Solar Rebate Tax Form Web 28 ao 251 t 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may

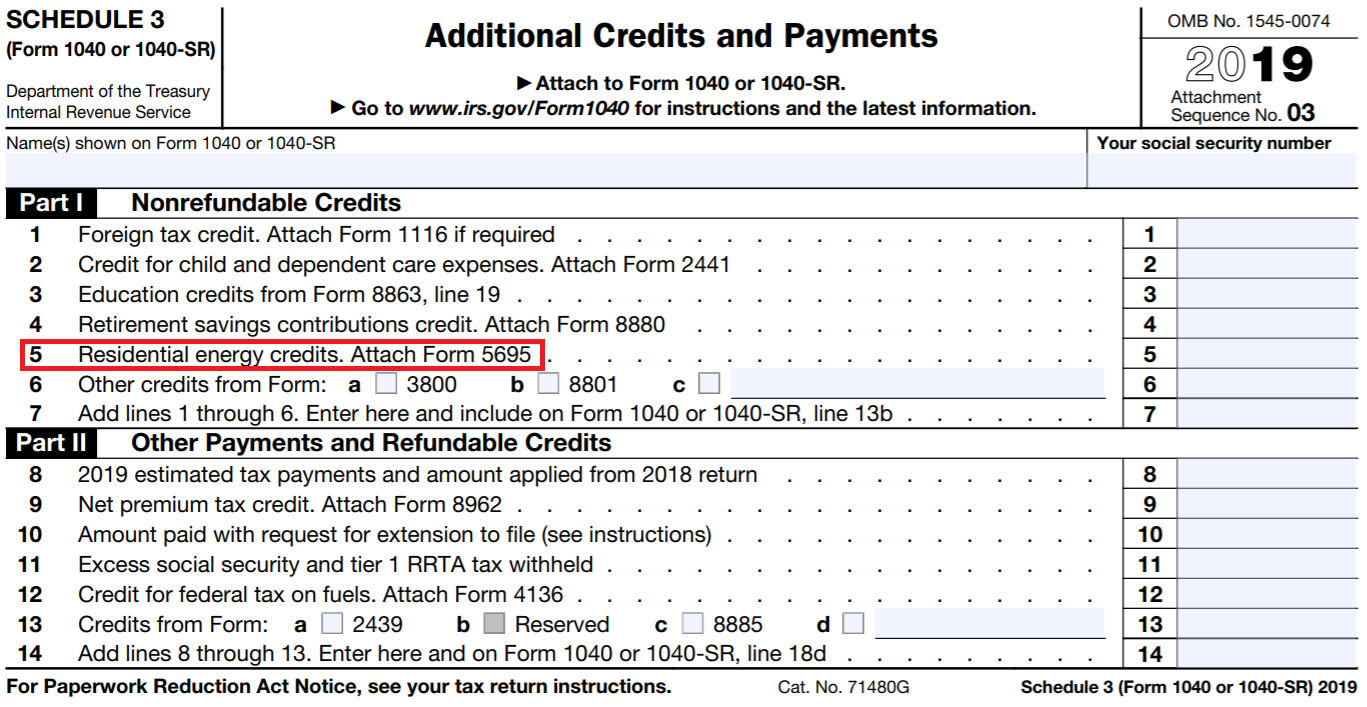

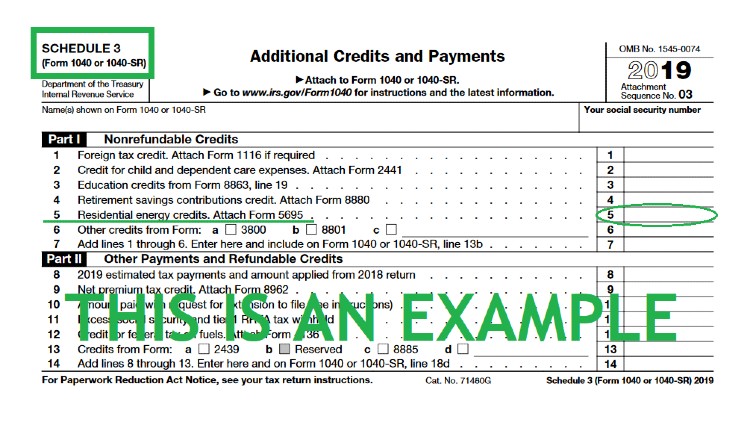

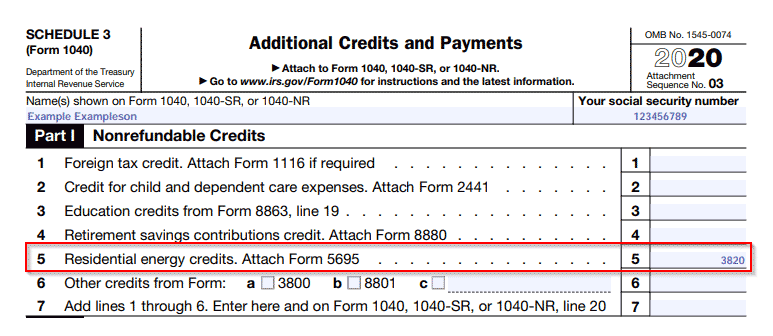

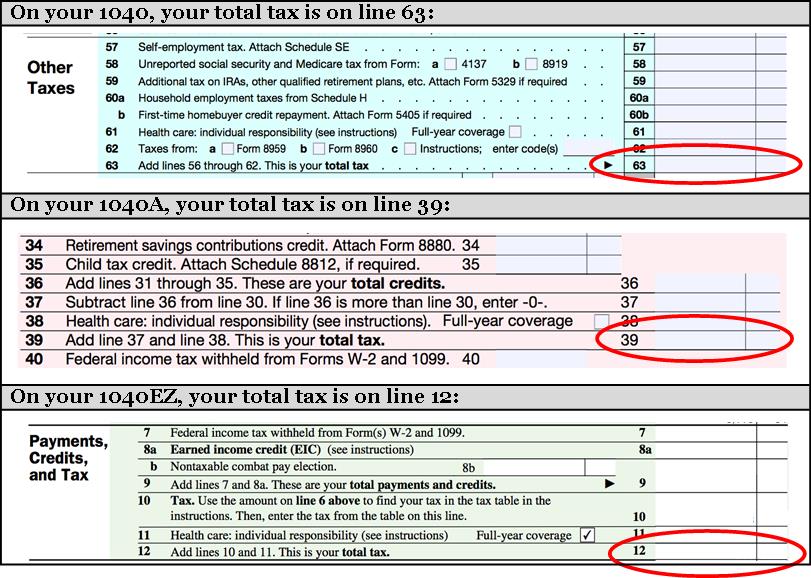

Web 22 sept 2022 nbsp 0183 32 To claim the solar tax credit you ll need to first determine if you re eligible then complete IRS form 5695 and finally add your renewable energy tax credit Web 8 oct 2021 nbsp 0183 32 The IRS has not yet released their revised Form 5695 so our example below uses 2021 s version and 26 tax credit amount One of the biggest immediate benefits of installing a solar electric system is that it

