Solar Rebates Incentives Sc Web 31 mai 2023 nbsp 0183 32 On top of the federal tax credit South Carolina offers a 25 tax credit on the cost of installing a solar power system The maximum credit is 3 500 or 50 of your state tax liability up to

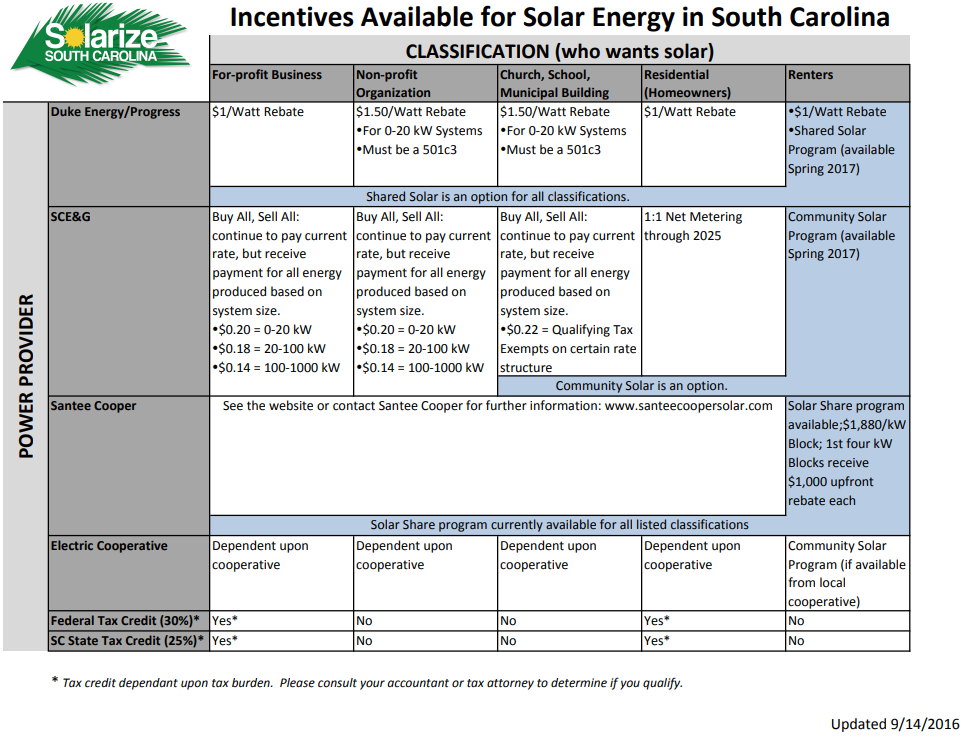

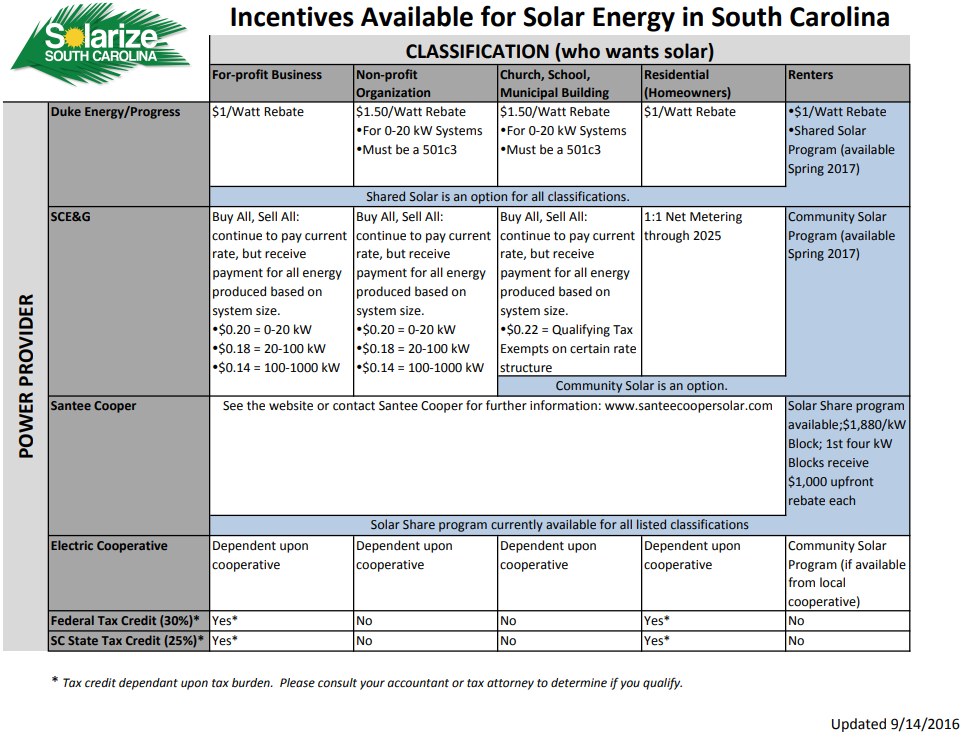

Web South Carolinians with sufficient tax liability can take advantage of federal and state tax credits for the purchase and installation of a solar electric system to reduce the cost For a database of tax credits and incentives Web 11 nov 2022 nbsp 0183 32 Low cost solar loans of up to 40 000 are available to eligible South Carolinians in exchange for their SRECs Utility solar rebates in South Carolina Residential customers could claim utility incentives up

Solar Rebates Incentives Sc

Solar Rebates Incentives Sc

https://pathtowarren.com/wp-content/uploads/2022/11/image-463.png

