Solar Tax Credit Income Limits Verkko 1 elok 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Get ready for simple tax filing with a 50

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

Solar Tax Credit Income Limits

Solar Tax Credit Income Limits

https://www.leafscore.com/wp-content/uploads/2022/08/federal-solar-tax-credit-inflation-reduction-act-scaled.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Solar Tax Credit

https://lirp.cdn-website.com/af303f9d/dms3rep/multi/opt/Screen+Shot+2022-12-11+at+5.33.42+PM-1920w.png

Verkko 30 marrask 2023 nbsp 0183 32 The solar tax credit is a dollar for dollar reduction of what you owe in federal income taxes So if you owed 15 000 in Verkko 13 jouluk 2023 nbsp 0183 32 Is there an income limit for the federal solar tax credit There is no income limit for the federal solar tax credit but to claim the full credit you ll need

Verkko 22 jouluk 2022 nbsp 0183 32 More information about reliance is available IRS FAQ Page Last Reviewed or Updated 05 Dec 2023 IR 2022 225 December 22 2022 The Internal Verkko What is a tax credit A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe For example claiming a 1 000 federal tax credit

Download Solar Tax Credit Income Limits

More picture related to Solar Tax Credit Income Limits

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

https://094777.com/774f1ba6/https/d98b8f/images.prismic.io/palmettoblog/283c592c-9e38-4b57-a6d0-f70cf6ce54f4_form-5695.jpg?auto=compress,format&rect=0,0,1200,800&w=1200&h=800

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

Solar Tax Credit Guide And Calculator

https://www.solar-estimate.org/build/images/pages/solar-tax-credit/residential-bar-e0482b8d.png

