Solar Panel Rebate Income Limit Web the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit For example if your solar PV system was installed before

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would Web 26 juil 2023 nbsp 0183 32 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a

Solar Panel Rebate Income Limit

Solar Panel Rebate Income Limit

https://web.archive.org/web/20190329204324/https://saegroup.com.au/wp-content/uploads/2015/07/Rebate-end1.jpg

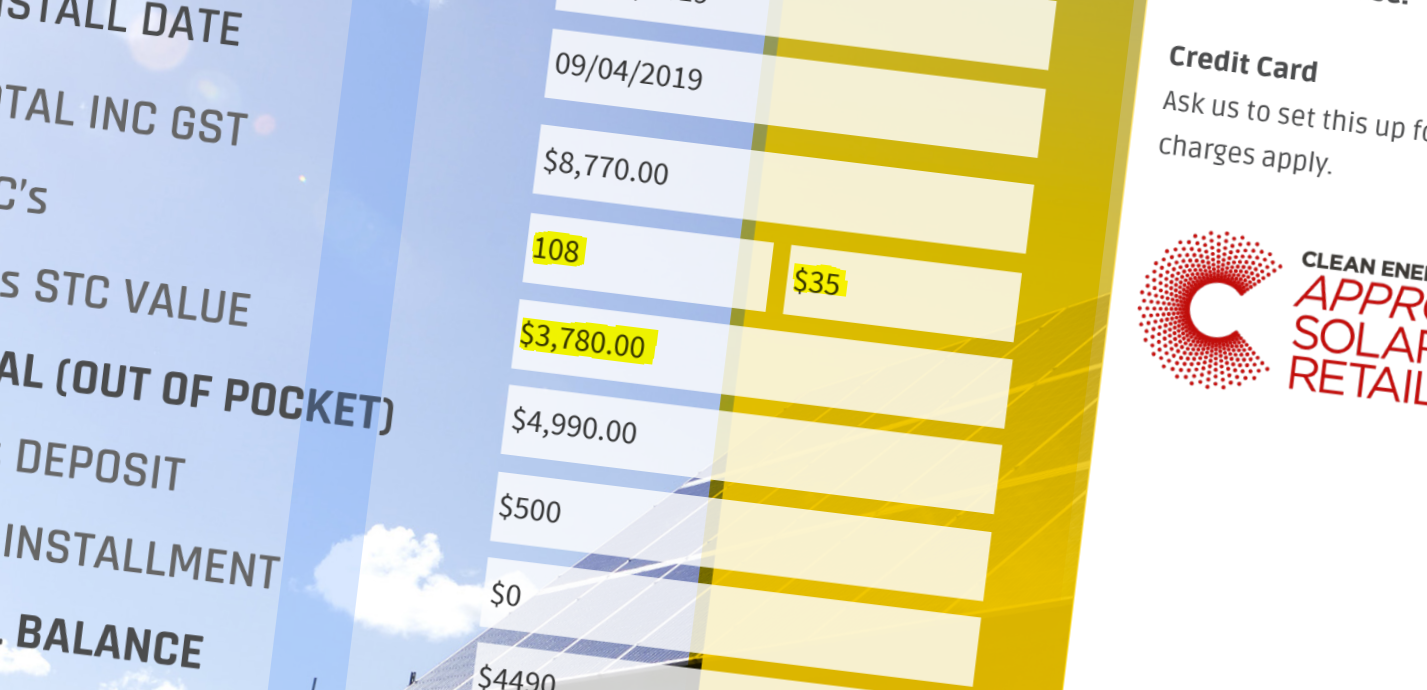

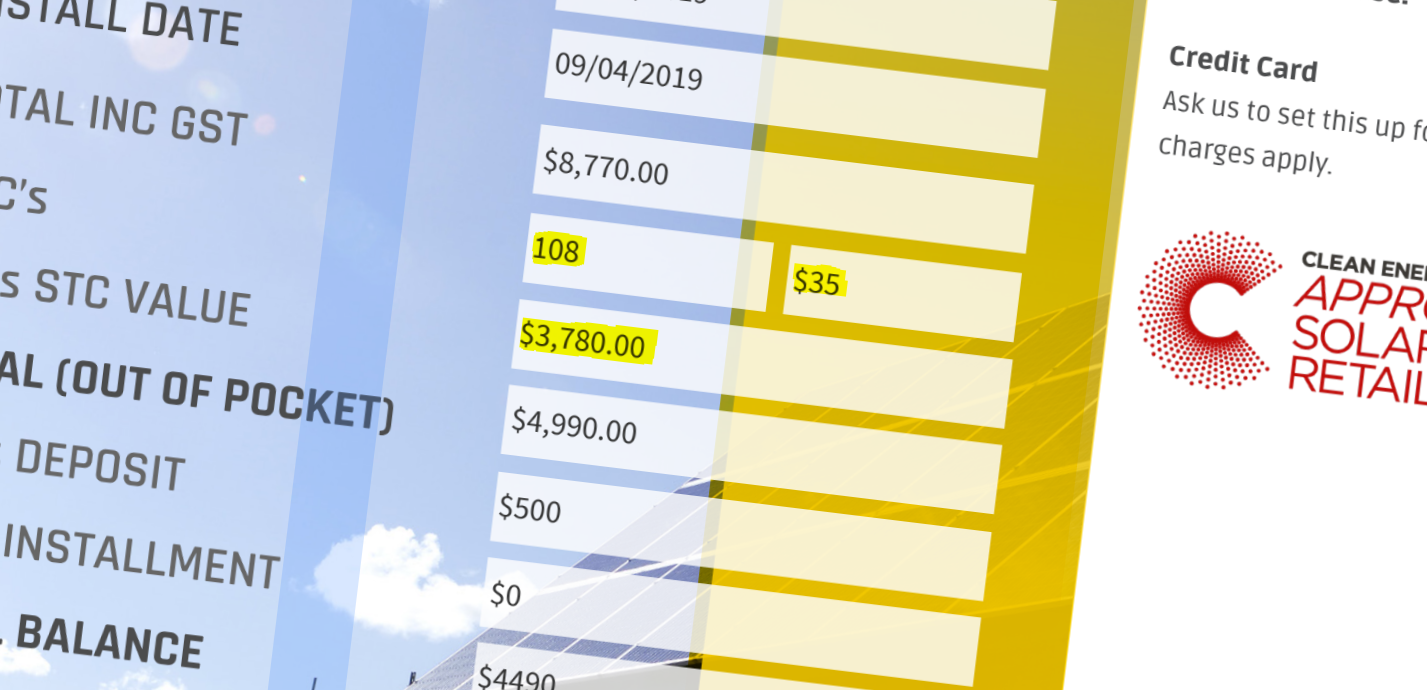

Your MAXIMUM Solar Rebate Perth WA Subsidy Ultimate Guide

https://perthsolarwarehouse.com.au/wp-content/uploads/2019/04/Solar-Panels-Perth-WA-Rebate-PSW.png

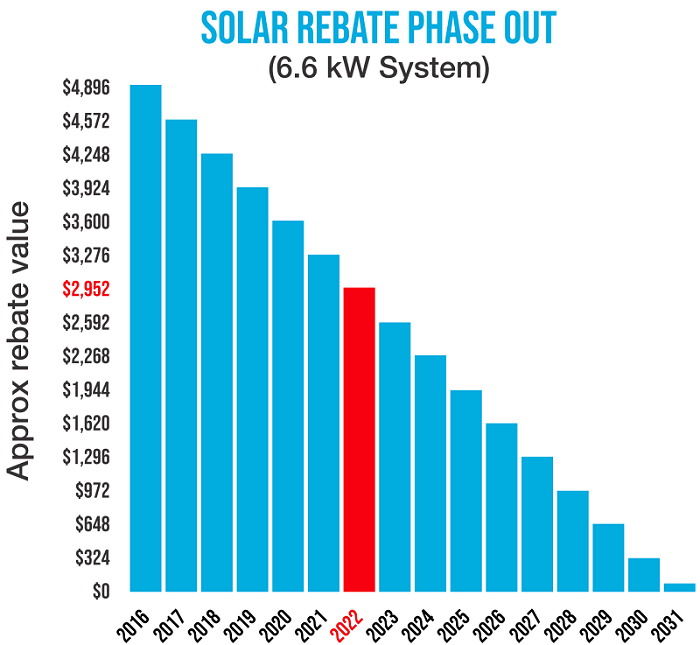

The Great Australian Solar Panel Rebate Phase Out 2020 Venergy Australia

https://venergyaustralia.com.au/wp-content/uploads/2021/03/solar_rebate_phase_out.jpg

