Solar Panels Rebates On pr 233 f 232 re vous pr 233 venir aucun panneau solaire n est gratuit Mais on vous rassure il existe tout de m 234 me des aides financi 232 res fiables et avantageuses Cela vaut la peine Afficher plus

Web 4 ao 251 t 2023 nbsp 0183 32 Some of the friendliest states for solar include New York Rhode Island Iowa Connecticut and Maryland Visit the EnergySage Marketplace to compare multiple quotes from vetted solar installers Major solar rebates and solar incentives Investment tax credits State tax credits Cash rebates Net metering Solar renewable energy credits SRECs Web 7 ao 251 t 2018 nbsp 0183 32 Le tarif de rachat photovolta 239 que est int 233 ressant en 2023 pour les reventes de sur plus de production il est sup 233 rieur au prix de march 233 de l 233 lectricit 233 Un contrat de vente de 20 ans entre EDF Obligation d Achat EDF OA et le particulier peut 234 tre mis en place La revente d 233 lectricit 233 photovolta 239 que g 233 n 232 re des revenus

Solar Panels Rebates

Solar Panels Rebates

https://breaze.org.au/images/19/Solar Rebate June 2019 Poster FB.png

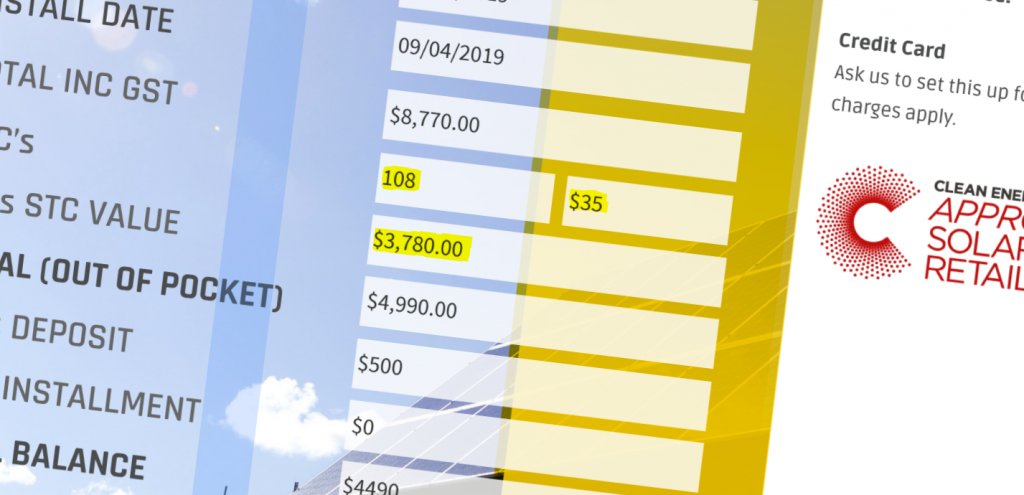

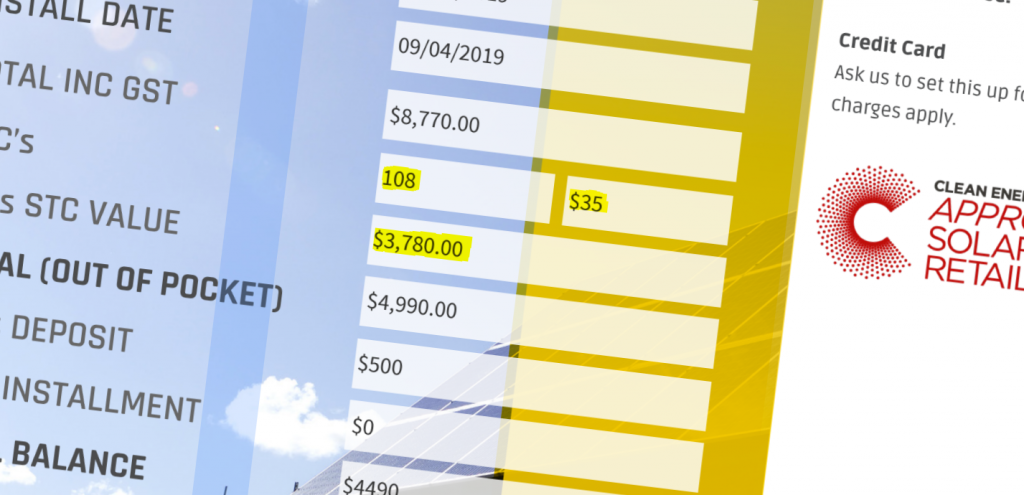

Your MAXIMUM Solar Rebate Perth WA Subsidy Ultimate Guide

https://perthsolarwarehouse.com.au/wp-content/uploads/2019/04/Solar-Panels-Perth-WA-Rebate-PSW-1024x495.png

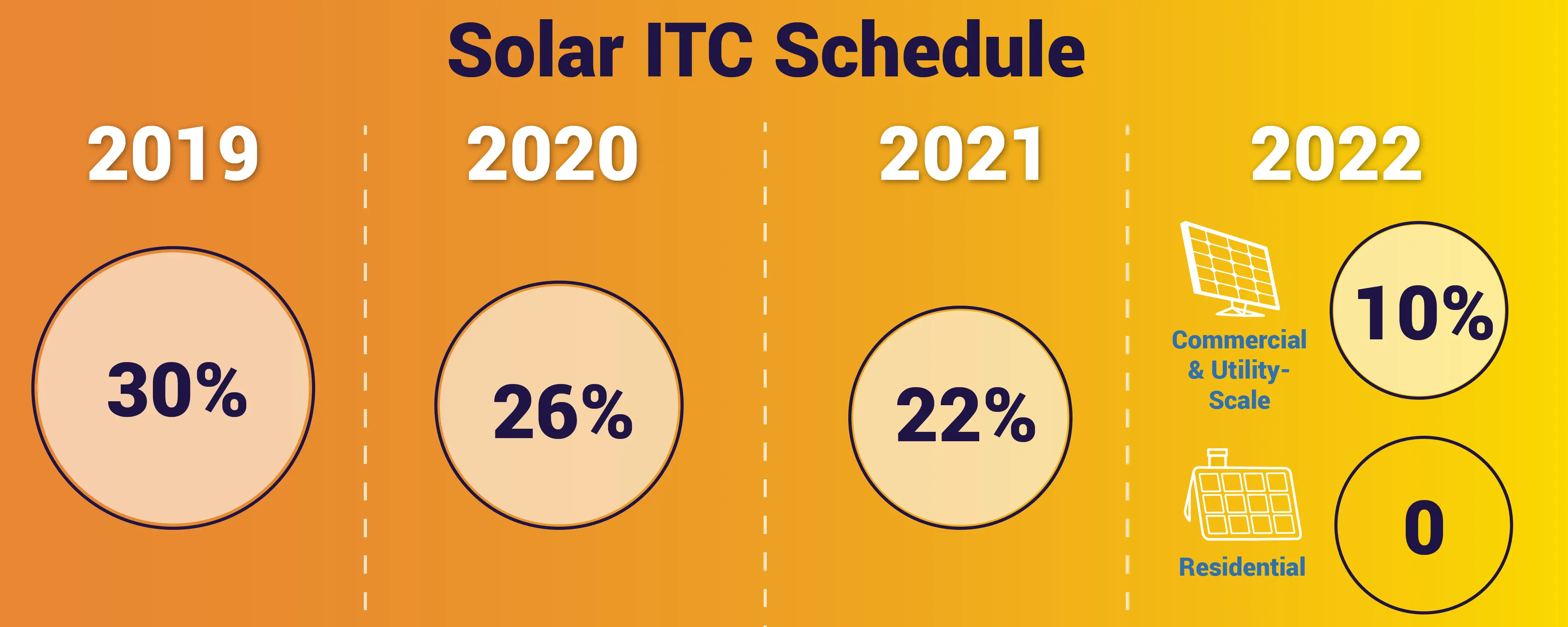

Federal Government Solar Tax Credit KnowYourGovernment

https://www.knowyourgovernment.net/wp-content/uploads/solar-panel-rebates-solar-tax-incentives-greenlight.png