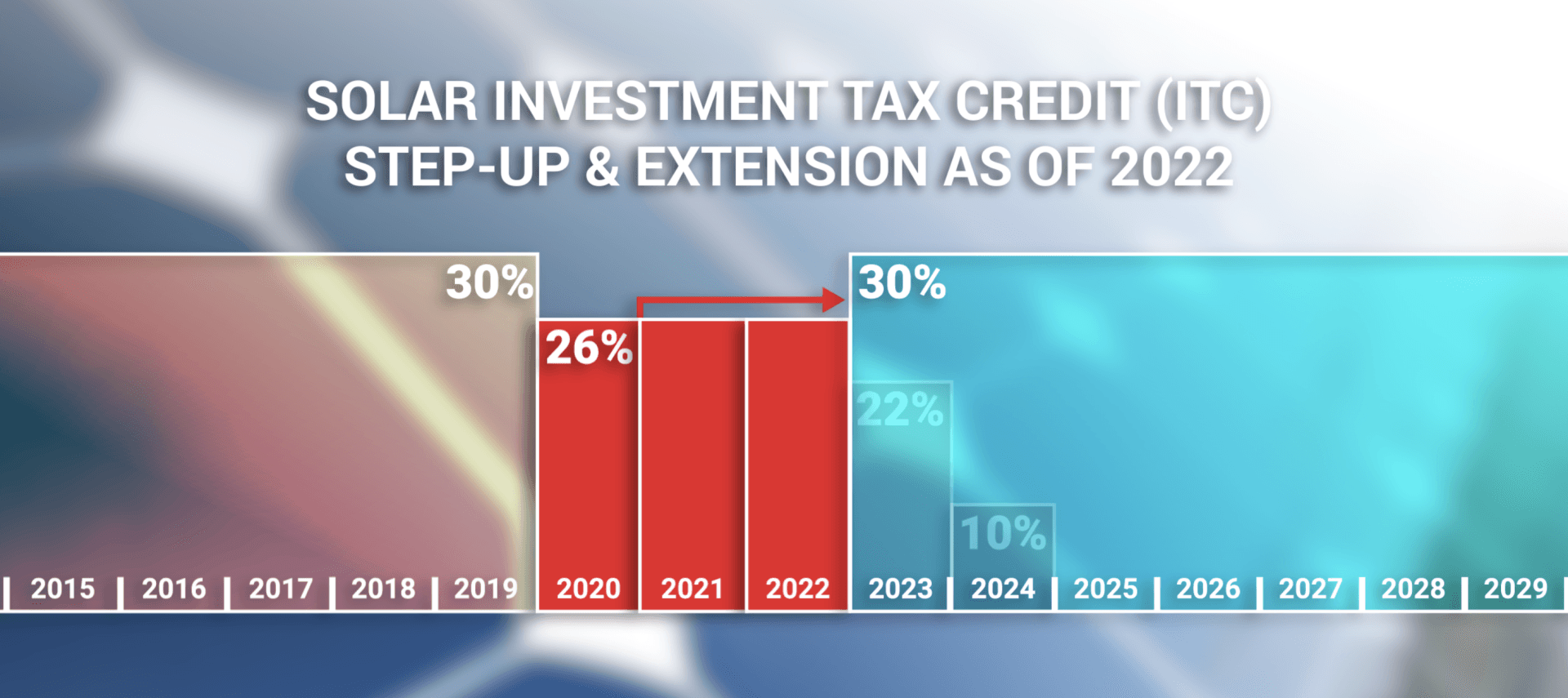

Verkko Home Home Energy amp Utilities How the Solar Tax Credit Works You can save a lot of money on solar panels by taking advantage of a federal tax credit for clean energy upgrades Here s Verkko 8 syysk 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve

Verkko 22 jouluk 2022 nbsp 0183 32 There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim Verkko 6 kes 228 k 2023 nbsp 0183 32 The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of

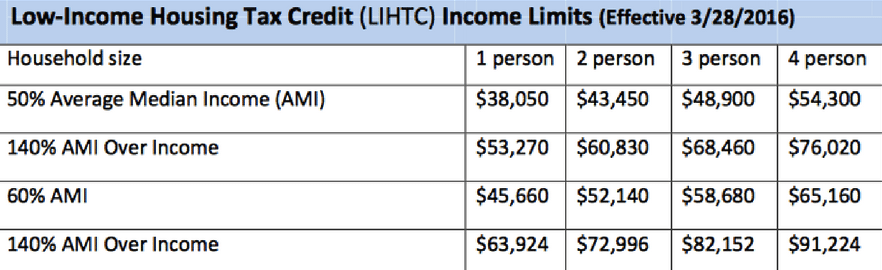

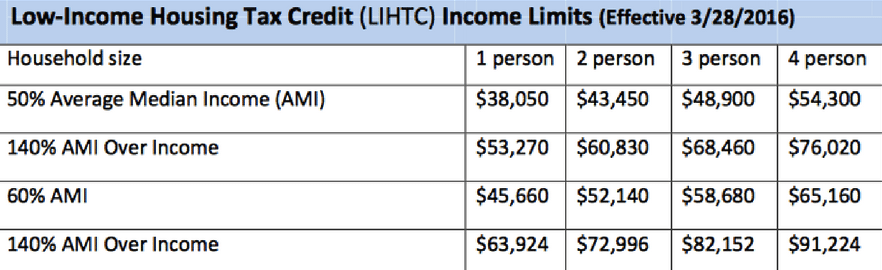

Ask The Apartment Experts What Is A Tax Credit Apartment Apartminty

http://blog.apartminty.com/wp-content/uploads/2017/07/low-income-housing-tax-credit-income-limits-1.png

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2021/10/What-is-a-Solar-Tax-Credit-R01-1089x1536.jpg

https://www.nerdwallet.com/article/taxes/sola…

Verkko 1 elok 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Get ready for simple tax filing with a 50

