Solar Loan With Fed Rebate Worth It Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Web 31 d 233 c 2019 nbsp 0183 32 PLUS Mosaic s PLUS loan product which can be used to finance other home improvements in addition to solar and batteries has monthly payments that do

Solar Loan With Fed Rebate Worth It

Solar Loan With Fed Rebate Worth It

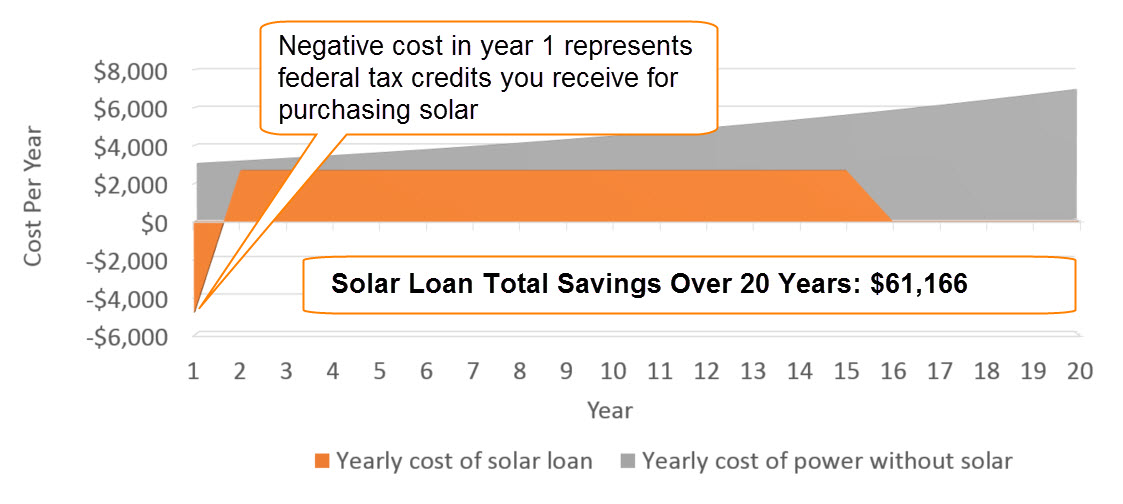

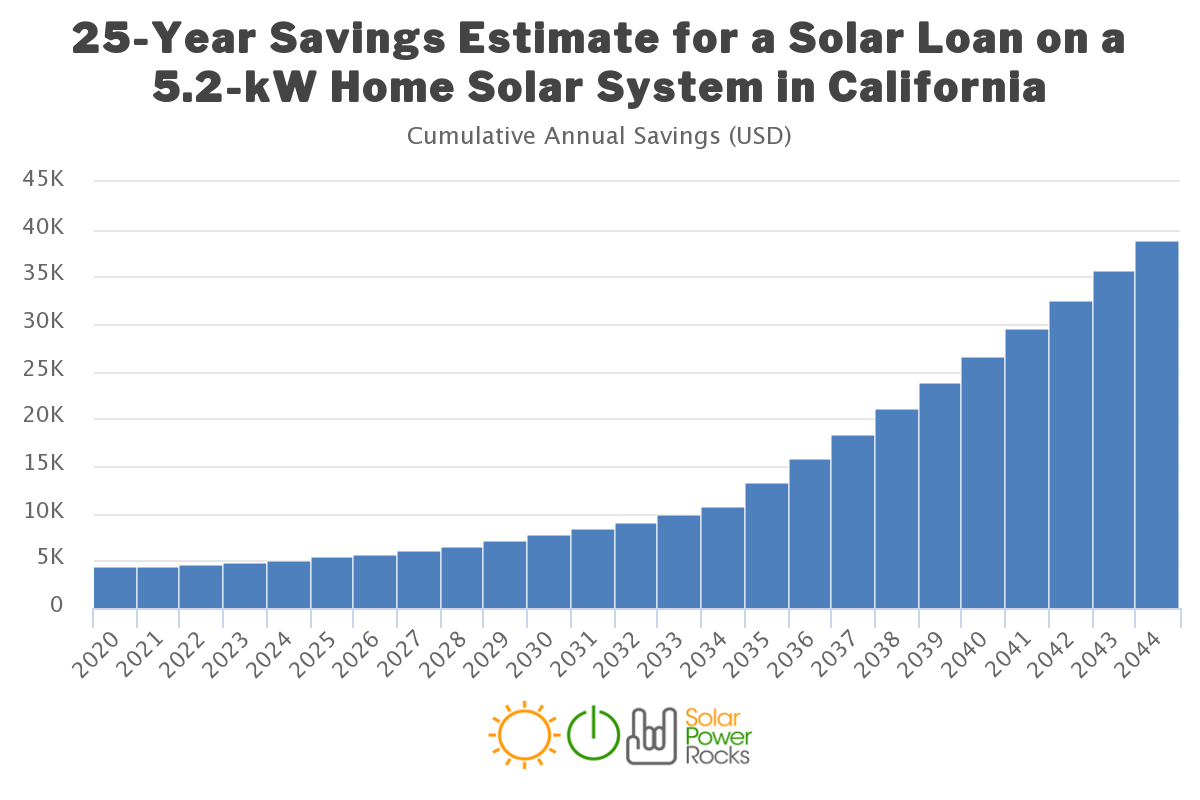

https://solarpowerrocks.com/wp-content/uploads/2017/12/5-kw-solar-loan-chart-CA.png

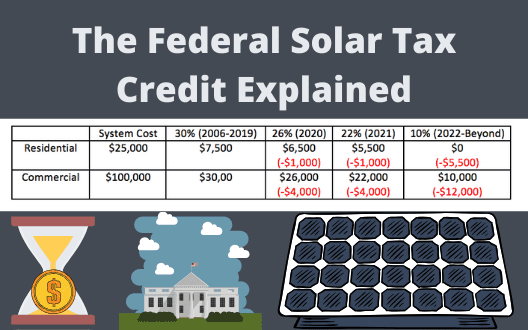

The Federal Solar Tax Credit Explained Sunshine Plus Solar

https://sunshineplussolar.com/wp-content/uploads/2020/05/The-Federal-Solar-Tax-Credit-Explained-2.png