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing Web 12 sept 2023 nbsp 0183 32 Learn about the federal solar tax credit by state if you qualify and how to apply Discover how you can maximize savings and benefit from the solar tax credit for

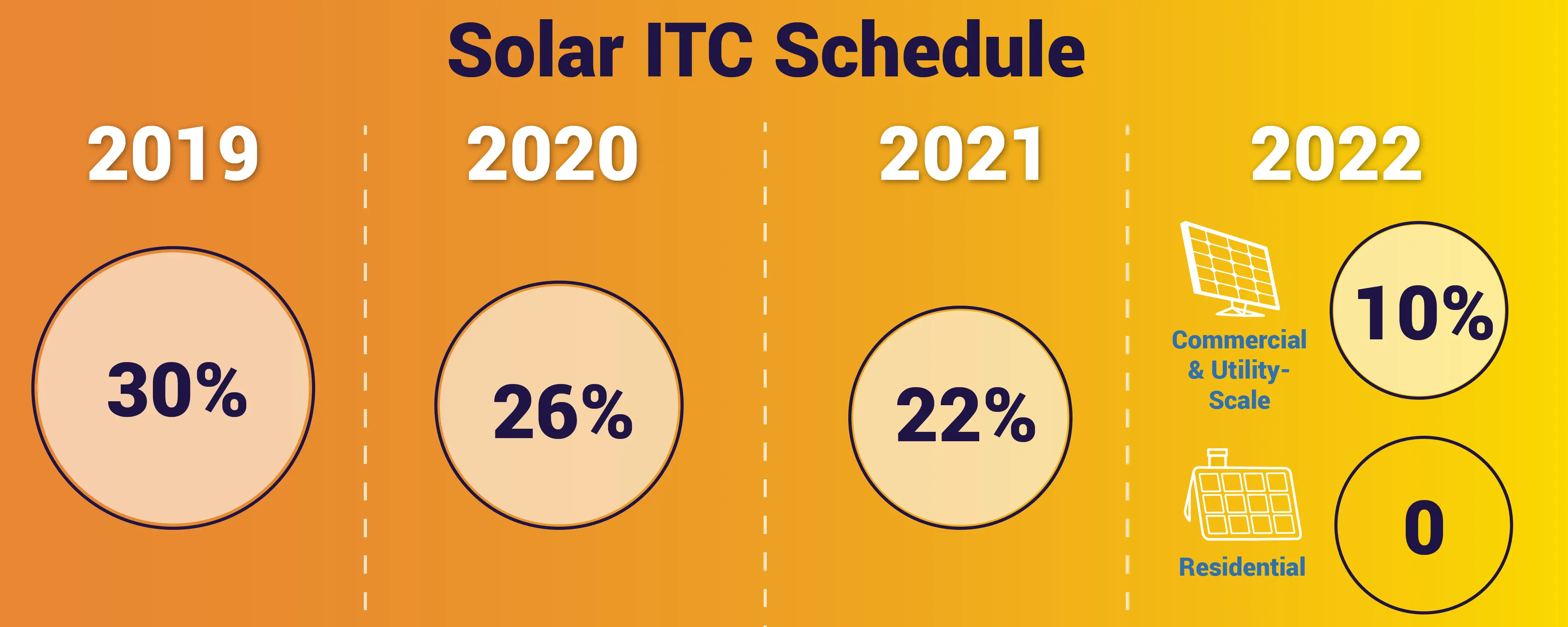

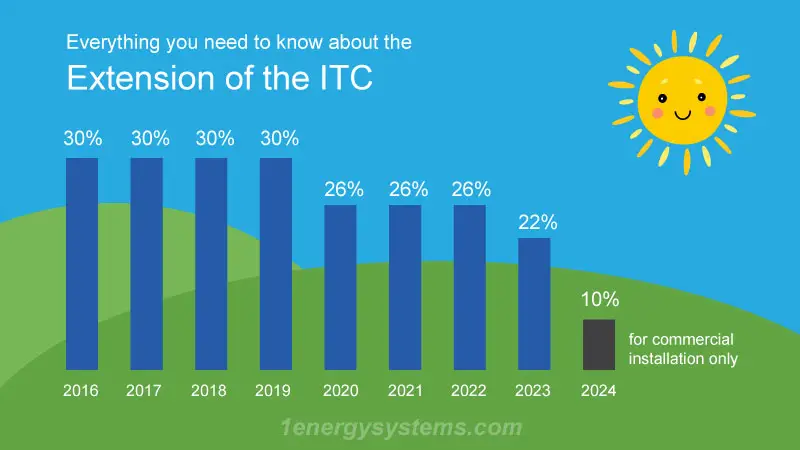

Web 1 ao 251 t 2023 nbsp 0183 32 The solar panel tax credit for 2023 taxes filed in 2024 is 30 of eligible costs It will remain at 30 for the tax year 2023 through 2032 It will remain at 30 for the tax year 2023 through 2032 Web 3 janv 2023 nbsp 0183 32 The investment tax credit ITC also known as the federal solar tax credit allows you to apply 30 percent of your solar energy system s cost as a credit to your

Download Solar Panel Rebate Income Limit

More picture related to Solar Panel Rebate Income Limit

Federal Government Solar Tax Credit KnowYourGovernment

https://www.knowyourgovernment.net/wp-content/uploads/solar-panel-rebates-solar-tax-incentives-greenlight.png

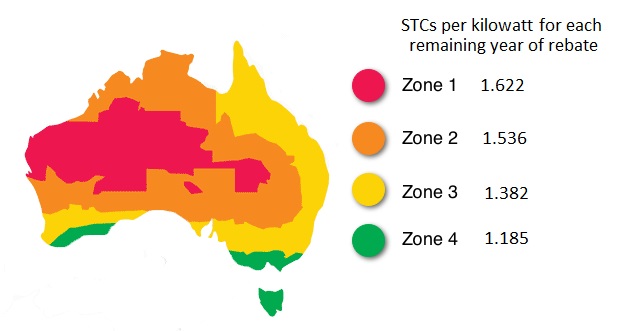

Solar Panel Rebate To Be Phased Out From 1st Of January 2017 Solar

https://www.solarquotes.com.au/blog/wp-content/uploads/2016/04/Zones-and-STCs-per-kilowatt-per-remaining-year-of-solar-rebate.jpg

Texas Solar Power For Your House Rebates Tax Credits Savings

https://i.pinimg.com/originals/68/9d/be/689dbefd7887b93edc4d0b9fde157e7d.png

