Solar Panels Tax Rebate Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed

Solar Panels Tax Rebate

Solar Panels Tax Rebate

https://www.cnet.com/a/img/resize/4ded0ed813a5e958493599572031b603bb9a4d61/hub/2022/02/17/21bac0be-4b9a-4652-b864-ef0320c496b2/gettyimages-172263059.jpg?auto=webp&width=1200

What The Solar Tax Rebate Means For Your Small Business

https://media.citizen.co.za/wp-content/uploads/2023/03/small-business-solar.jpg

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy improvements

Web 27 avr 2023 nbsp 0183 32 Business incentive For businesses a 125 tax incentive applies in terms of section 12B of the Income Tax Act for new and unused energy assets such as wind Web 1 ao 251 t 2023 nbsp 0183 32 The solar panel tax credit for 2023 taxes filed in 2024 is 30 of eligible costs It will remain at 30 for the tax year 2023 through 2032

Download Solar Panels Tax Rebate

More picture related to Solar Panels Tax Rebate

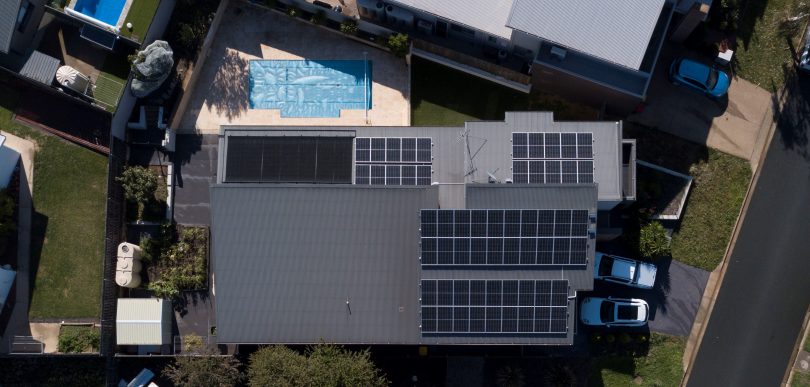

Solar Panels Tax Proposal Sends The Wrong Message About Regional

https://aboutregional.com.au/wp-content/uploads/2021/01/DJI_0223-810x387.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2023

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Leasing Solar Panels Tax Credit SolarProGuide

https://www.solarproguide.com/wp-content/uploads/tax-credit-decreases-soon-solar-energy-solutions.png

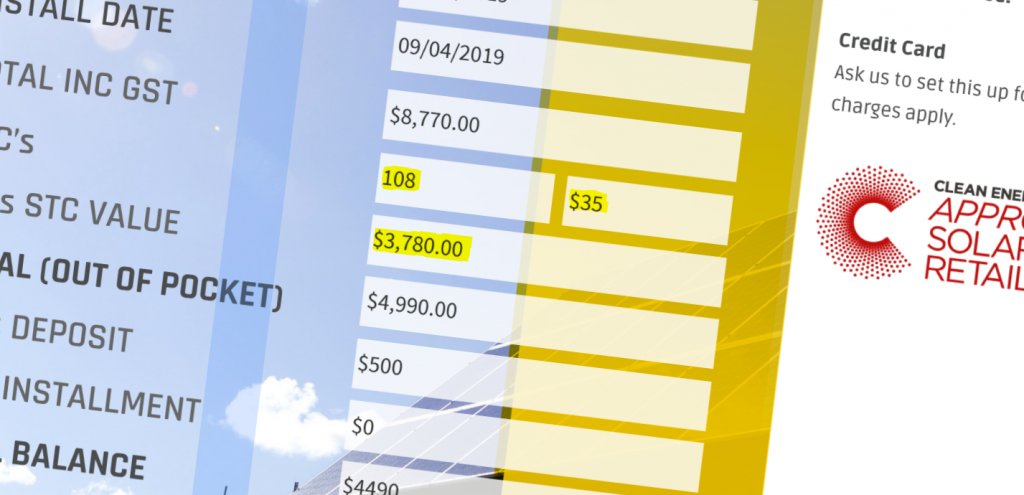

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC

Web 21 avr 2023 nbsp 0183 32 Solar systems installed before 2033 are eligible for a tax credit equal to 30 of the costs of installing solar panels A 20 000 solar system would receive a tax credit of 6 000 to what you owe in federal Web 7 ao 251 t 2023 nbsp 0183 32 Getty Images Installing your own solar power system can be an intimidating process especially for your wallet Adding one to your home is a significant

Solar Rebate 2023 Your Ultimate Guide To Australia Read Now

https://rescomsolar.com.au/wp-content/uploads/2022/12/solar-panels-save-money-scaled-1.jpeg

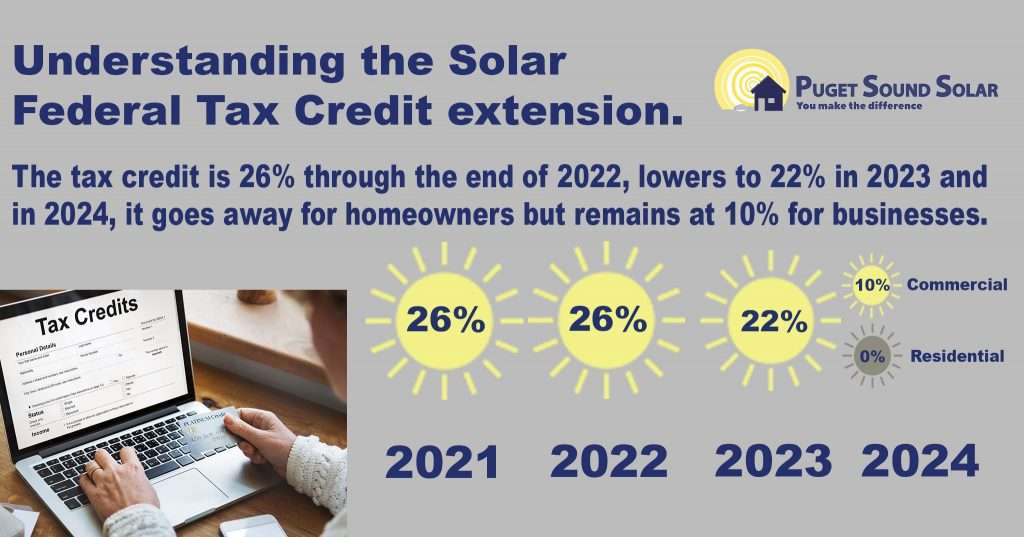

Are There Tax Credits For Solar Panels TaxesTalk

https://www.taxestalk.net/wp-content/uploads/understanding-the-federal-solar-tax-credit-changes-in-2021.jpeg

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Solar Energy Review Page Midiaesportiva

Solar Rebate 2023 Your Ultimate Guide To Australia Read Now

These 7 States Have The Best Tax Incentives For Solar Panels CNET

Let s Shine Some Light On The Tax Relief Available On Solar Panels

The Solar Investment Tax Credit Extension And Tax Exempt Entities

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Is There A California Tax Credit For Solar Panels Enlightened Solar

Your MAXIMUM Solar Rebate Perth WA Subsidy Ultimate Guide

Solar Panels Tax Credit 2021 Irs SolarProGuide

Solar Panels Tax Rebate - Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy improvements