Solar Tax Credits And Rebates By State Web 13 mars 2023 nbsp 0183 32 Almost all state tax credits have a maximum with current amounts between 500 and 5 000 depending on the state Solar panel rebates States utility companies and solar panel manufacturers offer

Web 18 mai 2023 nbsp 0183 32 Key takeaways The federal solar tax credit gives you 30 percent of the cost of your solar system in credit when you file your taxes Many states offer local solar incentives you can Web At the state level New York offers a wide range of solar incentives including A state tax credit worth 25 of solar costs up to 5 000 The NYSERDA rebate worth 20 30 cents per watt depending on where your live Sales tax exemption on solar equipment

Solar Tax Credits And Rebates By State

Solar Tax Credits And Rebates By State

https://www.solardailydigest.com/wp-content/uploads/state-solar-tax-credits-lg-usa-business.jpeg

Solar Tax Credits By State SolarDailyDigest

https://www.solardailydigest.com/wp-content/uploads/credit-file-solar-tax-credits-by-state.jpeg

Patrickkellydesigner Can A Home Builder Take The Itc Solar Tax Credit

https://www.solarenergyworld.com/wp-content/uploads/2021/01/ITC-chart-horizontal2021-FA-1024x661.png

Web 3 sept 2023 nbsp 0183 32 However there are several solar incentives and rebates that can make going solar a more affordable option 1 In this guide we ll Web Find solar rebates and incentives by state State solar incentive programs vary among states and utility companies Many states offer solar rebates for home solar power systems in addition to the f ederal solar tax credit

Web Here are a few common programs Tax credits A portion of your project costs can be deducted from your tax obligation reducing the amount of taxes you pay when you file In addition to the federal ITC available to all Americans some states have their own state solar tax credit in place Rebates Web 28 ao 251 t 2023 nbsp 0183 32 Solar Rebates amp Incentives Some states have chosen to offer tax credits others offer up front rebates administered by state agencies or utilities and still others offer performance based incentives that are paid by an agency or utility over time based on kWh production Effective direct incentives for solar energy can take a variety of forms

Download Solar Tax Credits And Rebates By State

More picture related to Solar Tax Credits And Rebates By State

Solar Energy Tax Credits By State MD NJ PA VA DC FL

https://www.solarenergyworld.com/wp-content/uploads/2020/08/ITC-decrease-chart.png

