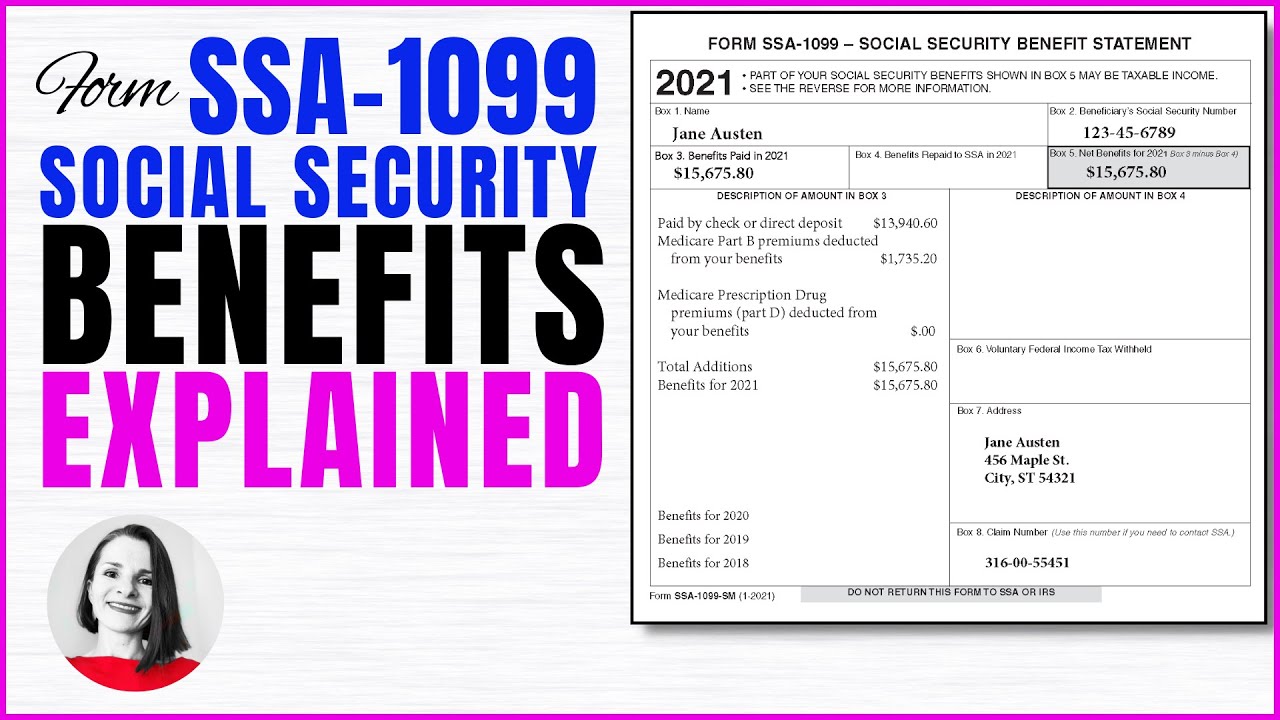

Social Security Benefits Tax Form A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your tax return

The Benefit Statement also known as the SSA 1099 or the SSA 1042S is a tax form we mail each year in January to people who receive Social Security benefits It shows the total amount of benefits you received from us in the previous year so you know how much Social Security income to report to the IRS on your tax return Some forms and paperwork might be difficult to track down If you misplaced your Benefits Statement or haven t received it by the end of January we ve made it easy to go online to get a replacement with a personal my Social Security account

Social Security Benefits Tax Form

Social Security Benefits Tax Form

https://www.printableform.net/wp-content/uploads/2021/09/tax-form-8332-printable-printable-form-2021.gif