Solar Rebate Tax Form

Solar Rebate Tax Form

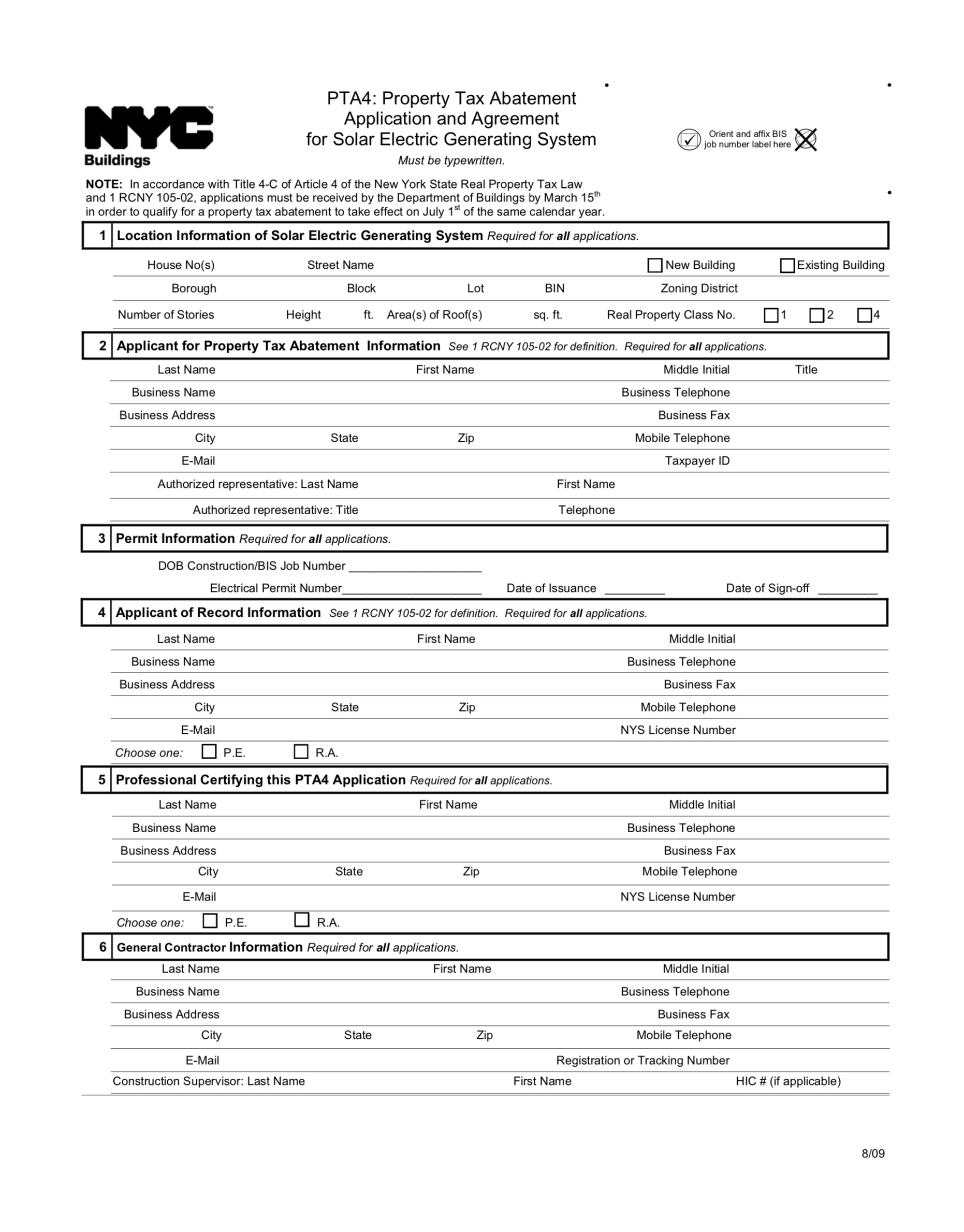

https://images.squarespace-cdn.com/content/v1/5c9195a701232cc26820169f/1568139294591-H965RBL0G7P40I5QT4WZ/ke17ZwdGBToddI8pDm48kGOMHX6mYlKeQUDB-8DjRi17gQa3H78H3Y0txjaiv_0fDoOvxcdMmMKkDsyUqMSsMWxHk725yiiHCCLfrh8O1z5QPOohDIaIeljMHgDF5CVlOqpeNLcJ80NK65_fV7S1USJtzInKmjaV_t2jk-slkYuCadpbNq49e5l2yx0ntfsRPWPOvZ4Spbhjs3xQZUzKCg/NYCDOBFormPTA4.jpg

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

http://southerncurrentllc.com/wp-content/uploads/How-To-Claim-Solar-Tax-Credit-2017.png

