Small Business Tax Rebate Australia Web Offsets and rebates for businesses Find out about tax offsets or rebates available to eligible businesses On this page About tax offsets Small business income tax offset

Web 29 mars 2022 nbsp 0183 32 Under changes announced on Tuesday night the government will allow eligible businesses to deduct 120 for every 100 they spend on services that support Web 29 mars 2022 nbsp 0183 32 Under the federal budget 2022 for the next 12 months small businesses will be able to claim a 120 tax deduction for every 100 they spend on digital

Small Business Tax Rebate Australia

Small Business Tax Rebate Australia

https://images.theconversation.com/files/205637/original/file-20180209-180826-ikf8da.jpg?ixlib=rb-1.1.0&q=30&auto=format&w=754&h=538&fit=crop&dpr=2

Nsw gov au Apply For The Small Business Fees Charges Rebate Australia

https://www.statusin.org/uploads/images2021/59550.jpg

Nsw gov au Apply For The Small Business Fees Charges Rebate Australia

https://www.statusin.org/uploads/images2021/59550-1.jpg

Web 12 sept 2023 nbsp 0183 32 12 September 2023 The KPMG member firm in Australia prepared reports about the following tax related developments The Australian Taxation Office ATO Web 29 mars 2022 nbsp 0183 32 The government will give temporary 120 per cent tax deductions for small and medium business spending on training and new technology The government is not further extending the temporary full