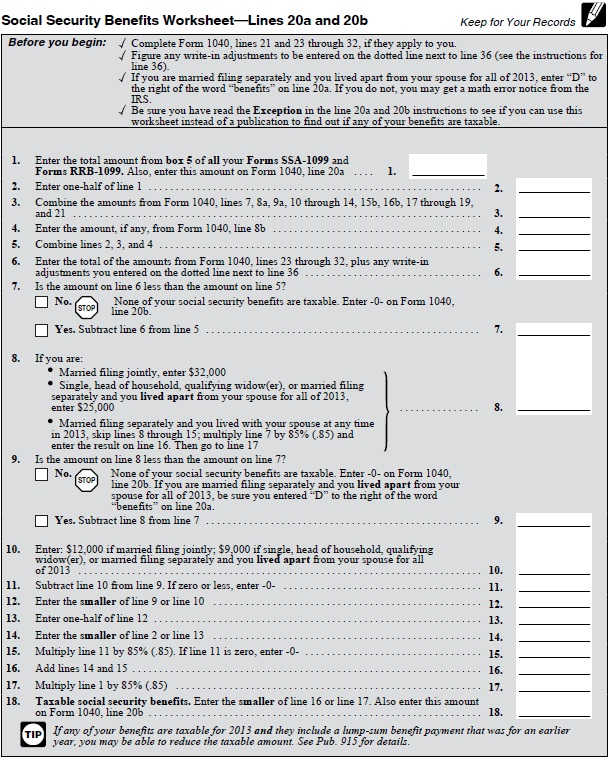

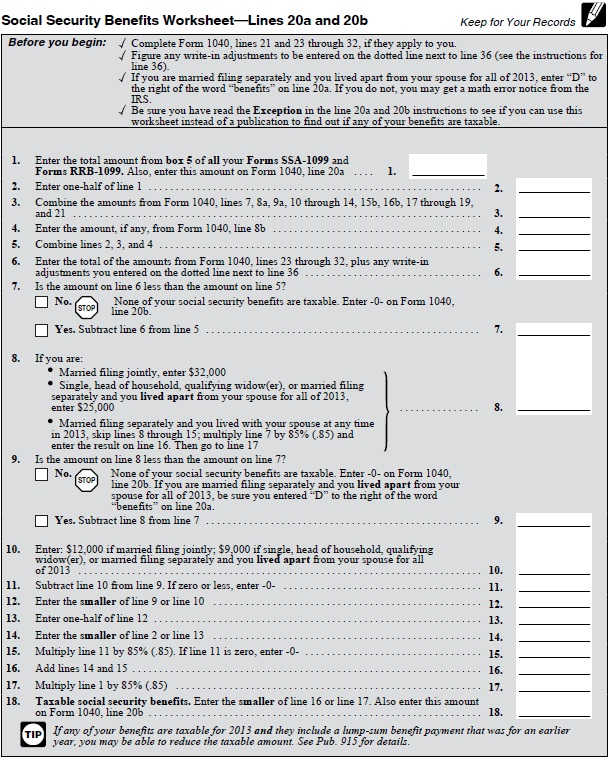

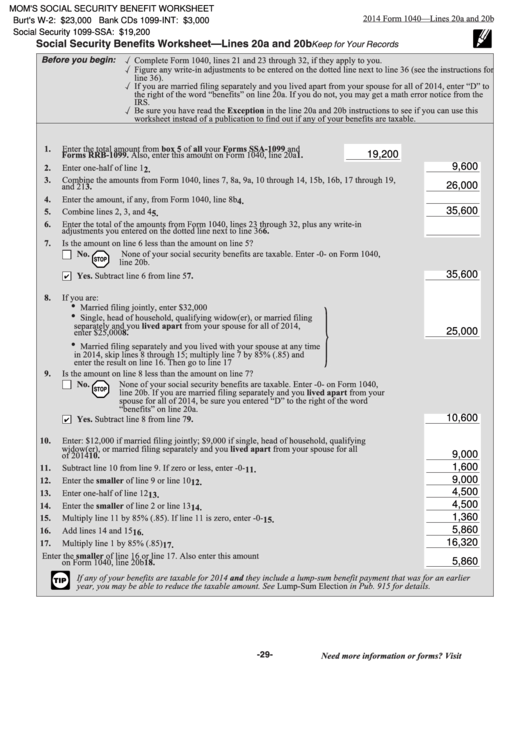

Ss Worksheet 2020

https://www.pdffiller.com/preview/535/780/535780986/large.png

Social Security Worksheet 2023 Fabad

https://i2.wp.com/www.irs.gov/pub/xml_bc/24811v37.gif

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply If you are already receiving benefits or if you want to change or stop your withholding you ll need a Form W 4V from the Internal Revenue Service IRS

You can get a replacement form SSA 1099 or SSA 1042S Benefit Statement for any of the past 6 years for which benefits were paid by Signing in to your personal my Social Security account and selecting the Replace Your Tax Form SSA 1099 SSA 1042S link Go to the Choose a year dropdown menu Mail or fax us a request to withhold taxes Download Form W 4 V Voluntary Withholding Request from the IRS website Then find the Social Security office closest to your home and mail or fax us the completed form