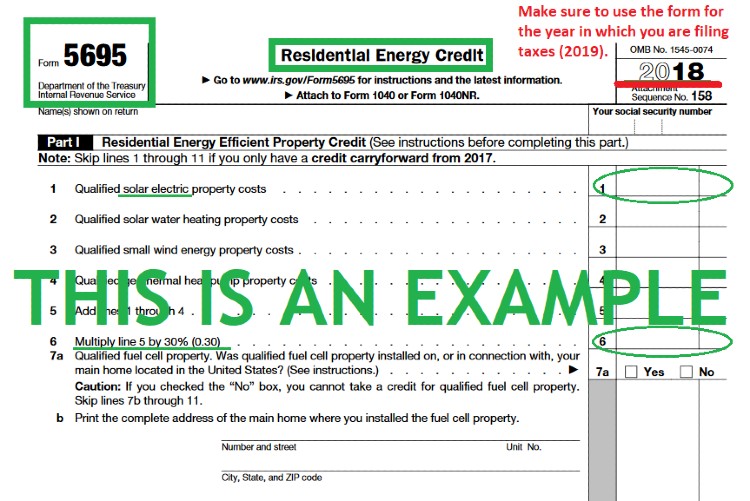

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

https://www.solarreviews.com/content/images/blog/irs_form2021.png

Web What is the Solar Energy Tax Credit The Solar Tax Credit is a federal tax credit for solar systems you can claim on your income taxes and reduces your federal tax liability The tax credit is calculated based on a Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to

Web 26 juil 2023 nbsp 0183 32 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Download Solar Rebate Tax Form

