Small Business Tax Concessions 2022 SMALL BUSINESS CONCESSIONS PREPAYMENTS Small Business Concession taxpayers can make prepayments up to 12 months on expenses e g loan

The Treasury Laws Amendment 2022 Measures No 4 Act 2023 Act No 29 of 2023 provided for a temporary technology investment boost for small businesses The tax concessions will apply from 1 July 2020 or 1 July 2021 and the Fringe Benefits Tax FBT related exemptions will apply for eligible businesses in

Small Business Tax Concessions 2022

Small Business Tax Concessions 2022

https://cdn.shopify.com/s/files/1/1246/6441/files/Small_business_tax_deductions.png?format=jpg&quality=90&v=1646776102

How To Reduce Your Small Business Tax Bill Small Business Tax Income

https://i.pinimg.com/originals/77/99/59/77995968fabe8baf343f4d6b8f298fba.jpg

15 Small Business Tax Tips To Legally Reduce Your Tax Bill 2022

https://cdn.shopify.com/s/files/1/1246/6441/files/Small_business_tax_tips.png?format=jpg&quality=90&v=1646675646

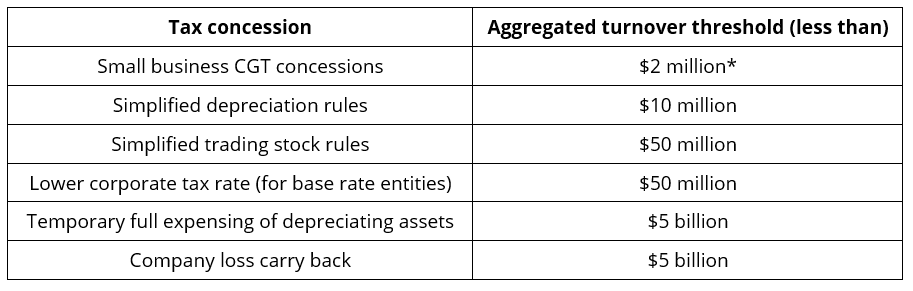

Small businesses with an aggregated turnover of less than 5 billion will be able to deduct the business portion of the cost of eligible new depreciating assets first Small Business Concession taxpayers can make prepayments up to 12 months on expenses e g loan interest rent subscriptions BEFORE 30 June 2022

Under the federal budget 2022 for the next 12 months small businesses will be able to claim a 120 tax deduction for every 100 they spend on digital technologies such as cloud computing Tax tips for small business Tax time is a great opportunity to get your accounts up to date Tips for tax concessions and more On this page The basics Income Deductions Tax

Download Small Business Tax Concessions 2022

More picture related to Small Business Tax Concessions 2022

Small Business Taxes To Expect In 2020 With Images Small Business

https://i.pinimg.com/originals/cb/84/be/cb84be147cafff0f44d081101d8f949d.jpg

Practical Small Business Tax Deductions For The Upcoming Tax Season

https://pbscalacpa.com/wp-content/uploads/2022/03/Untitled-design-6.jpg

5 Important Small Business Tax Tips From A CPA

https://helloalice.com/wp-content/uploads/2022/06/Tax_tips_event_blogpost_header_final_1000_675-1024x691.png

You will need to meet the following requirements Operate a business for all or part of the income year AND have a turnover of less than 10 million 10 million Key dates to consider Previously your business was considered a small business if your turnover was less than 2 million From 1 April 2017 the turnover

An Update On Tax Concessions For Small Business Susan Young B Com Llb Grad Dip Law Introduction There are a range of tax concessions available to small business What are the small business CGT concessions There are four small business CGT concessions on offer Small business 15 year exemption Subdivision 152 B of the

Your Handy Tax Checklist 2022 CGH Accounting

https://cghaccounting.com.au/wp-content/uploads/2022/06/tax_checklist.jpg

Small Businesses Tax Concessions And Offset KMT Partners

https://kmtpartners.com.au/wp-content/uploads/2021/12/small-business-tax-concessions.png

https://elementbusiness.com/2022/05/tax-planning...

SMALL BUSINESS CONCESSIONS PREPAYMENTS Small Business Concession taxpayers can make prepayments up to 12 months on expenses e g loan

https://www.ato.gov.au/.../small-business-entity-concessions

The Treasury Laws Amendment 2022 Measures No 4 Act 2023 Act No 29 of 2023 provided for a temporary technology investment boost for small businesses

7 Tax Tips For New Small Businesses In 2020 Small Business Tax

Your Handy Tax Checklist 2022 CGH Accounting

Small Business Tax Planning 2022 Tax Digital

Lower Your Taxes BIG TIME 2019 2020 Small Business Wealth Building

Small Businesses Tax Concessions And Offset KMT Partners

Small Business Tax Tips Strategies For Minimizing Tax Liability The

Small Business Tax Tips Strategies For Minimizing Tax Liability The

Is My Business Eligible For Small Business Tax Concessions

Tax Concessions For Small Business Entities KMT Partners

SMSF Small Business Tax Concessions IChoice

Small Business Tax Concessions 2022 - Small Business Concession taxpayers can make prepayments up to 12 months on expenses e g loan interest rent subscriptions BEFORE 30 June 2022