Download Social Security Benefits Tax Form

More picture related to Social Security Benefits Tax Form

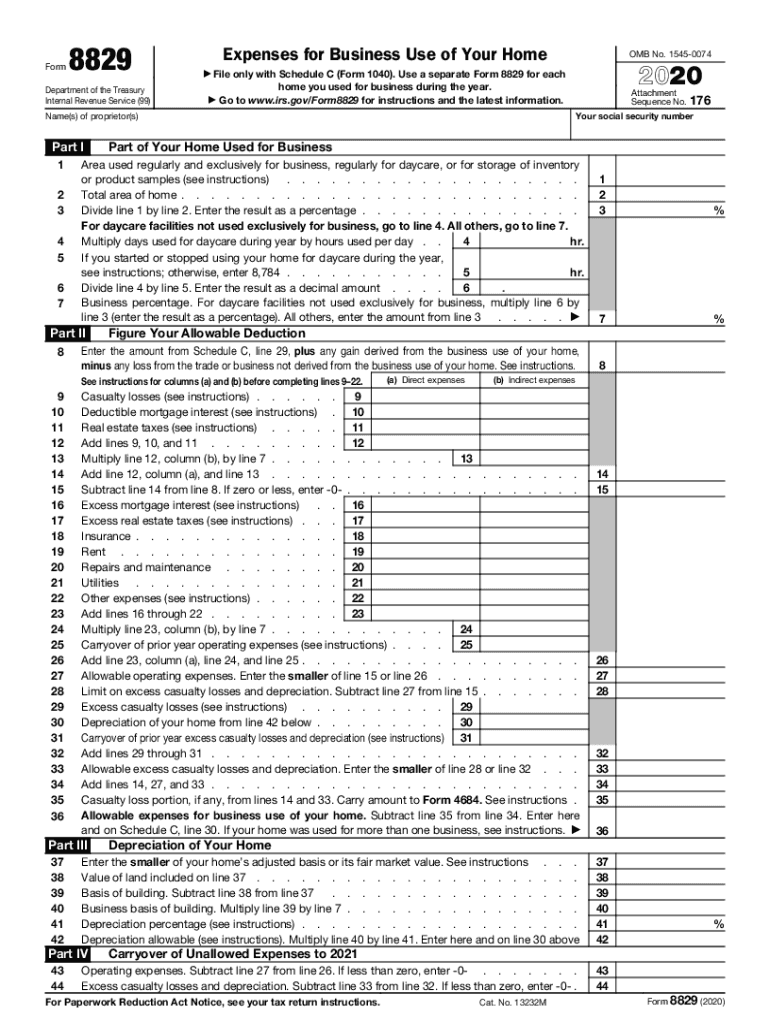

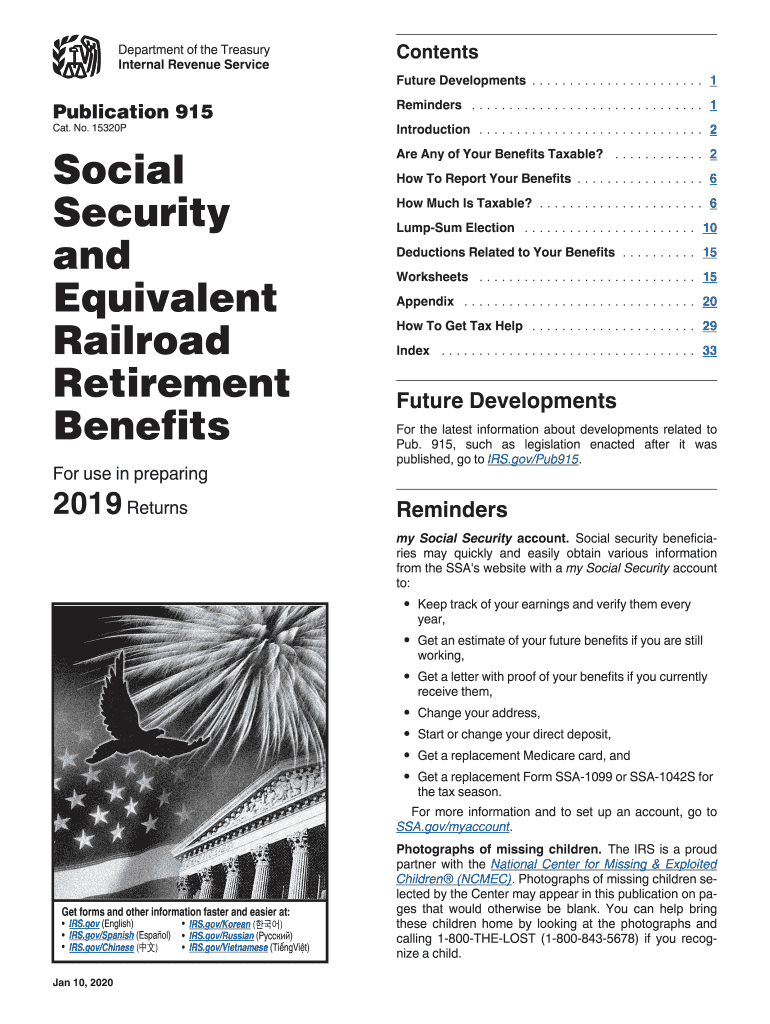

Publication 915 Worksheet Printable 2019 2024 Form Fill Out And Sign

https://www.signnow.com/preview/492/615/492615219/large.png

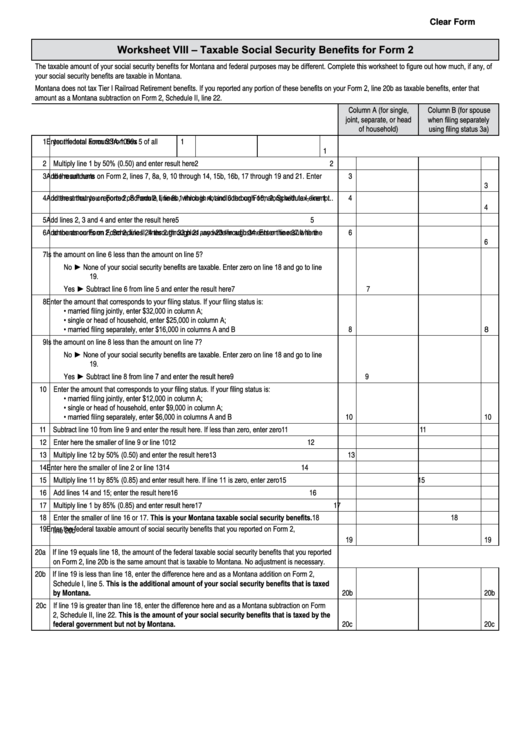

Fillable Worksheet Viii Taxable Social Security Benefits For Form 2

https://data.formsbank.com/pdf_docs_html/325/3254/325455/page_1_thumb_big.png

Tax Form SSA 1099 Social Security Benefit Explained Is My Social

https://i.ytimg.com/vi/8_9b9_HQkDY/maxresdefault.jpg

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply If you are already receiving benefits or if you want to change or stop your withholding you ll need a Form W 4V from the Internal Revenue Service IRS You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040 SR Your benefits may be taxable if the total of 1 one half of your benefits plus 2 all of your other income including tax exempt interest is greater than the base amount for your filing status

If you did not receive your SSA 1099 or have misplaced it you can get a replacement online if you have a My Social Security account Sign in to your account and click the link for Replacement Documents You ll Each January you will receive a Form Social Security 1099 SSA 1099 that shows the total benefits you received for the previous year and the total amount you are required to report to the IRS

Income Tax On Social Security Benefits Back Alley Taxes 2021 Tax