More picture related to Solar Rebate Tax Form

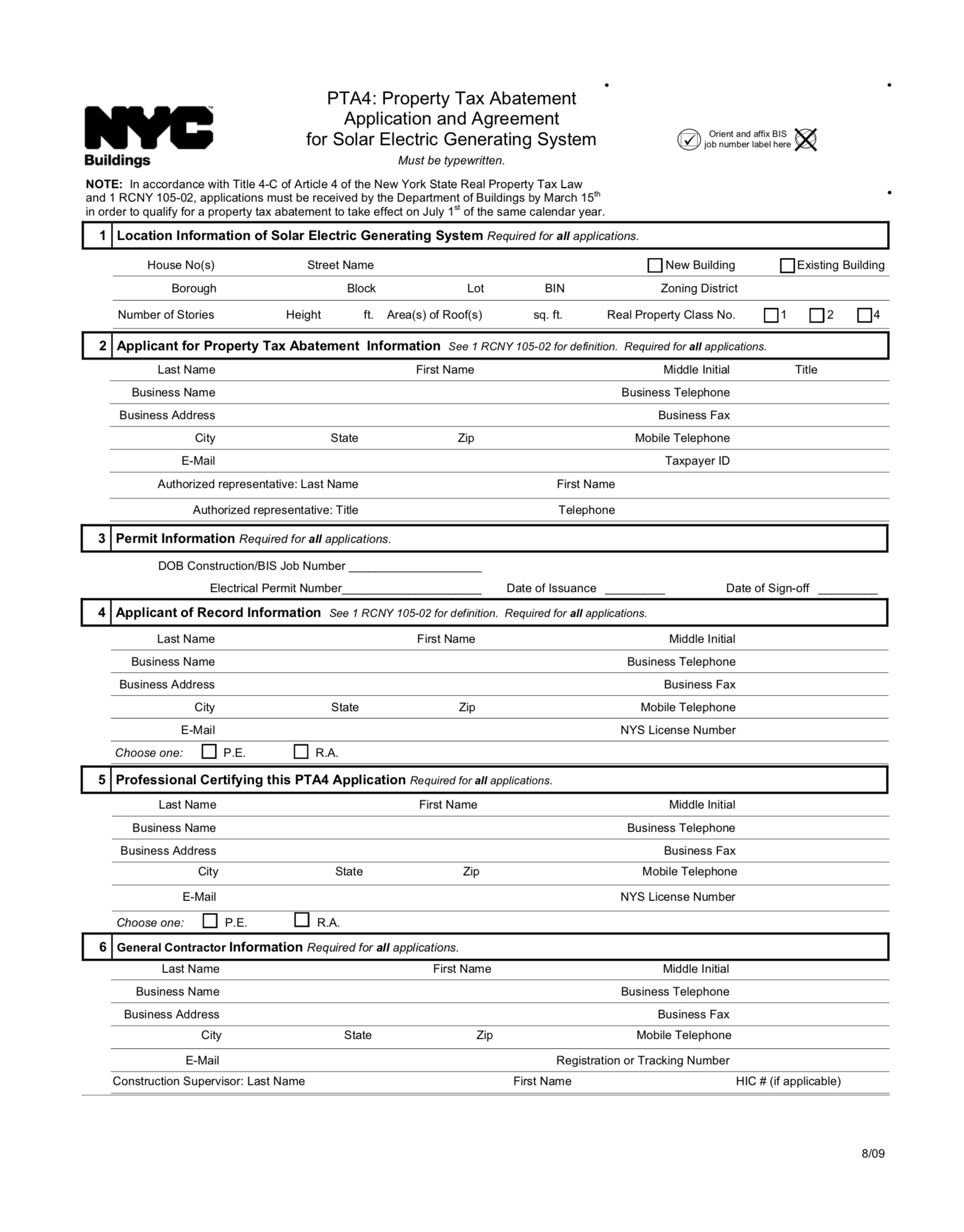

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

https://www.ysgsolar.com/sites/default/files/styles/panopoly_image_original/public/form_1040_rec.png?itok=pf_SEkRq