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the

The Federal Solar Tax Credit Increased Extended Solaria

Ask The Apartment Experts What Is A Tax Credit Apartment Apartminty

Federal Solar Tax Credit 2023 How Does It Work ADT Solar

Federal Investment Solar Tax Credit Guide Learn How To Claim The

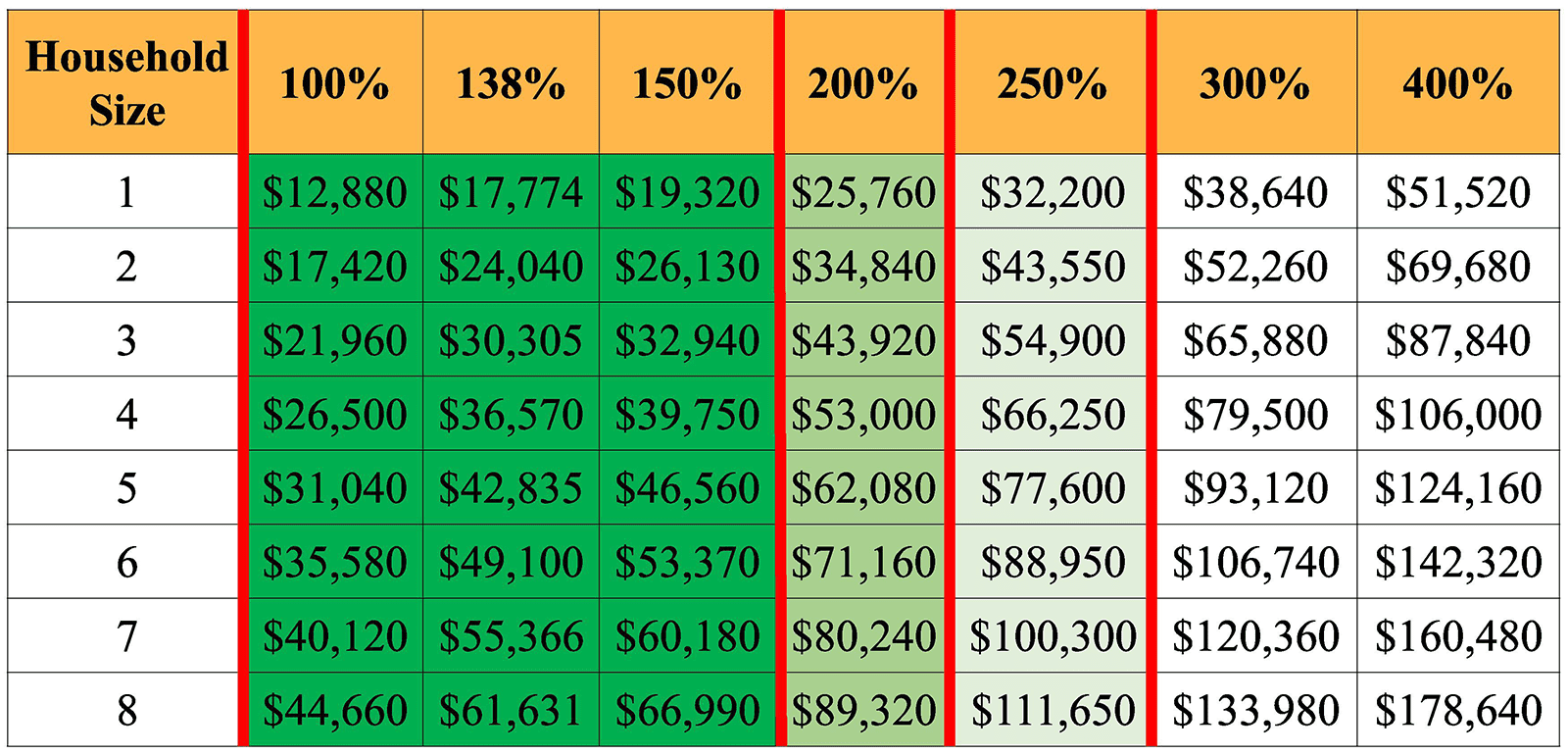

ACA Tax Credits To Help Pay Premiums White Insurance Agency

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit What You Need To Know 2022

Federal Solar Tax Credit 2022 How Does It Work ADT Solar

Solar Tax Credit Solarponics

Solar Tax Credit Income Limits - Verkko What is a tax credit A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe For example claiming a 1 000 federal tax credit