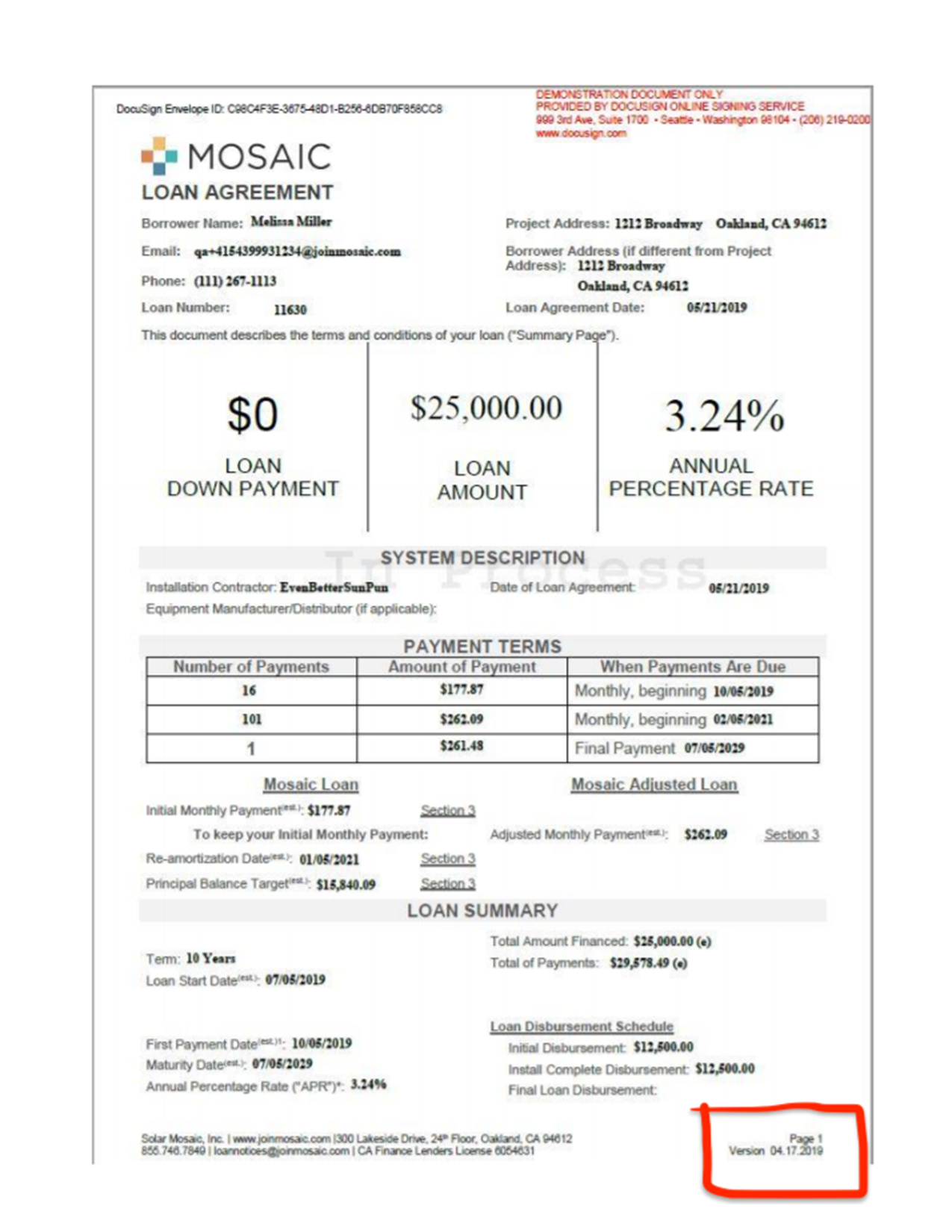

Solar Loans Re amortized After Rebates Solar Loan Consumer Lending

https://i.pinimg.com/originals/cd/8a/c8/cd8ac8c552a471d53bf0c936f64dac80.jpg

Web 8 sept 2023 nbsp 0183 32 The federal solar tax credit is a clean energy credit that you can claim on your federal returns This tax credit is not valued at a set dollar amount rather it s a percentage of what you spend to install a Web 13 juil 2023 nbsp 0183 32 The solar investment tax credit ITC also called the federal solar tax credit allows qualifying property owners to get a tax credit for 30 of the cost to install a solar

Web 16 ao 251 t 2022 nbsp 0183 32 So if your all in solar cost is 25 000 your federal solar tax credit would be worth 7 500 If you spend 75 000 on solar and battery your tax credit would be worth 22 500 The only requirements to use Web 20 juin 2023 nbsp 0183 32 The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax