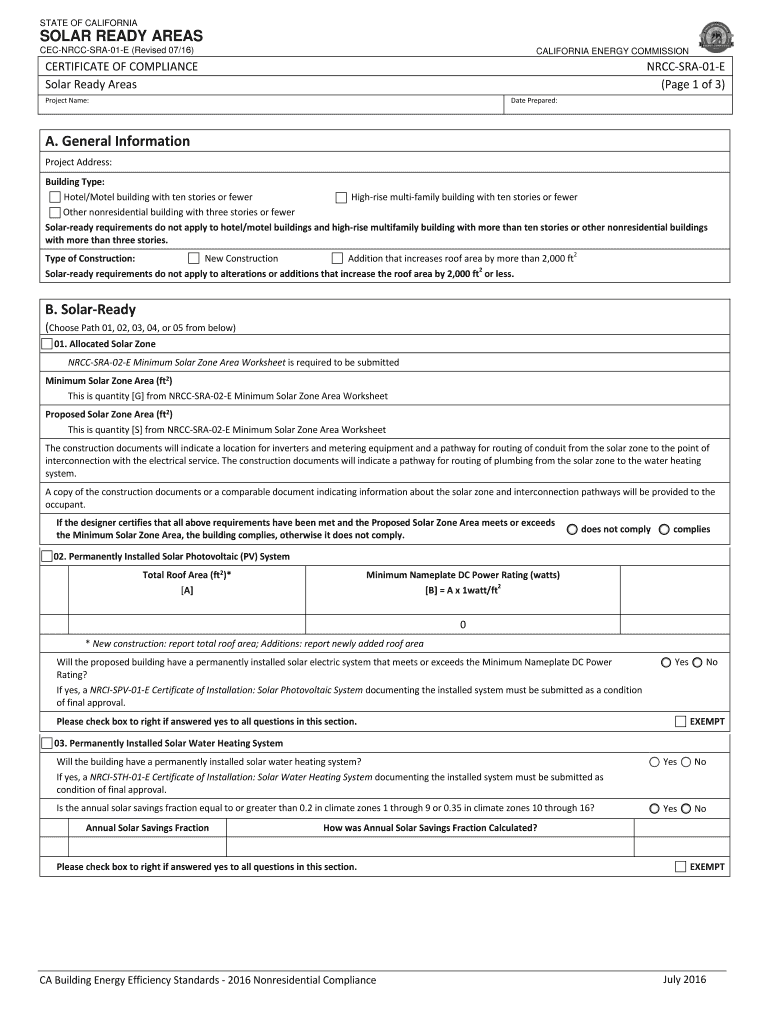

The California Solar Mandate Rolls Out In Here s How Fill Out And

https://www.signnow.com/preview/483/871/483871490/large.png

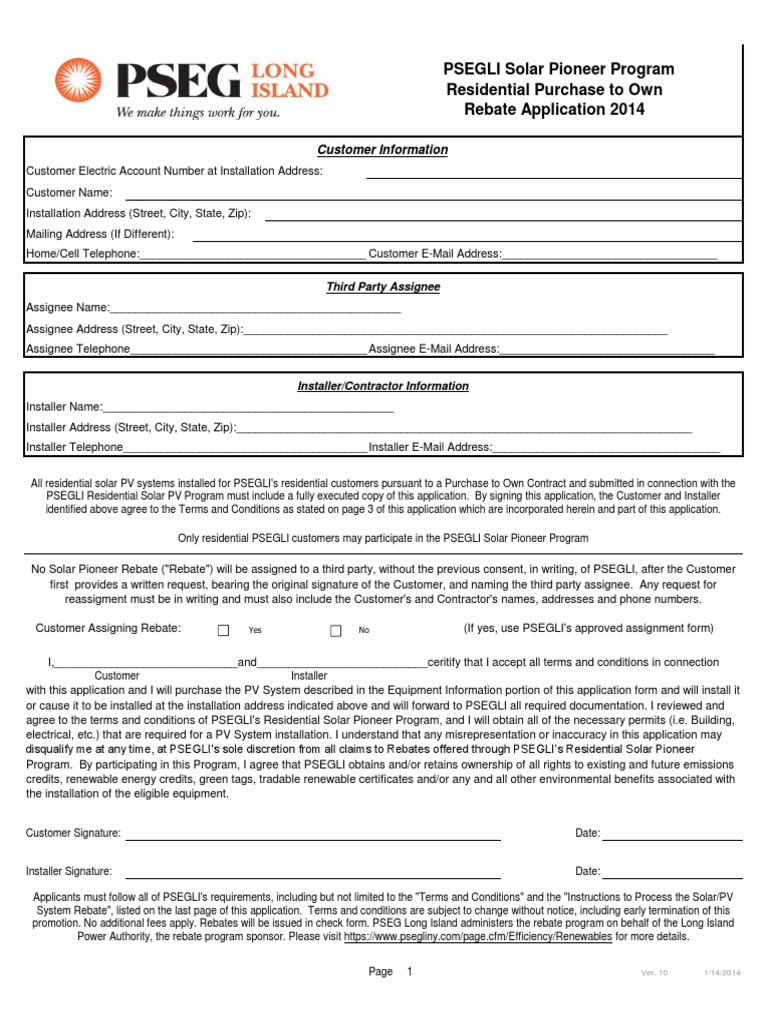

PSEG Long Island PSEGLI Solar Pioneer Program Residential

https://imgv2-1-f.scribdassets.com/img/document/329152203/original/3392a6ac1d/1584812978?v=1

Web Individuals will be able to claim a rebate to the value of 25 of the cost of new and unused solar photovoltaic PV panels up to a maximum of R15 000 per individual For Web 4 avr 2023 nbsp 0183 32 Individuals that install rooftop solar panels qualify for a 25 rebate on the cost of new or unused solar panels up to a maximum rebate of R15 000 To take

Web The steps above outline what you need to do to claim the Federal Solar Tax credit when you file your taxes with the IRS Be sure to include IRS Form 5695 when you submit Web To qualify for the Federal Investment Tax Credit in a particular year the eligible solar equipment must be installed by December 31st of that year You should always consult