Solar Rebates And Solar Tax Credits For Pennsylvania Tax Credits

https://i.pinimg.com/originals/92/89/3a/92893a81be60e9406c4674ff4fa378d5.gif

Texas Solar Power For Your House Rebates Tax Credits Savings

https://i.pinimg.com/originals/14/05/ef/1405ef205102ec2392f7c34907bb980e.png

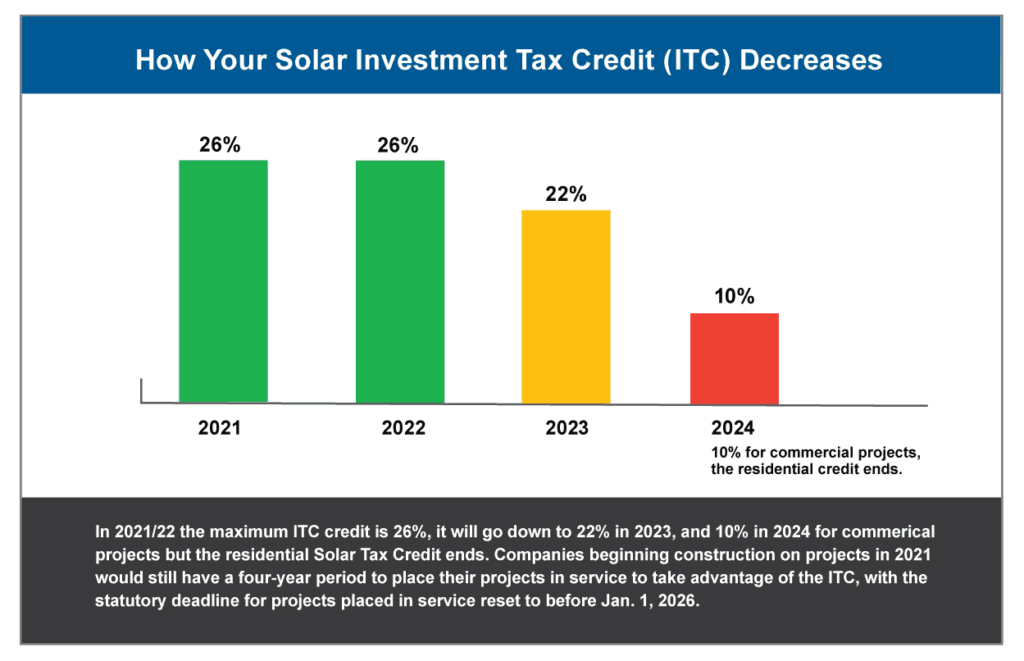

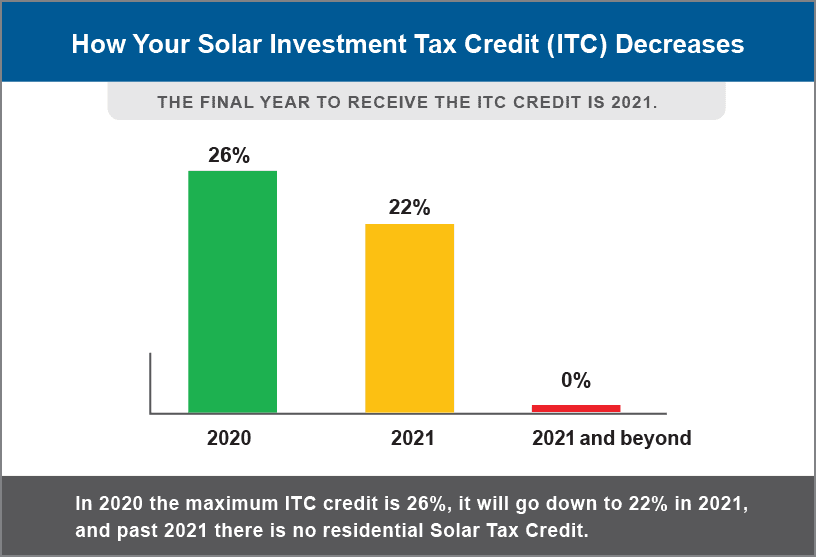

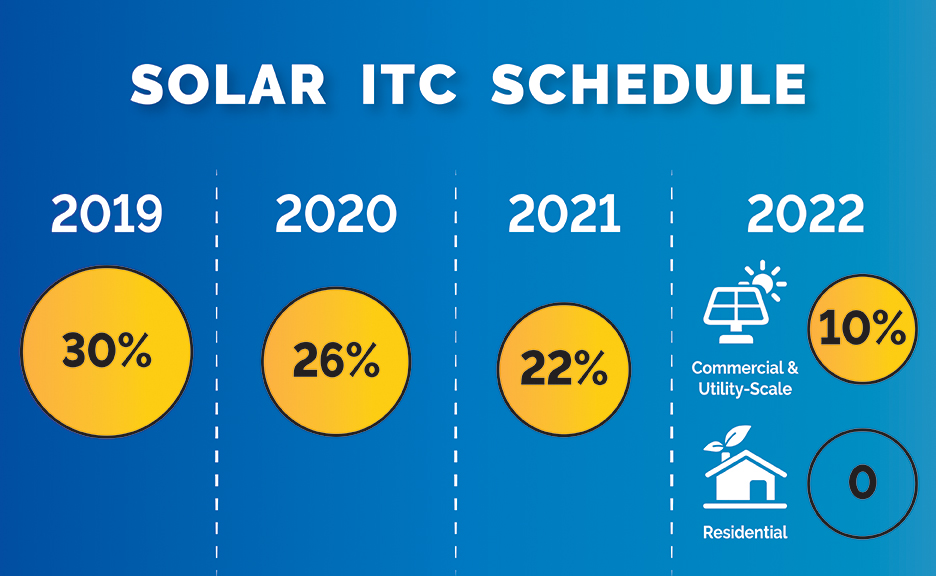

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit Web Tax Credits Rebates amp Savings Please visit the Database of State Incentives for Renewables amp Efficiency website DSIRE for the latest state and federal incentives and rebates 1000 Independence Ave SW Washington DC 20585

Web 12 sept 2023 nbsp 0183 32 Texas Solar Rebates and Tax Credits Texas Solar Property Tax Exemption Local Incentives Solar Buyback Programs Net Metering Which Solar System Is Right for Your Home Benefits of Web 29 avr 2023 nbsp 0183 32 The US government offers some of the best tax incentives for solar panels As of 2022 you can now qualify for up to 30 of the total cost of your solar system as a tax credit Virtually

2019 State Solar Power Rankings Solar Power Rocks

https://www.solarpowerrocks.com/wp-content/uploads/2018/12/2019-tax-credits-ring.png

2019 Guide To Maryland Home Solar Incentives Rebates And Tax Credits

https://www.solarpowerrocks.com/wp-content/uploads/2018/12/MD-tax-credits-ring.png

https://www.solarreviews.com/solar-incentives

Web 13 mars 2023 nbsp 0183 32 Almost all state tax credits have a maximum with current amounts between 500 and 5 000 depending on the state Solar panel rebates States utility companies and solar panel manufacturers offer

https://www.bankrate.com/homeownership/solar/tax-incentives-by-state

Web 18 mai 2023 nbsp 0183 32 Key takeaways The federal solar tax credit gives you 30 percent of the cost of your solar system in credit when you file your taxes Many states offer local solar incentives you can

Solar Tax Credit ITC Extension The Enrgy Miser

2019 State Solar Power Rankings Solar Power Rocks

Solar Tax Credits Rebates Missouri Arkansas

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

2020 South Carolina Solar Incentives Rebates And Tax Credits Tax

The Federal Solar Tax Credit Explained Sunshine Plus Solar

The Federal Solar Tax Credit Explained Sunshine Plus Solar

Solar In California Ultimate Guide Solar Panels In California How You

Texas Solar Power For Your House Rebates Tax Credits Savings Tax

Alternate Energy Hawaii

Solar Tax Credits And Rebates By State - Web Find solar rebates and incentives by state State solar incentive programs vary among states and utility companies Many states offer solar rebates for home solar power systems in addition to the f ederal solar tax credit