https://1044form.com/wp-content/uploads/2020/08/income-tax-on-social-security-benefits-back-alley-taxes-2.jpg

How To Calculate Taxable Social Security Income 2023

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

https://blog.ssa.gov/get-your-social-security-benefit-statement-ssa-1099

A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your tax return

https://blog.ssa.gov/get-your-social-

The Benefit Statement also known as the SSA 1099 or the SSA 1042S is a tax form we mail each year in January to people who receive Social Security benefits It shows the total amount of benefits you received from us in the previous year so you know how much Social Security income to report to the IRS on your tax return

2022 Social Security Benefits Worksheet Form

Income Tax On Social Security Benefits Back Alley Taxes 2021 Tax

How Do You Get The 250 Death Benefit From Social Security Fill Out

Social Security Benefits Worksheet Schedule 1

Form To Calculate Taxable Social Security TaxableSocialSecurity

Social Security Worksheet For Taxes TUTORE ORG Master Of Documents

Social Security Worksheet For Taxes TUTORE ORG Master Of Documents

Form 1040 Line 6 Social Security Benefits The Law Offices Of O

Social Security Benefits Worksheets

2023 Worksheet To Calculate Taxable Social Security

Social Security Benefits Tax Form - Once you know how much of your benefits are taxable you must include that amount on Line 6b of Form 1040 That income will be taxable along with any other income based on your tax