Solar Credit Rebate Web the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit For example if your solar PV system was installed before

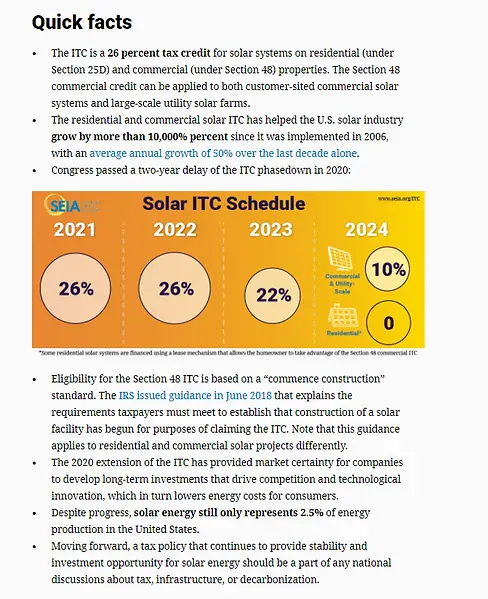

Web 14 mars 2023 nbsp 0183 32 The solar tax credit allows you to use a part of the cost of a solar power system to reduce the income taxes you owe The U S Department of Energy says the tax savings on an average solar Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on

Solar Credit Rebate

Solar Credit Rebate

https://blog.solarinstallguru.com/wp-content/uploads/2016/12/Federal_Solar_Tax_Credit_and_solar_rebates_Can_Slash_Solar_Panel_Installation_Cost_by_30_to_80_Percent.png