Web 6 juin 2023 nbsp 0183 32 The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of Web General Overview of the Energy Efficient Home Improvement Credit Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As

Web 8 sept 2022 nbsp 0183 32 The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed Web Breaker box 4 000 limit Electric wiring 2 500 limit Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

https://blog.solarinstallguru.com/wp-content/uploads/2016/12/Federal_Solar_Tax_Credit_and_solar_rebates_Can_Slash_Solar_Panel_Installation_Cost_by_30_to_80_Percent.png

Average Cost Of Solar Panels In Canada Updated 2018

https://solarpanelpower.ca/wp-content/uploads/2018/04/Solar-Power-Rebates-and-Tax-Credits-Canada.jpg

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit For example if your solar PV system was installed before

https://www.energy.gov/eere/solar/homeown…

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would

Solar Panel Rebates And Incentives A Comprehensive Guide

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits

Solar 101 A Guide To Buying Solar Power Systems

Solar Panel Rebate How It Works And How To Get It

Solar Panel Rebates Money Done Right

Solar Panel Rebates Money Done Right

2018 Guide To West Virginia Home Solar Incentives Rebates And Tax

2019 Texas Solar Panel Rebates Tax Credits And Cost

Solar Panel Deals Rebates And Incentives In Australia Solar Market

Solar Panel Rebate Income Limit - Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property