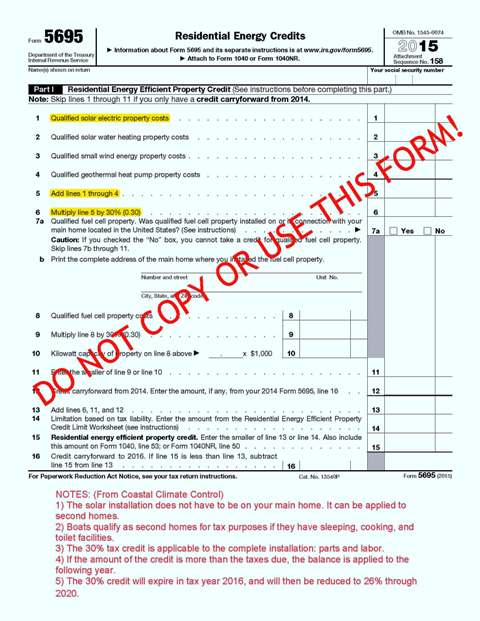

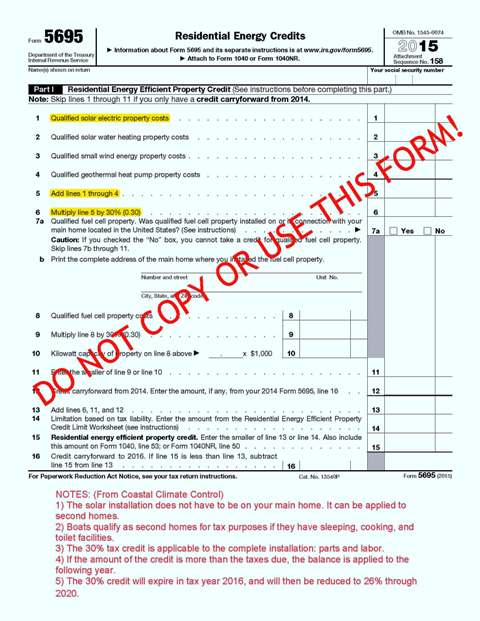

Solar Tax Credit And Your Boat

http://www.coastalclimatecontrol.com/images/solar/IRS_Form_5695_2015_Pg_1.jpg

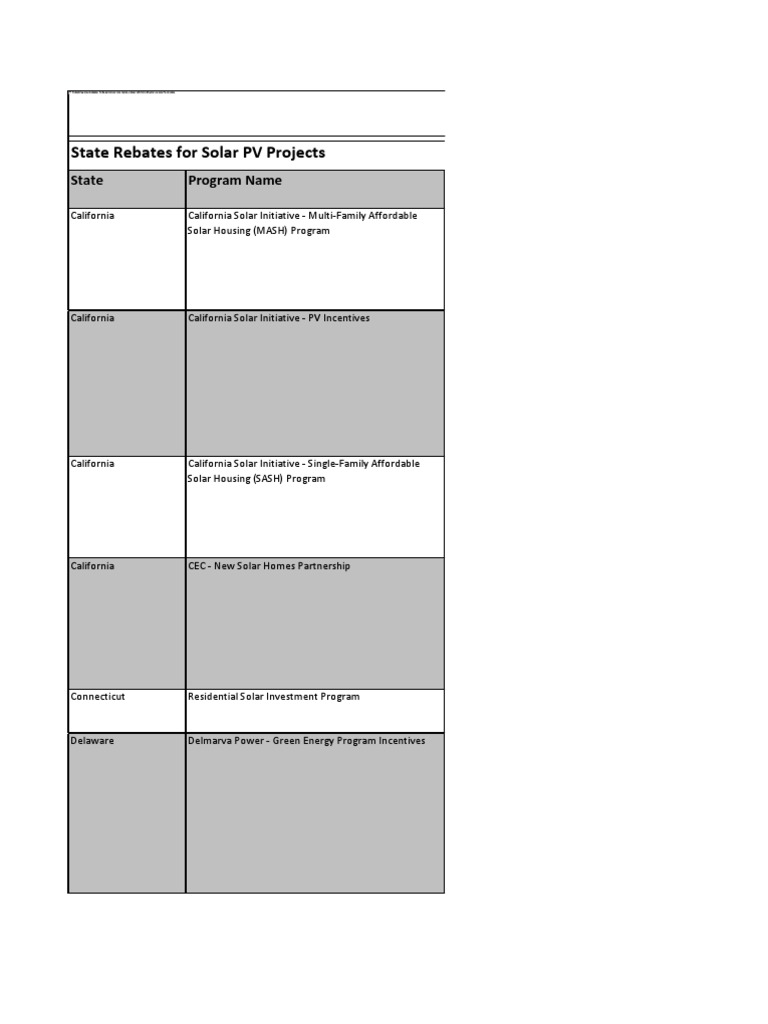

States Rebates For Solar PV Projects Photovoltaic System Renewable

https://imgv2-1-f.scribdassets.com/img/document/134605316/original/882bb48de2/1571598572?v=1