Solar Panels For South Carolina Homes Tax Incentive Price Info

https://solaractionalliance.org/wp-content/uploads/2015/12/South-Carolina_data-infographic.jpg

Solar Panel Installers Clinton SC Solar Power Rebates Incentives Gas

https://i0.wp.com/www.gasrebates.net/wp-content/uploads/2023/03/solar-panel-installers-clinton-sc-solar-power-rebates-incentives.png?w=1024&ssl=1

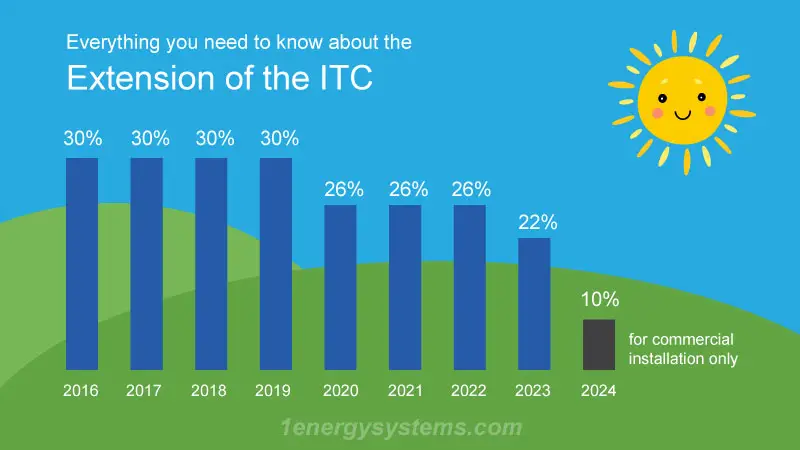

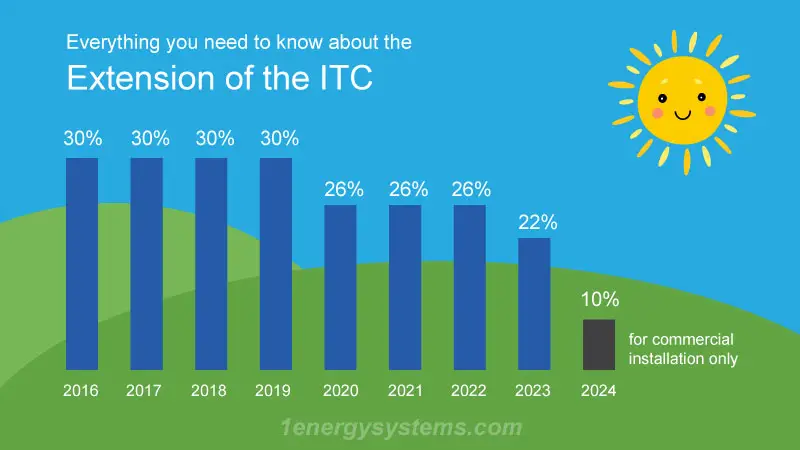

Web There are several incentives in South Carolina that make investing in solar and renewable energy cost effective South Carolina Incentive Database This information is sourced from DSIRE the most comprehensive source of information on incentives and policies that support renewables and energy efficiency in the United States Web The federal solar Investment Tax Credit ITC is the most beneficial solar incentive available to U S residents Homeowners who install a solar power system can save up to 30 of the total