Web 12 mai 2023 nbsp 0183 32 Sales and property tax exemptions Businesses may also be able to access certain incentives including tax breaks for going solar In some places homeowners and businesses may be able to offset the cost of going solar and reduce the payback period through net metering and performance based initiatives Go solar at home Web First some basic terms Solar Incentives Incentives provided to a homeowner or business installing solar by a government agency or utility in order to accelerate solar adoption Rebates A one time incentive for solar installations offered by utilities and or government agencies

Web 8 sept 2022 nbsp 0183 32 The ITC will cut the cost of installing rooftop solar for a home by 30 or more than 7 500 for an average system By helping Americans get solar on their roofs these tax credits will help millions more families unlock an additional average savings of 9 000 on their electricity bills over the life of the system Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar

Download Solar Panels Rebates

More picture related to Solar Panels Rebates

Pin On Solar Power Info graphics

https://i.pinimg.com/originals/28/9a/86/289a86f8e3a3f535e2fa5b854752b4fb.png

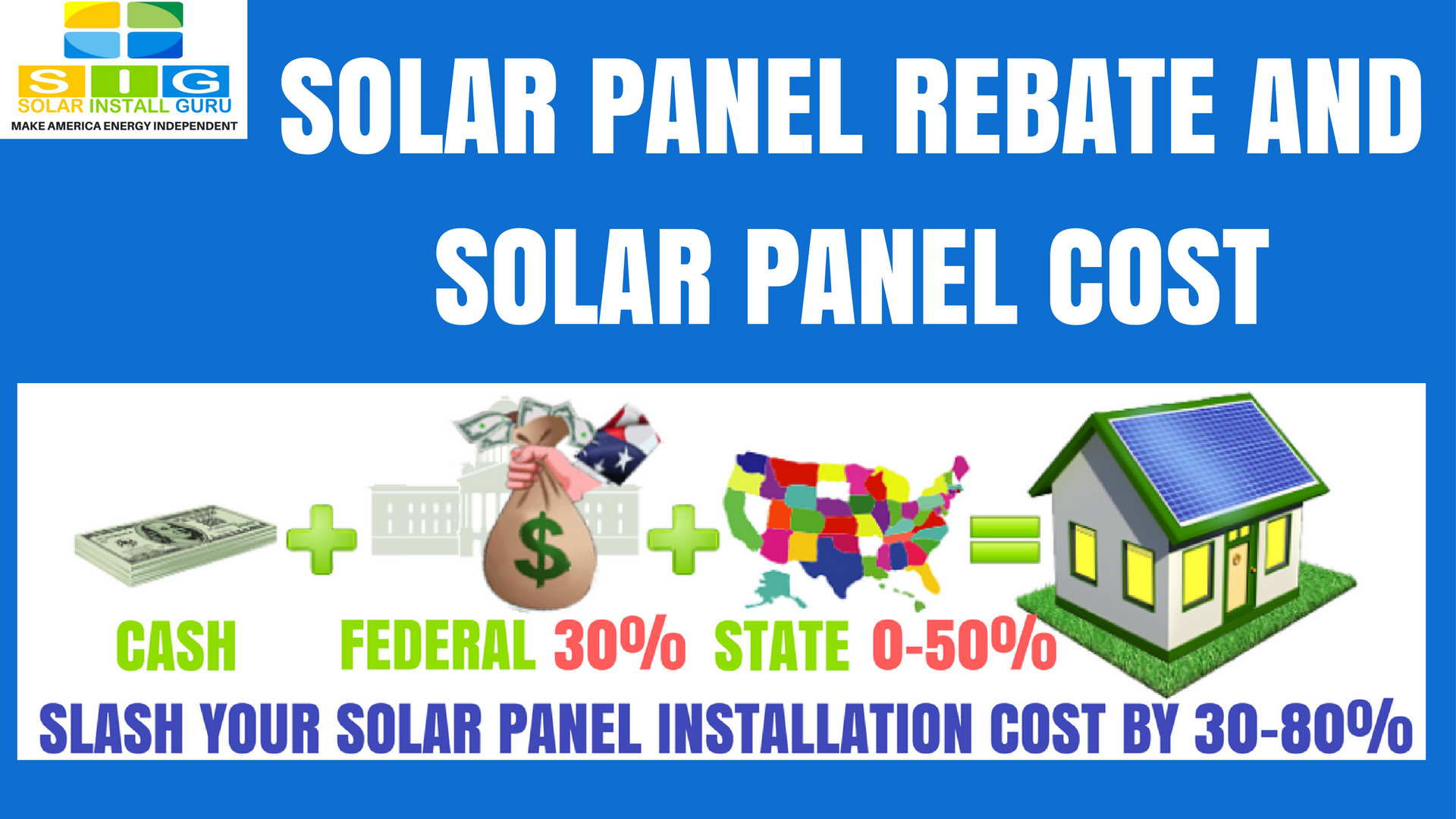

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

https://blog.solarinstallguru.com/wp-content/uploads/2016/12/Federal_Solar_Tax_Credit_and_solar_rebates_Can_Slash_Solar_Panel_Installation_Cost_by_30_to_80_Percent.png

2019 Texas Solar Panel Rebates Tax Credits And Cost

https://www.solarpowerrocks.com/wp-content/uploads/2018/12/TX-rebates-ring.png

Web 28 ao 251 t 2023 nbsp 0183 32 How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 Web If you are currently pending installation or in the process of getting binding quotes on solar you ll be eligible for the current 26 and the additional 4 for a total of 30 once the legislation passes That s an extra 1 000 on a 25 000 project Make sure to consult your tax professional regardless

