Rebate Eligible businesses can apply

Web 4 1 Small businesses including non employing sole traders and not for profit organisations are eligible for 3 000 worth of rebates on government fees and charges if Web 30 janv 2022 nbsp 0183 32 The package includes topping up the Small Business Fees and Charges Rebate from the current 2 000 limit to 3 000 The rebate will be expanded so it can

Download Small Business Fees And Charges Rebate

More picture related to Small Business Fees And Charges Rebate

Small Business Rebate For Govt Fees And Charges And Changes To

https://media.licdn.com/dms/image/C5612AQHLYlj3Wbhjcw/article-cover_image-shrink_720_1280/0/1619400033057?e=2147483647&v=beta&t=fBummuTFBCryPcQaRdCApCqjwW2m64ujbn0UqozMcH0

BUSINESS TIP SMALL BUSINESS FEES AND CHARGES REBATE

https://cdn.marcotran.com.au/wp-content/uploads/2021/04/BUSINESS-TIP-SMALL-BUSINESS-FEES-AND-CHARGES-REBATE-The-Simple-Entrepreneur-header.jpg?strip=all&lossy=1&ssl=1

Nsw gov au Apply For The Small Business Fees Charges Rebate Australia

https://www.statusin.org/uploads/images2021/59550.jpg

Web Redirecting to https www service nsw gov au system files 2022 05 eligible fees and charges small business rebate pdf Web 24 f 233 vr 2022 nbsp 0183 32 Fees and Charges Rebate Increased amp Extened to RAT Tests The NSW small business fees and charges rebate has been increased from 2 000 to 3 000 In

Web 5 mai 2023 nbsp 0183 32 La p ublication d une annonce de cr 233 ation dans un journal d annonces l 233 gales le prix varie de 121 224 387 selon la forme de soci 233 t 233 et le lieu de publication Les frais Web 1 janv 2023 nbsp 0183 32 Le co 251 t des formalit 233 s de cr 233 ation d une entreprise varie selon le type d entreprise et la nature de l activit 233 Il faut prendre en compte les co 251 ts pour les

Small Business Fees And Charges Rebate Australian Business Portal

https://all-opening-hours.com.au/guides/wp-content/uploads/sample-2.jpg

Small Business Fees Charges Rebate TSP Accountants

https://www.tspaccountants.com.au/wp-content/uploads/2021/04/TSP-BLOG-BANNER-10-1080x675.png

https://www.smallbusiness.nsw.gov.au/news/what-you-can-claim-your-15…

Web The Small Business Fees and Charges Rebate is open to small businesses that have a total wages bill below the new 2020 21 1 2 million payroll tax threshold The rebate is

https://www.service.nsw.gov.au/performance-dashboard/closed-covid-19...

Web 8 sept 2023 nbsp 0183 32 Small business fees and charges rebate A 3 000 rebate for small businesses sole traders and not for profit organisations to help pay for government

BUSINESS TIP SMALL BUSINESS FEES AND CHARGES REBATE

Small Business Fees And Charges Rebate Australian Business Portal

Nsw gov au Apply For The Small Business Fees Charges Rebate Australia

Support For Small Businesses To Buy Rapid Antigen Tests St George

Rebate Announced To Help Small Businesses News Of The Area

Small Business Charges Rebate Infinite Accounting Solutions

Small Business Charges Rebate Infinite Accounting Solutions

Last Day To Apply For 2022 Small Business Fees And Charges Rebate NSW

The NSW Small Business Fees And Charges Rebate Has Begun Offering

SMALL BUSINESS REBATE SCHEME KICKS OFF Liberal Party NSW

Small Business Fees And Charges Rebate - Web From 1 March 2021 funds can be used to cover the expenses of eligible NSW and local government fees and charges These include but are not limited to food authority