Welcome to Our blog, a room where inquisitiveness meets details, and where everyday subjects become engaging conversations. Whether you're looking for insights on lifestyle, technology, or a little every little thing in between, you've landed in the right location. Join us on this exploration as we dive into the worlds of the average and phenomenal, understanding the world one article at once. Your journey right into the interesting and diverse landscape of our Solar Tax Credit 2022 Rental Property begins here. Explore the fascinating content that awaits in our Solar Tax Credit 2022 Rental Property, where we untangle the complexities of different topics.

Solar Tax Credit 2022 Rental Property

Solar Tax Credit 2022 Rental Property

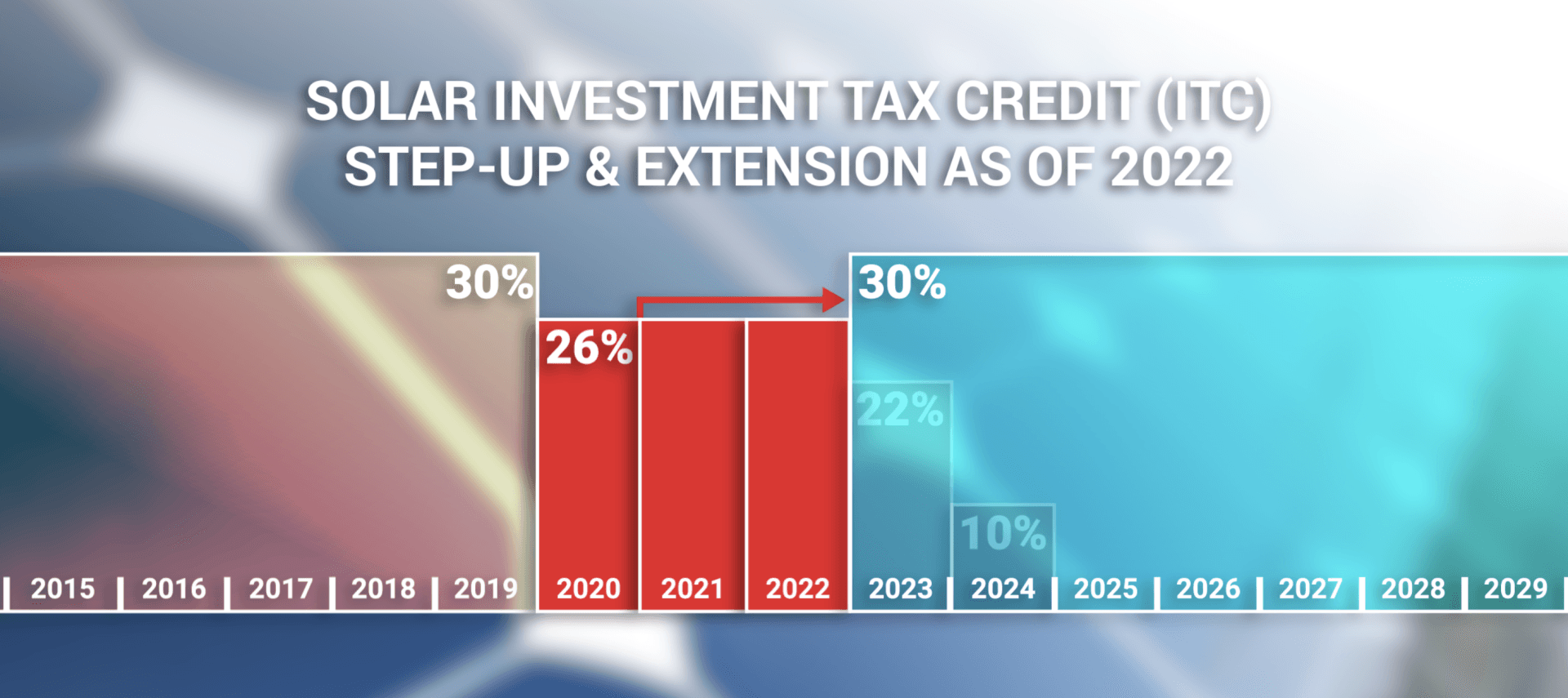

2022 Solar Tax Credit Explained Get Solar Now Save Money

2022 Solar Tax Credit Explained Get Solar Now Save Money

The Federal Solar Tax Credit Energy Solution Providers Arizona

