Solar Panel Tax Credit 2023 Form Use this form to claim the residential clean energy credit for installing solar panels fuel cells or other qualified property Enter the costs addresses and capacities of the

Learn how to claim a 30 tax credit for solar panels and other clean energy property installed in 2022 2032 Find out who qualifies what expenses are eligible and how Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into

Solar Panel Tax Credit 2023 Form

Solar Panel Tax Credit 2023 Form

https://www.solarreviews.com/content/images/blog/5695image6.png

Puget Sound Solar LLCClaim Your Federal Tax Credits For Solar Puget

https://pugetsoundsolar.com/wp-content/uploads/2021/04/2020-Solar-Federal-Tax-Credit-form-is-26.jpg

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

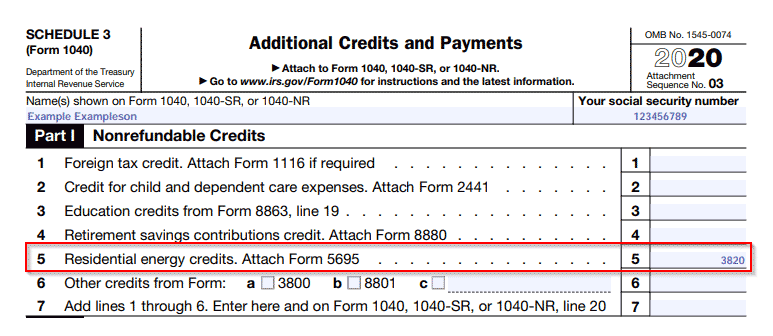

You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar Form 5695 calculates tax credits for various qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind turbines and fuel cells We ll

