Solar Energy Tax Credit Requirements If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

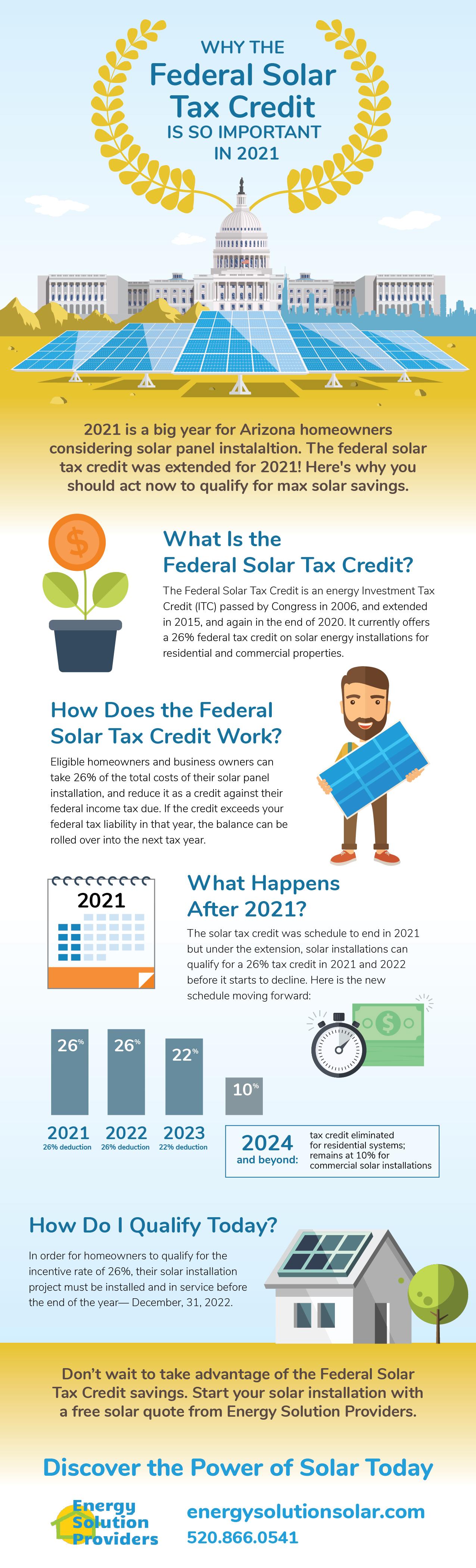

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other

Solar Energy Tax Credit Requirements

Solar Energy Tax Credit Requirements

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Solar Energy Tax Credit Basics

https://s2.studylib.net/store/data/009906505_1-1c8209be4201d8616781301da40ba34d-768x994.png

Commercial Solar Tax Credit Guide 2023

https://propertymanagerinsider.com/wp-content/uploads/2022/12/Commercial-Solar-Tax-Credit-Guide-2023.png

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

The 2024 federal solar tax credit also known as the Residential Clean Energy Credit is worth 30 of your total solar system cost for all installations in the U S completed through 2032 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inlation Reduction Act of 2022