Solar Tax Credit Guide And Calculator

https://www.solar-estimate.org/images/pages/solar-tax-credit/commercial-bar.png

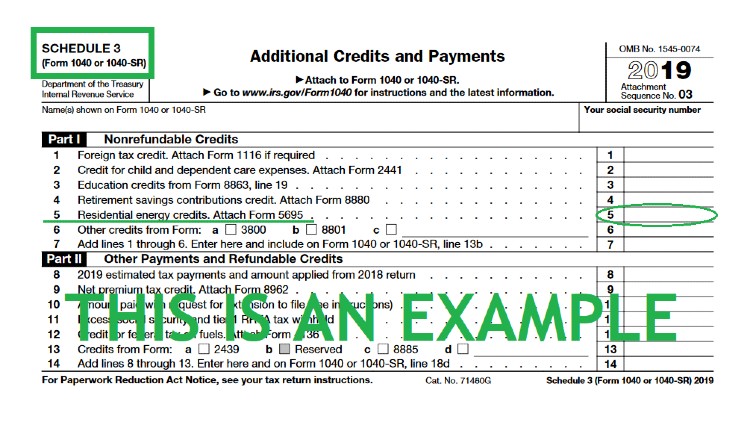

How To Claim The Federal Solar Tax Credit SAVKAT Inc

https://savkat.com/wp-content/uploads/2019/09/IRS-Form-5695-SAVKAT-Solar.jpg

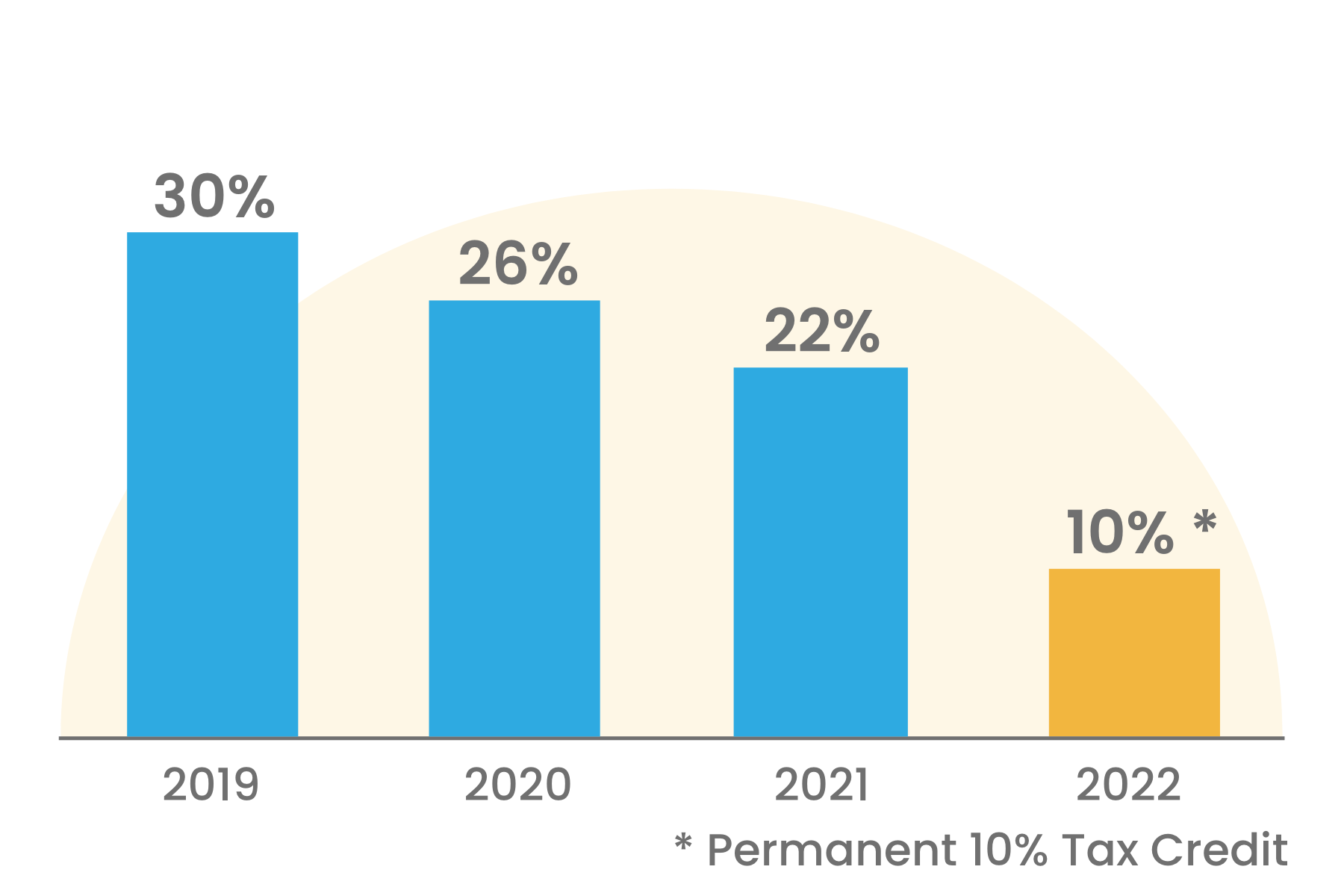

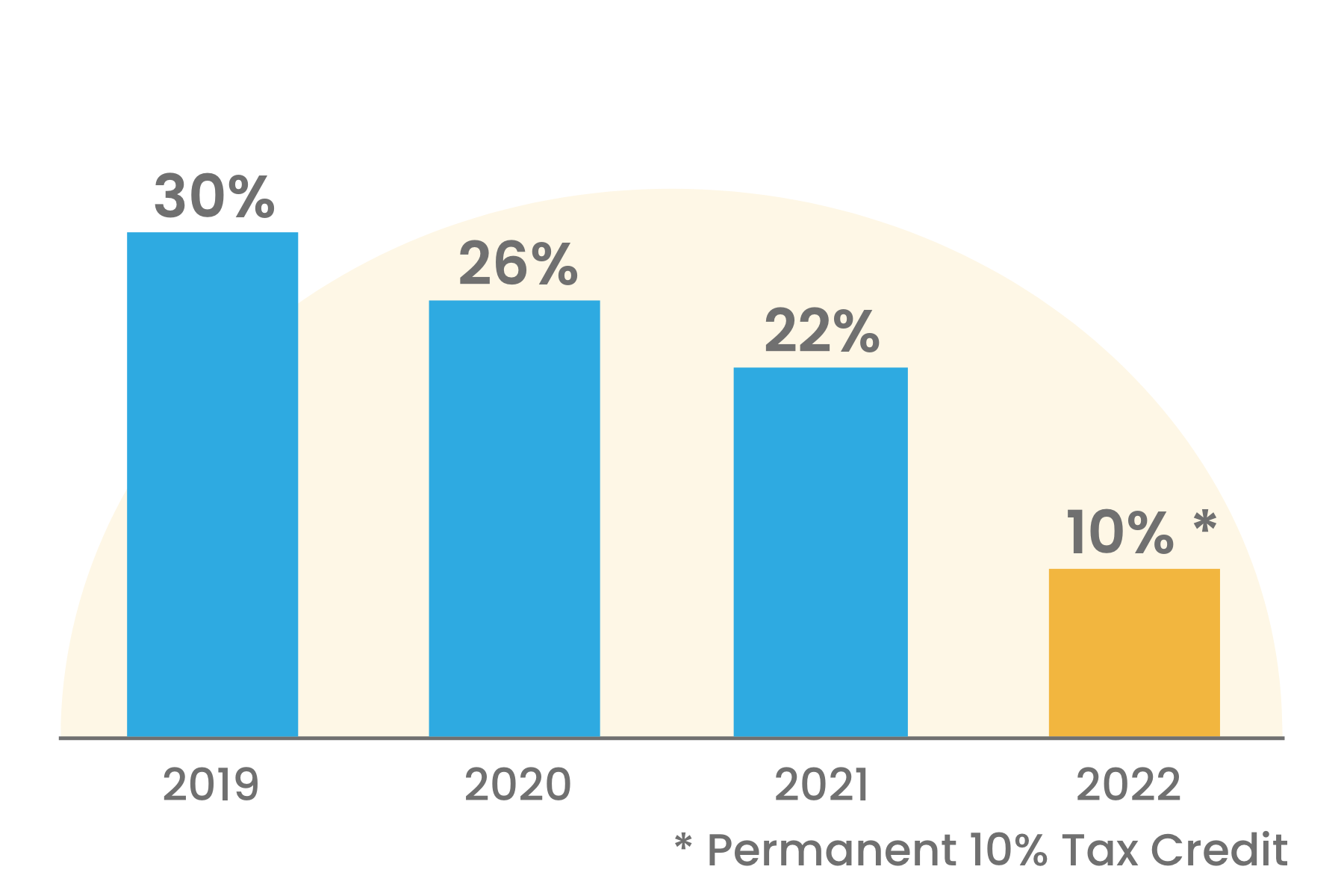

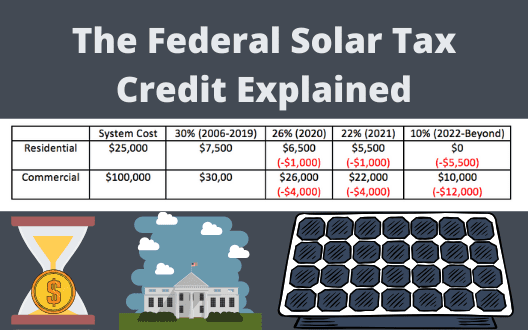

Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed Web The solar investment tax credit ITC is a tax credit available to all homeowners worth 30 of expenditures on solar and or battery storage with no maximum limit on the value of

Web 16 ao 251 t 2023 nbsp 0183 32 The solar credit is just one of the tax credit and rebate programs in the Inflation Reduction Act The legislation s incentives can also save you money on electric Web One of the most valuable incentives in the Inflation Reduction Act is the extension of the 30 Residential Clean Energy credit commonly known as the solar investment tax