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may

https://news.energysage.com/how-do-i-claim-the-solar-tax-credit

Web 22 sept 2022 nbsp 0183 32 To claim the solar tax credit you ll need to first determine if you re eligible then complete IRS form 5695 and finally add your renewable energy tax credit

Filing For The Solar Tax Credit Wells Solar

Solar Tax Credit And Your Boat

Filing For The Solar Tax Credit Wells Solar

State of New Mexico Incentive Area Solar Energy Gross Receipts Tax

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

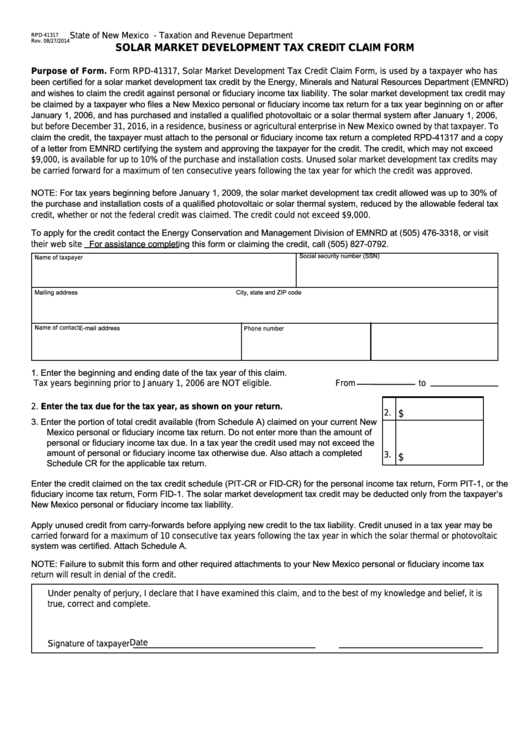

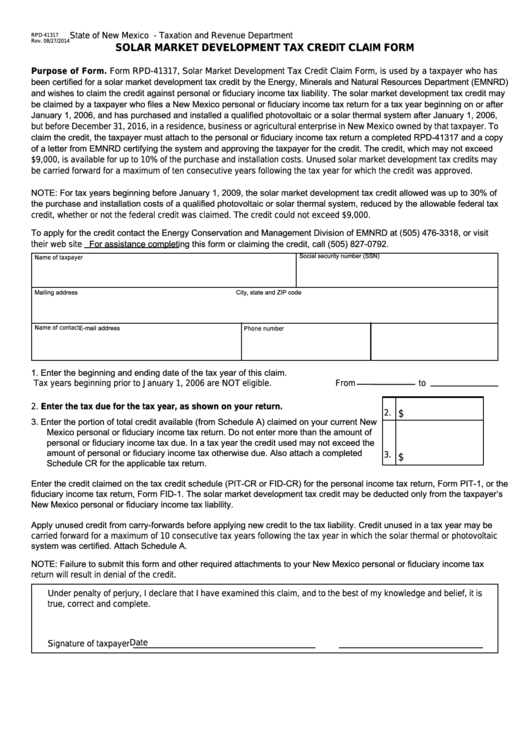

Fillable Form Rpd 41317 New Mexico Solar Market Development Tax

Fillable Form Rpd 41317 New Mexico Solar Market Development Tax

How To Claim The Solar Tax Credit Using IRS Form 5695

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Can You Use The 30 Federal Tax Credit For Solar The Energy Miser

Solar Rebate Tax Form - Web 26 juil 2023 nbsp 0183 32 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a