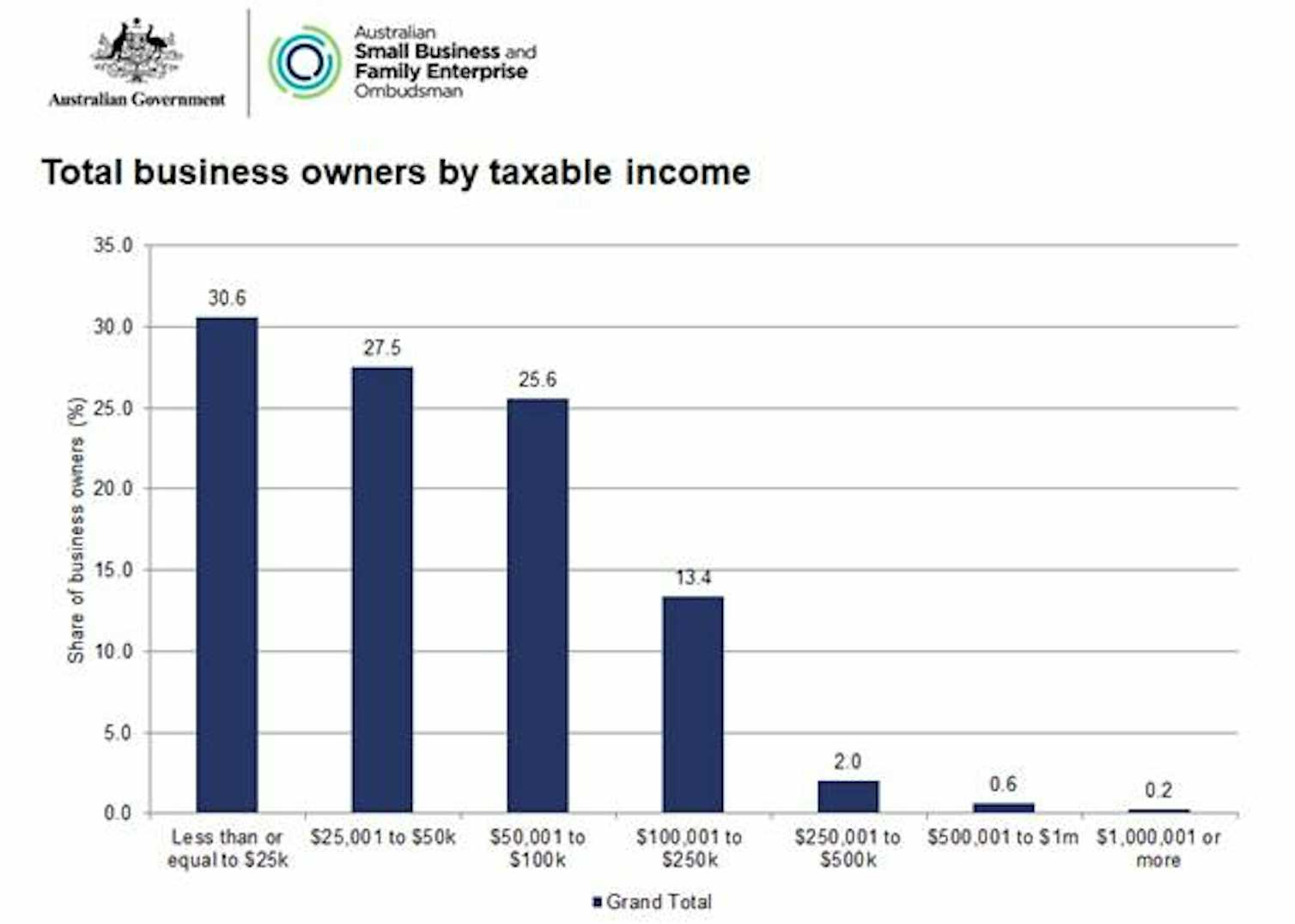

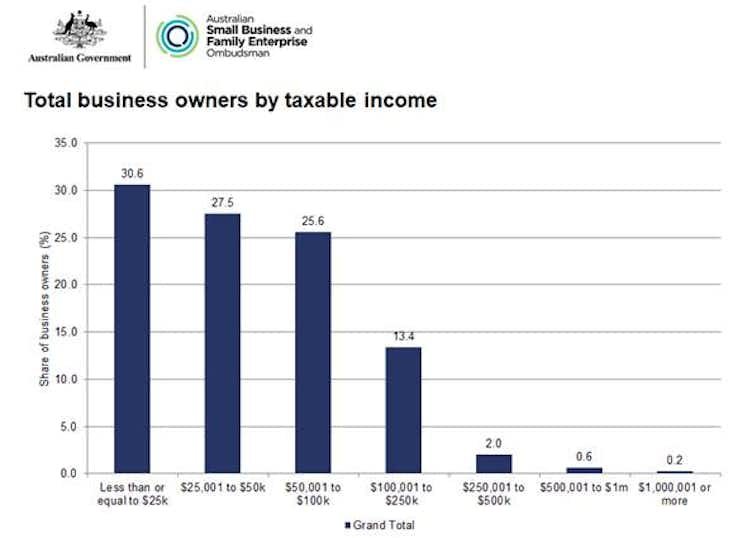

Web 13 juin 2023 nbsp 0183 32 Tax concessions for small business If you re a small business with an annual turnover of less than 10 million you may be able to get small business tax Web 30 juin 2021 nbsp 0183 32 Depending on your company s annual turnover the R amp DTI provides either a refundable or non refundable tax offset 43 5 refundable tax offset is available to

Download Small Business Tax Rebate Australia

More picture related to Small Business Tax Rebate Australia

Spend 100 Get A 120 Expense From The ATO Big Tax Rebates For Small

https://www.australiansmallbusiness.com.au/wp-content/uploads/2022/04/Australias-Digital-Economy-tax-incentives-and-PEPPOL-for-einvoicing-Xero-MYOB-QuickBooks-Courses-National-Bookkeeping-Courses-and-the-Career-Academy.png

Small Business Fees And Charges Rebate

https://waterfordaccountants.com.au/wp-content/uploads/2022/03/NEW-REBATE-TO-SUPPORT-SMALL-BUSINESS-e1648170402927.png

Australian Government Rebate Form GU Health

https://img.yumpu.com/30842239/1/500x640/australian-government-rebate-form-gu-health.jpg

Web This has opened up a range of new potential deductions The Federal Government has also moved to soften the regulatory and tax burden for small businesses with a number of Web 1 juin 2021 nbsp 0183 32 When you do your tax return you can claim most business expenses as tax deductions to reduce your taxable income The Australian Taxation Office ATO

Web 30 avr 2023 nbsp 0183 32 Up to 100 000 of total expenditure will be eligible for the incentive with the maximum bonus tax deduction being 20 000 per business Eligible assets or upgrades Web From a tax perspective a small business is usually defined as one with an annual turnover of less than 10 million except in relation to the small business CGT concessions

P55 Tax Rebate Form Business Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

Top 20 Tax Deductions For Small Business

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

https://www.ato.gov.au/.../Offsets-and-rebates-for-businesses

Web Offsets and rebates for businesses Find out about tax offsets or rebates available to eligible businesses On this page About tax offsets Small business income tax offset

https://www.smh.com.au/politics/federal/small-business-gets-1-billion...

Web 29 mars 2022 nbsp 0183 32 Under changes announced on Tuesday night the government will allow eligible businesses to deduct 120 for every 100 they spend on services that support

Beneficiary Tax Offset What You Need To Know The Grenfell Record

P55 Tax Rebate Form Business Printable Rebate Form

Luke Williams Author At Start An Online Business Buy An Online

Other Tax Rebates For Individuals ADN Business Solutions

Budget Highlights For 2021 22 Nexia SAB T

Declarations Items 24 And 25 Australian Taxation Office

Declarations Items 24 And 25 Australian Taxation Office

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Claim Your Small Business Safety Rebate UpDown Desks

Do Small Businesses Need To Pay Taxes In Australia Different Taxes

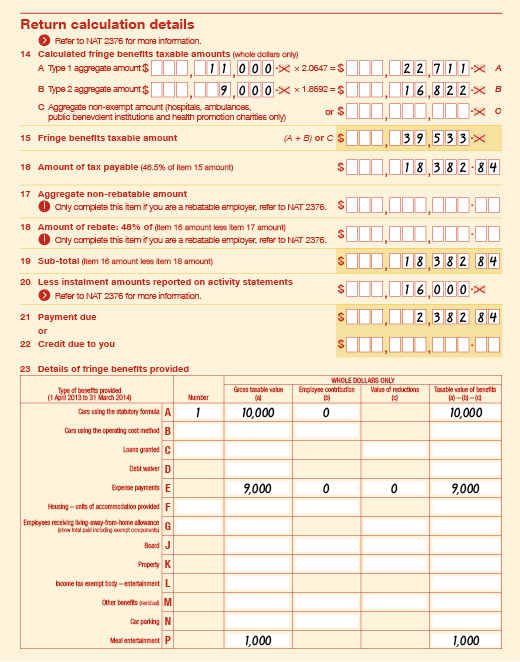

Small Business Tax Rebate Australia - Web Small Business Payroll Tax Rebate The small business payroll tax rebate operated from 2013 14 to 2016 17 and was provided to eligible employers with a taxable Australian