Download Solar Credit Rebate

More picture related to Solar Credit Rebate

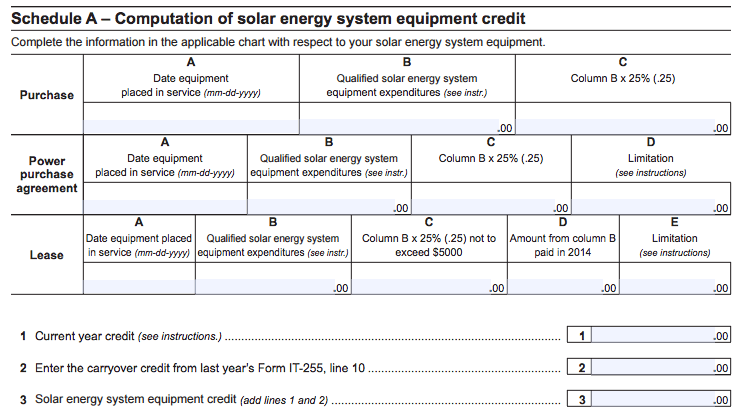

How To File The Federal Solar Tax Credit A Step By Step Guide Solar

https://s3.amazonaws.com/solarassets/wp-content/uploads/solar-form-5695.png

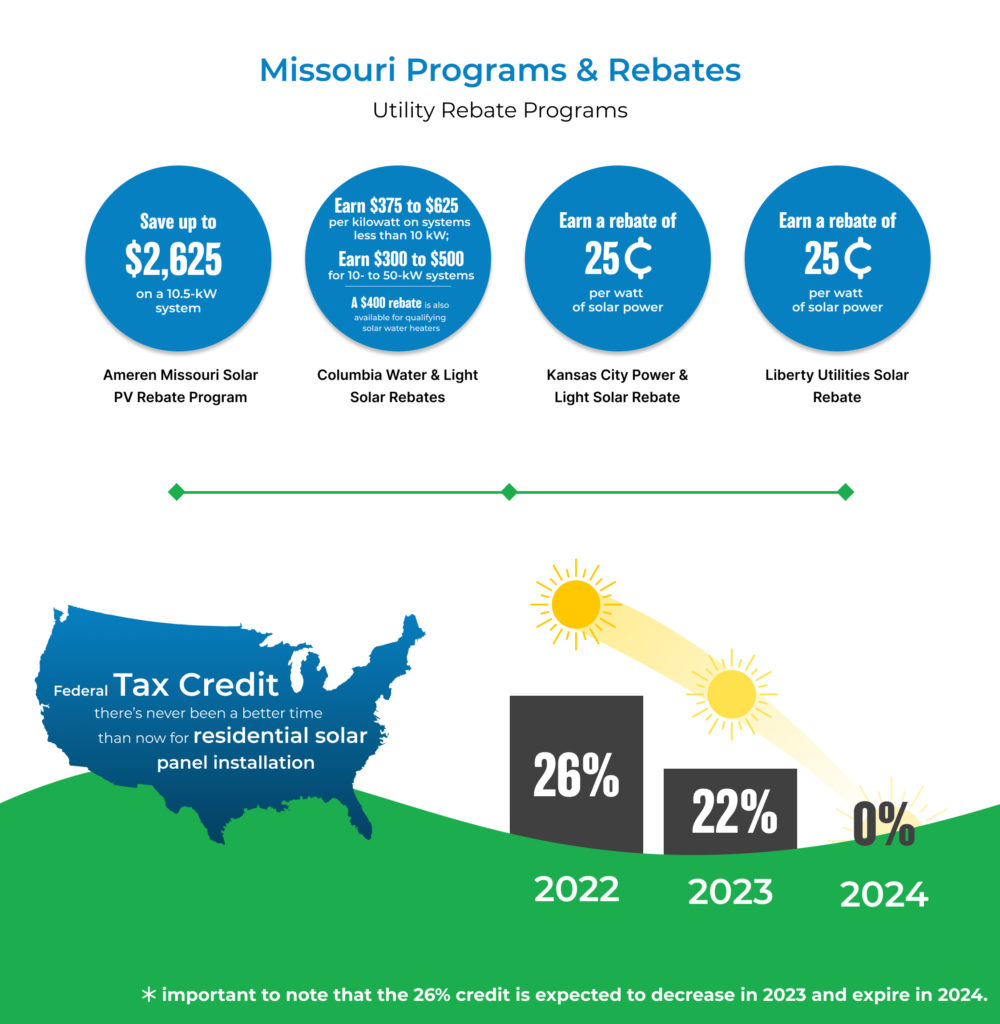

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

Solar Panels Federal Tax Credit 2021 SolarProGuide

https://www.solarproguide.com/wp-content/uploads/solar-rebates-and-tax-incentives-realsolarsbc.png

Web 20 juin 2023 nbsp 0183 32 Households with income less than 80 of AMI 30 tax credit up to 600 per year for conditioners and natural gas propane and oil furnaces and water boilers Households with income between 80 150 Web 8 sept 2023 nbsp 0183 32 The total cost of solar panels in California generally ranges between 15 000 and 25 000