Web Choosing a System Considerations before installing and common types of solar electric systems Learn More Financing a System Financing options such as loans leases and tax credits incentives Learn More Installing Web EnergySaver App Search by Category To make your search easier Energy Saver has divided energy saving opportunities into the categories below Use the search bar if you know the name of a specific program or export a list of all available programs Grants and Loans Electric Rebates Natural Gas Tax Incentives Solar Residential Low Income

Download Solar Rebates Incentives Sc

More picture related to Solar Rebates Incentives Sc

South Carolina Solar Power Rebates And Incentives Southern Current

https://southerncurrentllc.com/wp-content/uploads/South-Carolina-Solar-Power-Rebates-And-Incentives-2017.png

Solar Panel Deals Rebates And Incentives In Australia Solar Market

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/solar-panel-deals-rebates-and-incentives-in-australia-solar-market.jpg?resize=768%2C510&ssl=1

2020 South Carolina Solar Incentives Rebates And Tax Credits Tax

https://i.pinimg.com/originals/23/b0/e8/23b0e83deb727576a8231415ea1cb2a0.png

Web 1 ao 251 t 2023 nbsp 0183 32 Some solar incentives you might qualify for are Rebates A solar rebate is a partial refund after the purchase of your solar system Rebates might be offered by your local utility company your county or your state The rebates are usually applied before tax credits are calculated Web 8 ao 251 t 2023 nbsp 0183 32 Solar incentives are intended to make renewable energy usage more affordable via financial incentives for those who install solar panels on their homes Various types of incentives such as discounts cash back or credit towards your monthly utility bill may be available to you

Web 8 ao 251 t 2023 nbsp 0183 32 The term quot solar incentives quot refers broadly to financial incentives that are in place to encourage increased use of renewable energy by making installing and using solar panels more affordable Various kinds of incentives including cash back discounts or credit towards your monthly utility bill might be available to you Web The maximum incentive for the S C state solar tax credits is 35 000 or 50 of taxpayer s tax liability for that taxable year whichever is less The maximum amount that will be paid out each year is 3 500 This credit has no expiration date and any excess credit may be carried forward up to 10 years view SC Solar TAX Form

CPS Energy Solar Rebate 2020 Wells Solar

https://wellssolar.com/wp-content/uploads/2020/02/CPS-Energy-Solar-Rebate-Incentive-2020-sm.jpg

Rebates Drive Success Of SC Solar Program Duke Energy Illumination

https://s3.amazonaws.com/cms.ipressroom.com/264/files/201610/5820eb7f2cfac26c5d35539c_04-PS_SC_Solar/04-PS_SC_Solar_4c26c281-7d34-4499-8d32-c1cb2eb7ee70-prv.jpg

https://www.forbes.com/.../solar/south-carolina-solar-incentives

Web 31 mai 2023 nbsp 0183 32 On top of the federal tax credit South Carolina offers a 25 tax credit on the cost of installing a solar power system The maximum credit is 3 500 or 50 of your state tax liability up to

https://solar.sc.gov/financing-system/tax-cred…

Web South Carolinians with sufficient tax liability can take advantage of federal and state tax credits for the purchase and installation of a solar electric system to reduce the cost For a database of tax credits and incentives

Rebates Drive Success Of SC Solar Program Duke Energy Illumination

CPS Energy Solar Rebate 2020 Wells Solar

South Carolina Solar Incentives Rebates Solar Payback Time In 2019

Oncor Solar Rebate 2020 Wells Solar

Australian Solar Battery Rebates Subsidies Incentives 2023

Solar Panel Rebates And Incentives A Comprehensive Guide

Solar Panel Rebates And Incentives A Comprehensive Guide

Solar Rebates And Tax Incentives Realsolar PowerRebate

Rebates Drive Success Of SC Solar Program Duke Energy Illumination

PPT Commercial Solar Rebates Incentives And Grants GEE Energy

Solar Rebates Incentives Sc - Web The federal solar Investment Tax Credit ITC is the most beneficial solar incentive available to U S residents Homeowners who install a solar power system can save up to 30 of the total