Download Solar Loan With Fed Rebate Worth It

More picture related to Solar Loan With Fed Rebate Worth It

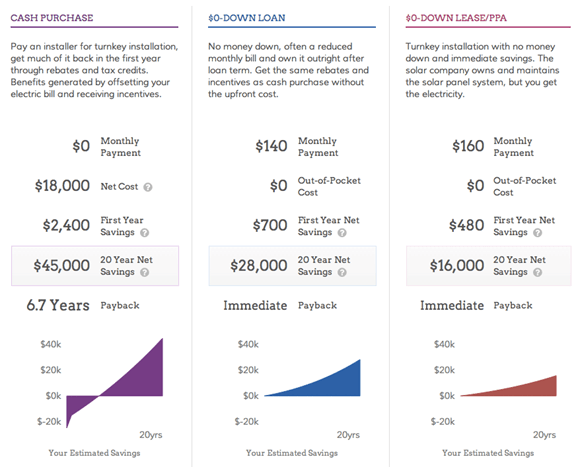

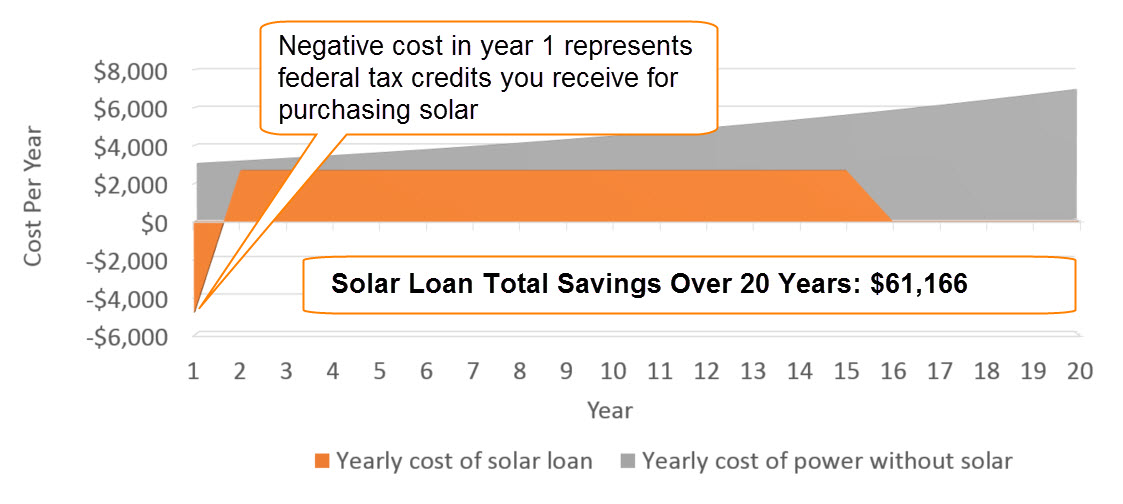

Solar Loans The Best Of Both Worlds Solar News

http://blog.energysage.com/wp-content/uploads/2014/03/solar-loan-comp-chart.png

Green Loans Go Solar With No Upfront Cost

https://cdn11.bigcommerce.com/s-3nrr5bfo5i/product_images/uploaded_images/solar-loan-example.png

Pin On Solar Power Info graphics

https://i.pinimg.com/originals/28/9a/86/289a86f8e3a3f535e2fa5b854752b4fb.png

Web Rebate from My Electric Utility to Install Solar Under most circumstances subsidies provided by your utility to you to install a solar PV system are excluded from income Web In a re am solar loan borrowers are allowed a free one time reamortization to accomodate the solar tax credit although the money for the lump payment can come from anywhere and at anytime Elsewhere in the

Web 26 avr 2023 nbsp 0183 32 A calculator A pencil Form 1040 is the standard federal income tax form But this year you get to fill in a few extra boxes to reduce your tax bill How to Calculate Your Solar Tax Credit Calculating the Web 23 f 233 vr 2023 nbsp 0183 32 The federal government provides a 30 tax credit for those who purchase and install a solar panel system between 2022 and 2032 The credit will decrease to

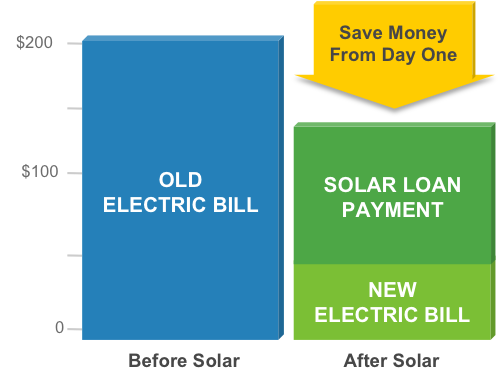

Solar Loans How Do They Work

https://solar-to-the-people.com/wp-content/uploads/2015/02/Solar-Loan-Savings-Example.jpg

