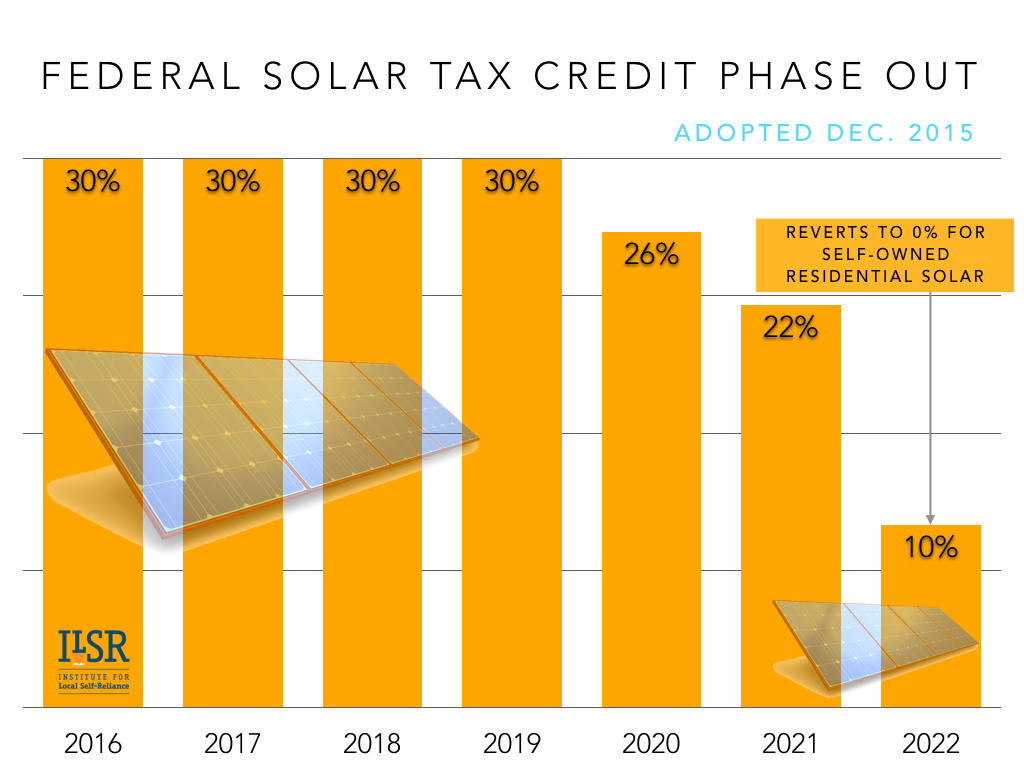

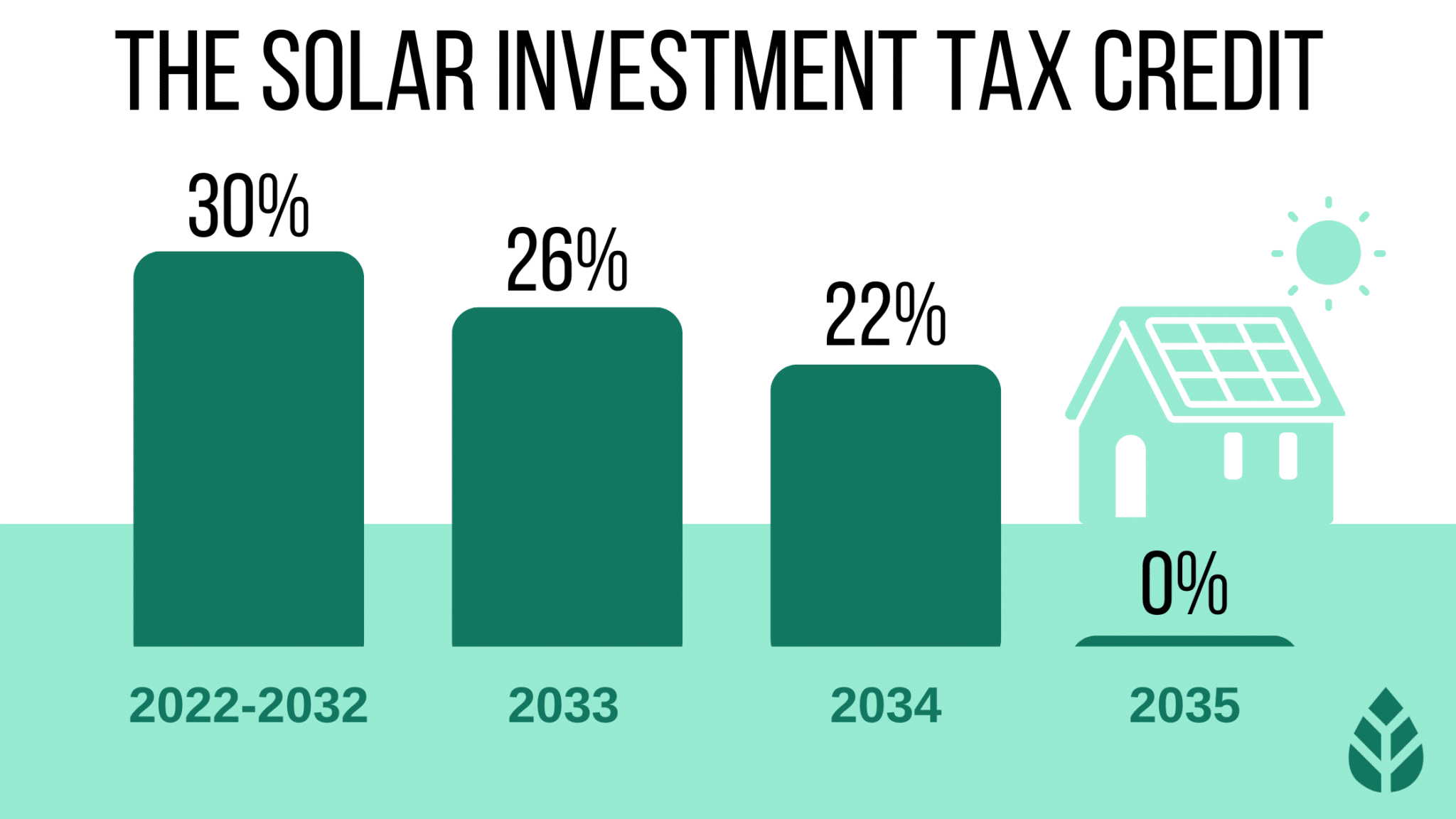

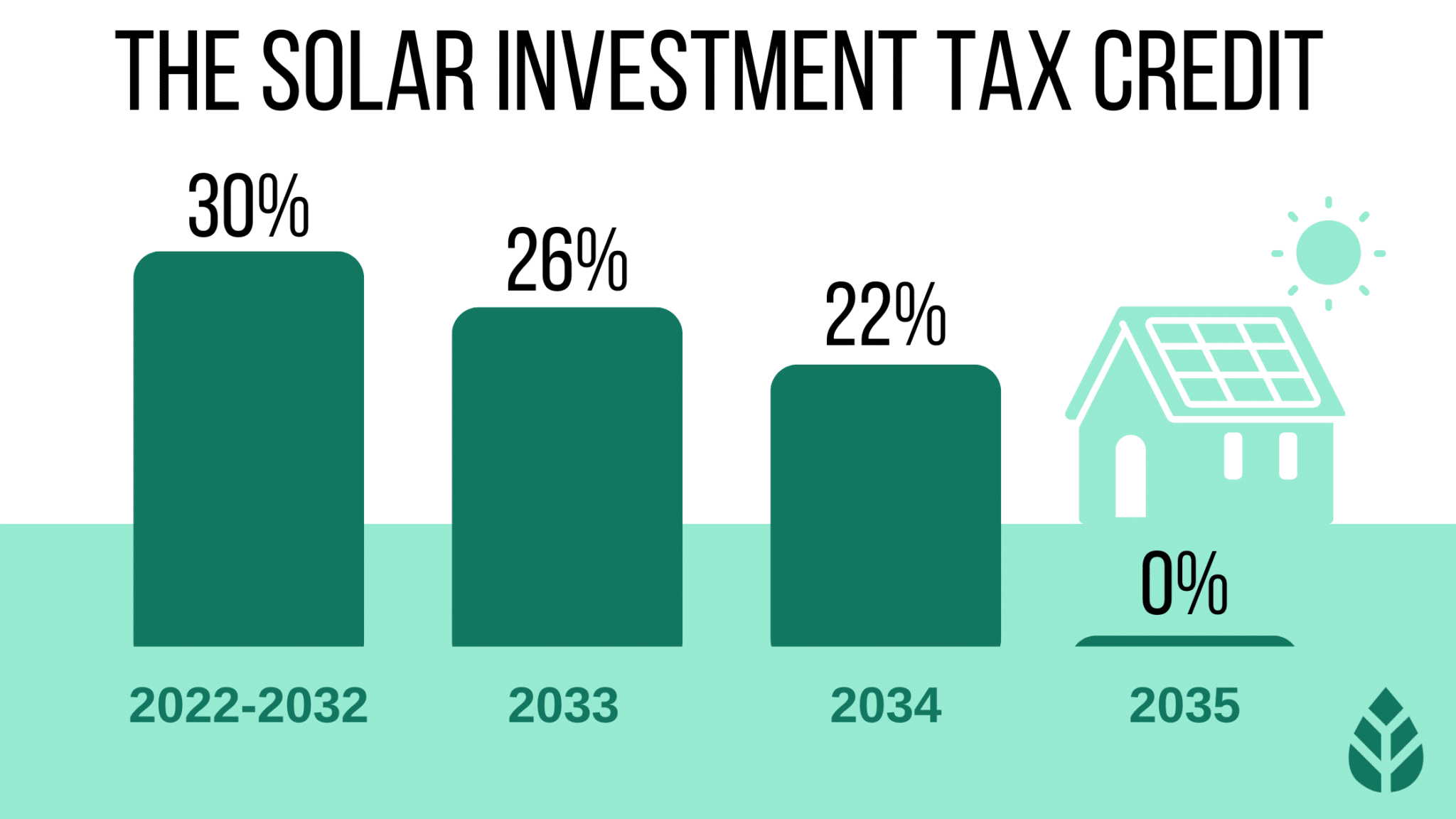

Solar Energy Tax Credit Extension The bill calls for a 10 year extension at 30 of the cost of the installed equipment which will then step down to 26 in 2033 and 22 in 2034 The tax credit applies to individuals

To qualify for the 30 Residential Clean Energy Credit you re solar system needs to be installed and deemed operation by a city inspector in any of the tax years 2022 2032 The 30 credit applies retroactively to systems installed in 2022 when the credit was still at 26 Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Solar Energy Tax Credit Extension

Solar Energy Tax Credit Extension

https://s2.studylib.net/store/data/009906505_1-1c8209be4201d8616781301da40ba34d-768x994.png

Solar Tax Credit Extension

https://energywithrob.com/wp-content/uploads/2021/01/solar-tax-credit-extension-1110x550.jpg

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On this page How it works Who qualifies Qualified expenses Qualified clean energy property How to claim the credit Related resources How it works Extends the Residential Clean Energy Credit ensuring that households will be able to continue receiving a tax credit to cover up to 30 percent of the costs of installing rooftop solar and starting next year battery storage through at least 2034

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2021 You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

Download Solar Energy Tax Credit Extension

More picture related to Solar Energy Tax Credit Extension

The Federal Solar Tax Credit Extension Can We Win If We Lose

http://ilsr.org/wp-content/uploads/2015/09/value-of-federal-itc-over-time-ilsr.jpg