The Federal Solar Tax Credit Energy Solution Providers Arizona

Gallery Image for Solar Tax Credit 2022 Rental Property

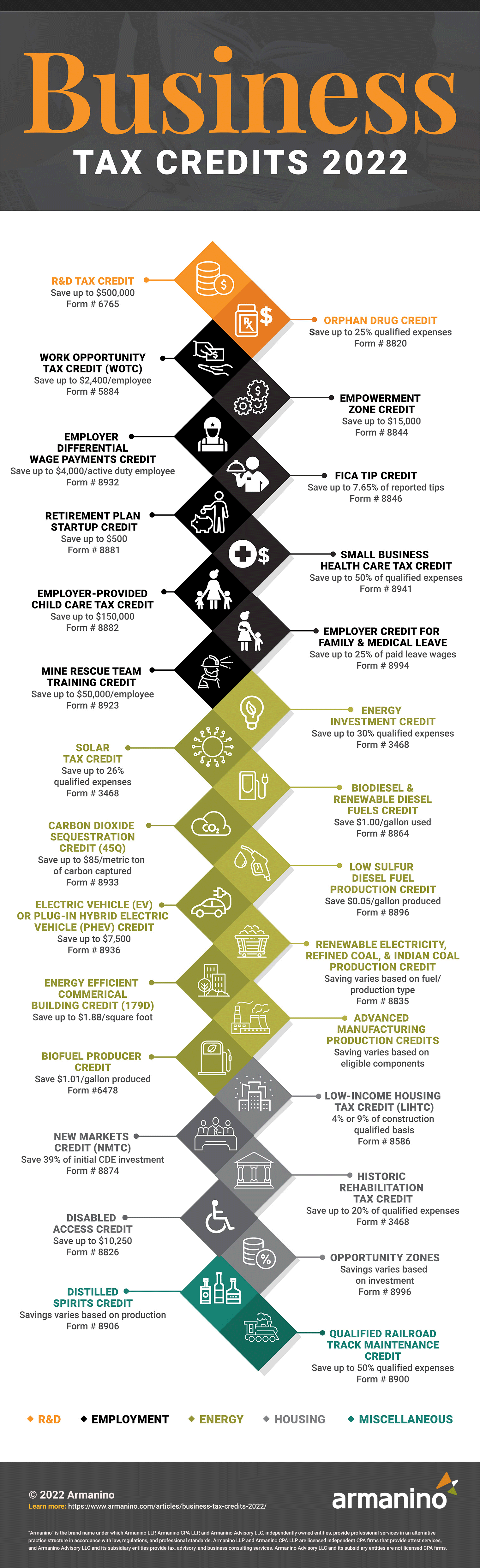

2022 Business Tax Credits Armanino

EITC TAX CREDIT 2022 EARNED INCOME TAX CREDIT CALCULATOR 2022 YouTube

Solar Tax Credit

2021 Energy Federal Tax Credit And Rebate Programs Epic Energy

30 Solar Tax Credit The New 2022 Law YOU MIGHT NOT BE ELIGIBLE

Federal Solar Tax Credit In 2022 Complete Guide EnergySage

Federal Solar Tax Credit In 2022 Complete Guide EnergySage

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

Thank you for selecting to explore our internet site. We truly wish your experience surpasses your assumptions, and that you uncover all the information and resources about Solar Tax Credit 2022 Rental Property that you are looking for. Our commitment is to supply an user-friendly and insightful platform, so do not hesitate to navigate with our web pages effortlessly.