Solar Panel Tax Rebate 2024 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

Solar Panel Tax Rebate 2024

Solar Panel Tax Rebate 2024

https://solariaenergysolutions.com/wp-content/uploads/2022/09/solar-panel-roof.jpeg

More Clarity Needed On Tax Incentive For Solar Panels

https://media.citizen.co.za/wp-content/uploads/2023/02/Solar-panel-tax-rebate-2023-Budget-speech.jpg

Nearing Expiration Idaho Solar Panel Tax Credit Update 2022 SiteReportCard

https://www.sitereportcard.com/wp-content/uploads/2022/06/solar-tax-credits-2022-1536x1024.jpeg

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit However starting in 2022 those who installed new solar panels or invested in an off site community solar project could get a tax credit of up to 30 percent through the Residential Clean Energy

The tax credit is designed to step down to 26 in 2033 22 in 2034 then settle at a permanent rate of 10 for commercial solar installations and will be eliminated for homes starting on January 1st 2035 Learn more The federal solar tax credit explained State tax credits Several states also offer tax credits for solar power An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

Download Solar Panel Tax Rebate 2024

More picture related to Solar Panel Tax Rebate 2024

SOLAR PANEL TAX INCENTIVE FOR INDIVIDUALS SD Management Accounting

https://sdmanagement.co.za/wp-content/uploads/2023/04/SOLAR-PANEL-TAX-INCENTIVE-FOR-INDIVIDUALS-768x576.jpg

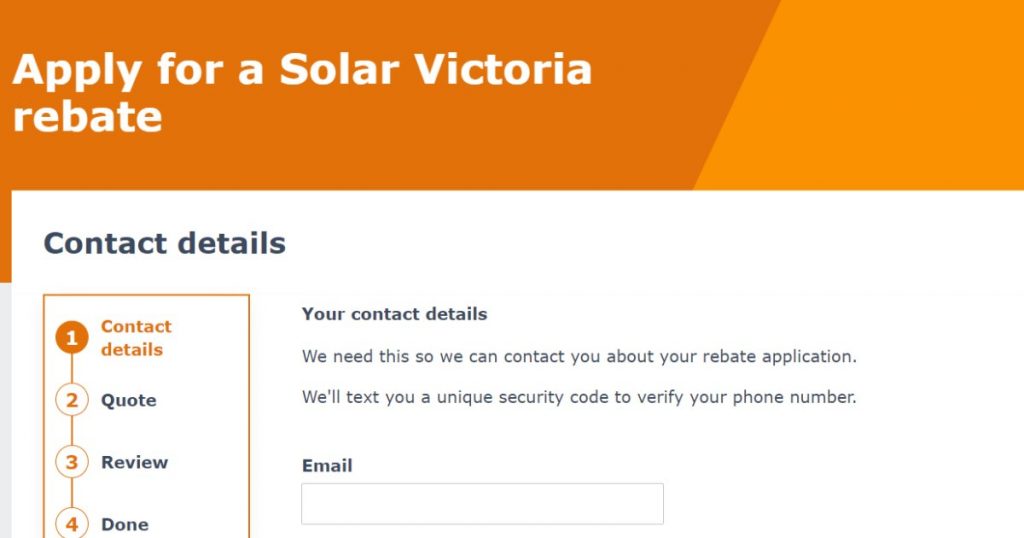

Victoria Solar Panel Rebate Signup To Be Simplified Solar Quotes Blog

https://www.solarquotes.com.au/blog/wp-content/uploads/2020/02/solar-rebate-identification-1024x538.jpg

Federal Solar Tax Credit Solar Panel Tax Credit Solar Energy Credit

https://thegreensolarenergy.com/wp-content/uploads/2021/01/97667867867.jpg

The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar

Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs How to Claim Your Solar Tax Credit in 2024 To claim your solar tax credit first your solar installation should be completed Next you will need to fill out the IRS Form 5695 while completing your taxes When filling out the form you can calculate the total value of your solar tax credit

Applying For A Solar Panel PV Rebate Post Puff

https://www.postpuff.com/wp-content/uploads/2022/10/solar-rebate-Melbourne.jpg

Solar Victoria Panel Rebate Find Out If You re Eligible Grow Energy

https://growenergy.com.au/assets/media/Solar-Homes-Fact-Sheet-Homes-PV-Rebate.PNG

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of

Made In USA Treasury Details Solar Panel Tax Credits NTD

Applying For A Solar Panel PV Rebate Post Puff

How To Apply For A Rebate On Your Solar Panels REenergizeCO

At 30 Solar Panel Tax Credits Are At A High Point For Now The New York Times

What The Solar Tax Rebate Means For Your Small Business

Solar Panel Rebate Melbourne Government Rebate Solar Panels

Solar Panel Rebate Melbourne Government Rebate Solar Panels

When Does Solar Tax Credit End SolarProGuide 2022

Solar Panel Rebate How It Works And How To Get It

Another Victorian Solar Panel Rebate Reduction Looms

Solar Panel Tax Rebate 2024 - Overview There are two tax credits available for businesses and other entities like nonprofits and local and tribal governments that purchase solar energy systems see the Homeowner s Guide to the Federal Tax Credit for Solar Photovoltaics for information for individuals The investment tax credit ITC is a tax credit that reduces the federal income tax liability for a percentage of the