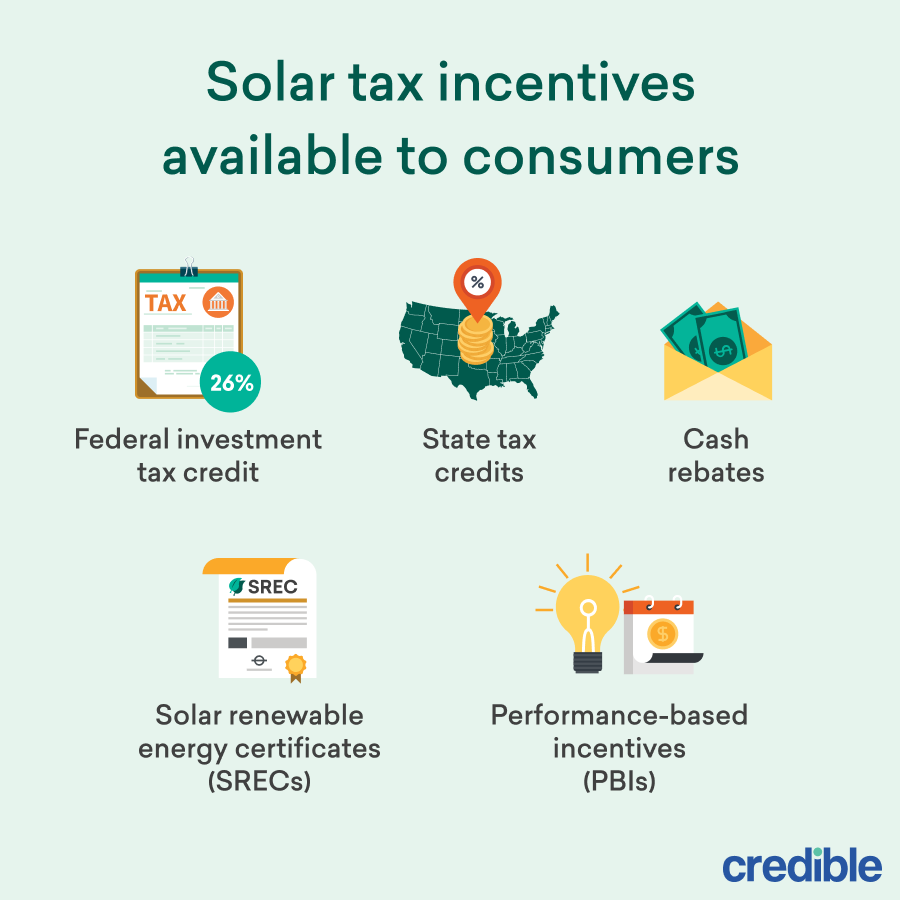

Web Thanks to the Inflation Reduction Act the Federal Solar Investment Tax Credit is at 30 until the end 2032 which is a great start to reducing the cost of your solar system However you may also have access to Web 2 ao 251 t 2022 nbsp 0183 32 Solar renewable energy certificates SRECs are a performance based solar incentive that allow you to earn additional income from solar electricity generation As a