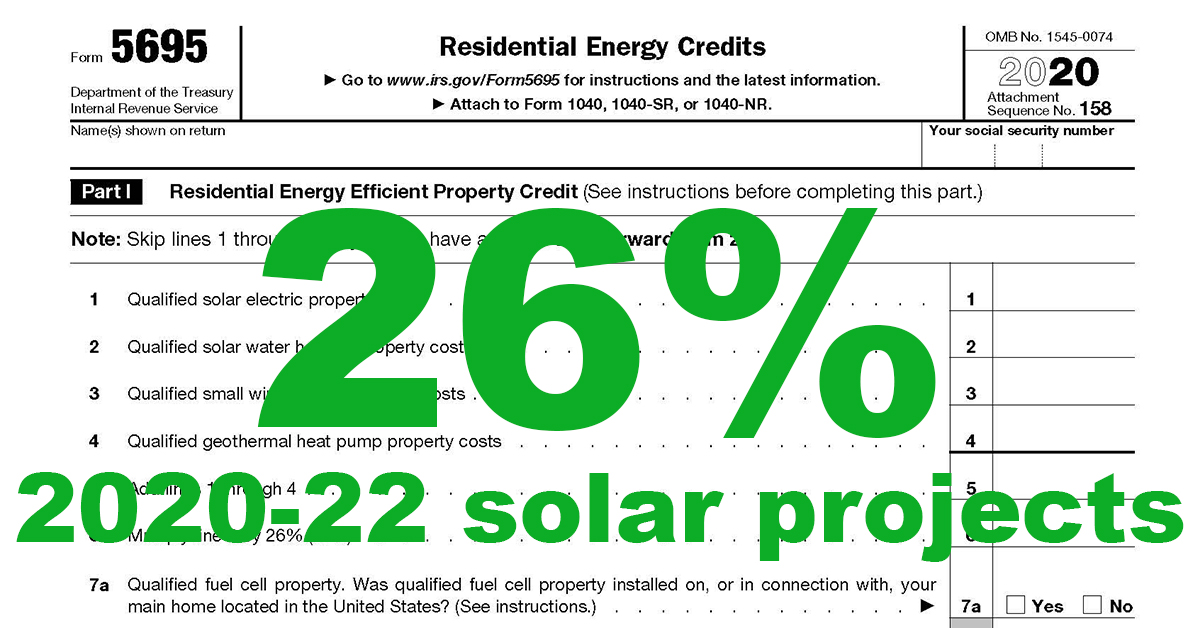

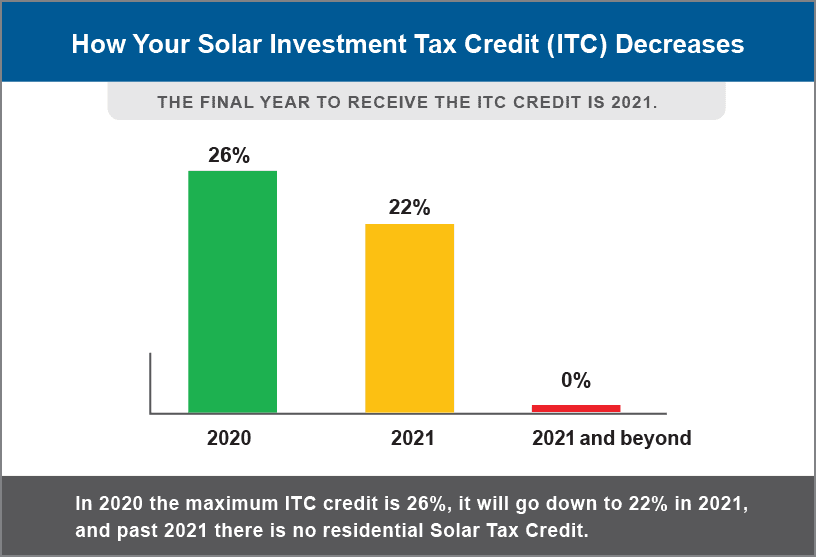

Step by step instructions on how to fill out IRS Form 5695 to claim the Solar Investment Tax Credit on your federal taxes and get the savings you deserve In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for

Download Solar Panel Tax Credit 2023 Form

More picture related to Solar Panel Tax Credit 2023 Form

Momentum Solar Jobs Salary Sindy Saxon

https://www.ecowatch.com/wp-content/uploads/2022/04/federal-solar-tax-credit-tips-1.jpg

Understanding Tax Credits For Solar Energy Systems

https://thenewutility.com/wp-content/uploads/2016/11/solar-tax-credits-1024x384.jpg

Solar Energy Tax Credits By State MD NJ PA VA DC FL

https://www.solarenergyworld.com/wp-content/uploads/2020/08/ITC-decrease-chart.png

Step by step instructions for using IRS Form 5695 to claim the 30 federal solar tax credit The solar panel tax credit also known as the Investment Tax Credit ITC is a federal incentive that rewards homeowners for installing solar energy systems on their

Download IRS Form 5695 to file as part of your tax return On Part I of the tax form calculate the credit You ll file your solar system as qualified solar electric property costs So on line You will need four IRS tax forms plus their instructions to file for your solar panel tax credit Form 1040 standard federal income tax form Schedule 3 Form 1040

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGGUgZShlMA8=&rs=AOn4CLD0u4VMgupTPJWuWOaZRVksaroCPw

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/12/solar-tax-credit-2023-1024x576.png

https://www.irs.gov/pub/irs-pdf/f5695.pdf

Use this form to claim the residential clean energy credit for installing solar panels fuel cells or other qualified property Enter the costs addresses and capacities of the

https://www.irs.gov/credits-deductions/residential...

Learn how to claim a 30 tax credit for solar panels and other clean energy property installed in 2022 2032 Find out who qualifies what expenses are eligible and how

A Guide To The Solar Panel Tax Credit In 2023 Lifestyle Design By Sully

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Solar Panel Roof Tax Credits How To Get The Most Benefit 2023

Irs Solar Tax Credit 2022 Form

Is There A Tax Credit For Solar Panels 2023 Rules Reward

How To Claim Your Solar Panel Tax Credit In 2023 Solar Optimum

How To Claim Your Solar Panel Tax Credit In 2023 Solar Optimum

How To Get Residential Solar Panel Tax Credits In New Jersey

Are Solar Panels Tax Credits Real

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Solar Panel Tax Credit 2023 Form - The 2023 solar tax credit applicable for taxes filed in 2024 provides financial incentives to make solar installations more accessible and affordable for