Solar Tax Rebate 2024 How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit

Solar Tax Rebate 2024

Solar Tax Rebate 2024

https://media.citizen.co.za/wp-content/uploads/2023/03/small-business-solar.jpg

How Does The Federal Solar Tax Credit Work IVee League Solar

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

Solar Tax Credits And Rebates In Colorado

https://image.slidesharecdn.com/solarisesolar-210127113258/95/solar-tax-credits-and-rebates-in-colorado-3-1024.jpg?cb=1611747298

An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Federal tax credit The federal solar tax credit offers new solar owners in the United States a tax credit equal to 30 of costs they paid for their solar installation The tax credit is designed to step down to 26 in 2033 22 in 2034 then settle at a permanent rate of 10 for commercial solar installations and will be eliminated for homes The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating

Download Solar Tax Rebate 2024

More picture related to Solar Tax Rebate 2024

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

According to our 2023 survey of homeowners with solar respondents paid an average of 15 000 to 20 000 for their solar panel systems When you factor in the 30 federal solar tax credit the In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020 2022 and 22 for systems installed in 2023 4 The tax credit expires starting in 2024 unless Congress renews it There is no maximum amount that can be claimed

However starting in 2022 those who installed new solar panels or invested in an off site community solar project could get a tax credit of up to 30 percent through the Residential Clean Energy Nebraska s Dollar and Energy Savings Loans program offers fixed rate loans for homeowners across the state through lenders The rates are 5 3 5 or lower and loans can last as long as 15 years

Solar Tax Credit Calculator NikiZsombor

https://www.credible.com/blog/wp-content/uploads/2021/07/Solar-tax-incentives-available-to-consumers-infographic.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

Income Tax Rebate Under Section 87A

Solar Tax Credit Calculator NikiZsombor

Missouri Solar Incentives StraightUp Solar

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

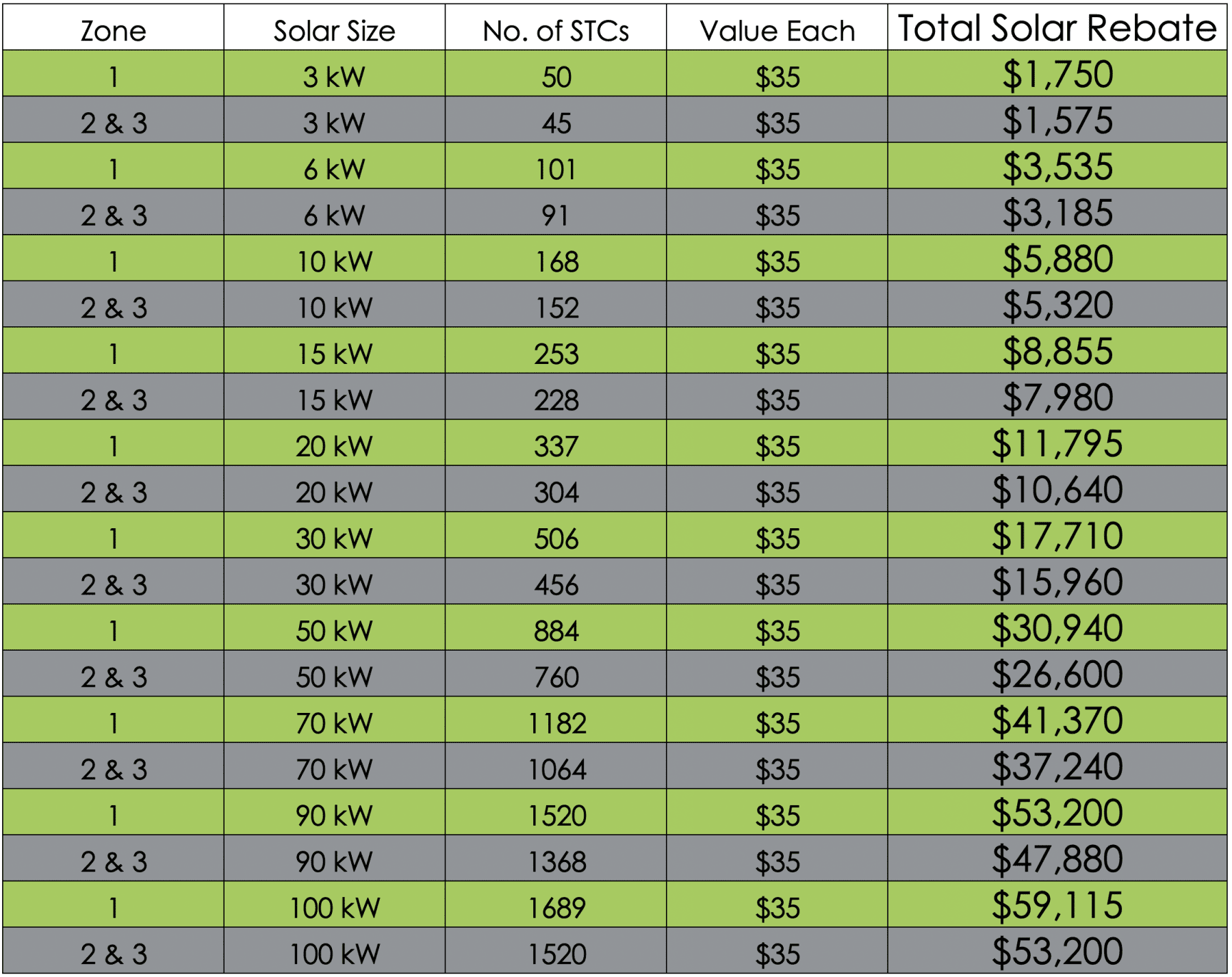

How Much Is The Solar Rebate In Queensland QLD GI Energy

Property Tax Rebate Pennsylvania LatestRebate

Planning Now For The 2022 Sunset Of Federal Solar Tax Rebate New Mexico Water Electric Is

Solar Tax Rebate 2024 - Federal tax credit The federal solar tax credit offers new solar owners in the United States a tax credit equal to 30 of costs they paid for their solar installation The tax credit is designed to step down to 26 in 2033 22 in 2034 then settle at a permanent rate of 10 for commercial solar installations and will be eliminated for homes