Download Solar Energy Tax Credit Requirements

More picture related to Solar Energy Tax Credit Requirements

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

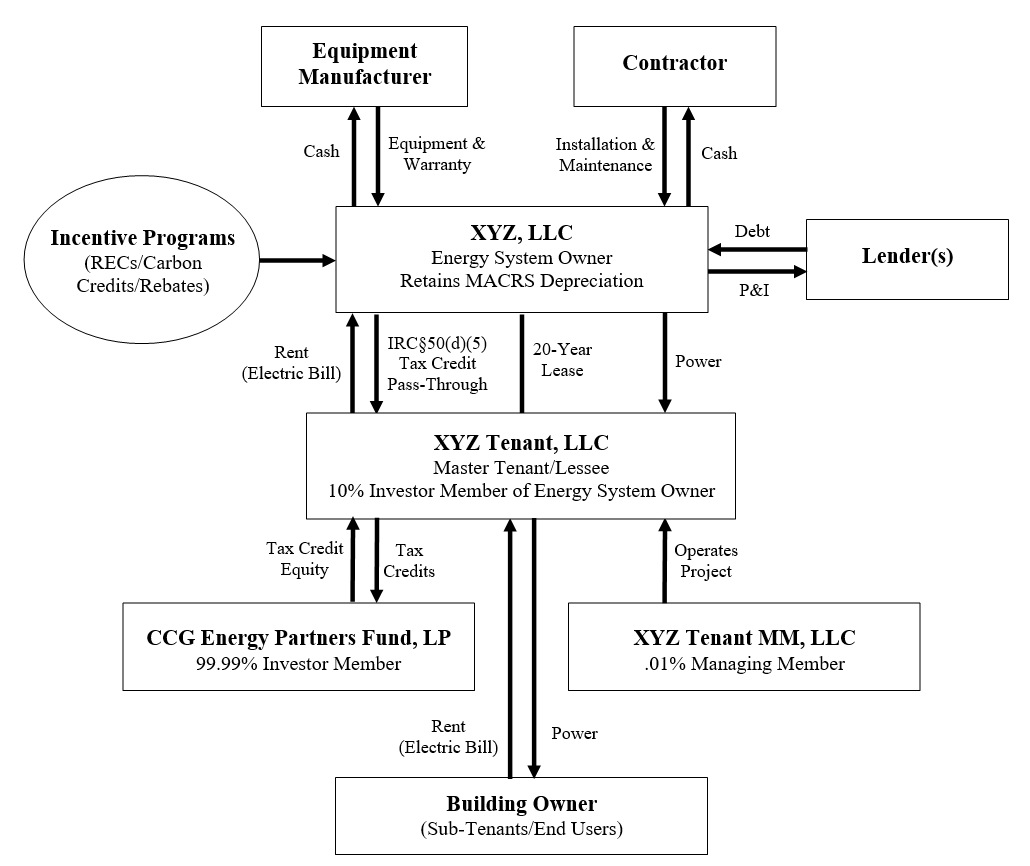

Solar Energy Transactional Structures CityScape Capital Group The

https://images.squarespace-cdn.com/content/v1/5b072f6789c172576d276207/1527364069036-7KEFSJLYUBE4USCMBKKY/setc_multitier_lease.png

You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar installation A calculator A pencil Form 1040 is the standard federal income tax form When you purchase not lease new solar powered equipment that generates electricity or heats water or purchase solar power storage equipment you generally can claim the Residential Clean Energy Credit to lower your tax bill

This guide provides general guidance on the newly introduced solar energy tax credit under section 6C of the Income Tax Act 58 of 1962 It does not consider the technical and legal detail that is often associated with tax and should therefore not be The solar tax credit lets homeowners subtract 30 of a solar purchase and installation off their federal taxes Here s how it works and who it works best for

Solar Tax Credits Solar Tribune

http://solartribune.com/wp-content/uploads/2011/07/sxc.hu-solar.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

https://www.irs.gov/credits-deductions/residential...

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

https://www.energy.gov/sites/default/files/2023-03/...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

How To Calculate Your ERC Tax Credit The News God

Solar Tax Credits Solar Tribune

Federal Solar Tax Credits For Businesses Department Of Energy

The Federal Solar Tax Credit Energy Solution Providers Arizona

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2023 Residential Clean Energy Credit Guide ReVision Energy

2023 Residential Clean Energy Credit Guide ReVision Energy

The Solar Energy Tax Credit A How To Video 1040 Attachment 5695

New Mexico s Solar Energy Tax Credit Passes Legislature

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Solar Energy Tax Credit Requirements - The Inflation Reduction Act expanded the federal solar tax credit to 30 until 2032 We ll show you exactly how to take advantage of it