Solar Rebates Are They Worth The Time And Effort

https://off-grid-living.com/wp-content/uploads/2016/05/5-1.jpg

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer

QLD GOVERNMENT SOLAR INTEREST FREE LOANS BATTERY REBATE INCENTIVE1

Solar Loans How Do They Work

Solar Borrowing 101 Loans Are Not Always What They Seem

The 5 Best Ways To Finance Solar Panels For Your Home From Solar Loans

SunPower Rebate Form

How To Claim The Federal Solar Tax Credit SAVKAT Inc

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Solar Rebates Renewable Energy Incentives For California AltE

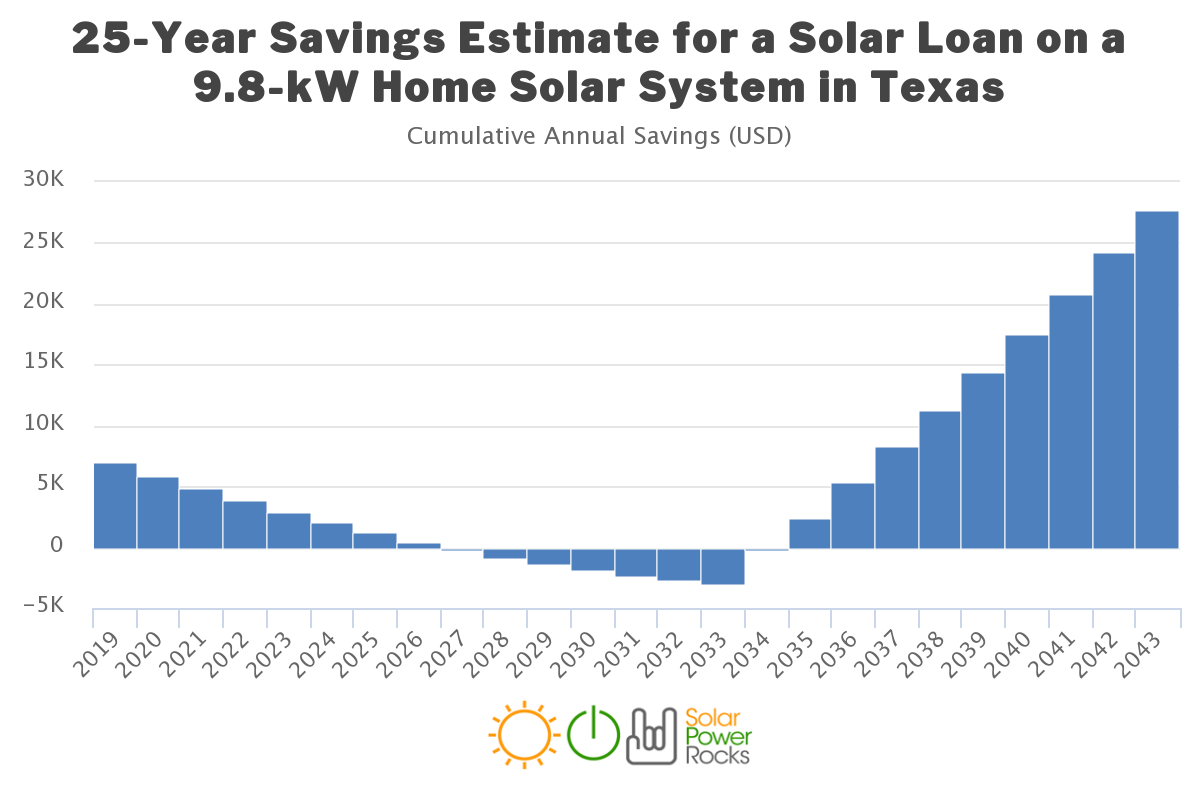

Solar Rebates Renewable Energy Incentives For Texas AltE

Solar Victoria Panel Rebate Find Out If You re Eligible Grow Energy

Solar Loan With Fed Rebate Worth It - Web 13 juil 2023 nbsp 0183 32 The solar investment tax credit ITC also called the federal solar tax credit allows qualifying property owners to get a tax credit for 30 of the cost to install a solar