2019 Texas Solar Panel Rebates Tax Credits And Cost

https://www.solarpowerrocks.com/wp-content/uploads/2018/12/TX-rebates-ring.png

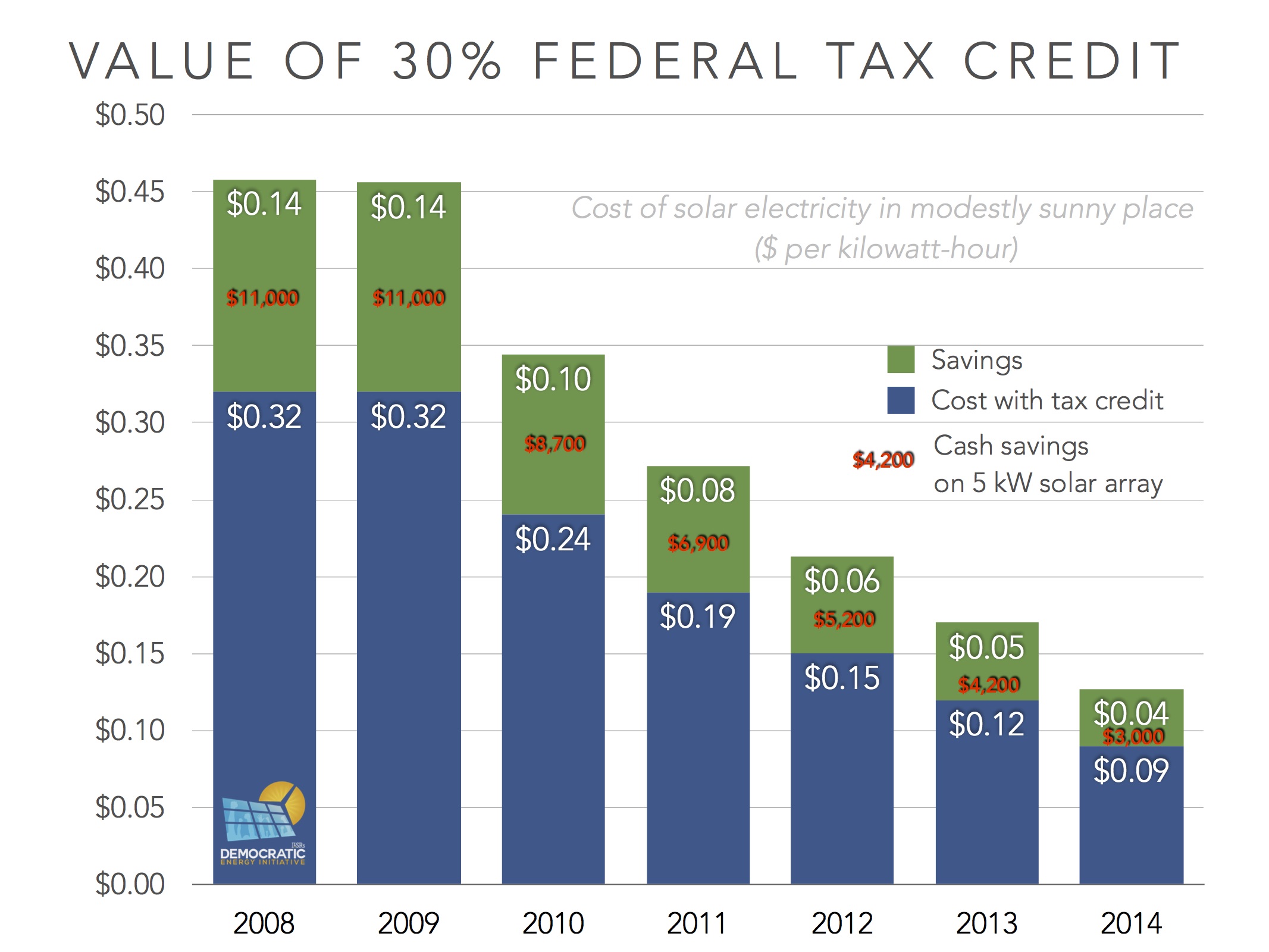

The Federal Solar Tax Credit Extension Can We Win If We Lose

http://ilsr.org/wp-content/uploads/2015/09/value-of-federal-itc-over-time-ilsr.jpg

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit For example if your solar PV system was installed before

https://www.nerdwallet.com/article/taxes/sola…

Web 14 mars 2023 nbsp 0183 32 The solar tax credit allows you to use a part of the cost of a solar power system to reduce the income taxes you owe The U S Department of Energy says the tax savings on an average solar

Solar Tax Credit Calculator NikiZsombor

2019 Texas Solar Panel Rebates Tax Credits And Cost

The Federal Solar Tax Credit Explained Sunshine Plus Solar

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

New York Solar Tax Credit Explained EnergySage

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

Solar Panel Deals Rebates And Incentives In Australia Solar Market

Filing For The Solar Tax Credit Wells Solar

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Solar Credit Rebate - Web 12 mai 2023 nbsp 0183 32 Orlando Utilities Commission offers residential electrical solar PV customers a rebate of 2 000 for a solar battery with capacity of at least 8 kWh and at least a 10