Congress Gets Renewable Tax Credit Extension Right Institute For

https://ilsr.org/wp-content/uploads/2016/01/federal-solar-tax-credit-phase-out-ILSR-2015.jpeg

Unpacking The New Solar Energy Tax Credit BDO

https://www.bdo.co.za/getmedia/42bc4ed7-5b6d-449f-b850-9155b31464ce/new-solar-energy-tax-credit-social.jpg.aspx?width=1200&height=630&ext=.jpg

The residential energy property credit which expired at the end of December 2014 was extended for two years through December 2016 by the Protecting Americans from Tax Hikes Act of 2015 The Consolidated Appropriations Act The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient

The U S Congress is close to enacting legislation that will provide a two year extension of the solar Investment Tax Credit ITC and additional funding for research and development The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for solar system installations on residential property It also increased the credit s value Let s take a closer look at some of the benefits

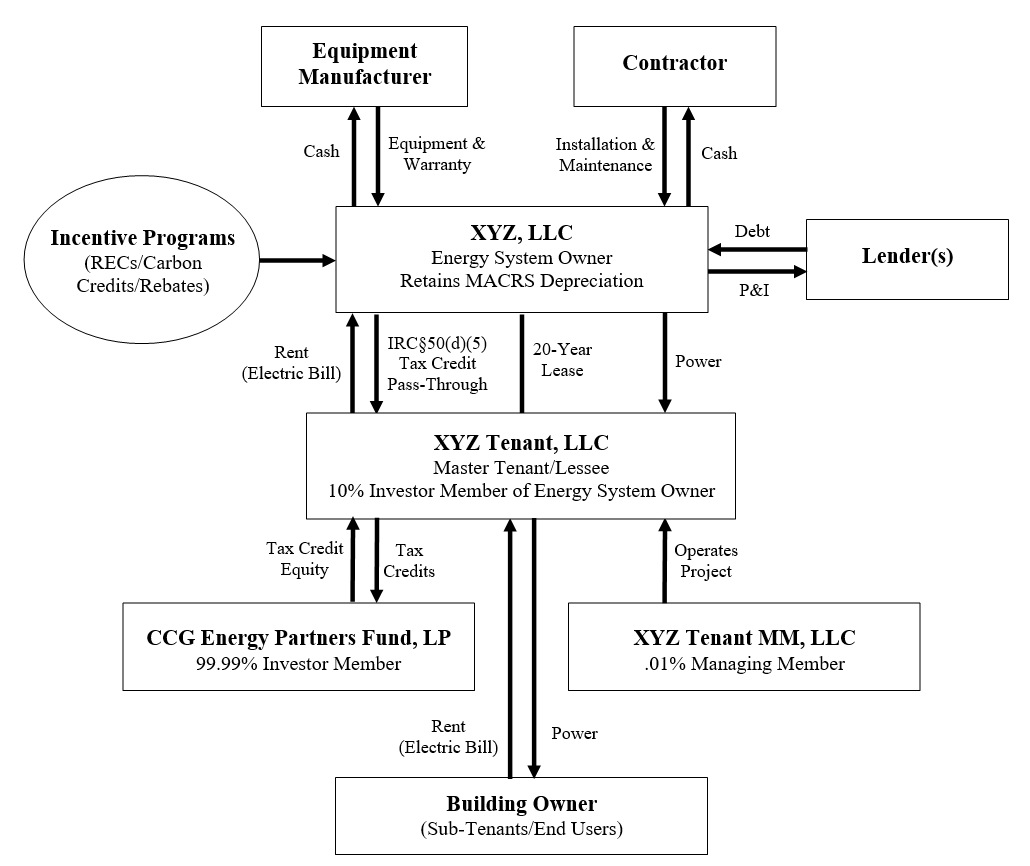

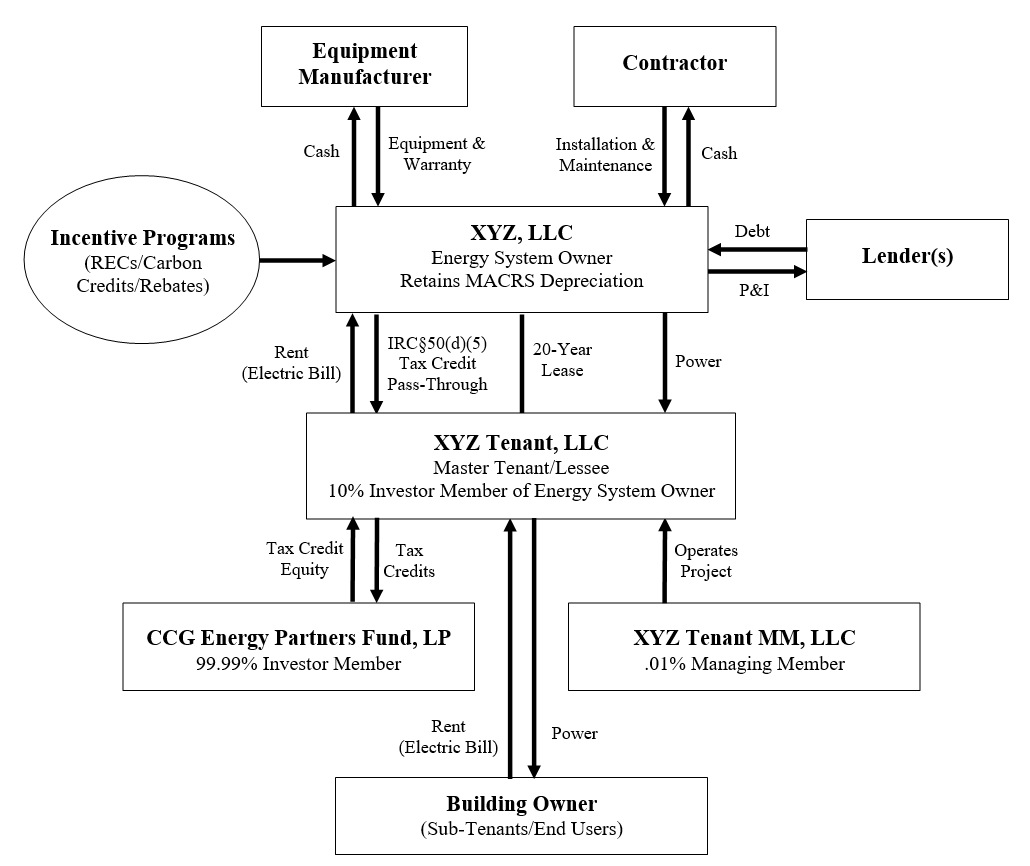

Solar Energy Transactional Structures CityScape Capital Group The

https://images.squarespace-cdn.com/content/v1/5b072f6789c172576d276207/1527364069036-7KEFSJLYUBE4USCMBKKY/setc_multitier_lease.png

Equipment Tax Credits For Primary Residences About ENERGY STAR

https://www.energystar.gov/sites/default/files/TaxCredit_Residential.png

https://www.pv-magazine.com › us-to...

The bill calls for a 10 year extension at 30 of the cost of the installed equipment which will then step down to 26 in 2033 and 22 in 2034 The tax credit applies to individuals

https://www.solar.com › learn › federal-solar-tax-credit-steps-down

To qualify for the 30 Residential Clean Energy Credit you re solar system needs to be installed and deemed operation by a city inspector in any of the tax years 2022 2032 The 30 credit applies retroactively to systems installed in 2022 when the credit was still at 26

Solar Tax Credits Solar Tribune

Solar Energy Transactional Structures CityScape Capital Group The

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Solar Tax Credit Calculator ChayaAndreja

Texas Solar Incentives Tax Credits Rebates More In 2023

Texas Solar Incentives Tax Credits Rebates More In 2023

The Solar Energy Tax Credit A How To Video 1040 Attachment 5695

New Mexico s Solar Energy Tax Credit Passes Legislature

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Solar Energy Tax Credit Extension - Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2021