Web Installing solar panels can be financially rewarding due to federal and state incentives such as the Solar Investment Tax Credit rebates and performance based incentives To maximize savings homeowners should carefully follow the process of claiming the federal solar tax credit and research available state specific incentives Web 1 sept 2023 nbsp 0183 32 solar photovoltaic PV panels wind turbines hydro systems solar water heaters and air source heat pumps Owners have 2 options for receiving benefit for their STCs Assigning them to an agent usually the system installer in exchange for a discount or delayed cash payment Selling the certificates themselves

2020 Guide To Solar Panels In Maryland Solar Tax Credits SRECs More

https://www.solarpowerrocks.com/wp-content/uploads/2020/01/2020-MD-solar-rebates--ranked.png

Denton Texas Solar Rebate Program Alba Energy

https://i1.wp.com/albaenergy.com/wp-content/uploads/2018/10/Denton-Texas-Solar-Panels-Rebate-Program.jpg?fit=900%2C471&ssl=1

https://terresolaire.com/Blog/rentabilite-photovoltaique/financement...

On pr 233 f 232 re vous pr 233 venir aucun panneau solaire n est gratuit Mais on vous rassure il existe tout de m 234 me des aides financi 232 res fiables et avantageuses Cela vaut la peine Afficher plus

https://www.energysage.com/local-data/solar-rebates-incentives

Web 4 ao 251 t 2023 nbsp 0183 32 Some of the friendliest states for solar include New York Rhode Island Iowa Connecticut and Maryland Visit the EnergySage Marketplace to compare multiple quotes from vetted solar installers Major solar rebates and solar incentives Investment tax credits State tax credits Cash rebates Net metering Solar renewable energy credits SRECs

Solar Panel Rebate And Solar Panel Cost SOLAR Install GURU Blog

2020 Guide To Solar Panels In Maryland Solar Tax Credits SRECs More

Texas Solar Power For Your House Rebates Tax Credits Savings

Solar Panel Rebate Victoria How It Works How To Claim

Solar Panel Rebate How It Works And How To Get It

Solar Panel Deals Rebates And Incentives In Australia Solar Market

Solar Panel Deals Rebates And Incentives In Australia Solar Market

Our Guide To The Government Solar Rebate WA IBreeze

CPS Energy Solar Rebate 2020 Wells Solar

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits

Solar Panels Rebates - Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar